For updates post 17 March click here.

17 March

Estonia/Finland

Tallink Grupp will temporarily suspend the operation of its vessels Silja Serenade and Silja Symphony on the Helsinki-Stockholm route from 19 March. On that day, Finland plans to close its borders to all traffic. The Helsinki-Stockholm route is the largest one for travel retail sales within the Tallink Grupp network.

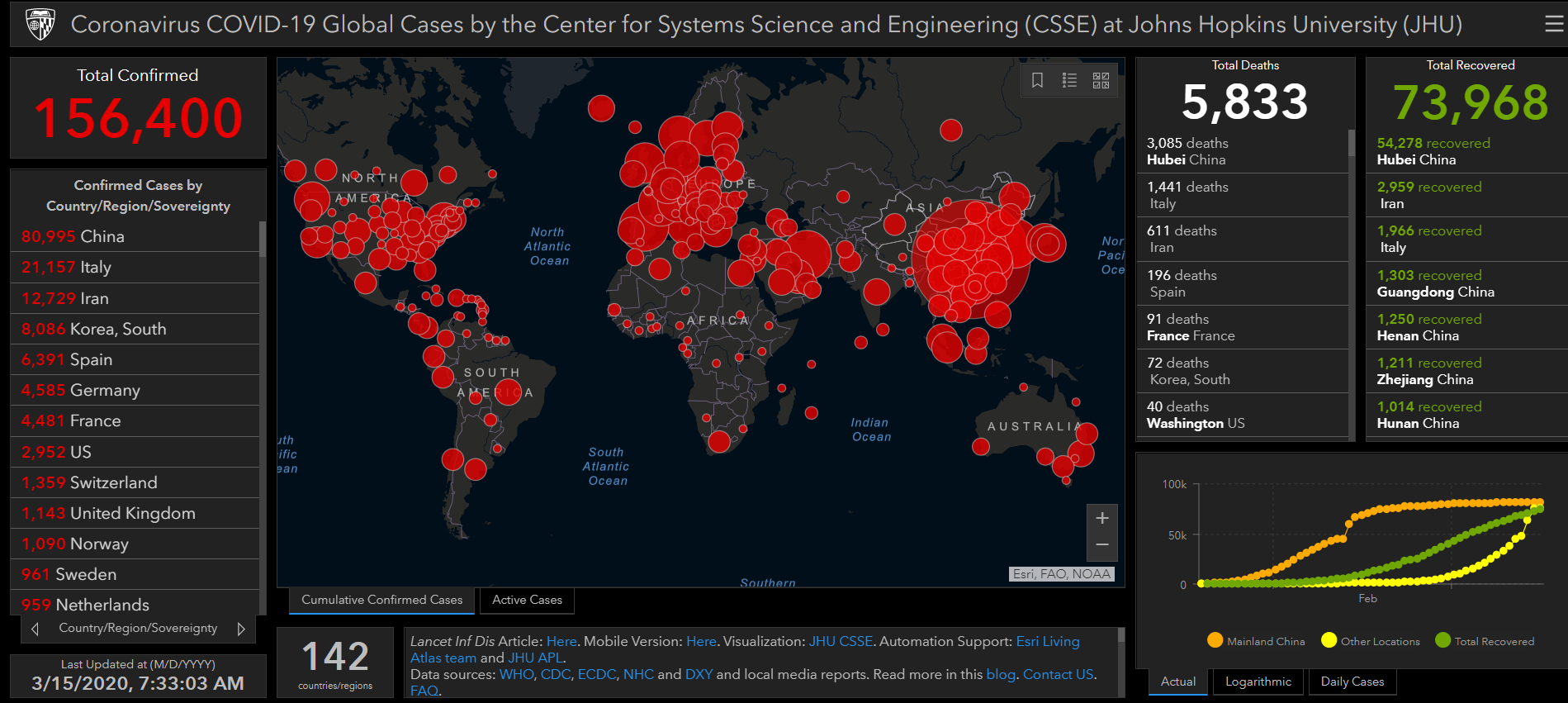

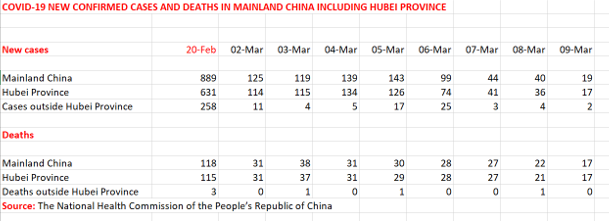

| At a glance: Today’s major developments – Only 21 new cases were announced in Mainland China, while South Korea had less than 100 new cases for the third consecutive day |

UK

London Gatwick Airport has introduced a raft of cost-saving measures in light of the “unprecedented impact” of the COVID-19 outbreak.

Two of the airport’s six piers will shut, while the airport will also close to flights between midnight and 05.30 from today, except for emergency landings. Gatwick said further operational action was likely to be announced in coming days.

The airport is also deferring spending on its investment programme for the foreseeable future, while the airport’s executive team will take a -20% salary cut and waive any bonus for the current financial year.

Some 200 staff on temporary fixed-term contracts and contractors will also have their employment terminated “in order to protect the business”.

Austria

Vienna Airport is closing most shops and restaurants landside and airside today in response to the COVID-19 outbreak. A limited service will be maintained that includes grocery stores and the pharmacy in Terminal 1.

Airport operations are already limited by travel restrictions, with a full suspension of travel from China, South Korea, Italy and Iran. In addition, flights from Spain, Switzerland, France, UK, Ukraine, Russia and the Netherlands will be discontinued in the near future by order of the Austrian federal government.

Austrian Airlines will cease flight operations by 28 March and Laudamotion by 8 April while other airlines are now winding down their flight schedules.

US

The Global Department Store Summit, due to be held in Seattle 28-29 May, has been postponed to the week of 7-11 June 2021.

Executive Director of the organiser, the Intercontinental Group of Department Stores, Werner Studer said: “We have been constantly monitoring the situation and hoped for the best. It is unfortunate that we have to postpone the event as we have managed to put together a powerful agenda with a great list of top speakers. However, the recent developments of the virus outbreak and its implication on people’s potential health and security exposures have forced us to reset the entire event to next year.”

Further information on 2021’s event will be revealed in autumn of this year.

US/Europe

Some 3.3 million airline seats are at risk of elimination from the market as a result of the US’ transatlantic travel ban on most non-US residents entering the country from much of Europe.

Travel analyst ForwardKeys has revealed the extent of the impact of the ban on airlines and countries in a new report – with the world’s busiest and most profitable segment of the aviation industry “decimated.”

Click here for the full story.

Switzerland

Zürich Airport has closed most shops and restaurants until at least 19 April. Some outlets will remain open, among them pharmacies, grocery stores, kiosks and takeaway food services, said the airport company today. Lounges are also closed, as is the visitor terrace at the airport.

New travel restrictions mean that all visitors from Germany, Italy, Austria and France will undergo checks upon entering the country.

UK

The UK Travel Retail Forum (UKTRF) today called on the UK government to urgently step in to support the aviation and travel retail sector as the impact of travel restrictions on the industry deepens.

The organisation said that traffic had fallen by over -70% in recent days as a result of measures introduced to limit the spread of COVID-19. Those “worst affected are airport operators, travel retail operators, and landside, airside and maritime concessionaires,” said UKTRF.

UK Travel Retail Forum Chair Francois Bourienne said: “COVID-19 poses a clear threat to the UK and international travel system. The government has previously indicated it would take action to minimise the economic damage caused by this pandemic. We know that this crisis is likely to get worse before it gets better, and the need for urgent government support measure is clear.”

For the full story, click here.

Lebanon

Beirut Rafic Hariri International Airport is to cease all commercial flights from Wednesday 18 March until 29 March, by order of the Council of Ministers in Lebanon. Exceptions include flights for military, diplomatic and international agency workers.

Europe

Airports Council International (ACI) Europe President Jost Lammers has written to EU transport ministers ahead of their extraordinary meeting tomorrow (18 March) calling for urgent support measures for the continent’s airports.

“Extraordinary and urgent funding” is needed, he says, with an expected €2 billion revenue loss in the first quarter set to deepen in coming months.

“The unprecedented shock to their traffic and revenues means that several airports are facing cash flow issues – and that an increasing number of them will face such issues in the coming weeks if the situation continues,” Lammers wrote. “These cash flow problems risk becoming systemic for Europe’s airports and raise issues of business continuity, which must be addressed by the EU.”

Click here for the full story.

UK

Manchester Airports Group, the operator of Manchester, London Stansted and East Midlands airports, has announced a number of cost-saving measures to deal with what it calls “a rapid and unprecedented reduction in demand for air travel in and out of the UK”.

The airport operator will over the coming days consult with colleagues and unions ahead of introducing enforced annual leave, reduced working hours, temporary pay cuts and temporary lay-offs. With immediate effect, the executive team has taken a pay cut, recruitment has been frozen and capital expenditure paused.

Manchester Airports Group CEO Charlie Cornish said: “These are difficult decisions and they have not been taken lightly. We recognise the impact they will have on our people and we will be consulting with our colleagues. Our aim will always be to protect jobs wherever possible, and we need to take these steps now to ensure the company’s future.

“It is too early to predict with any accuracy the long-term effects of this crisis. We are seeing many of our airlines and supply chain partners make similar announcements and we are doing what we need to do in the face of an unpredictable and fast-moving situation.”

Billing the COVID-19 outbreak as “the greatest threat the UK’s travel sector has ever faced”, Cornish added: “The UK depends on air travel to supports its economy. The government must stand behind the aviation industry to make sure it is still there and ready to help the economy recover once this is all over.”

Europe

The European Tourism Manifesto alliance has called on the European Commission and national governments to implement several measures to help the travel and tourism sector deal with the COVID-19 pandemic. These are:

- Temporary state aid for the sector

- Fast and easy access to short- and medium-term loans to overcome liquidity shortages

- Fiscal relief starting with small and medium enterprises (SMEs) and extending to economic operators of all sizes

- Protection of workers from unemployment and loss of income through short-time work schemes or upskilling/reskilling programmes and support for self-employed tourism stakeholders

- Fast launch of the European Unemployment Reinsurance Scheme

- Deferment of fiscal and social contributions

- Immediate passing of temporary airport slots waiver

- Support action for the wider field of culture

- Better coordination between national authorities in terms of alignment of travel advice to affected regions

The alliance added: “Action is required now to strengthen the resilience of the sector in the long run and prepare the ground for a swift recovery from this unprecedented crisis.”

China

More good news out of China. Yesterday 930 patients were released from hospital after being cured from COVID-19. A further 1,105 people who had had close contact with infected patients were freed from medical observation. Serious cases decreased by 202.

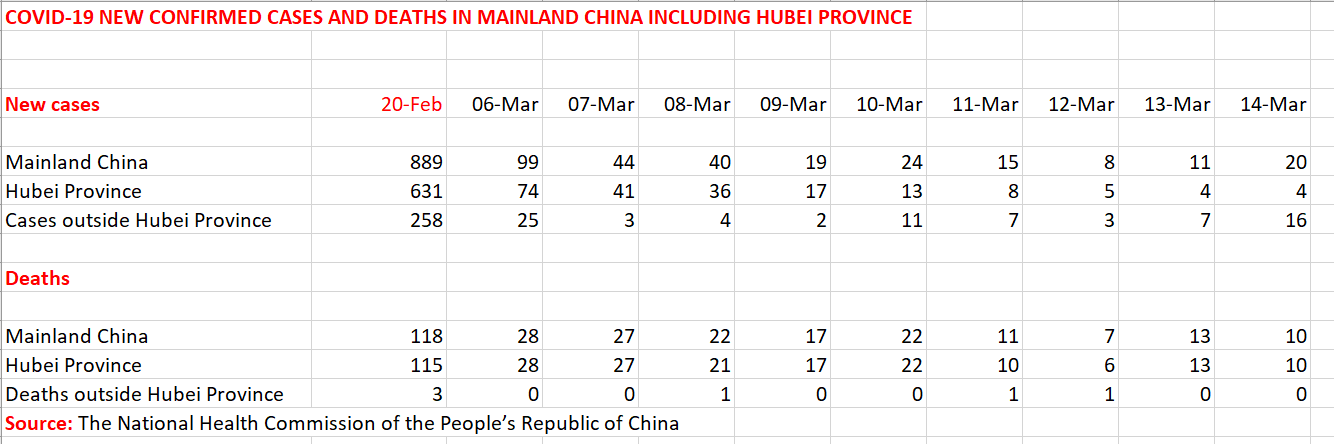

Only 21 new confirmed cases were reported in Mainland China and only one in Hubei Province, home to the outbreak’s original epicentre of Wuhan. 13 deaths were reported nationwide.

The National Health Commission of the People’s Republic of China reports similarly encouraging news from Hong Kong, Macau and Taiwan, where in each case local government and medical authorities have achieved remarkable control of initially serious outbreaks. As of 24:00 on 16 March, 235 confirmed infections had been reported across the three areas: 157 in Hong Kong (4 deaths and 88 cured and discharged from hospital); 11 in Macao (ten cured and discharged;) and 67 in Taiwan (1 death and 22 cured and discharged).

