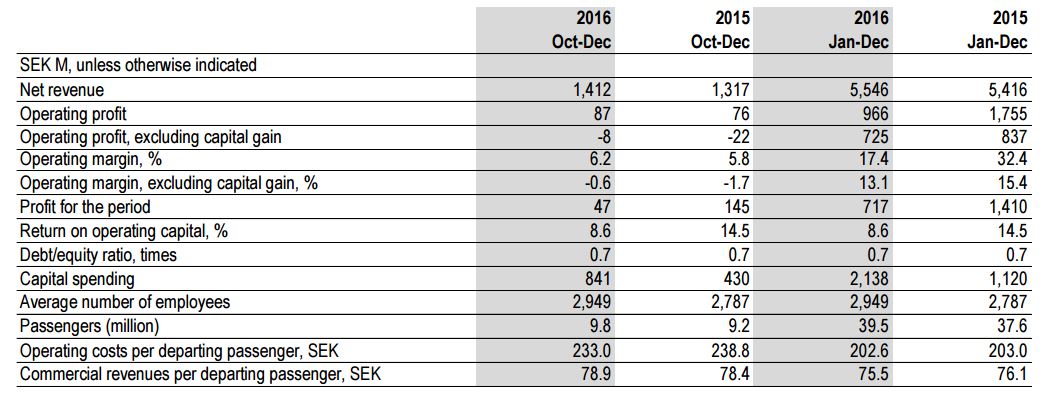

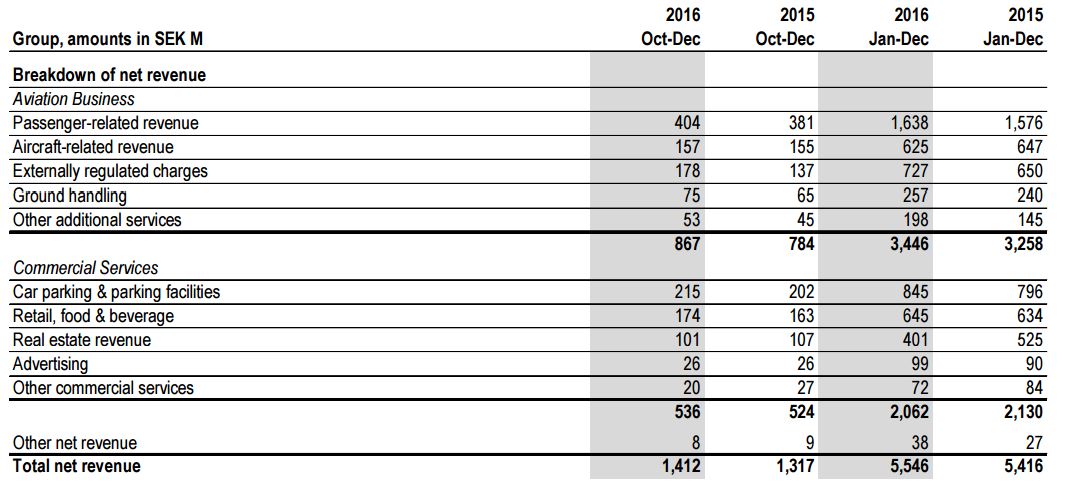

SWEDEN. Airport operator Swedavia posted a +1.74% year-on-year increase in combined retail and food & beverage revenues in 2016, to SEK645 million (US$72.4 million).

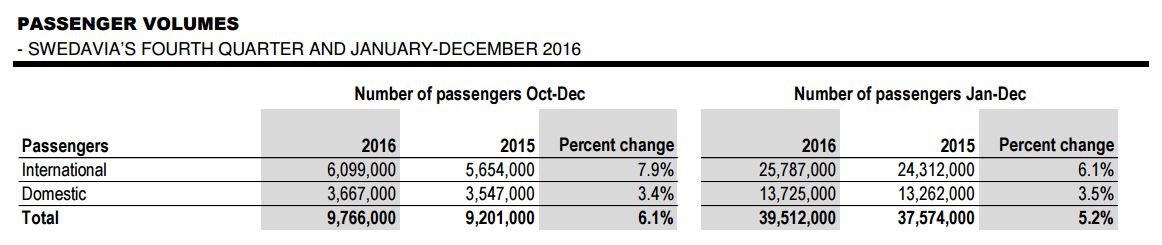

However, the company noted that revenue from retail dropped despite a +5.2% increase in passenger volumes at the ten Swedish airports it owns and operates. This suggests that food & beverage performed strongly, although precise figures for the segment were not reported.

