Commercial Sales Results

Retail performance outstrips passenger traffic growth for Groupe ADP in 2024

Spend per passenger at the group’s retail and hospitality outlets (under the Extime Paris brand) grew +4.9% year-on-year to €32.10, and reached an impressive high of €87.60 in the renovated CDG Terminal 1.

Income per passenger rose +1.9% to NZ10.16 (US$5.81) with the passenger spend rate (PSR) nudging ahead by +0.3% year-on-year. However, international PSR was down -1.5%.

TAV Airports today reported a +27% year-on-year rise in revenue to €1.66 billion in 2024, outpacing an +11% rise in passenger traffic.

For the full year ended 31 December, the retailer’s net profit reached BD5.015 million (US$13.3 million).

Airports of Thailand reports a +2.7% rise in non-aeronautical revenues for the three months ended 31 December 2024, but this lags behind a +16.4% leap in passenger traffic. UPDATED.

Lagardère Travel Retail posted €5,812 million in revenue in 2024, up +15.8% year-on-year and +12.5% on a like-for-like basis, along with a sharp rise in profitability. UPDATED.

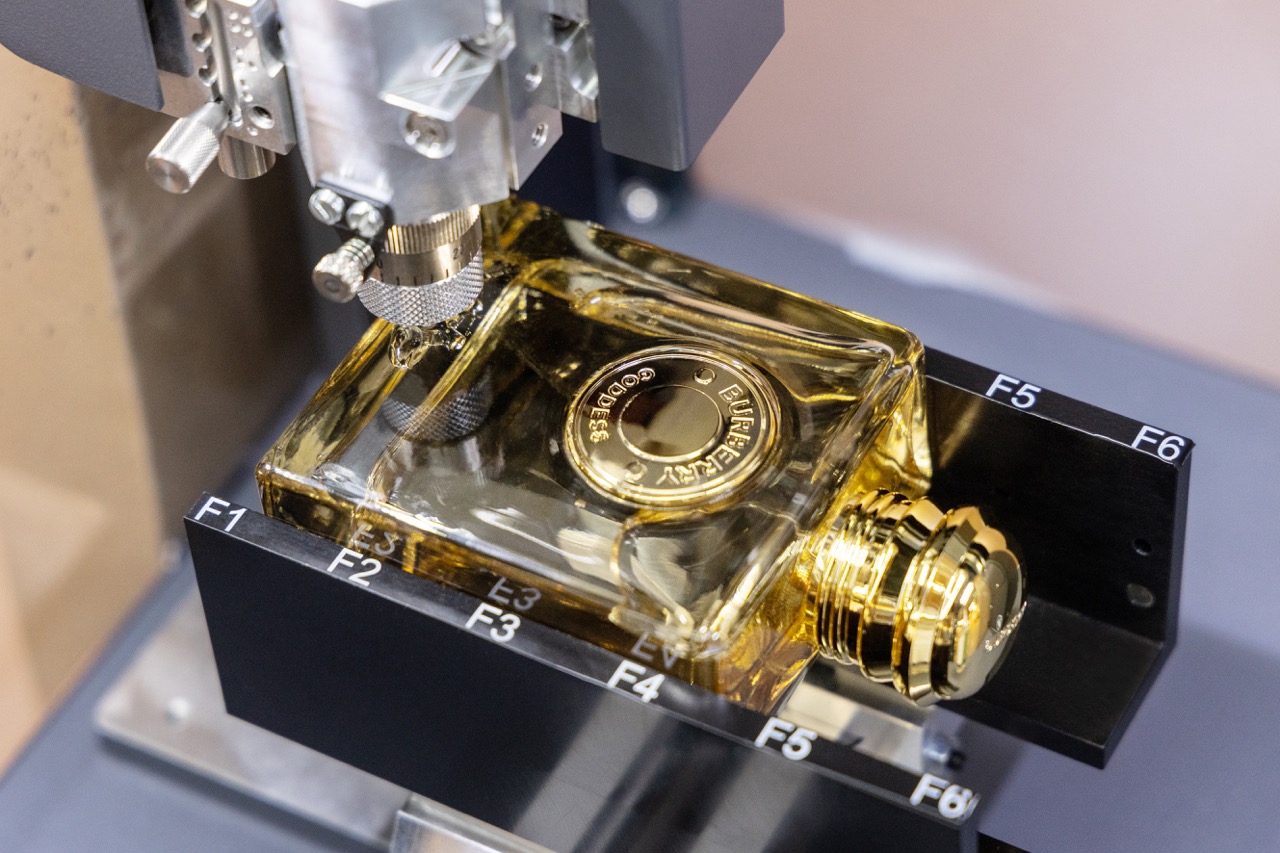

Despite strong demand for prestige fragrances, Q2 net revenue declined due to continued weakness in the mass beauty market and ongoing challenges in APAC, notably in China and Asian travel retail.