These are important statistics in analysing the situation that lies ahead in countries where the outbreak is accelerating.

South Korea

International

16 March

EU

The EU Commission has proposed that members states adopt a 30-day suspension on non-essential travel into the region. Commission President Ursula von der Leyen suggested the move in a call with G7 leaders today. The move will essentially shut down long-haul travel to and from the region for the month ahead.

In a video message, she said: “The less travel, the more we can contain the virus. I propose temporary restrictions on non-essential travel to the EU. These should be in place for an initial 30 days, which can be prolonged.”

Importantly, she said later that the ban would exclude UK-EU travel. There are also exemptions for long-term residents, family members of EU nationals, diplomats and medical and care workers.

| At a glance: Today’s major developments – China and South Korea continue to post encouraging numbers for new cases |

India

India will prohibit all travel to the country from European Union and European Free Trade Association member countries as well as Turkey and the UK from midnight on 18 March.

At the same time, compulsory quarantine for a minimum period of 14 days will be introduced for passengers coming from/transiting through the UAE, Qatar, Oman, and Kuwait.

Both measures will be in force until 31 March 2020, when they will be reviewed.

Europe

Ryanair has said it expects to ground most of its fleet in the next seven to ten days and has not ruled out ceasing operations entirely for a period.

The airline said it had seen a substantial decline in bookings over the last two weeks, and expects this to continue for the foreseeable future.

A statement today said: “Over the past seven days, Italy, Malta, Hungary, Czech Republic, Slovakia, Austria, Greece, Morocco, Spain, Portugal, Denmark, Poland, Norway and Cyprus have imposed flight bans of varying degrees, from all flights to/from the country, or banned flights to/from countries with high risk of Covid infection. Over the weekend for example, Poland and Norway have banned international flights, while in other countries (without travel bans) there has been severe reduction of ATC and essential airport services.

“Ryanair expects the result of these restrictions will be the grounding of the majority of its aircraft fleet across Europe over the next seven to ten days. In those countries where the fleet is not grounded, social distancing restrictions may make flying to all intents and purposes, impractical, if not, impossible.

“For April and May, Ryanair now expects to reduce its seat capacity by up to -80%, and a full grounding of the fleet cannot be ruled out. Ryanair is taking immediate action to reduce operating expenses, and improve cash flows. This will involve grounding surplus aircraft, deferring all capex and share buybacks, freezing recruitment and discretionary spending, and implementing a series of voluntary leave options, temporarily suspending employment contracts, and significant reductions to working hours and payments.”

Philippines

Duty Free Philippines yesterday closed its Fiesta Mall and Luxe Duty Free stores in Manila, and will close its Ninoy Aquino International Airport shops in the capital tomorrow as a preventative measure against the spread of COVID-19. Regent Asia duty paid stores are also being closed along with all other stores at the airport.

The Philippines government yesterday imposed strict home quarantine measures and halted work across the main island of Luzon, home to metropolitan Manila, effectively putting half the country’s population on lockdown.

International

Royal Caribbean Cruises has suspended all its sailings until 11 April. In a statement, the cruise line added: “We will conclude all current sailings as scheduled and assist our guests with their safe return home.”

Estonia

Leading maritime travel retailer Tallink Grupp will suspend operations on its Tallinn-Helsinki route from tomorrow, 17 March, with the Silja Europa remaining in Tallinn until further notice. The move follows the suspension of other Tallink routes, including Tallinn-Stockholm, in recent days.

France/International

Groupe ADP and local authorities have announced the suspension of passenger traffic at Amman Queen Alia International (Jordan), Riga (Latvia) and Ohrid (Macedonia) airports under measures to combat the impact of the COVID-19 outbreak.

Amman, the gateway to Jordan, will halt flights from tomorrow until further notice, while Riga, which serves the Latvian capital, will suspend international flights from tomorrow until at least 14 April.

Of the airport closures Groupe ADP said: “For the international platforms of Groupe ADP, [there will be] a complete closure of the airports of Amman in Jordan, Ohrid in Macedonia and Riga in Latvia. Operations with very low traffic are expected for the group’s airports in Tunisia, in Saudi Arabia and in Madagascar. The airports in Turkey and Georgia remain open at this stage even if infrastructure optimisations are considered to accompany the decline in traffic.”

ADP has also assessed the potential impact on EBITDA and revenues, and offered relief for its partners in Paris. For more, click here.

