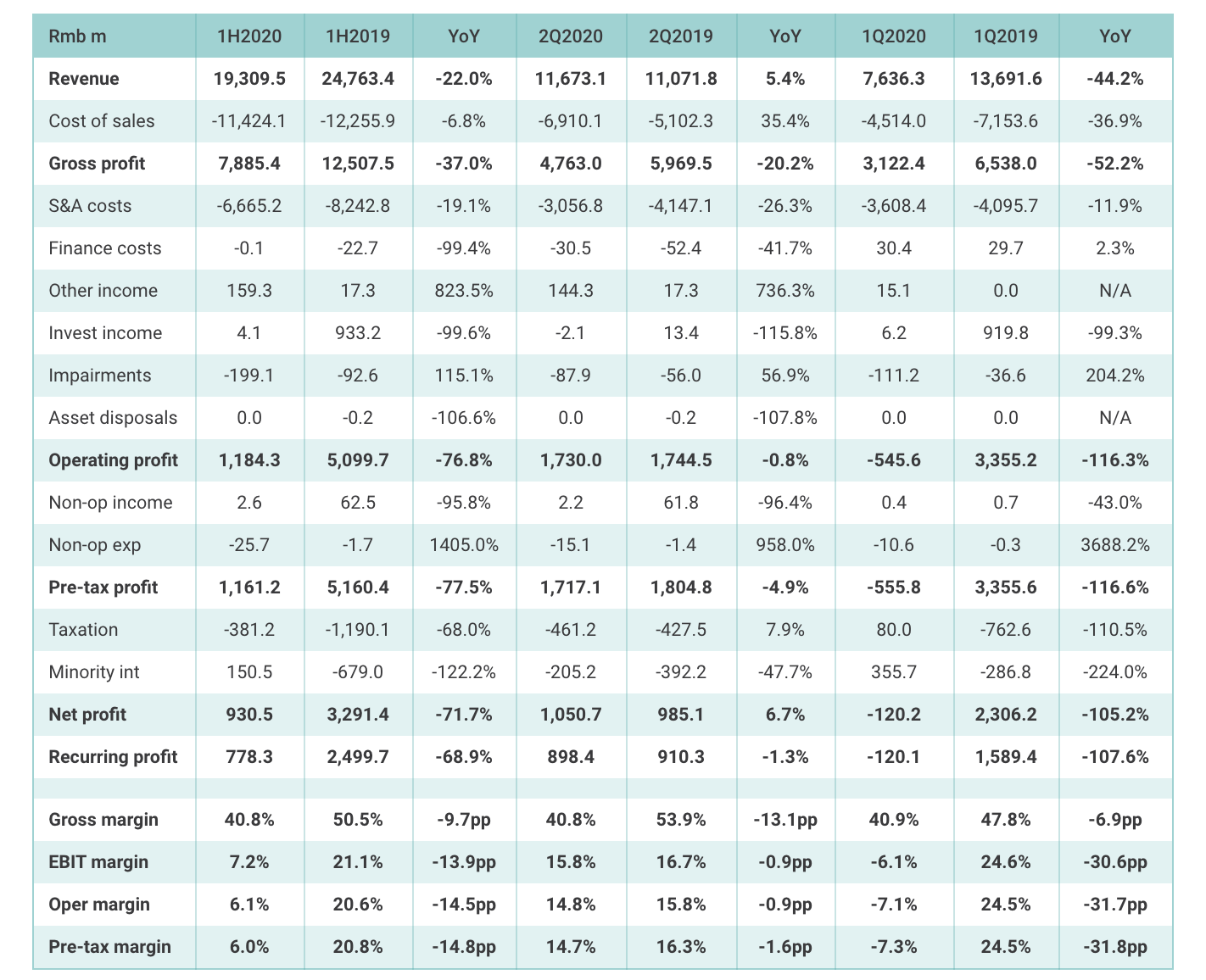

CHINA. China Tourism Group Duty Free Corp has reported first-half revenue of RMB19,310 million (US$2,855 million), making China Duty Free Group (CDFG) the world’s largest duty free retailer for the first half of the year by turnover according to the Moodie Davitt Business Intelligence Unit.

