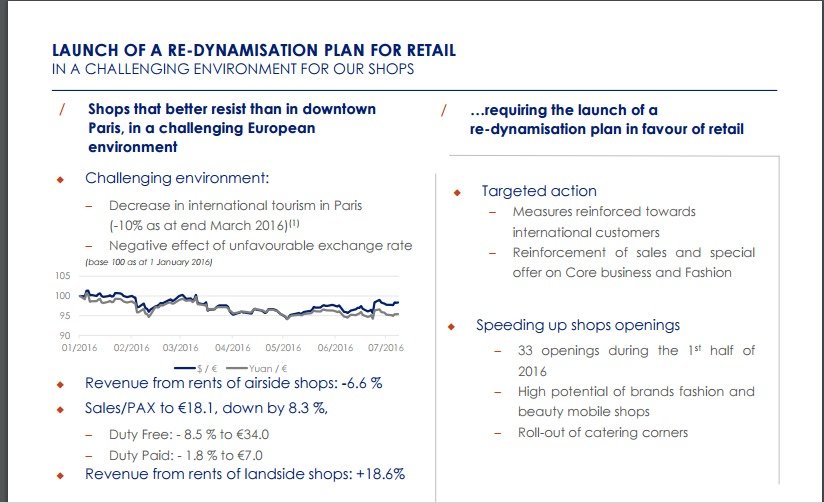

FRANCE. Aéroports de Paris (ADP), operator of Paris Charles de Gaulle and Orly airports, has announced a “re-dynamisation plan” for retail activities in response to a worrying -8.3% slump in Parisian airside shop sales per passenger to €18.10 in the first half of 2016. Duty free sales were the worst affected, falling -8.5% to €34.0. The decline was attributed to the slowdown in international traffic and unfavourable exchange rates.