International

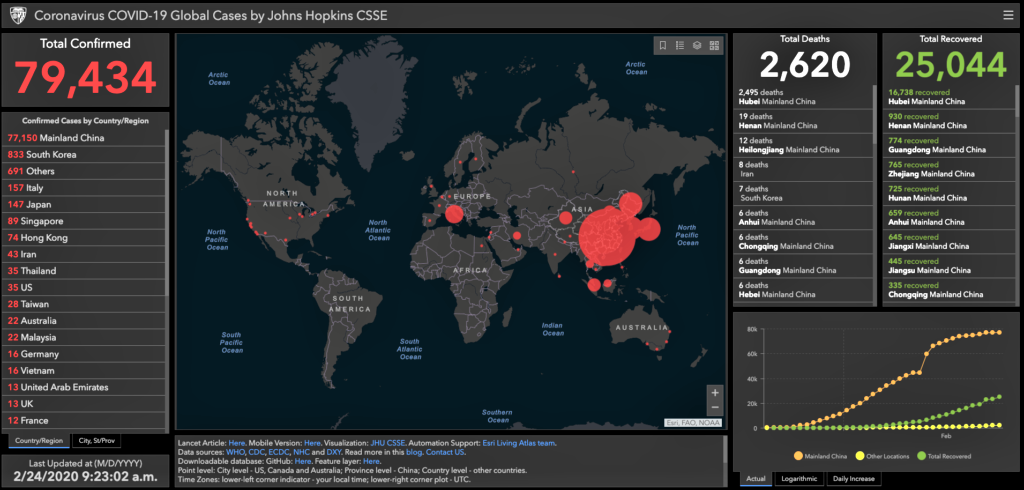

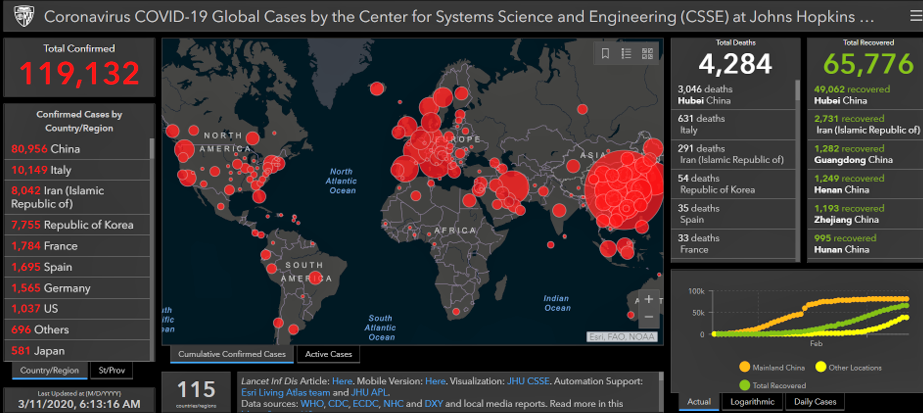

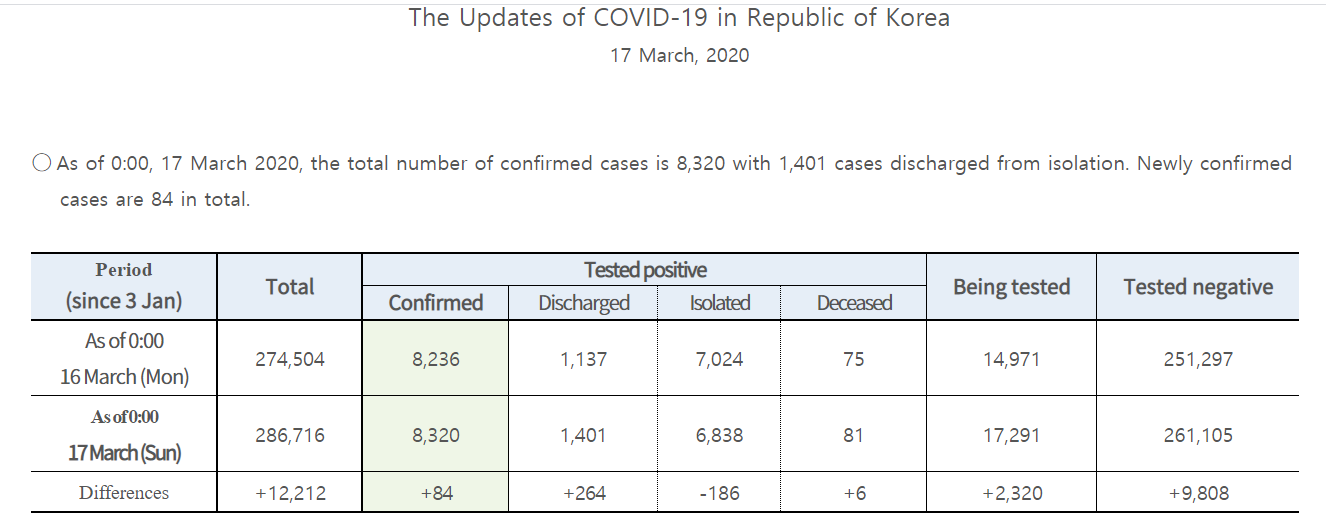

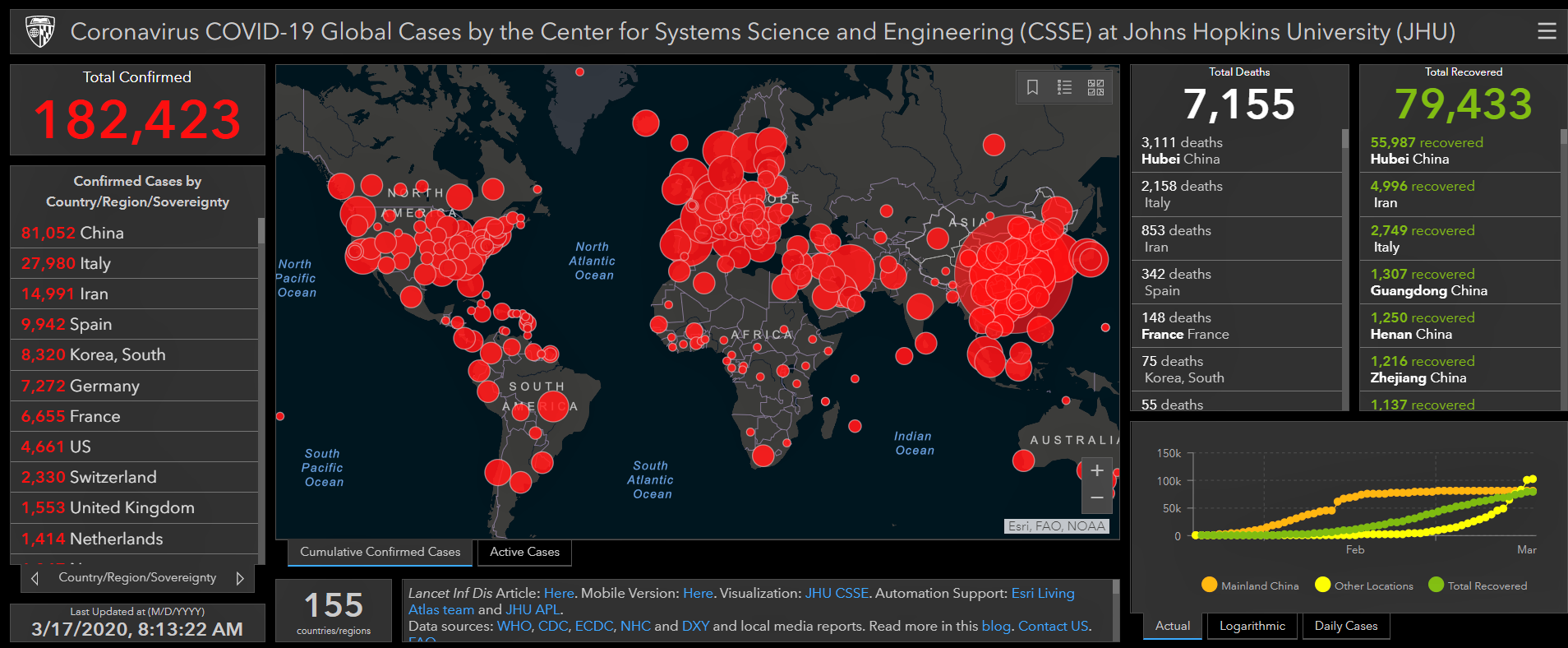

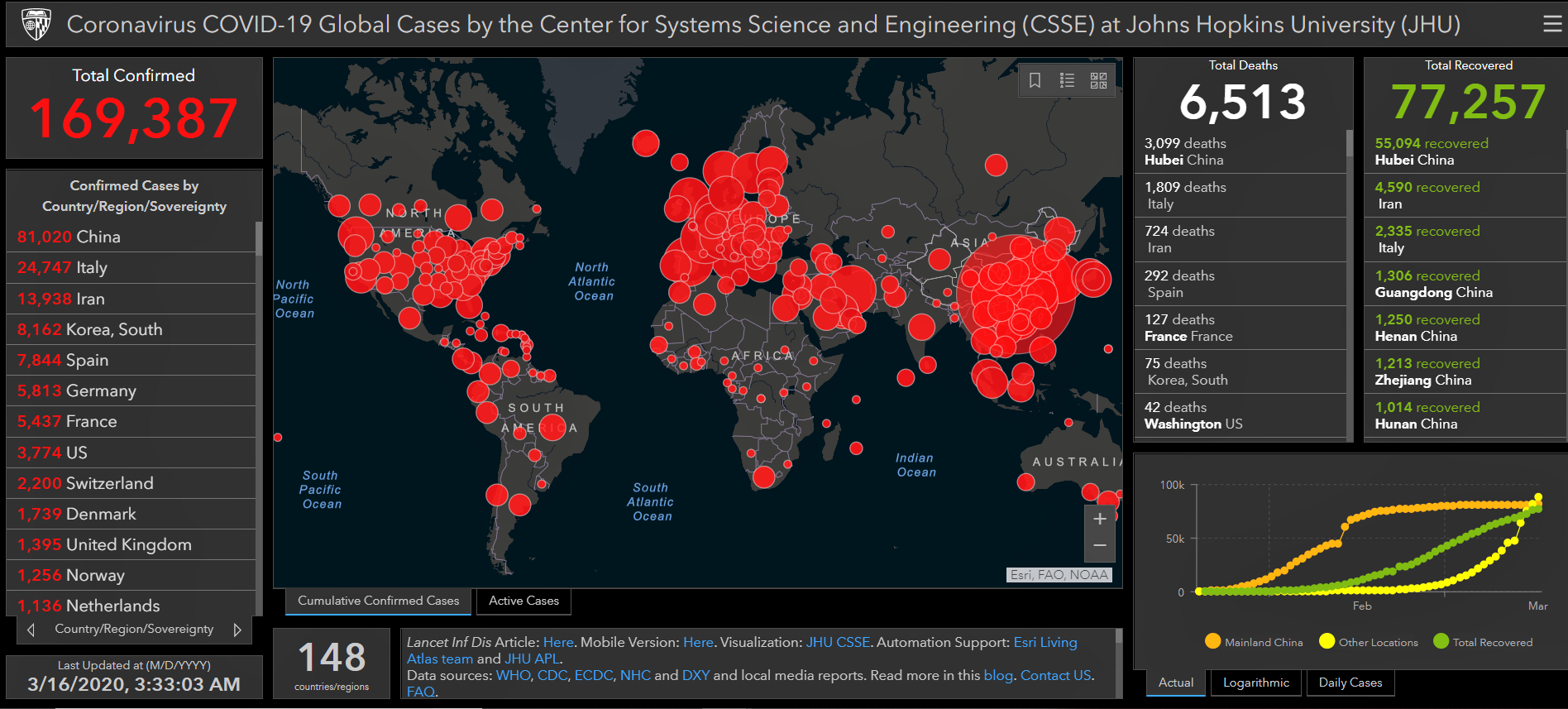

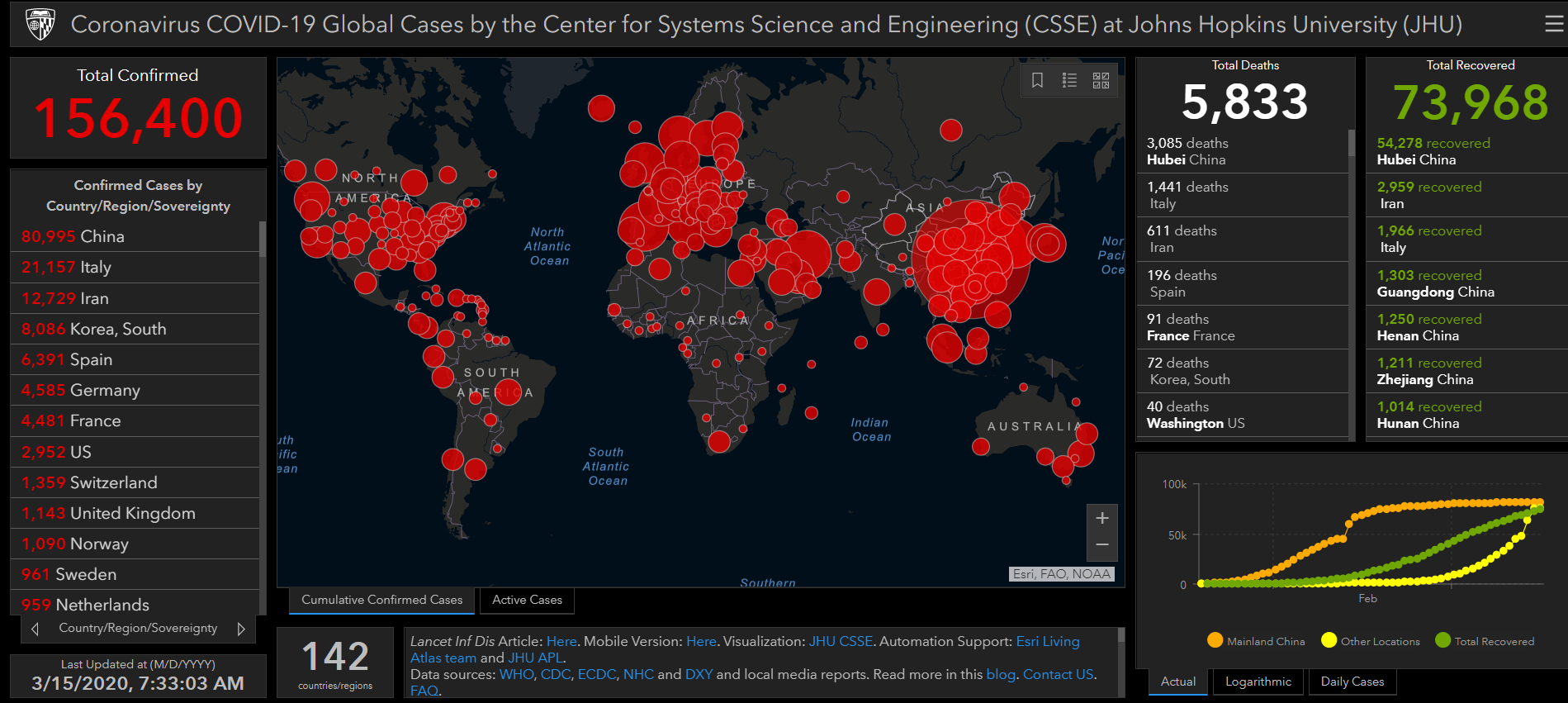

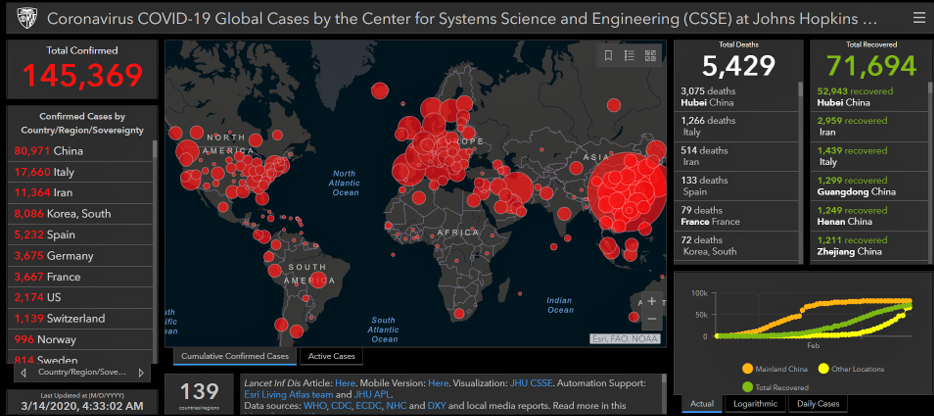

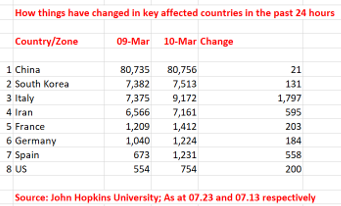

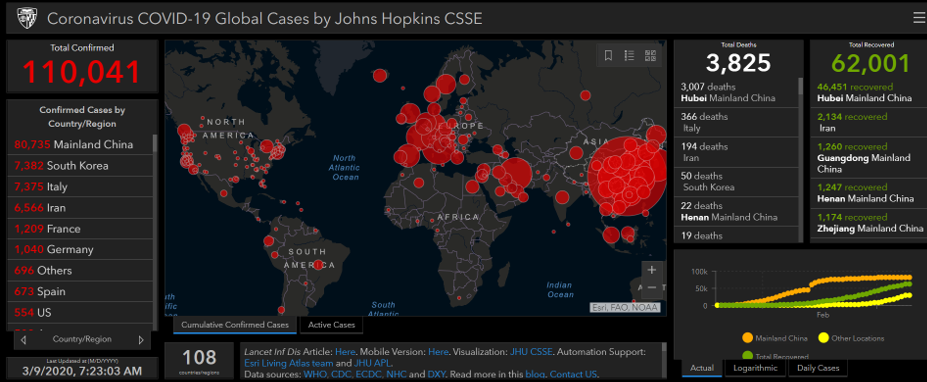

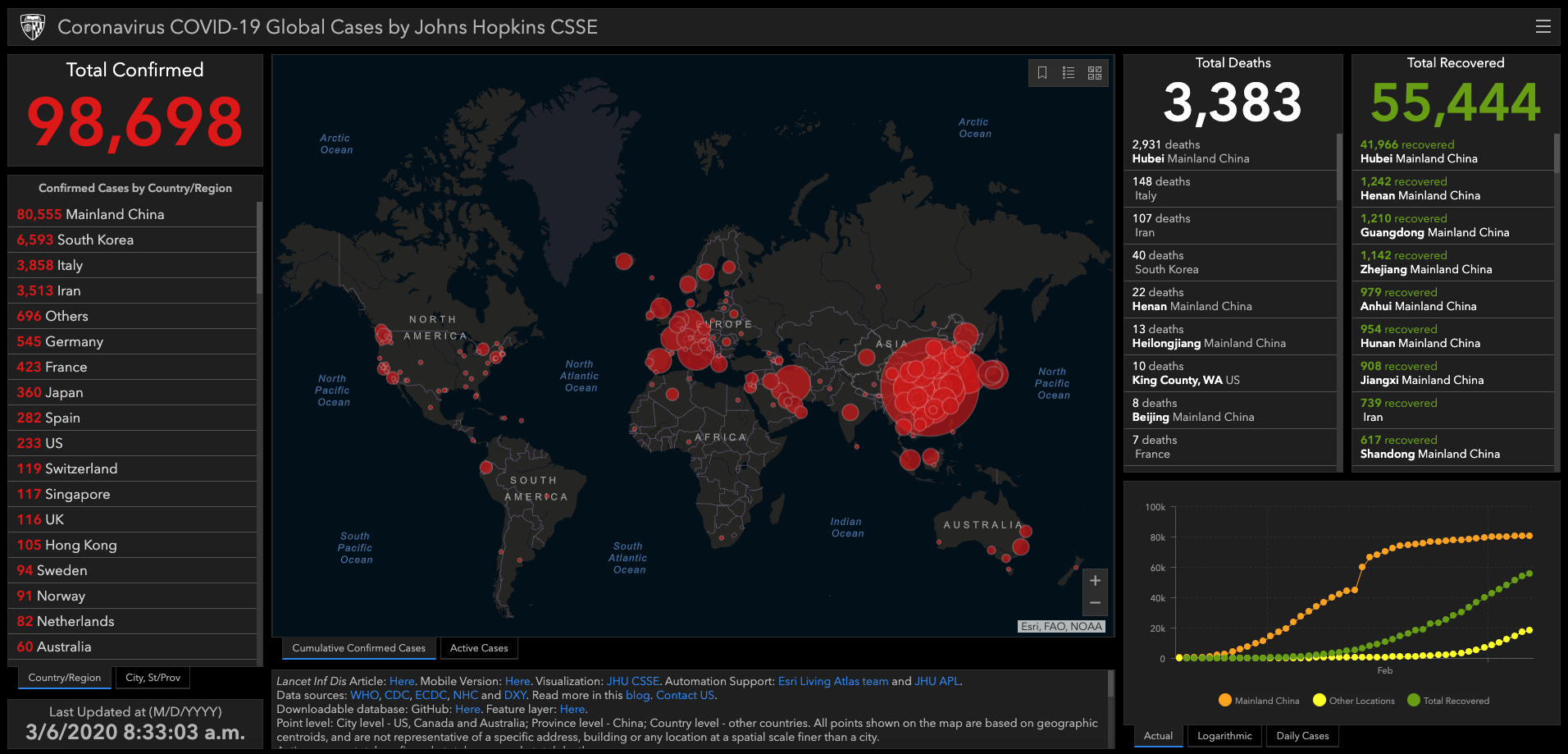

Another day in the COVID-19 crisis. The heat maps and country counts from Johns Hopkins University show the daily change in numbers and spread. Click charts to enlarge and click here for a (safe) link to an individual country tally.

