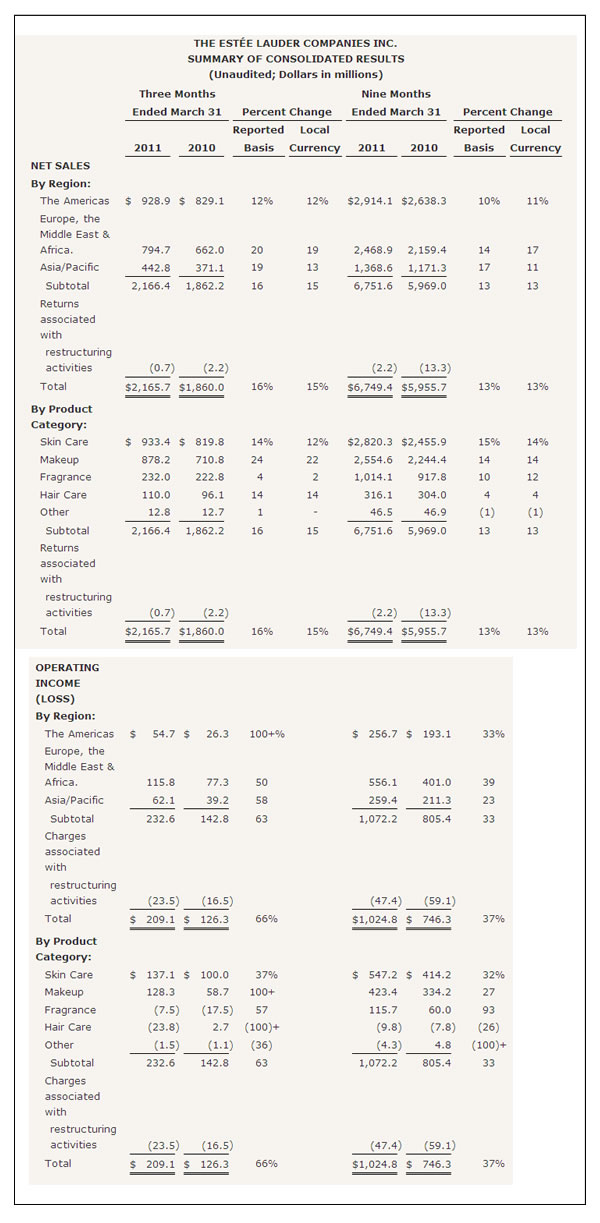

US. The Estée Lauder Companies has reported net sales of US$2.17 billion in the third quarter ended 31 March 2011, a +16% increase compared with US$1.86 billion reported in the prior year. Excluding the impact of foreign currency translation, net sales increased +15% from the previous year.

Net earnings hit US$124.7 million in the quarter, a +117% increase from US$57.5 million last year. Diluted net earnings per common share rose +121% to US$0.62, compared with US$0.28 reported in the prior year.

For the nine months ended 31 March 2011, the company reported net sales of US$6.75 billion, a +13% increase from US$5.96 billion in the comparable prior-year period. On a reported basis, as well as in constant currency, net sales grew in each geographic region and major product category. Sales also increased in all major product categories within each region.

|

“Our broad and well differentiated portfolio of brands, product categories and geographies gives us the flexibility to take advantage of opportunities in stronger environments to compensate for challenges that may arise in other areas of the world“ |

Fabrizio Freda President and Chief Executive Officer The Estée Lauder Companies |

Net earnings amounted to US$659.7 million for the nine months, a +45% increase from the US$454.4 million in the same period last year. Diluted net earnings per common share for the nine months increased +44% to US$3.28, compared with US$2.27 reported in the same prior-year period.

During the quarter, the company’s performance was better than anticipated, due to stronger overall business, particularly from its largest brands, as well as from a weaker US dollar. It posted strong across-the-board sales gains in its major product categories and geographic regions, particularly travel retail. Sales also increased in all major product categories within each region.

Travel retail performed particularly well within the Europe/Middle East/Africa region, generating strong double-digit net sales growth during the quarter as a result of successful product launches and increased distribution, according to the company. This reflects “both an improvement in global airline passenger traffic and stronger conversion of shoppers into buyers, driven by improved marketing and distribution”, the company added. Travel retail continues to leverage the strategic investment spending in local markets and benefit from the increase in international travellers, particularly in Asia.

During the balance of the fiscal year, the company expects to significantly increase global advertising spending on new initiatives and impactful product launches.

The company’s outlook in the Americas, as well as certain European countries, remains cautious, reflecting the uncertainty or softening of certain retail environments in these regions.

In Asia Pacific, the disasters in Japan are expected to negatively impact full fiscal year diluted earnings per share by approximately US$0.05. While the Japan crisis did not have a material impact on its results for the quarter, the company believes that negative market conditions in Japan will continue for at least the next six to nine months.

Net sales are forecasted to grow between +10% and +11% in constant currency. On a product category basis, in constant currency, skin care and makeup are expected to be the leading sales growth categories, followed by fragrance and hair care. Geographic region net sales growth in constant currency is expected to be led by Europe, the Middle East & Africa, followed by the Americas and Asia Pacific.

President and Chief Executive Officer Fabrizio Freda said: “Our results for the quarter and year to date continue to validate our strategic direction. Our focus on building enduring brand equities and on serving the global demand for prestige quality products and high-touch services is clearly resonating with consumers.

“Our broad and well differentiated portfolio of brands, product categories and geographies gives us the flexibility to take advantage of opportunities in stronger environments to compensate for challenges that may arise in other areas of the world. This is reflected in our results this quarter across our brands, regions and channels. With our fiscal year drawing to a close, we have the confidence to raise our full-year diluted earnings estimate to US$3.55 to US$3.65 per share.”

Click here to view the full report.

|

Click here to view the enlarged image (then hover over graphs with your cursor and click for full detail) |

Advertisement |