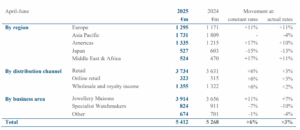

Luxury house Richemont posted a +6% year-on-year rise in sales at constant exchange rates (+3% actual) to €5.4 billion for its first quarter ended 30 June 2025.

The group described the performance as “solid”, coming amid a volatile macroeconomic and geopolitical context.

Richemont’s Jewellery Maisons division was the star of the show with sales up +11% at constant exchange rates.

The Specialist Watchmakers arm saw a softer sequential rate of decline with revenues falling -7% at constant exchange rates.

‘Other’, including Fashion & Accessories Maisons, declined -1%

Regional growth was led by double-digit increases in Europe, the Americas and Middle East & Africa, more than offsetting Japan’s sales decline against high prior-year comparatives, while sales elsewhere in Asia Pacific remained stable.

In Europe, sales grew +11%, driven by robust demand from local clients and overall positive tourist spend, supported by successful high jewellery events.

Almost all main markets in the region saw an increase in sales this quarter, with notable performances in Italy and Germany.

In the Americas, sales growth remained strong at +17%, driven by supportive local demand across all business areas and markets. Sales in the Middle East & Africa region rose +17%, led by the UAE and higher tourist spend.

In Japan, sales declined -15% against a demanding +59% comparative in the prior-year period, with a strengthening Yen strongly reducing tourist spend, most notably from Chinese clientele, while local demand remained positive.

Asia Pacific sales were stable overall versus the prior-year period, as a -7% decline in Mainland China, Hong Kong and Macau combined was fully compensated by robust growth in almost all other Asian markets.

Encouragingly, sales in Australia and South Korea were up double digits.

Growth was consistent across all distribution channels, each up +6%, led by Jewellery Maisons.

Retail sales accounted for 69% of Group sales, with growth across all regions excluding Japan.

Wholesale sales growth was driven by solid increases in the Americas, Europe and Middle East & Africa. Online retail sales showed robust growth across almost all regions.

The Group’s four Jewellery Maisons – Buccellati, Cartier, Van Cleef & Arpels and Vhernier – recorded an +11% rise in sales, marking a third consecutive quarter of double-digit growth, supported by both jewellery and watch product lines.

For ‘Other business’, highlights included continued solid momentum at Peter Millar and Alaïa, an encouraging performance at Chloé and robust growth at pre-loved watches business Watchfinder & Co. ✈