These are tough times in the world’s biggest duty-free market with Shinsegae Duty Free’s fortunes mirroring those of its peers as heavy concession fee costs weigh on Q4 and full-year results.

The Japanese beauty house Shiseido’s travel retail sales fell -23.8% in 2024 while core operating profit plunged -70.7% amid deeply challenging conditions in Hainan and South Korea.

L’Oréal CFO Christophe Babule drew on a Dickensian allusion to describe the contrasting fortunes of North Asia and the rest of the world. While Dickens’ famous ‘It was the best of times, it was the worst of times’ opening line doesn’t quite apply, there is no doubt how sharply the region’s performance varied from its geographic counterparts. UPDATED.

“We delivered solid, broad-based growth of +5.1%, once again outperforming the global beauty market. Excluding North Asia, where the Chinese ecosystem remained challenging, sales advanced in high single digits,” says CEO Nicolas Hieronimus.

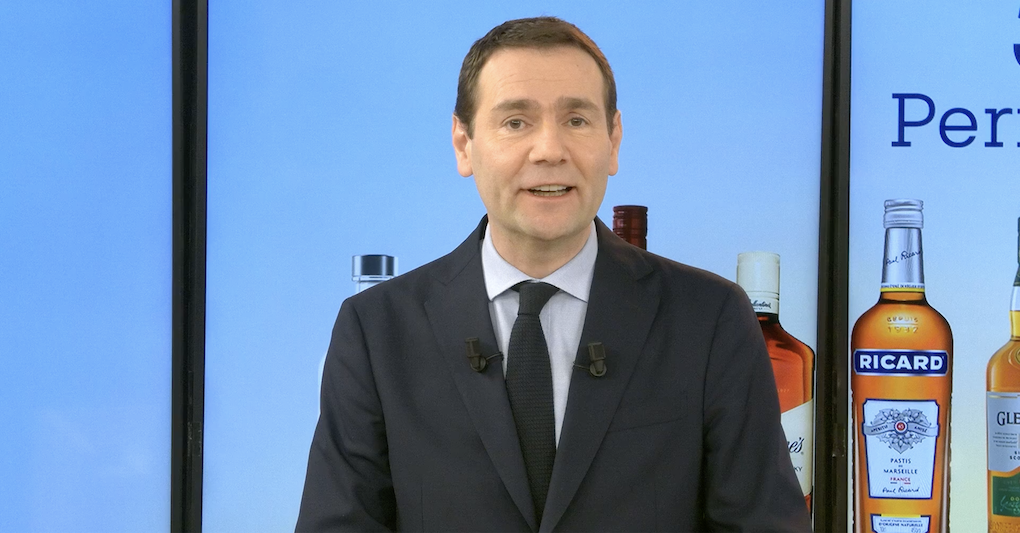

Leading drinks group Pernod Ricard today reported sales of €6,176 million for the first half of its financial year, with sales down -6% year-on-year on a reported basis.

Hainan duty-free retailers welcomed 240,500 shoppers during the eight-day Spring Festival period. Visitors enjoyed dynamic promotional campaigns and government incentives designed to encourage spending.