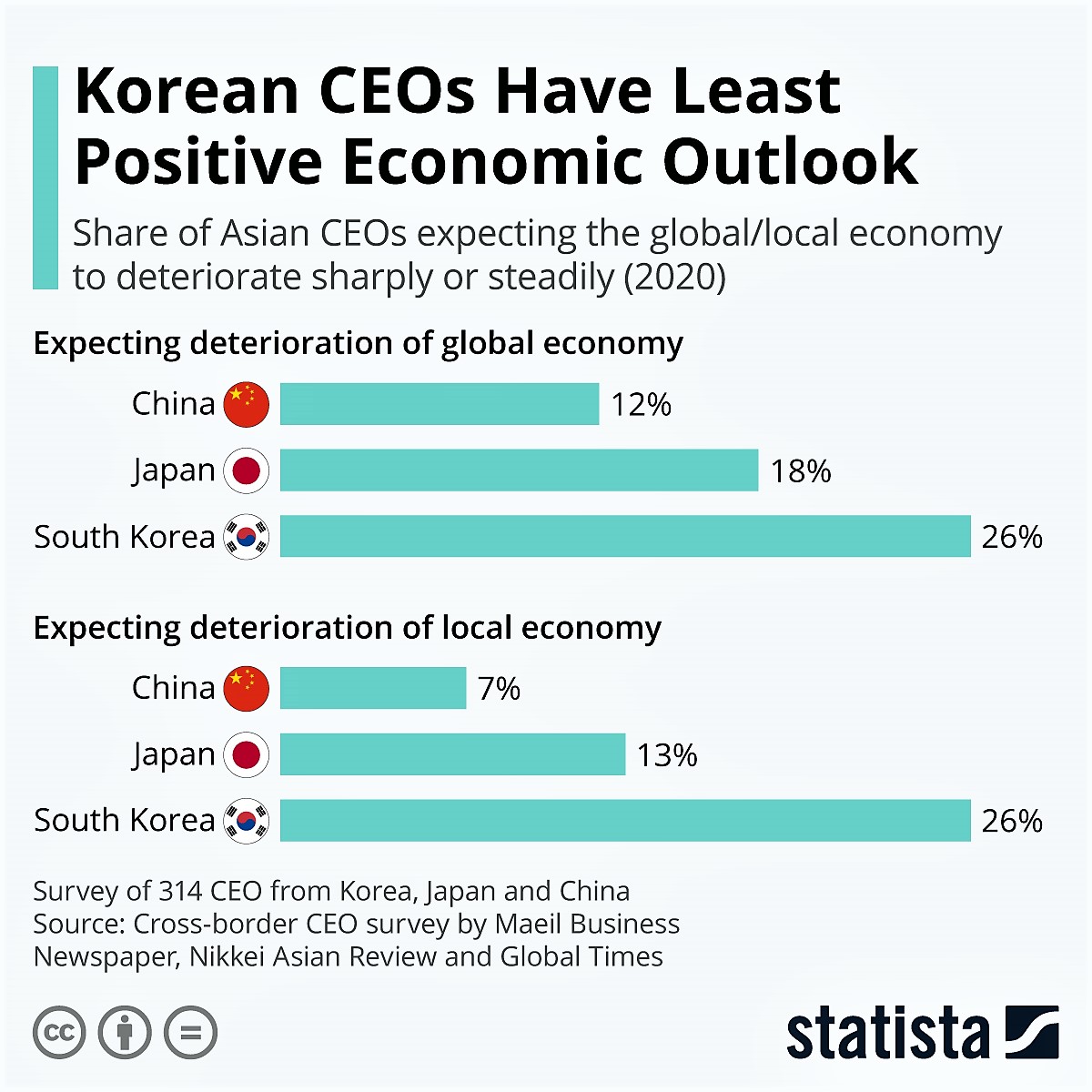

ASIA PACIFIC. Chief executive officers in South Korea are the most concerned about economic conditions in the coming 12 months – and Chinese CEOs the least worried – according to a cross-border survey of business leaders from South Korea, China and Japan.

A poll of 314 CEOs in East Asia’s three most important economies (by GDP) indicates that company leaders are most upbeat in China, where only 12% thought that the global economy would deteriorate ‘sharply’ or ‘steadily’ this year, and even fewer at 7% thought the same about their domestic economy.

The CEO’s survey was undertaken by South Korea’s Maeil Business Newspaper, Nikkei Asian Review and the Global Times.

In sharp contrast, more than a quarter (26%) of Korean CEOs believe that both their local and the global economywill deteriorate sharply or steadily this year. In Japan, CEOs were more distrusting of the global marketplace where 18% expect some deterioration, versus 13% for the local market.

The particularly gloomy outlook in South Korea is in sharp contrast to travel retail’s fortunes where Chinese-led duty free sales are booming (albeit driven almost entirely by an ever-vulnerable daigou business). However, domestically the overall market has been affected by a flat economy in 2019.

The country’s quarterly GDP grew at just +0.4% in the three months to September 2019, easing from +1.0% in the previous quarter, after a contraction of -0.4% in Q1. This has been due to a slower rise in services and sharp declines in utilities and construction. On the expenditure side, household consumption and government spending grew less and fixed investment shrank.

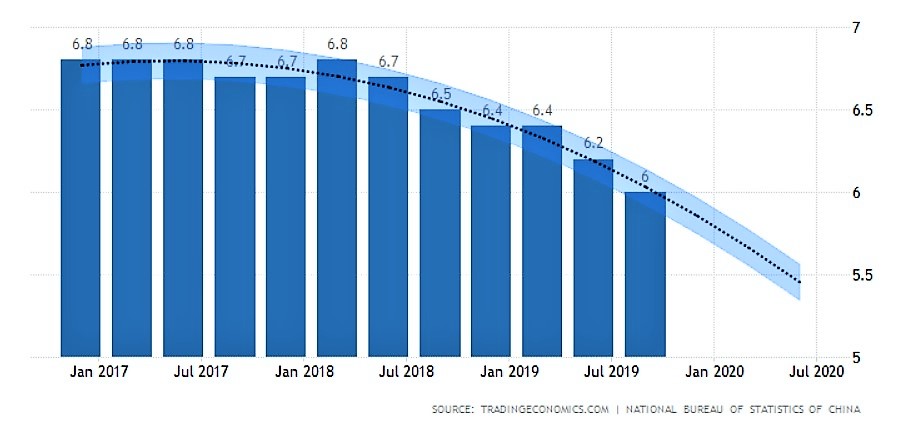

On the other hand China, while seeing slowing annual growth slow over recent years, is still forecast to end 2019 at around +6% versus South Korea’s possible+2%.