Pernod Ricard has revealed sales for its travel retail division increased +6% in FY19 accounting for 7% of overall sales for the spirits and wine house.

In the financial results covering the 12 months to the end of June 2019, Pernod Ricard said growth for travel retail came thanks to a strong performance in Asia, while brands in the Strategic International and Speciality Brands divisions led the way.

Pernod Ricard Chairman & Chief Executive Officer Alexandre Ricard said: “Strong growth in travel retail [was] driven by Asia as well [as] globally. Our Transform & Accelerate ambition there is leveraging our leadership in the premium plus segment. It’s a great showcase channel. It’s a very strategic channel, but it is also a profitable channel with a lot of effort made on pricing, on mix, [a] strong focus on consumers, accelerating pace as well on a number of innovations.”

Pernod Ricard added that Martell saw strong overall growth, while the whisky portfolio of Chivas XV, Royal Salute, The Glenlivet and Jameson had strong overall value growth. Beefeater also had encouraging results, aided by the introduction of Beefeater Pink.

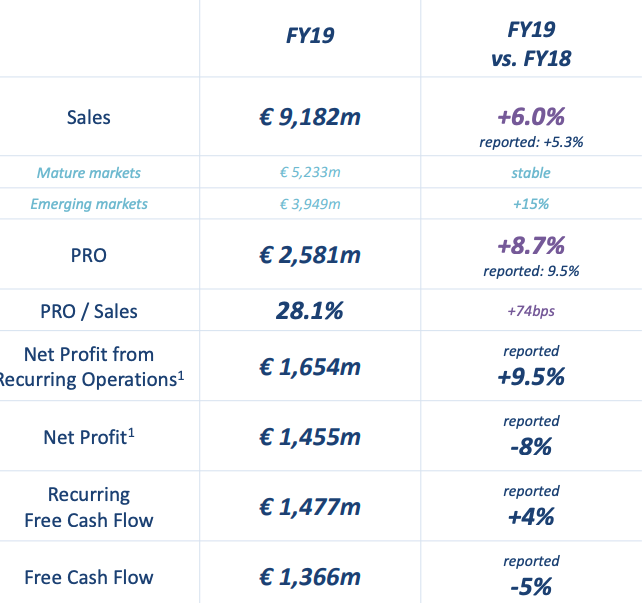

Furthermore, the focus on consumer centricity, innovation, a strengthened route to market and improved strategic customer partnerships have all paid off for travel retail.  Pernod Ricard’s overall business saw organic sales grow +6% (+5.3% reported) to €9.18 billion (US$10.1 billion), while organic profit from recurring operations was up +8.7%.

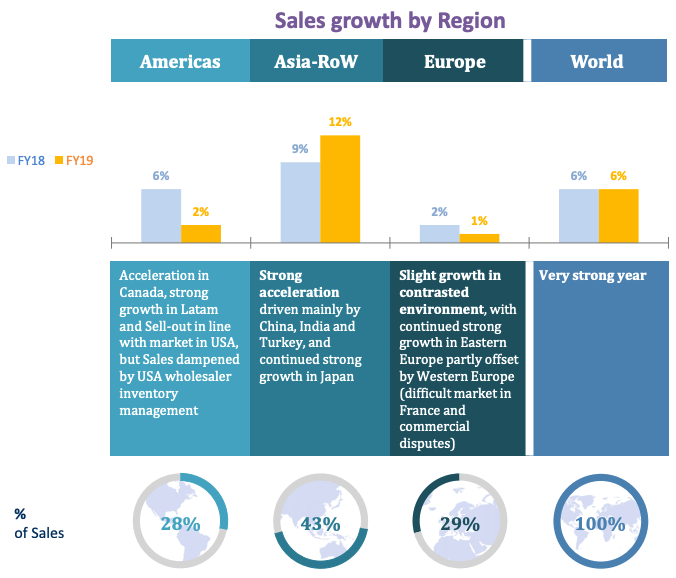

Pernod Ricard’s overall business saw organic sales grow +6% (+5.3% reported) to €9.18 billion (US$10.1 billion), while organic profit from recurring operations was up +8.7%.  On a regional basis, overall sales were up +2% in the Americas, +1% in Europe and +12% in Asia/Rest of the World. In what the spirits and wine company has identified as must-win markets, sales were stable in the US, up +21% in China and up +20% in India.

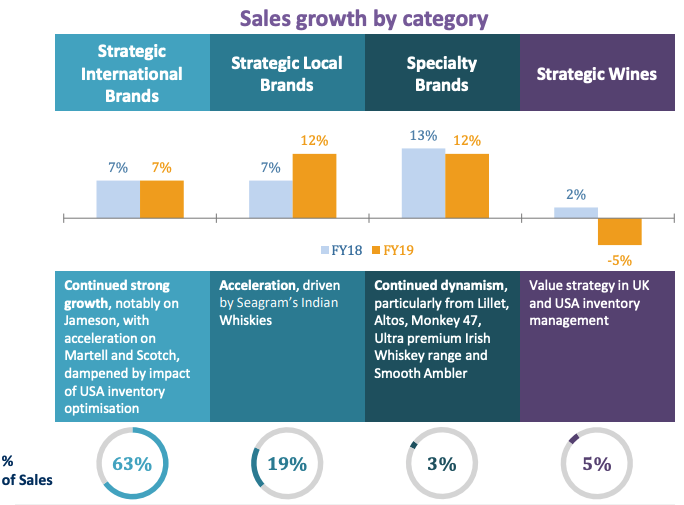

On a regional basis, overall sales were up +2% in the Americas, +1% in Europe and +12% in Asia/Rest of the World. In what the spirits and wine company has identified as must-win markets, sales were stable in the US, up +21% in China and up +20% in India.  The Strategic International Brands division grew +7%, notably through Jameson and Martell. Strategic Local Brands grew +12%, thanks to Seagram’s Indian Whiskies, while the Speciality Brands division was up +12%, thanks to Lillet, Altos, Monkey 47 and ultra-premium Irish whiskey. Strategic Wines, however, was down -5% due to UK and US inventory management, Pernod Ricard said.

The Strategic International Brands division grew +7%, notably through Jameson and Martell. Strategic Local Brands grew +12%, thanks to Seagram’s Indian Whiskies, while the Speciality Brands division was up +12%, thanks to Lillet, Altos, Monkey 47 and ultra-premium Irish whiskey. Strategic Wines, however, was down -5% due to UK and US inventory management, Pernod Ricard said.

Looking ahead to FY20, Pernod Ricard predicted its dynamic sales growth would continue, but growth rates were expected to moderate in the must-win markets of India and China.