Another day in the COVID-19 crisis. The heat maps and country counts from Johns Hopkins University show the daily change in numbers and spread. Click charts to enlarge and click here for a (safe) link to an individual country tally.South Korea

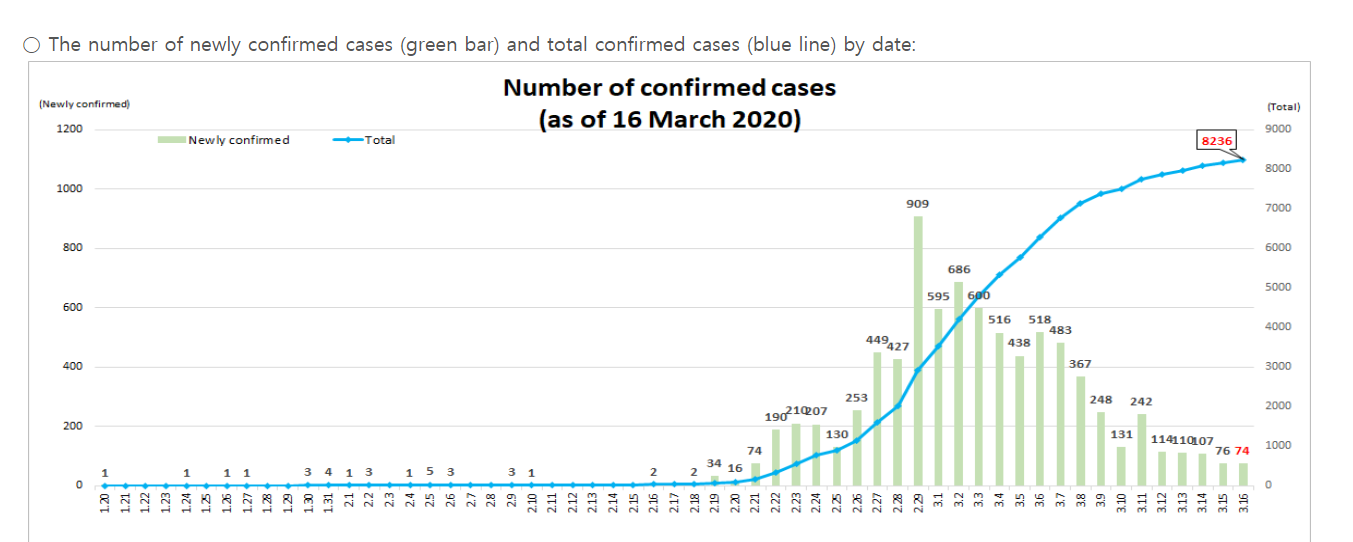

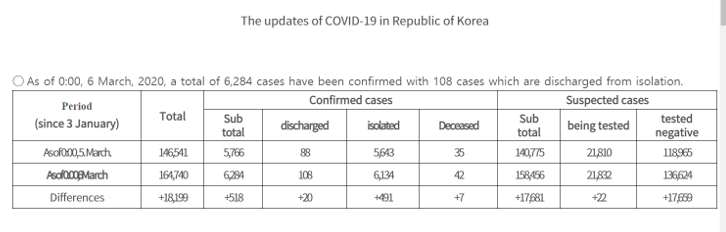

On top of the encouraging news from China this morning, we bring you heartening information from South Korea where just 74 new cases were reported yesterday by the Korea Centers for Disease Control and Prevention.

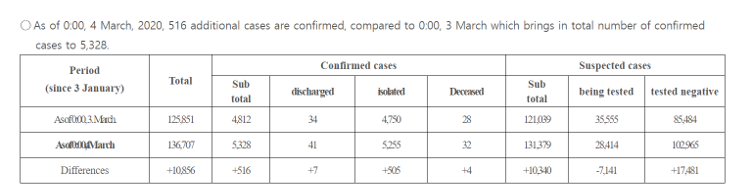

China

Here are the key numbers from China and they are encouraging.

As of 24:00 on 15 March, the National Health Commission of The People’ Republic of China reported just 16 confirmed new cases in Mainland China for the day, four of them in Hubei Province (all in the capital Wuhan) and 12 elsewhere (all imported from overseas). China’s growing challenge now is to stop the disease from being reimported from offshore.

Underlining the vast scale of the challenge fought by the Chinese authorities and people in recent weeks, the National Health Commission revealed that 80,860 confirmed cases and 3,213 deaths have been reported since the outbreak began across 31 provincial-level regions on the Chinese Mainland and the Xinjiang Production and Construction Corps. In all, 67,749 patients have been cured and discharged from hospital. 9,898 confirmed cases remain (including 3,032 in serious condition) and 134 suspected cases.

So far, 680,462 people have been identified as having had close contact with infected patients. 9,582 are now under medical observation.

15 March

From the Publisher

From today, the focus and tone of our coverage of the COVID-19 pandemic, and the crisis that the outbreak has prompted in the aviation, tourism and travel retail sectors, shifts.

The outbreak is simply moving so fast, the crisis deepening so alarmingly, that it is impossible to give adequate space to the key sector and medical developments each day. This crisis is swamping our sector and many of the businesses within it.

Analysis globally suggests that retail, hospitality and travel are the sectors with most businesses at risk of going into liquidation, as consumers choose or are forced to stay away. Our industry combines all those sectors, and both those dynamics, in one.

All companies in our industry, from giant Korean conglomerates to family-run concerns, from airports to retailers to brand houses, face distressing financial and human pressures amid this crisis. I write not just as a commentator; for as a pure play travel retail enterprise we are among those companies.

As revenue dries up with frightening speed, costs need to be slashed to aid, though not guarantee, company survival. Costs often equate to people, and all around the travel retail and aviation community, business leaders are having to make unpalatable employment decisions and managers and staff having no choice but to accept them.

It was as if each of them was simply trying to come to terms with the change to the human condition as much as they were trying to navigate the immediate future of their businesses. |

Cash flow is a dilemma for many. Prudent cost management and cash reserves are keys to weathering the storm – but for how long?

Travel retail has faced many great moments of adversity. We talk often, and rightly, about the sector’s historic resilience to – and ability to bounce back from – crises caused by geo-political events. Due to a combination of COVID-19’s geographic spread, its ferocious advance and its direct sector impact, this pandemic, for so long a China-related crisis and now a global one, is the greatest challenge of all.

From now, then, our coverage becomes less a blow by blow development of how COVID-19 is impacting our sector – there are simply too many blows to keep up – and more a regular analysis of how our world stands. Commentary becomes more important than news: where are the green shoots of recovery? What are the prospects for and likely speed of recovery? The lessons from crisis – and there are many already becoming obvious, none more so than the giant fault line that runs through the airport concession model – can wait. This is now all about making it through the storm.

– Martin Moodie, Founder & Chairman, The Moodie Davitt Report

| At a glance: Today’s major developments – China numbers remain low double digit. |

China (Hong Kong)

Passenger traffic at Hong Kong International Airport (HKIA) fell by -68% year-on-year in February to 1.9 million as a result of the COVID-19 outbreak. For the first two months of this year, HKIA handled 7.6 million passengers, a year-on-year decrease of -38.5%.

The combined decline of passenger volume in January and February was mainly caused by a -63% year-on-year slump in visitor traffic.

Airport Authority Hong Kong said: “Passenger traffic was particularly impacted in February due to weak travelling demand amid the outbreak of COVID-19, in addition to immigration restrictions and quarantine measures implemented by authorities in different countries and regions.

“Traffic to and from Mainland China and Southeast Asia recorded the most significant decreases in the month. It is expected to see continued drop in traffic figures in March as airlines have suspended more flights, and authorities in different markets continue to implement immigration restrictions and quarantine measures.”

Israel

Israel Airports Authority has closed all its shops and most food & beverage outlets at Ben Gurion International Airport, following a government directive yesterday for all such non-essential services to shut nationwide.

Israel Airports Authority Director General – Commerce and Business Development Yoram Shapira confirmed the decision to The Moodie Davitt Report. “We left some F&B sites open but all others (shops and restaurants) are closed after last night’s decision by the government that all shopping malls etc. would be closed until we will pass this virus crisis.

“You can just pick up your takeaway, that’s it. You cannot sit in a restaurant – we are only operating a coffee bar service.”

The main retailer at Ben Gurion is JR/Duty Free, James Richardson – a joint venture between JR and Gebr Heinemann of Germany.

Shapira said that passenger traffic in March had plummeted 75-80% year-on-year. Most of those are Israelis returning home, non-Israeli Jewish visitors entering or non-Israelis leaving.

“Traffic has already dropped dramatically but as it looks right now, it will drop even more dramatically in a week or two,” he said.

Shapira said it was the worst crisis he had seen at the airport in a career at the commercial department dating back to early 1989. That included periods of major conflict with Israel’s neighbours as well as global events.

“I have never been in this situation – never. Most of the time you know what to do and how to handle it. This time no. People are afraid to fly. And when they arrive back they have to stay at home for 14 days, so no-one wants to fly anyway.”

“We are living in unprecedented times,” another Israeli travel retail executive told The Moodie Davitt Report.

France

Group ADP has closed its shops and restaurants at Paris Charles de Gaulle (CDG) and Orly airports because of the COVID-19 crisis in France and beyond.

“All non-essential shops at Paris-CDG and Paris-Orly airports will be closed from midnight on Saturday [15 March] until further notice. Relay shops, mini-markets, pharmacies and takeaway food-only stores will remain open,” Aude Ferrand, Group ADP Retail Director Shops, Food & Beverage, Advertising, Financial services under Terminals, told The Moodie Davitt Report.

Société de Distribution Aéroportuaire, the joint venture between Aéroports de Paris and Lagardère Travel Retail has closed its duty free and most specialist retail stores. Relay and other convenience shops such as M&S Simply Food will stay open as they are being considered ‘Essential Stores for the Continuity of Service’, Lagardère Travel Retail CEO France & Luxembourg Vincent Romet told us.

Some F&B units will remain open in the airside area, including Eric Kayser, Paul Brioche Dorée, and Starbucks but no seating is allowed.

On Saturday evening, French Prime Minister Edouard Philippe announced the closure of all places “non-essential” to public life, including restaurants, cafes, cinemas and discos, effective midnight. “We must absolutely limit movement, meetings and contacts,” he said on Saturday evening. Food shops, tobacconists, banks and public transport will remain open.

SDA said in an email: “Following our Prime Minister’s announcement this evening, and after consultation with [Group] ADP, all sales points will be closed tomorrow morning.” All managers were told to inform staff not to turn up to work.

In related news Paris-Orly Airport 2 will be temporarily closed from 17 March until further notice.