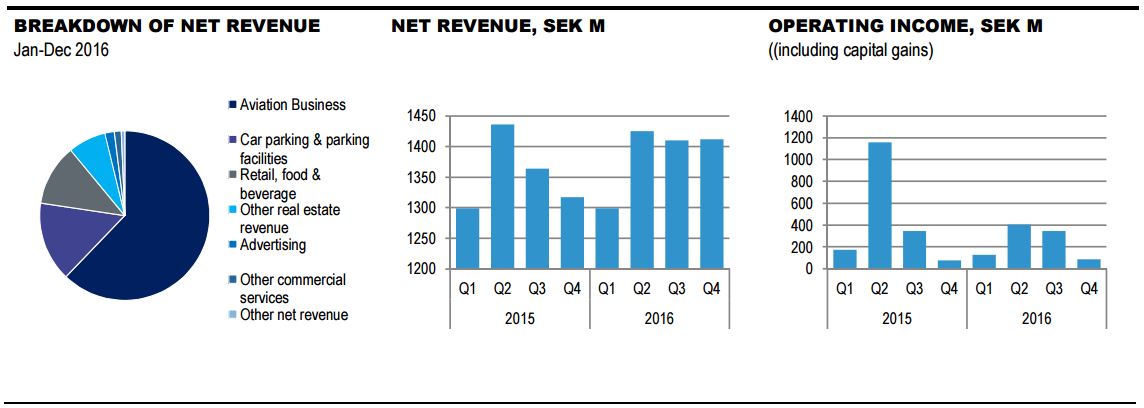

Commercial revenue overall was down -3.2% at Swedavia’s airports, to SEK2,062 million (US$231.2 million). A sharp decline in real estate revenue (-23.6%) was largely responsible. Swedavia said the property portfolio sold in June last year led to a SEK143 million (US$15.9 million) reduction in rental income during the first half of the year.

Commercial revenue per departing passenger declined -0.79%, to SEK75.5 (US$8.47).

The company attributed the decrease in sales to a change in the mix of destinations, which it said led to lower tax and duty free sales, and a change in passengers’ purchasing behaviour.

Source (all charts): Swedavia

The higher passenger volume in 2016 led to a net revenue increase of +2.4% to SEK5,546 million (US$622 million). Net profit was down -49.1%, to SEK717 million (US$80.5 million). Operating profit for 2015 was affected by capital gains on sales totalling SEK918 million (US$103 million).

Swedavia President and CEO Jonas Abrahamsson commented: “The sharp passenger growth continues, and we are now entering a phase of substantial capital spending to increase capacity at our airports. This involves more than a doubling in our pace of investment.”

In the fourth quarter of 2016, commercial revenue totalled SEK536 million (US$60.2 million), up +2.29%. Increased passenger volume (+6.5%) drove the result, Swedavia said.

Commercial revenue per departing passenger increased +0.64% in the quarter, to SEK78.9 (US$8.86).

In Swedavia’s year-end report, Abrahamsson noted a number of challenges the company and the air travel industry in general were facing. These included how to handle “new retail patterns as more people choose to shop online instead of in shops”. Other challenges include the possibility of people travelling less because of adverse political developments around the world, and the potential introduction of a Swedish aviation tax.

“In our organisation, we work with great resolve together with other companies and organisations at the airports to handle these challenges,” he wrote.

“We have a bright outlook and will continue to be an attractive alternative for modern airport visitors. This requires new ways of thinking and innovative solutions with a focus on capacity expansion, improved efficiency, continued competitive airport charges, increased revenue from our commercial offering and continued value creation in our real estate business.”