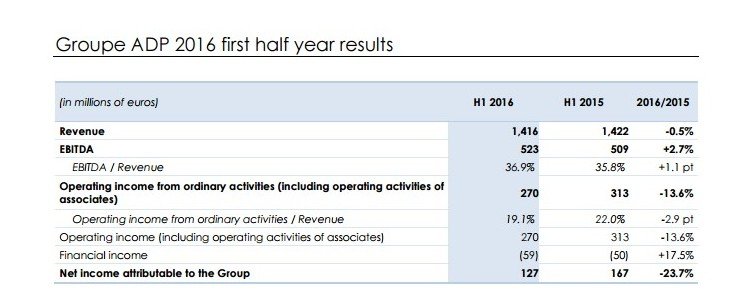

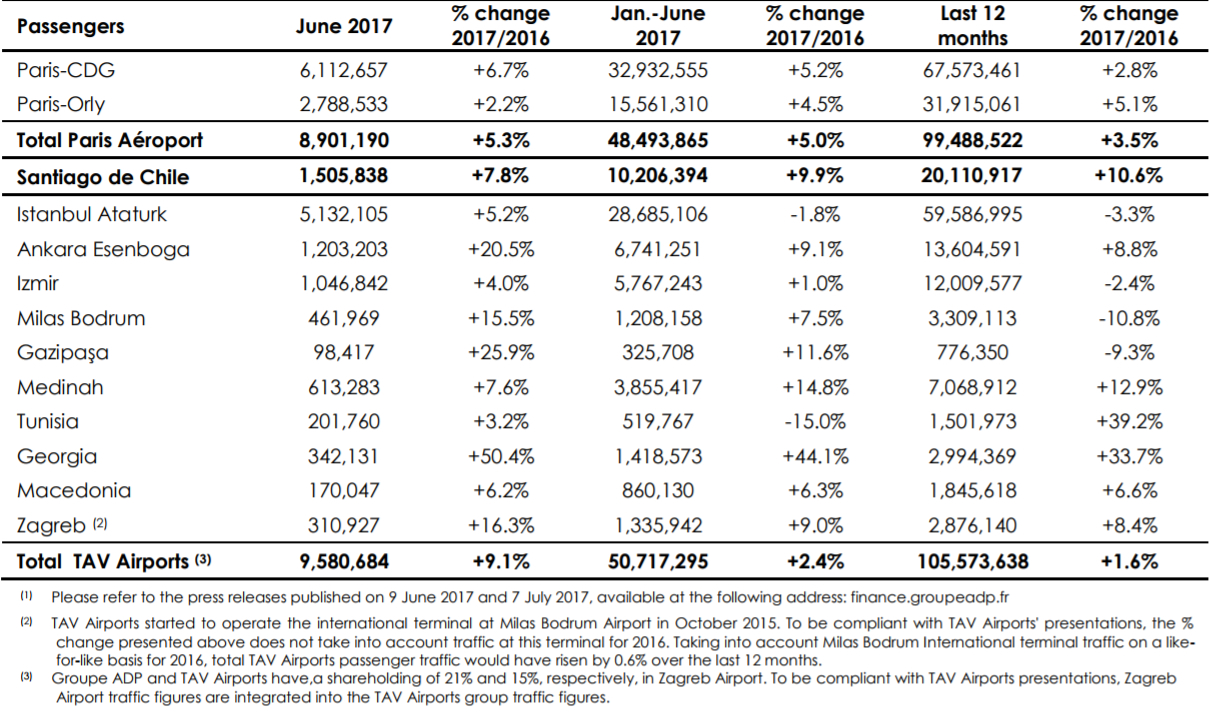

The initiative (see chart below), which will include the launch of loyalty programme My Paris Aéroport, was revealed as ADP, which manages (directly or indirectly) 34 airports worlwide, unveiled its six-month results. These showed a +2.3% increase in passengers to 70.5 million but a -0.5% fall in consolidated revenue to €1,416 million, driven by the slowdown of retail activities.

The group’s Parisian airports suffered from a terrorism-linked decrease in international tourism to the French capital (-10% as at end March 2016).

Under its ambitious Connect 2020 plan, ADP is targeting sales per passenger of €23 by 2020 after the delivery of several major infrastructure projects beginning from this year.

