Listed global beauty player Coty is looking at the possibility of divesting its Professional Beauty division as its seeks to reduce complexity, and sharpen its focus on fragrance, cosmetics and skincare – its mainstay segments in the travel retail channel.

After analysis, it was felt that future growth opportunities of the Professional Beauty business – which is focused on haircare and nailcare products for salon professionals – lay “increasingly outside Coty’s core strategic focus”.

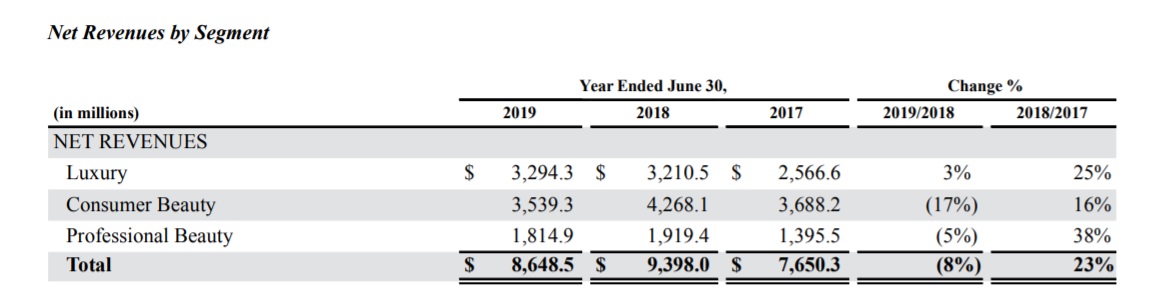

Professional Beauty is one of three divisions within Coty. It had sales of US$1.8 billion in fiscal 2019 (ended June) and accounted for 21% of Coty’s global revenues of US$8.6 billion that year (down -8%). The other divisions are Luxury (US$3.3 billion) and Consumer Beauty (US$3.5 billion).

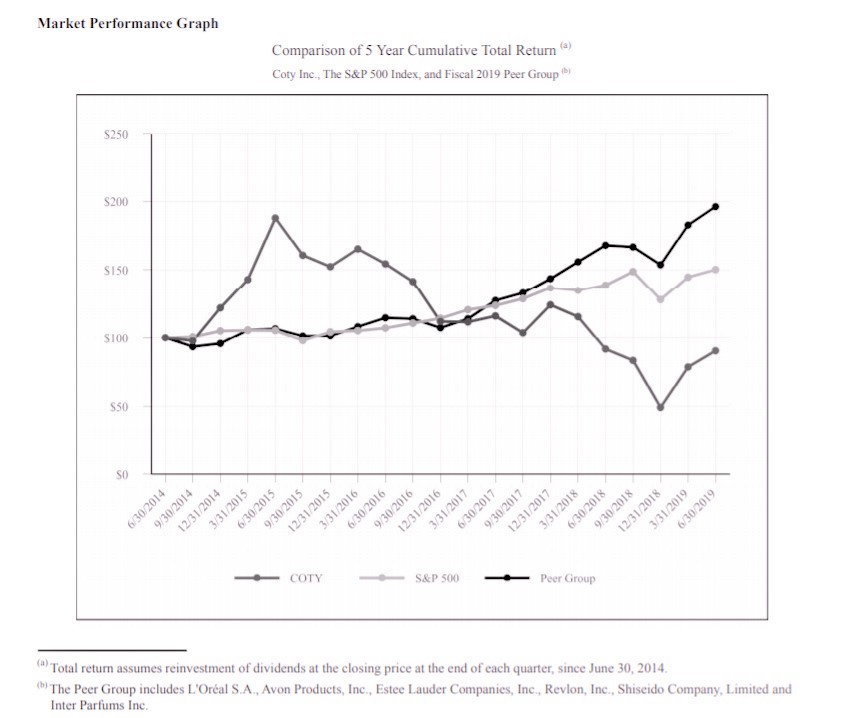

The decision to consider a sale comes as part of a strategic review designed to move the business forward and improve the company’s value to shareholders. Since 2017, Coty stock has under-performed the S&P 500 and beauty peers (in the chart below they consist of Avon Products, The Estée Lauder Companies, Inter Parfums, L’Oréal, Revlon and Shiseido).

Assuming a US$100.00 investment on 30 June 2014, Coty’s common stock in mid-2019 was valued below that original value. Meanwhile the S&P 500 Index the Peer Group values have reached US£150 and almost US$200 respectively. The figures are based on the company’s own data.

Accelerating Coty’s transformation

Coty CEO Pierre Laubies said: “After stabilising our operations in fiscal 2019, we announced in early July a plan to turn around Coty’s performance. Today’s announcement accelerates this transformation and will help reposition Coty as a more focused and agile company… and improve our ability to invest in areas with the greatest growth potential.”

He added: “The Professional Beauty teams have done an incredible job over the past three years in creating a strong business platform, putting us in a favourable position to find the best owner for that business.”

Coty said that the process – in which Credit Suisse will assist – will “explore strategic alternatives for the Professional Beauty business and associated hair brands, as well as the company’s Brazilian operations, including a divestiture”. The process is expected to be completed by summer 2020.

Proceeds from any potential transaction will be used to pay down debt and return excess cash to shareholders.

Coty Chairman Peter Harf – who is also Founder and Managing Partner of JAB Holdings which has a 60% stake in Coty – said: “The strategic review of the Professional Beauty business aims to find the best option to realise significant value for Coty and its shareholders.”

Once the review is completed, Coty wants to step up its innovation capabilities and drive growth in its luxury unit where the powerful portfolio includes fragrance licences such as Burberry, Calvin Klein, Gucci, and Hugo Boss. In the cosmetics business, brands include Rimmel, Max Factor, Covergirl and Sally Hansen; while skincare brands include Lancaster and philosophy.