Beauty group L’Occitane International is to acquire skincare brand Elemis in a US$900 million deal. Founder-led since 1990, Elemis has strong markets positions in the UK and USA.

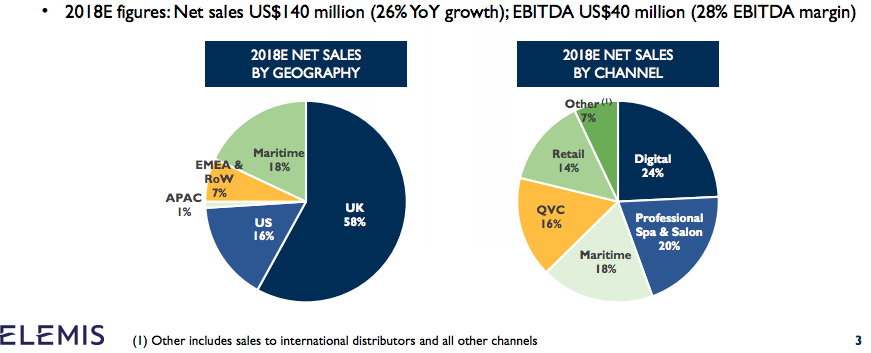

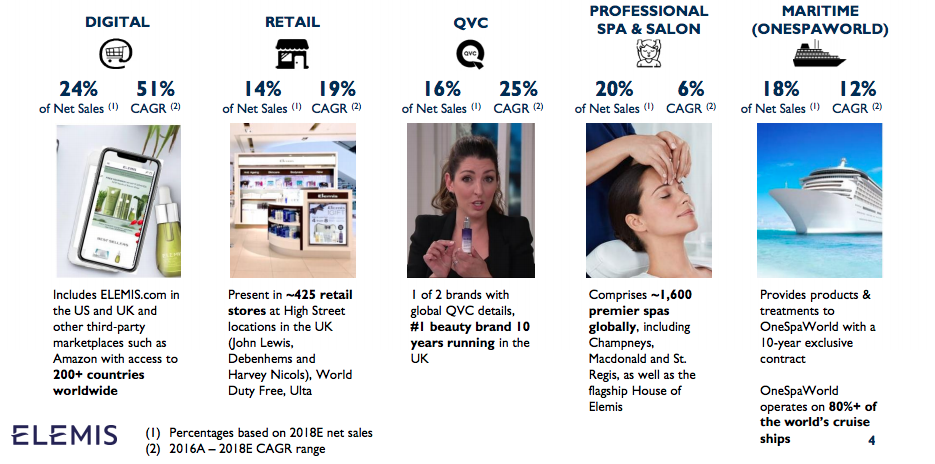

The brand sells both directly to consumers through its websites and wholesale to various distribution channels, including digital, retail distribution, QVC, professional spa and maritime.

L’Occitane said in a statement: “The acquisition fits into the group’s strategy of building a leading portfolio of premium cosmetics brands. The acquisition will further strengthen L’Occitane’s omni-channel distribution and product categories, particularly in skincare, in which it has invested substantially in recent years.”

Elemis will continue to be led by Co-Founder and Chief Executive Officer Sean Harrington, Co-Founder and President Noella Gabriel and Co-Founder and Chief Marketing Officer Oriele Frank.

L’Occitane Chairman and CEO Reinold Geiger said: “This is L’Occitane’s largest acquisition since listing and a major step forward in building a group of premium beauty brands. Elemis presents a unique opportunity that fits us perfectly in terms of brand ethos, product quality, management capability, as well as growth and profitability trajectory.

“Elemis has enormous growth potential in untouched markets and channels, particularly in Asia Pacific where we have strong presence. We are confident Elemis will be immediately accretive to the group’s results, in line with our aim to deliver sustainable value to our shareholders.”

Sean Harrington said: “We are thrilled to announce this agreement with L’Occitane, which will strengthen the continued growth and momentum behind our timeless brand and transformative products. L’Occitane’s philosophy resonates closely with our own, in creating quality products sourced from nature and developed through cutting-edge science and technology. I am confident about realising our mission to grow Elemis into one of the leading skincare brands in the world.”

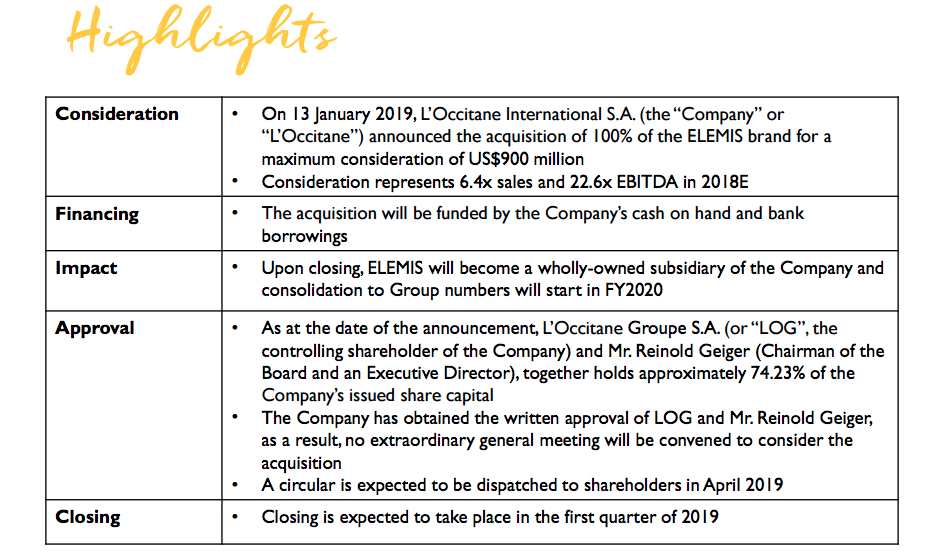

The acquisition will be funded by L’Occitane’s cash on hand and bank borrowings and is expected to close in the first quarter of 2019. Upon closing, Elemis will become a wholly-owned subsidiary of the group.

Elemis’ unaudited pro forma net sales and EBITDA for the year ended December 2017 were US$110.6 million and US$27.6 million respectively, with net pre-tax profit of US$2.73 million. Prepared on the same basis, Elemis’ estimates of the net sales and EBITDA for the year ended 31 December 2018 were US$140.2 million and US$39.9 million respectively.

L’Occitane International, listed on the Hong Kong Stock Exchange, had €1,319 million in FY2018 net sales and €141 in operating profit.

Jefferies and Nomura acted as financial advisors to Elemis, and Kirkland & Ellis served as legal advisor.