China

South Korea

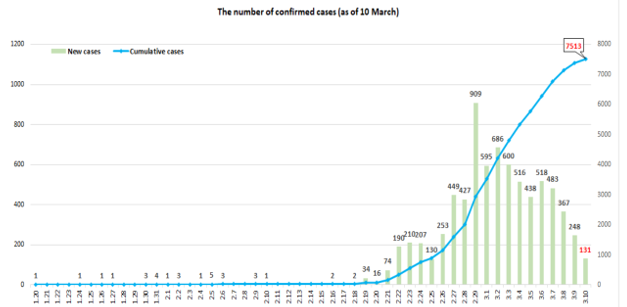

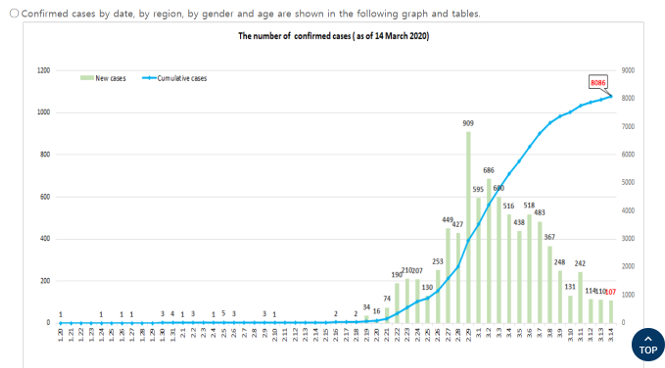

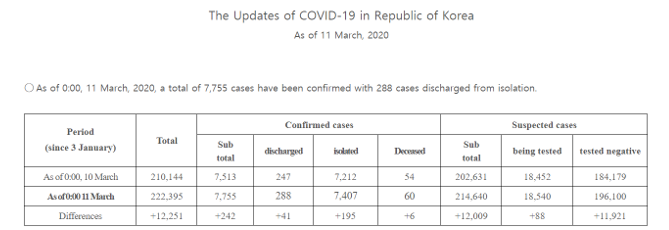

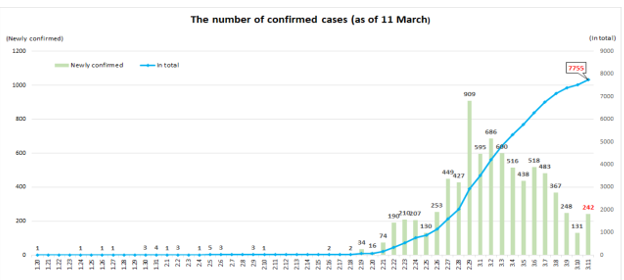

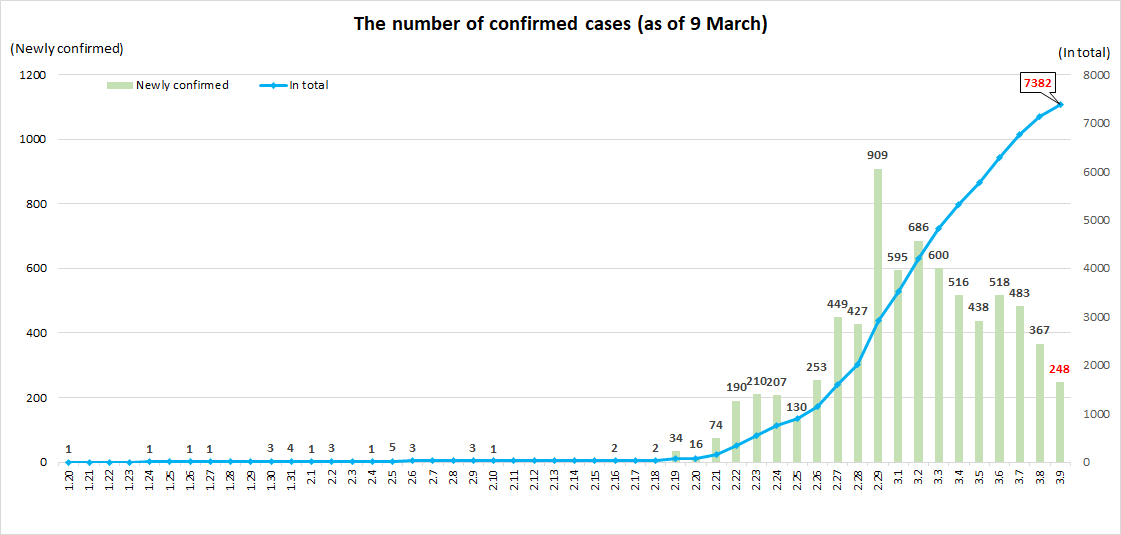

New confirmed case numbers continue to fall with just 76 new cases reported yesterday, according to the Korea Centers for Disease Control and Prevention. The tally continues an encouraging recent daily trend (see graph below):

13 March: 107

12 March: 110

11 March: 114

10 March: 242 (the only spike of recent days)

9 March: 131

8 March: 248

7 March: 367

6 March: 483

5 March: 518

International

14 March

| At a glance: Today’s major developments – Spain is on lockdown. Only supermarkets and pharmacies remain open. From Monday people will not be allowed to leave their homes except for supplies or exceptional reasons. |

New Zealand

Everyone arriving in New Zealand (whether a national or foreigner) from midnight Sunday must isolate themselves for 14 days. As of midnight Saturday, no cruise ships will be able to dock in New Zealand until June 30.

“We must plan and prepare for more cases. We must go hard and we must go early. We must do everything we can to protect the health of New Zealanders,” said Prime Minister Jacinda Ardern at a media conference.

“Alongside Israel and a small number of Pacific islands who have effectively closed their borders, this decision means New Zealand will have the widest ranging and toughest border restrictions of any country in the world.”

She also warned New Zealanders against all non-essential foreign travel. All measures will be reviewed in 16 days time. The news, though generally welcomed by Kiwis, will have a devastating impact on tourism (and travel retail).

Estonia

Tallink Grupp said today that it will suspend sailings on its Tallinn-Stockholm route from 15 March until further notice. It affects the passenger vessels Baltic Queen and Victoria I.

The company said the move was due to the “state of emergency declared in Estonia and to ensure the health and safety of people around the Baltic Sea”. Tallink said yesterday that it would suspend its cruise service on the route and offer only one-way tickets; now it has taken the measure a step further by suspending the route entirely.

In 2018, the Stockholm-Tallinn route handled one 1 million passengers out of 9.75 million in total for the group.

South Korea

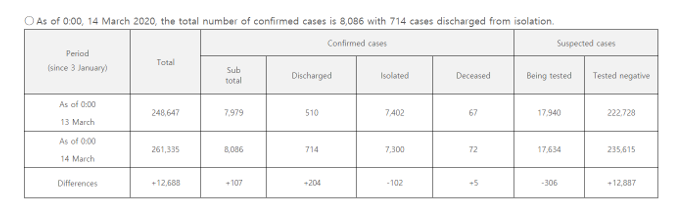

New confirmed case numbers continue to fall with just 107 new cases reported yesterday, according to the Korea Centers for Disease Control and Prevention.

The tally continues an encouraging recent daily trend:

12 March: 110

11 March: 114

10 March: 242 (the only spike of recent days)

9 March: 131

8 March: 248

7 March: 367

6 March: 483

5 March: 518

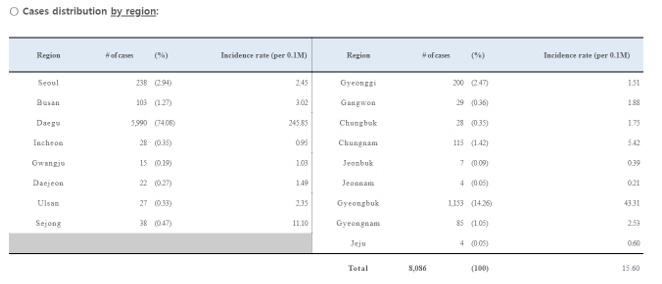

The charts above and below show the improving situation in the Republic of Korea and how it is focused on the city of Daegu. Source: Korea Centers for Disease Control and Prevention; Click to enlarge

The charts above and below show the improving situation in the Republic of Korea and how it is focused on the city of Daegu. Source: Korea Centers for Disease Control and Prevention; Click to enlargeNorway

Norway’s airports company Avinor is to close nine regional airports to commercial traffic from 18 March. It did not say how long the closures would last. The regional airports in question are Vardø, Berlevåg, Sørkjosen, Stokmarknes, Svolvær, Mo i Rana, Mosjøen, Førde and Sandane.

The move, said Avinor, was to “enable displacement of personnel and equipment to other airports.”

Avinor CEO Dag Falk-Petersen said: “With the aim of safeguarding our society, the Norwegian government has implemented the most pervasive measures in peacetime. In this situation, Avinor’s task is to contribute to ensuring that life, health and vital social interests are safeguarded for the entire nation throughout the crisis. The transport sector and Avinor have been defined as central parts of national emergency preparedness. The closing is done to ensure that this preparedness can be maintained over time.

“To ensure that we have an operational network of airports, we are now freeing up resources in order to increase robustness at other airports, and with that, securing our operational capability over time.”

Falk-Petersen said that further action was being considered “including at Oslo Airport”, without specifying what measures would be taken. Airport closures, especially those serving international traffic, would have a sharp impact on travel retail sales, especially in the critical arrivals channel, managed by Gebr Heinemann at the major Norwegian airports.

As the COVID-19 outbreak spreads, the Norwegian Directorate of Health has said that all individuals arriving to Norway from countries outside of the Nordic states will be quarantined (or must return home).

China

13 March

US

Seatrade Cruise Global, the largest cruise industry gathering in the world, has been postponed. The event, which attracted over 13,000 professionals last year, the biggest in its history, was due to take place in April at The Miami Beach Convention Center.

Italy

Italian womenswear and accessories house Coccinelle has launched a fundraising project to help Italy overcome the spread of COVID-19. The country has been devastated by the outbreak, with 15,113 cases confirmed at 17.53 local time today, compared with just 2,036 on 3 March, the world’s second-highest toll after China.

The fund is called Coccinelle Ci Mette Il Cuore (‘Coccinelle puts your heart into it’).

The monies from the campaign will be used stricly according to the priorities of the public emergency, said Coccinelle Global Commercial Director Emanuele Mazziotta in an email to the travel retail community.

“Small gestures make the biggest difference: it’s true,” the company said. “Coccinelle is convinced this is the right thing to do: together, united, even if it’s from a distance, we can overcome this. Now more than ever.”

Members of the travel retail sector can donate via: https://www.gofundme.com/f/wwwgofundmecomfcoccinelle-ci-mette-il-cuore

International

Costa Cruises is postponing the global operations of its ships until 3 April. As reported yesterday (12 March), Princess Cruises – another Carnival Corporation company – announced it had halted the global operations of 18 cruise ships for two months, impacting all voyages until 10 May.

Costa previously suspended operations in China and departures from its Italian ports. Several Costa cruise ships have been prevented from docking in recent weeks as a result of the COVID-19 outbreak.

“As an industry leader, we feel it is our responsibility to be ready to make hard choices when times require it,” said Costa Cruises President Neil Palomba. “In Costa, we always have the health and safety of our guests and crew members at heart. Now that these unprecedented circumstances require unprecedented actions to make sure that people across the world stay healthy, we are ready to play our role.”

Estonia

Tallink Grupp today announced that it will stop selling round-trip cruise tickets on the Tallinn-Stockholm route from 13 March until 1 May due to the COVID-19 outbreak. From today customers can only buy one way tickets.

The move will effectively curtail leisure traffic on the route, and will have a sharp impact on travel retail sales. Cruise travellers can avail of duty free prices due to the short stop-off in the Åland Islands with many choosing the return-trip option to shop, eat and drink and enjoy the onboard entertainment.

A Tallink spokesperson told The Moodie Davitt Report: “The main point is that we are cancelling the cruise product, and what remains is the transport product. It will have an impact as there will be fewer people travelling and mainly those people who need to travel.

“The decision [will] limit leisure travel. Ferry traffic in the current situation is continuing to ensure a transport service and to ensure transport of goods between the countries.”

Tallink Grupp CEO Paavo Nõgene said: “We completely understand the necessity of implementing the measures that our governments are implementing and will cooperate fully with the Estonian, Finnish, Swedish and Latvian authorities with one common goal in mind – to ensure the health and safety of us all.

“We will work with the authorities now on the specifics and details behind all the measures announced and identify the best solutions for preventing the spread of the virus. We are ready to take any steps necessary and to act decisively and without delay in this current situation. We will communicate any additional measures, decisions and actions without delay.”

Tallink Grupp restaurant and shop sales (including onshore) hit €524.4 million in 2018, and contributed 55.2% of total revenue. The Stockholm-Tallinn route handled one 1 million passengers out of 9.75 million in total in 2018.

Turkey

Turkish airports group TAV Airports is reacting to “contain the effect of fluctuations in markets due to the coronavirus” by initiating a share buyback.

TAV Airports President & CEO Sani Şener said: “The coronavirus pandemic and related precautions resulted in a decrease in passenger traffic at the airports we operate around the world. Due to the fact that we’re in the low season, the effect of this traffic decrease had a limited effect on our financial performance to date.

“On the other hand, the pandemic has serious implications for the global tourism and aviation industry and this has reflected negatively in our share price. In order to confirm our confidence in our company, our Board has decided to initiate a share buy-back up to TL200 million (US$32 million). We believe that the effects of the pandemic will be contained in coming weeks and the aviation industry will have a quick recovery, as we witnessed in prior incidents.”

TAV-owned and managed airports handled 8.5 million passengers in the first two months of this year, down by -3% compared to the same period in 2019.

Germany

As Fraport Group releases its annual results this morning, the company says it expects “a significant slump in passenger numbers at Frankfurt for the full year”. This will also lead to a sharp decline in revenue at the leading German airport. The executive board currently forecasts the traffic loss to result in a negative EBITDA effect of about €10 to 14 per missing passenger across the year.

Chairman Dr. Stefan Schulte says: “We have to assume that the strong decline in air traffic volumes will continue during the next few weeks and months. At the same time, we are unable to reliably forecast the extent and duration of this development. Therefore, we cannot provide a detailed guidance for the full year 2020. Out of our responsibility towards our employees and the company as a whole, it is now vital to adjust staff deployment to the reduced demand – as fast as possible and in a socially responsible manner.”

The impact of the coronavirus outbreak on passenger traffic at Fraport’s other airports could have further dampening effects on revenue and other key financial figures.

For more on this story and on the Fraport retail performance in 2019, click here.

Australia

The Australian government today urged its citizens to “reconsider your need for overseas travel” due to the risk of contracting COVID-19. It has said that regardless of destination, age or health, “if your overseas travel is not essential, consider carefully whether now is the right time”.

Government advice stated: “There may be a higher risk of contracting COVID-19 overseas. You may come in contact with more people than usual, including during long-haul flights and in crowded airports. Health care systems in some countries may come under strain and may not be as well-equipped as Australia’s or have the capacity to support foreigners. You may not have your normal support networks overseas.”

It also warned: “Overseas travel has become more complex and unpredictable. Many countries are introducing entry or movement restrictions. These are changing often and quickly. Your travel plans may be disrupted. You may be placed in quarantine or denied entry to some countries.”

Europe/US

“Having downplayed the significance of the crisis – for which there is some argument – he then stigmatizes an entire continent. Fear is more damaging and spreads faster than a virus.”