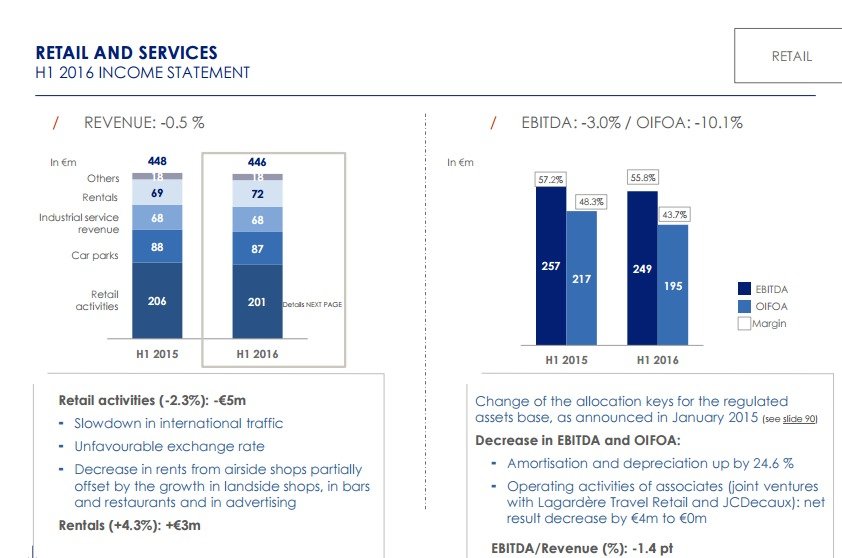

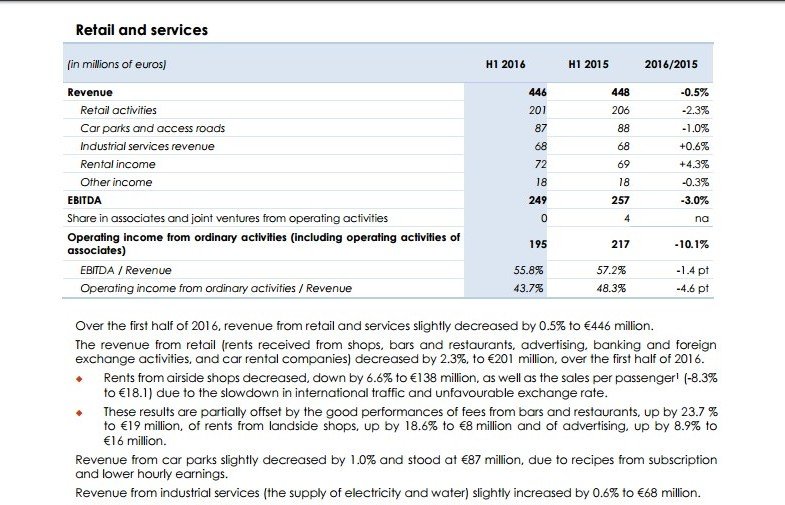

Revenue from retail and services decreased by -0.5% to €446 million. The revenue specifically from retail (rents received from shops, bars and restaurants, advertising, banking and foreign exchange activities, and car rental companies) decreased by -2.3% year-on-year to €201 million, impacted by the slowdown in international traffic and by the unfavourable effect of the strong Euro.

Rents from airside shops decreased by -6.6% to €138 million.

Rents from airside shops decreased by -6.6% to €138 million.

https://www.youtube.com/watch?v=gedPSERGFX0

[Above: I love Paris, Paris Charles de Gaulle’s new upscale restaurant, was named Best Chef-led or Fine Dining restaurant in The Moodie Davitt Report’s Airport FAB Awards last month]

These results were partially offset by the good performances of fees from bars and restaurants, up by +23.7 % to €19 million; of rents from landside shops, up by +18.6% to €8 million; and of advertising, up by +8.9% to €16 million. Revenue from car parks slightly decreased by -1.0% to €87 million.

Group EBITDA rose +2.7% to €523 million as a result of careful control over operating expenses and non-renewable reversals of provisions.

ADP Chairman & CEO Augustin de Romanet said: “This first half-year results occurred in a difficult temporary context, in particular for international activities, and bring us to intensify optimisation strategy. The level of traffic in Paris is in line with our annual assumption, despite the decrease of international destinations, mainly Japan and Malaysia, offset essentially by the growth in traffic of low cost carriers.

ADP Chairman & CEO Augustin de Romanet said: “This first half-year results occurred in a difficult temporary context, in particular for international activities, and bring us to intensify optimisation strategy. The level of traffic in Paris is in line with our annual assumption, despite the decrease of international destinations, mainly Japan and Malaysia, offset essentially by the growth in traffic of low cost carriers.

“EBITDA is in line with our forecast, underpinned by the control over the operating expenses and by non-renewable reversals of provisions. The retail activities bear the consequence of unfavourable traffic mix and exchange rate and will be supported by the launch of a re-dynamisation plan. “At last, our international activities were impacted by the slowdown of tourism and the difficulties met by TAV Airports and TAV Construction. In this context, on the basis of a traffic growth assumption in Paris Aéroport of +2.3% in 2016 compared to 2015, we confirm our forecast of a slight growth in EBITDA in 2016. We revised our forecast for net result attributable to the Group: we now expect a slight decrease of the net result attributable to the Group in 2016 compared to 2015, with a slight organic growth.”

“At last, our international activities were impacted by the slowdown of tourism and the difficulties met by TAV Airports and TAV Construction. In this context, on the basis of a traffic growth assumption in Paris Aéroport of +2.3% in 2016 compared to 2015, we confirm our forecast of a slight growth in EBITDA in 2016. We revised our forecast for net result attributable to the Group: we now expect a slight decrease of the net result attributable to the Group in 2016 compared to 2015, with a slight organic growth.”