The European Travel Commission (ETC), the European Tourism Association (ETOA), United States Tour Operators Association (USTOA) and the European Travel Agents’ and Tour Operators’ Associations (ECTAA) have called for urgent bilateral conversations between European and US authorities to review and cancel the travel suspension from Europe to the United States of America.

As reported, President Donald Trump this week announced a 30-day suspension of travel by non-US citizens from 26 countries in Europe’s Schengen Zone to the US in an effort to curb the spread of COVID-19. Trump said the European Union had “failed to take the same precautions” as the US had implemented to contain the coronavirus outbreak. Non-members of Schengen such as the UK, Ireland, Croatia, San Marino, Monaco, Serbia and Montenegro are not covered by the ban.

The trade associations said in a joint statement that the ban is not “evidenced based” and adds more confusion to a beleaguered industry. The President’s initiative will likely add more losses to an already-damaged travel and tourism business with long-term consequences for the future recovery of jobs and economic growth, the statement said.

Supporting that position, European Travel Commission CEO Eduardo Santander: “The coronavirus is a global crisis, not limited to any destination and it requires cooperation rather than unilateral action. Planes fly from A to B and B to A, the European tourism sector disapproves this unilateral travel ban without any consultation which will equally affect travel and tourism businesses and citizens at both sides of the Atlantic.”

The President’s statement is puzzling,” said ETOA CEO Tom Jenkins. “Having downplayed the significance of the crisis – for which there is some argument – he then stigmatizes an entire continent. This is a global crisis and we need global understanding. As it stands this move disproportionately damages inbound tourism to the US and punctures confidence in Europe as a destination. Fear is more damaging and spreads faster than a virus.”

International

South Korea

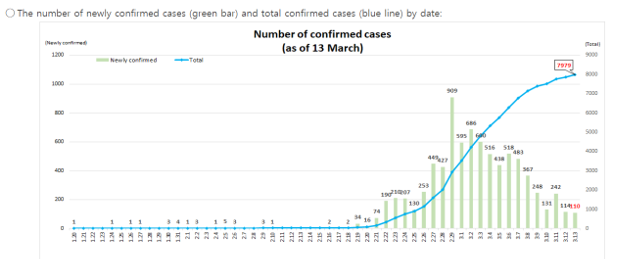

New confirmed case numbers continue to fall as health authorities in the Republic continue their impressive management of a situation that just weeks ago appeared to be getting out of hand. Just 110 new cases were reported yesterday, according to the Korea Centers for Disease Control and Prevention.

The tally continues an encouraging recent daily trend:

11 March: 114

10 March: 242 (the only spike of recent days)

9 March: 131

8 March: 248

7 March: 367

6 March: 483

5 March: 518

The green bars tell an encouraging story as the Republic of Korea, home to the world’s biggest duty free market, appears to be getting the outbreak under control. Source: Korea Centers for Disease Control and Prevention (Click to enlarge)

The green bars tell an encouraging story as the Republic of Korea, home to the world’s biggest duty free market, appears to be getting the outbreak under control. Source: Korea Centers for Disease Control and Prevention (Click to enlarge)China

12 March

Malaysia

Malaysia Airlines is temporarily suspending inflight duty free sales indefinitely due to the rise in COVID-19 cases. This will be applicable for both duty free and buy-on-board on all routes.

The flag carrier airline said customers can still conduct duty free shopping online for home delivery.

International

Princess Cruises is pausing its global operations of 18 cruise ships for two months, impacting all voyages departing between 12 March and 10 May.

“Princess Cruises is a global vacation company that serves more than 50,000 guests daily from 70 countries as part of our diverse business, and it is widely known that we have been managing the implications of COVID-19 on two continents,” said Princess Cruises President Jan Swartz.

“By taking this bold action of voluntarily pausing the operations of our ships, it is our intention to reassure our loyal guests, team members and global stakeholders of our commitment to the health, safety and wellbeing of all who sail with us, as well as those who do business with us, and the countries and communities we visit around the world.”

We have always been dedicated to one truth: the health, safety, & well-being of our guests, teammates, & communities we visit. #PrincessCruises President Jan Swartz shares an update on how our company is upholding this core value during this unprecedented time. pic.twitter.com/5u6pSR62Cb

— Princess Cruises (@PrincessCruises) March 12, 2020

Guests onboard two Princess Cruises vessels – Diamond Princess in Japan and Grand Princess in California – had tested positive for the novel coronavirus over recent months.

US

US airports expect to lose at least US$3.7 billion because of a COVID-19-driven steep decline in air travel.

That was the message from Airports Council International – North America (ACI-NA) after its President and CEO Kevin M. Burke today joined the directors of nine American airports for a White House meeting with key administration officials to discuss measures underway to protect the travelling public and airport employees from the spread of COVID-19. They also discussed the economic impact of the sharp drop in air travel.

“North American airports responded swiftly to contain the spread of COVID-19 and continue to take aggressive steps to protect everyone traveling through their facilities,” Burke said. “However, the abrupt decline in air travel resulting from this outbreak will cost U.S. airports at least $3.7 billion this year, and possibly more as people continue to cancel their travel plans. This unexpected shortfall will strain airport operating budgets and potentially disrupt the funding of infrastructure projects already underway.

“We appreciate the opportunity to meet with top administration officials to discuss our coordinated efforts to protect people from COVID-19 and explain how this outbreak will constrain airport budgets moving

forward,” Burke continued. “We are grateful for the White House’s leadership on this critical public health and economic issue, and we will continue to work closely with all relevant government agencies and public-health officials to ensure the health and safety of the traveling public and anyone who works in, or passes through, an airport.”

ACI-NA estimates US commercial airports will lose at least US$3.7 billion in calendar year 2020, based on preliminary data about flight cancellations. This figure does not include the impact from the travel restrictions from Europe announced by President Trump yesterday. Therefore, this figure will more than likely increase, ACI-NA said. The current estimate is based on the following elements:

- Passenger enplanements are expected to decline by 100 million during the first half of 2020, based on an anticipated 30 percent decrease during the March through June period, and 126 million for the full year.

- Total airport revenue is expected to fall by about US$2.5 billion for the first half of the year, representing a nearly 22 percent reduction, and US$3.2 billion for the remainder of 2020.

- Collection of the Passenger Facility Charge, an important funding source for U.S. commercial airports, is expected to fall by close to $500 million in 2020.

This comes as the total outstanding debt for US commercial airports stands at roughly US$100 billion. US airports also face increasing operating expenses due to increases in custodial costs associated with more frequent cleaning of public areas and restrooms, more and upgraded supplies, extra shifts and staffing, additional hand sanitisers in airport public areas for passengers and employees, and additional education and training for airport employees and contractors.

Czech Republic

The Czech Republic has closed its borders to travellers from 15 countries to project the spread of COVID-19. Prime Minister Andrej Babis declared an initial 30-day state of emergency, covering foreign nationals travelling from Germany, Austria, Italy, Sweden, Norway, France, the Netherlands, Belgium, Spain, Denmark, Switzerland, China, South Korea, Iran and the UK all banned from entering the country.

The ban will almost certainly ean the postponement (more likely than cancellation) of the the ACI Airport Commercial & Retail Conference & Exhibition in Prague on 21-23 April.

Italy

Food & beverage company Autogrill has reported an estimated negative impact on group revenue of approximately €25-30 million as a result of the COVID-19 outbreak, as of the end of the first week of March. The company’s share price had fallen -22.60% to €3.85 as of CET17.21. Click here for more details.

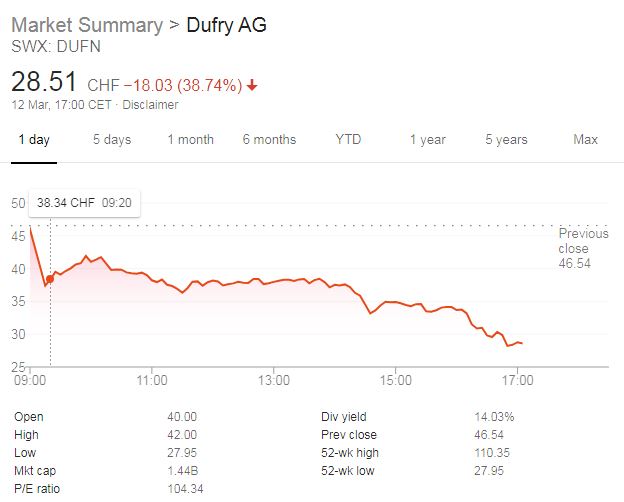

Switzerland

US/Europe

OAG, which analyses global flight schedules, says that the US ban on travellers from the Schengen Area will affect around 7,000 flights and millions of seats. As reported, the ban takes effect tomorrow and runs for 30 days initially.

According to OAG’s Flight Schedules Analyser, if the planned flights in this period from the 26 Schengen states were cancelled due to lack of demand it would remove close to two million seats each way from the market.

Of the 26 Schengen countries, Germany, France and the Netherlands will be most affected as these make up 57% of all flights between the Schengen Area and the US, said OAG.

“The worst-affected airlines will be Delta Air Lines and United Airlines, which, together are scheduled to fly 31% of all flights between the US and the Schengen Area in this period. Lufthansa is the most-affected European airline, flying 13% of flights between the two areas.

“Overall, the ban will affect 10.9% of all US international flights that had been scheduled for the next four weeks, and 16.9% of capacity seats. The overall impact for European airlines is somewhat less with these flights making up just 2.4% of the international scheduled flights from Schengen Area countries, and 3.9% of capacity.”

International

Viking Cruises has suspended operations of its river and ocean cruises for all embarkations until 30 April with immediate effect.

“I am sure you recognise that COVID-19 has made travel exceedingly complicated,” Viking Cruises Chairman Torstein Hagen said. “An increasing number of ports, including Venice, Monte Carlo and Bergen, have temporarily closed to cruise ships; major attractions such as the Vatican and other museums have been closed; and some countries are imposing restrictions on public gatherings and visitors.”

He continued: “I am writing today because the situation has now become such that operating as a travel company involves significant risks of quarantines or medical detentions, which could diminish the travel experiences for which our guests have been planning.

“As a private company with strong finances, we do not have to worry about quarterly profit expectations – and that flexibility allows us the ability to do what is best for our guests and our employees, as we have always done.

“Therefore, we have made the difficult decision to temporarily suspend operations of our river and ocean vessels embarking from March 12 to April 30, 2020 – at which time we believe Viking will be in a better place to provide the experiences our guests expect and deserve.

“This is a decision we made with a heavy heart, but with present circumstances what they are, we are unable to deliver the high-quality Viking experience for which we are known.”

The cruise line operates a fleet of 62 river vessels and six ocean ships, offering cruises along the rivers and oceans of North and South America, the Caribbean, Europe, Russia, Egypt, China and Southeast Asia.

Italy

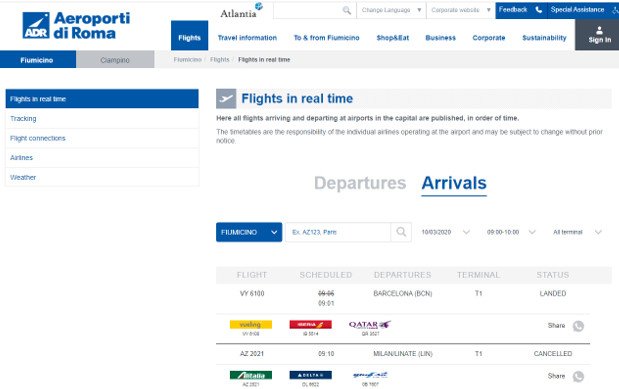

Aeroporti di Roma (AdR) said today that it plans to sharply reduce operations at Rome Fiumicino and Ciampino airports. The airport company said the decision “has become necessary due to the multiple flight cancellations to and from Italy announced by many airlines that normally operate at both Rome airports”.

From 14 March, Rome Ciampino, which handles mainly low-cost flights and is a hub for Ryanair, will close to passenger traffic. General aviation activities, state authority and cargo aviation activities will continue.

From 17 March, Rome Fiumicino T1 will close temporarily, with all operations shifting to Terminal 3.

AdR said: “The passenger terminals at Fiumicino and Ciampino airports will resume normal operations as soon as the current state of emergency is over.”

International

South Korea

South Korea today reported just 114 new confirmed COVID-19 daily cases, returning to the pattern of decline after a spike to 242 the previous day, the first rise in several days. That brief surge followed daily totals of 131 (a day earlier), 248, 367, 483 and 518 cases, respectively, as the situation improved. Source: Korea Centers for Disease Control and Prevention.

China

USA

In a dramatic response to the COVID-19 crisis, the US government has suspended inbound travel by foreign nationals coming from the Schengen Area in Europe. The ban takes effect from midnight on Friday and will run for an initial 30 days, President Donald Trump said in a televised address.

President Trump last night signed a Presidential Proclamation, which prevents the entry of “most foreign nationals who have been in certain European countries at any point during the 14 days prior to their scheduled arrival to the United States”.

These Schengen Area countries include: Austria, Belgium, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden and Switzerland.

11 March

India

The Indian government has suspended most visitor visas from 13 March until 15 April, effectively halting foreign travel into the country in that period. Responding to the threat of COVID-19, ministers decided to invalidate all visas except for those related to diplomatic, official, UN/international organisation, employment or project activity.

In a further dramatic step, the government advised Indian nationals to avoid non-essential travel overseas, noting that they may be subject to quarantine on their return.

For the full story click here.

International

The World Health Organization (WHO) has officially declared the COVID-19 outbreak a pandemic, after the number of cases outside China increased 13-fold in the past two weeks. A pandemic is a disease or outbreak that occurs over a wide geographic area and affects a high proportion of the population; this is the first time a coronavirus has been classified as a pandemic.

WHO Director General Tedros Adhanom Ghebreyesus said: “Pandemic is not a word to use lightly or carelessly. It is a word that, if misused, can cause unreasonable fear, or unjustified acceptance that the fight is over, leading to unnecessary suffering and death.

“Describing the situation as a pandemic does not change WHO’s assessment of the threat posed by this virus. It doesn’t change what WHO is doing, and it doesn’t change what countries should do.”

BREAKING

“We have therefore made the assessment that #COVID19 can be characterized as a pandemic”-@DrTedros #coronavirus pic.twitter.com/JqdsM2051A

— World Health Organization (WHO) (@WHO) March 11, 2020

Praising the steps taken by the countries that have been worst affected by the outbreak, Ghebreyesus added: “We are grateful for the measures being taken in Iran, Italy and the Republic of Korea to slow the virus and control their epidemics.

“We know that these measures are taking a heavy toll on societies and economies, just as they did in China. All countries must strike a fine balance between protecting health, minimising economic and social disruption, and respecting human rights.”

International

The United Nation’s World Tourism Organization (UNWTO) has agreed further cooperation with the World Health Organization (WHO) as the two groups respond to the COVID-19 outbreak.

The Director General of the WHO, Tedros Adhanom Ghebreyesus, welcomed a UNWTO delegation for a series of meetings.

The two organisations agreed on the importance of international cooperation and responsible leadership, as well as that any response to the outbreak should be proportionate and based on the latest public health measures.

UNWTO Secretary General Zurab Pololikashvili said: “This meeting reaffirmed the importance of strong cooperation and international solidarity and I welcome the Director General’s recognition of the role tourism can play both now and in the future.”

The UNWTO will also communicate with other UN bodies, including the International Civil Aviation Organization (ICAO), the International Maritime Organization (IMO), and with the International Air Transport Association (IATA) to ensure tourism’s response is coordinated and consistent.

Italy

Italian fashion & accessories company Coccinelle announced today that it will temporarily close all of its directly managed boutiques in Italy.

In a statement to partners, Coccinelle CEO Peter Kim said: “To encourage the containment measures required by the government in the face of the COVID-19 emergency, and to better protect customers and employees, Coccinelle has decided to close all the directly managed boutiques present on the national territory.”

Kim added: “Faced with the emergency of these days, the measure is a gesture of love by our brand with a deeply Italian DNA towards the moment of great difficulty faced by the whole of Italy — but also an act of concrete responsibility.”

Despite the worsening situation in Italy, Kim also highlighted how the COVID-19 crisis has forced the company to think smarter, stressing that retail activities on coccinelle.com will continue. Kim also announced that Coccinelle will be holding a fundraiser with all proceeds to be donated to support Italian hospitals during the epidemic crisis. The company will follow this announcement by communicating how donations can be made via its official channels tomorrow.

Denmark

COVID-19 is beginning to have a profound effect on Copenhagen Airport. The Danish gateway first felt the impact of the outbreak in February as passenger volumes fell slightly on last year, reaching almost two million. The impact of the crisis deepened in March with passenger traffic slumping by close to one third during the first ten days of the month.

A total of 1,987,766 passengers travelled through Copenhagen Airport in February, a decline of -0.4%. However, with 2019 being a leap year, February had 29 days. Adjusted for the extra day, the decline was -3.7%.

The main casualties were passenger volumes related to long-haul intercontinental routes out of Europe, resulting from considerably fewer departures and lower demand on departures to and from Asia. Towards the end of February, short-haul European routes were also affected, and in early March that trend has sharply accelerated.

“During the first ten days of March, the number of departures and travellers in and out of Denmark have dropped by one third,” said Copenhagen Airport CEO Thomas Woldbye. “This is something we’ve never seen before. The situation is developing much faster and more dramatically than what happened during the financial crisis, after 9/11, the ash cloud and any other event that has impacted on aviation since the Second World War.

“The crisis will impact not only airlines and airports. It will also affect large parts of the business community. For example, 32% of Danish exports by value is moved via air freight. The crisis has also been a major blow to the experience economy, impacting hotels, cultural events and venues as well as restaurants.

“There are much fewer tourists and business people flying to Denmark these days and the effect is really noticeable. In Denmark, many people have cancelled their trips, and the drop in demand has made the airlines cancel more and more departures and arrivals,” said Woldbye. He warned that the crisis may have long-lasting and damaging consequences for the country.

“We have to make sure that fear doesn’t overtake common sense,” he continued. “Fortunately, the Danish government and the rest of parliament are very concerned with tackling the current health crisis, and they are also making every effort to prevent the situation from becoming a full-blown economic crisis. Businesses, the government and the labour market must join forces and work to curb the impact of the crisis and steer the country through it, limiting the damage as much as possible and preparing the country for when the Corona crisis subsides.”

South Korea

Lotte Duty Free is to temporarily close its cosmetics & fragrance operation at Gimpo International Airport in Seoul from 12 March in the face of the COVID-19 crisis.

The company said that flight schedules had been reduced to one or two per day and that there are “virtually no duty free shoppers”. It said it was uncertain when the operation would resume. It will also reduce its downtown store operating times by one hour per day.

Click here for the full story.

International

UK

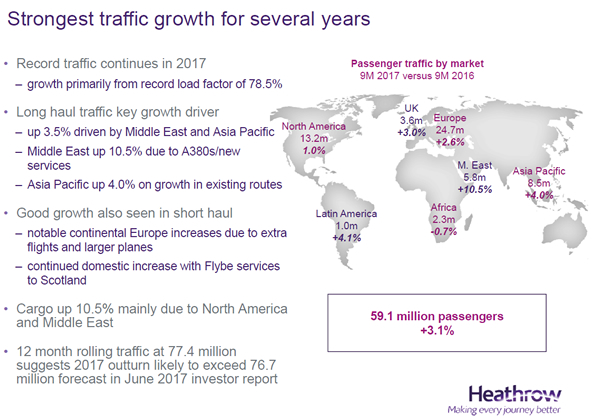

Heathrow Airport, one of the world’s key travel retail locations, today reported a -4.8% decline in February passenger numbers to 5.4 million (after adjusting for the 2020 leap day), due to lower demand on Asian and European routes. Demand has continued to weaken going into March and Heathrow expects a further year-on-year decrease in coming weeks.

Heathrow CEO John Holland-Kaye said: “The threat of Coronavirus is an increasing challenge for the UK and we are working day and night to ensure Britain’s front door is open and safe for our people and passengers. We will continue to work with the Government to limit the impacts this will have on UK plc.”

China

China

More encouraging numbers out of China with just 24 new confirmed COVID-19 cases reported yesterday, 13 of them in Hubei Province (all in Wuhan). 22 further deaths were recorded, again all in Wuhan, according to the latest statistics from The National Health Commission of the People’s Republic of China.

South Korea

10 March

Europe

Airports Council International (ACI) Europe has warned that the COVID-19 outbreak has escalated into an “unprecedented crisis” for Europe’s airports. The airports body is forecasting a -13.5% year-on-year drop in regional passenger traffic in the first three months, and -7.5% for the full year.

For the full story, click here.

South Korea

Hong Kong (China)

Passenger traffic (arriving and departing) at Hong Kong International Airport plummeted -68% year-on-year in February to 1,879,000. Aircraft movements were down -44.5%.

The February passenger result, driven by the COVID-19 outbreak in Hong Kong, Macau and Mainland China, followed a comparatively modest -11.7% fall in January.

International

Italy

Italy now has the highest number of COVID-19 cases outside China, overtaking South Korea over the past 24 hours. The whole country is in lockdown after the government yesterday extended strict quarantine measures in northern and parts of central Italy to a nationwide order. The government has said only those with a valid work or family reason that cannot be postponed will be allowed to travel.

China

International

UK

The British-Irish Airports Expo has been rescheduled to 5-6 October.

The event, which had been due to take place 9-10 June and attracts more than 3,000 visitors, was postponed after consultation with the hosting airport coalition of Heathrow, Gatwick, London City and Manchester Airports Group.

The organisers said moving the Expo to a new date will allow the core airport partners to maintain an undistracted focus on operational, safety and commercial discussions.

The rescheduled event will still take place at London’s ExCel Centre with the full planned itinerary moved to the new dates.

9 March

Japan

Japan today introduced additional measures to prevent the spread of COVID-19, including new restrictions on inbound travel from China and South Korea.

The Ministry of Foreign Affairs issued a notice saying that entry visas issued up to 8 March by Japanese embassies or consulates in both countries would be suspended from 9 March. In addition, visa exemptions for the Hong Kong and Macau Special Administrative Regions are also suspended from the same date.

The move will effectively stop the flow of visitors from China and South Korea to Japan, though the Ministry has not invalidated visas of those who have already travelled. The Ministry said the measures would last at least until the end of March and will invalidate around 3 million recently issued visas, according to Japanese media.

China and South Korea account for around half of all tourists to Japan (just under 6 million combined in 2018) and the move will have a severe impact on a travel retail sector already reeling from the crisis. Chinese visitors are the driver of recent growth in Japanese travel retail, accounting for 60-70% of turnover in airport duty free and around 90% in downtown duty free.

Germany

Lufthansa Group is to cut its flight capacity by up to -50% in coming weeks and may take its fleet of Airbus A380s out of service due to the spread of COVID-19. The company cited the “exceptional circumstances” caused by the outbreak, including many flight cancellations, saying it has decided to “reduce the flight capacity on offer even more than previously planned”. The changes will apply to all airlines in the group.

The company said: “Depending on the further development of demand, capacity is to be reduced by up to -50% in the coming weeks. In addition, the extent to which the entire Airbus A380 fleet (14 aircraft) can be temporarily taken out of service in Frankfurt and Munich is currently being examined.”

Lufthansa said that it is not yet possible to estimate the impact on earnings due to the crisis. It has implemented cost saving measures around personnel, material costs and project budgets.

Alongside a hiring freeze, like many other airlines, it has offered staff unpaid leave and the chance to bring forward annual leave. The company will announce its annual results on 19 March.

South Korea

Has South Korea reached a turning point in the COVID-19 crisis? Latest figures from the Korea Centers for Disease Control and Prevention (KCDC) offer encouragement. The KCDC said that the number of new cases (248, see chart above) was also below the average daily increase of 500 last week, and the lowest number since 26 February.

According to a Reuters report today, South Korean officials have warned against prematurely calling the peak of the outbreak while expressing cautious optimism.

“I’m still extremely cautious, but there’s hope we can reach a turning point in the near future,” Prime Minister Chung Sye-kyun said on Monday from the hard-hit southeastern city of Daegu, Reuters reported.

The South Korean situation is critical to the fortunes of the travel retail sector. The daigou market (Chinese professional shoppers buying duty free goods for resale in China) has been the locomotive of Asian travel retail in recent years, particularly for the boom beauty sector. Because the daigou sector is demand-driven (i.e. from Mainland China) rather than tourism-orientated like most duty free shopping, it is likely to recover quickly – and strongly – if travel to South Korea (the country that offers daigou traders the best price savings over China domestic) is considered relatively safe.

Most daigous buy in Seoul. Note from the chart below that only 130 of the country’s 7,382 cases have been recorded in the Korean capital. In contrast, some 75% of cases have been notified in Daegu, the southeastern city that is home to the cult-like Shincheonji Church.

“More than 79 percent of COVID-19 cases were found to be related to mass infection, and among them, 62.5 percent were linked to the Shincheonji Church,” KCDC Director Jung Eun-kyong said at a daily press briefing, The Korea Times reported.

Chinese demand for beauty and other products bought in Korean duty free has not declined during the crisis. Conversely, it has soared due to the comparative lack of supply. If the Korean COVID-19 numbers continue to tumble, a rare bright light amid this crisis may be switched on.

International

China

Saudi Arabia

In an attempt to minimise the COVID-19 outbreak, the Saudi government has this weekend introduced sweeping travel restrictions regarding departures to and arrivals from seven Middle East countries, Italy and South Korea.

The General Authority of Civil Aviation of Saudi Arabia (GACA) announced that with immediate effect Saudi citizens and others living in the Kingdom are prohibited from travelling to the UAE, Kuwait, Bahrain, Lebanon, Egypt, Syria, Iraq, Italy and South Korea. Additionally, passengers from any of those countries – or who have visited any of them in the past 14 days – are prohibited from entering the Kingdom. For full story, click here.

8 March

International

Summary of key developments over the past 24 hours

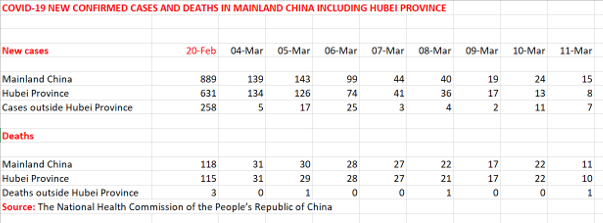

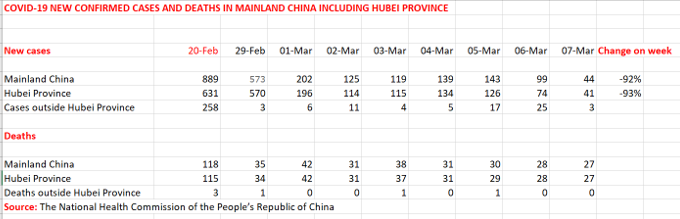

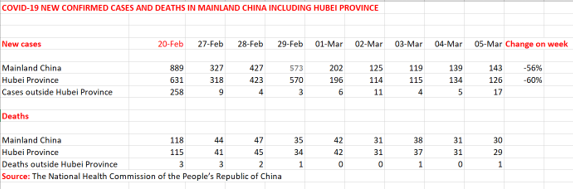

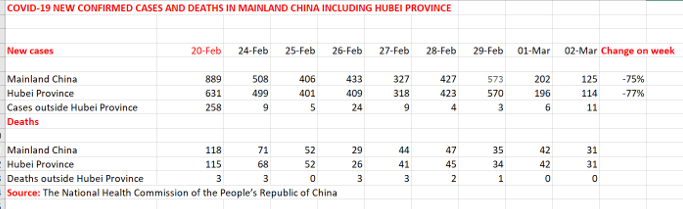

The COVID-19 crisis continues to escalate globally while steadily being brought under control in China, where just 44 confirmed new cases were reported yesterday, down from 573 a week earlier. Only three of the new cases were outside Hubei Province.

As of 06.53 GMT 106,165 cases had been reported globally, leading to 3,594 deaths. The tally continues to soar in South Korea, Italy and Iran with rapid rises in France, Germany and several other countries including the US.

Italian Prime Minister Giuseppe Conte signed a decree early today which places most of northern Italy under lockdown due to the escalating crisis – the toughest quarantine measure taken outside of Mainland China. The entire Lombardy region is included as well as 14 other northern and central provinces.

Anybody living in Lombardy and the other provinces requires permission to enter or leave. Milan and Venice (the latter home of T Fondaco dei Tedeschi by DFS) are both affected. Schools, ski resorts, musuems, gyms and pools will be closed and all events in “public and private spaces” suspended, Conte said.

DFS has complied with a government request to close stores in the ‘red zone’, which includes Venice, on Saturday and Sunday, a spokesperson confirmed to The Moodie Davitt Report.

US

Seatrade Cruise Global said on Friday that with just six weeks to go before its Seatrade Cruise Global event – a key date in the cruise calendar – it is moving forward with plans to host activities as scheduled on 20-23 April in Miami.

In a statement, the organisers said: “We are in communication with state and local officials and the Miami Beach Convention Center, and, at this point, there are no plans to cancel any shows at the facility due to coronavirus. The Miami Beach Convention Center and Seatrade Cruise Global are taking precautionary measures inside the venue while the state and local agencies are taking steps to limit the spread of respiratory viruses.

“We have spoken with many of our partner associations, exhibitors, and cruise lines and the overwhelming feeling is of support and that the event should, if it’s able to, go ahead at this crucial time for the industry. We want to assure you that the health and safety of our attendees is our top priority, and we will continue to monitor and follow the guidance of the leading health authorities.”

7 March

US

The Centers of Disease Control (CDC) has confirmed 21 people on the Grand Princess cruise ship have tested positive for COVID-19.

All guests and crew on the ship, which is currently off the coast of California, will remain isolated in their rooms. Princess Cruises will follow the guidance of the CDC to determine next steps and if additional precautionary measures need to be taken.

International

South Korea

China

6 March

International

The United Nation’s World Tourism Organization (UNWTO) has called for financial and political support for the tourism sector.

The organisation has estimated international tourist arrivals will be down by between -1% and -3%, translating into an estimated loss of US$30 billion to US$50 billion this year. This first assessment expects that Asia Pacific will be the worst0affected region, with an anticipated fall in arrivals of -9% to -12%.

The UNWTO said that political and financial commitments are necessary to ensure that tourism can lead the wider economic and social recovery from the COVID-19 outbreak.

International

The number of new confirmed daily cases outside of Mainland China, Hong Kong and Macau dropped slightly yesterday, according to the World Health Organization (WHO).

According to the WHO’s daily situation report, 2,098 new cases were confirmed outside of China on 5 March, a slight drop on the 2,103 recorded on 4 March.

This comes after the number of new daily cases outside of China had accelerated in recent days.

US

The California Air National Guard has airdropped test kits for COVID-19 onto a cruise ship off the coast of California.

There are no confirmed cases of COVID-19 among the 3,533 people onboard the Grand Princess cruise ship, but some guests have shown influenza-like symptoms, Princess Cruises said in a statement.

#GrandPrincess Update: We can confirm that while there are no confirmed cases of COVID-19 currently on board, the @CDCgov has identified groups of guests and crew who will be tested before arrival into San Francisco.

— Princess Cruises (@PrincessCruises) March 5, 2020

Samples of 45 people – a mix of crew and guests – have now been delivered to the California Department of Public Health and the results are expected today.

In the meantime, all passengers on the cruise ship have been asked to stay in their rooms where they are receiving meal deliveries. Princess Cruises added that guests have been provided with additional television options and complimentary internet.

The upcoming Grand Princess Hawaii cruise set to depart on 7 March has been cancelled.

International

5 March

Singapore

The global duty free industry has applauded the Tax Free World Association’s (TFWA) decision to cancel the TFWA Asia Pacific Exhibition & Conference.

DFS Singapore Venture Regional Merchandise Manager Patricia Sim said: “It’s sad for the travel retail industry players, but for the safety of everyone, this is understandable. Travel retail will come out of this stronger.”

Germany

The World Travel Catering & Onboard Services Expo (WTCE), which was set to take place in Hamburg from 30 March to 2 April, is the latest major travel event to be postponed amid the COVID-19 outbreak. The event attracts many airline and their service providers, and was due to run alongside the Aircraft Interiors Expo and Passenger Experience Conference at the same venue, Hamburg Messe. Organiser Reed Exhibitions said today that all three events will move to alternative dates.

Reed Exhibitions Portfolio Director Katie Murphy said: “The health and safety of our exhibitors, visitors and staff is our priority. In close coordination with all partners involved, we will promptly announce an alternative date for the events.

“We have been closely monitoring the situation and notices issued by the World Health Organisation (WHO), as well as the German Federal Government and Hamburg local authorities. While it is disappointing to postpone the events, given the ongoing developments related to COVID-19, we believe it is the best course of action for all involved.

“This is not a decision we have taken lightly. We trust that postponing the events will provide the international passenger experience industry the opportunity to achieve their business objectives later in the year and we are working to have confirmed dates as soon as possible.”

France/Singapore

The Tax Free World Association (TFWA) has taken the seemingly inevitable and appropriate decision to cancel the upcoming TFWA Asia Pacific Exhibition & Conference due to the escalating COVID-19 outbreak.

The decision to call off the event, due to take place at the Marina Bay Sands Expo & Convention Centre 10-14 May, was made by TFWA Board & Management Committee members today.

Europe

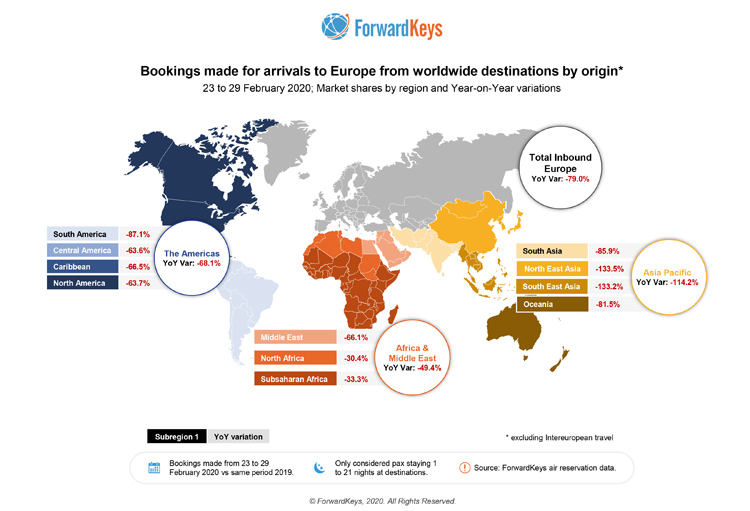

A report by travel analytics company ForwardKeys, commissioned by European Cities Marketing (ECM), has underlined the scale of booking cancellations to Italy and Europe from overseas markets amid the outbreak of COVID-19.

After China imposed restrictions on outbound travel, in the week of 20 January, until 22 February, when the outbreak of COVID19 cases in northern Italy began, bookings to Europe from intercontinental source markets had decreased by -23.7%. However, in the final week of February, after the first deaths were reported in Italy, the number of new bookings to that country was outpaced by the cancellation of existing bookings, with overall bookings down by -138.7%. The impact on travel was not confined to Italy; the number of new flight bookings to Europe fell by -79% in the same week.

ForwardKeys’ analysis of Europe’s various source markets shows a double-digit decline in bookings in the final week of February from every major region of the world.

Bookings from the Asia Pacific region fell by -114.2% (cancellations exceeding new bookings), followed by the Americas which fell by -68.1% and Africa & the Middle East, which fell by -49.9%.

Visitor arrivals in Europe have shown a two-phased decline as a consequence of the COVID19 crisis, said the analyst.

“Initially, intercontinental visits to Europe tracked collectively +1.3% above 2019 levels in the period from the start of the year to 28 January. The first phase of decline in Europe began on 29 January, nine days after the beginning of the crisis in China, when European destinations started to suffer, and arrivals decreased by -17.6% from 29 January to 23 February.

“Phase two began with the sharp slump in visits which happened in tandem with the explosion of COVID-19 cases in northern Italy. In Phase two, arrivals in Europe collapsed by -25.9% between 24 and 29 February alone, leaving the year to date results -10.5% below the same period last year.

International

The International Air Transport Association (IATA) has updated its analysis of the financial impact of the COVID-19 crisis – painting a stark picture of the outbreak’s impact on the global air transport industry – and called for urgent relief measures.

The association said it estimates 2020 revenue losses for the global aviation sector will be US$63 billion in a scenario where COVID-19 is contained to the current markets and US$113 billion if it spreads more broadly.

France/Singapore

TFWA will today make a decision on the fate of the TFWA Asia Pacific show in Singapore, due to be held on 10-14 May. The Board and Management Committee had been due to meet in Barcelona but the spiralling COVID-19 outbreak in Spain and elsewhere prompted the association to convene the gathering from its Paris headquarters with Board and Management Committee members able to attend in person or via conference call.

As with all event organisers (including The Moodie Davitt Report, which was forced to postpone its Airport Food & Beverage Conference & Awards in Istanbul from June until September), TFWA finds itself in an invidious position in weighing up the options of deferring a decision, postponing or cancelling. As revealed by The Moodie Davitt Report, The 2020 Duty Free & Travel Retail Summit of the Americas, due to be held on 30 March-2 April in Orlando, was cancelled earlier this week due to COVID-19.

Four Asian nations or zones (Mainland China, South Korea, Japan and Singapore) are among the ten most-affected countries with several others in the top 20 (Hong Kong, China; Malaysia, Thailand and Taiwan), according to this morning’s figures from John Hopkins University.

With less than nine weeks to go before the show and little likelihood of the crisis easing in the near-term, allied to current supplier and buyer reluctance to travel (sometimes prohibited by their companies) and a widespread wish to defer investment to a hoped-for second-half recovery, it seems likely that caution will prevail.

China

International

Japan

Chinese President Xi Jinping has postponed a much-anticipated state visit to Japan amid an escalating COVID-19 count in China’s near neighbour.

Italy

Italy has shut all schools and universities from today for ten days as it strives to contain an escalating COVID-19 outbreak.

According to latest figures from John Hopkins University, 3089 people have been infected with the disease in Italy – the third-highest tally in the world behind Mainland China (80,410) and South Korea (5,766).

4 March

Asia Pacific

GlobalData has dramatically revised its sales estimate for the Asia Pacific duty free market in 2020.

The analytics company had originally predicted sales for the year in the region of US$43.4 billion, but is now predicting annual sales will be -19.1% lower at US$35.2 billion. It is expected US$5.5 billion will be lost from the South Korean forecast and US$1.5 billion from China.

GlobalData Retail Analyst Suresh Sunkara added: “The forecasts may change further during the course of time if the virus spread is prolonged to the second half of 2020, or if it spreads to other key duty-free markets in the region including India, Malaysia and Australia, which are currently not significantly affected by the spread.”

International

The International Wines & Spirits Record (IWSR) is to release an IWSR Coronavirus Risk Assessment Model in the second quarter of the year. The tool will quantify and forecast the impact of major global events and give industry leaders data-driven insights and situational forecasts.

IWSR CEO Mark Meek said: “In this rapidly-evolving situation, the IWSR Coronavirus Risk Assessment Model will give industry leaders the clarity needed to confidently respond to a serious event with global implications.