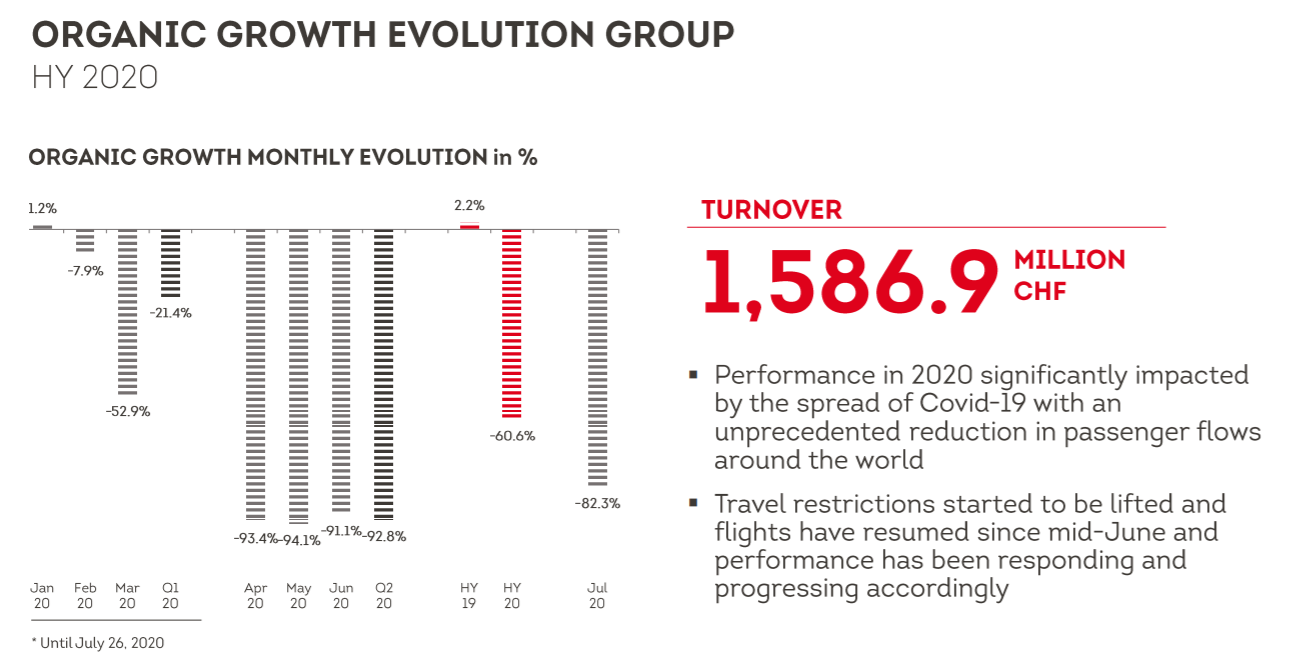

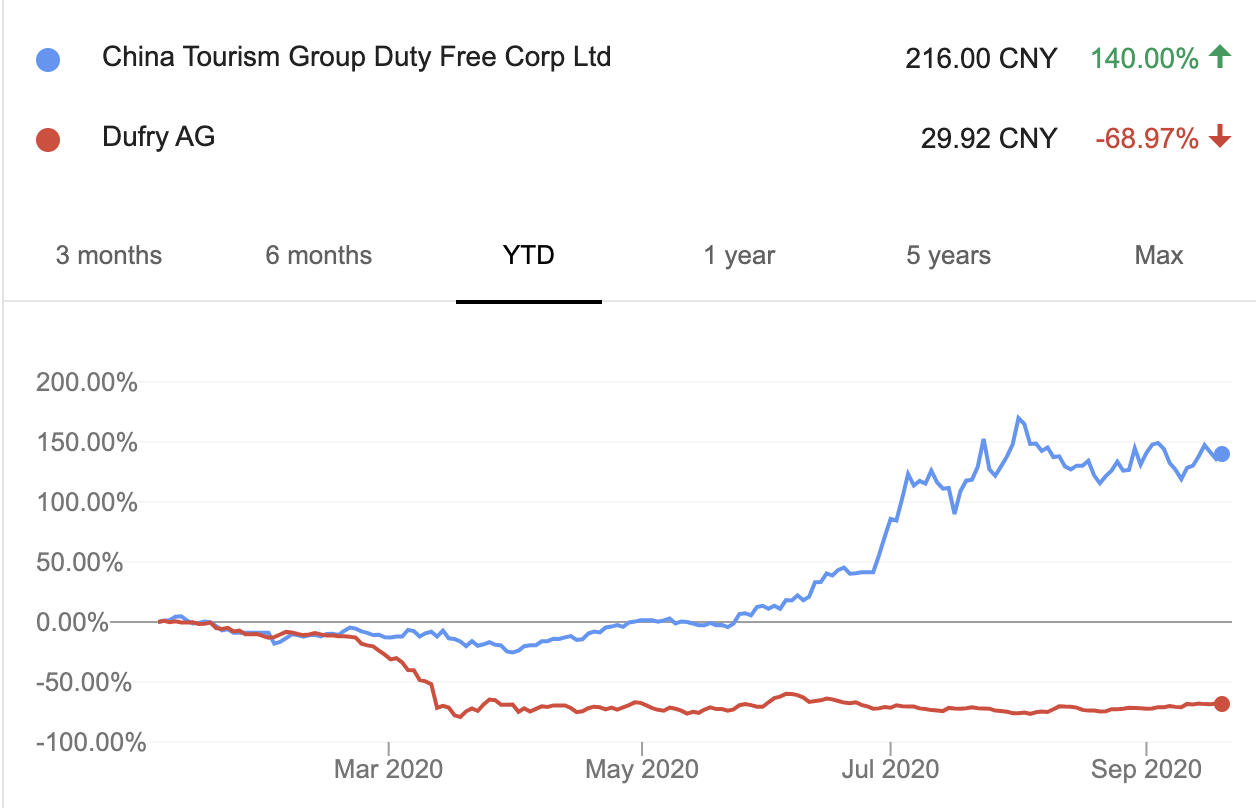

As reported, Dufry, which has topped The Moodie Davitt Report Top 25 Travel Retailer Rankings by turnover for the last six years, saw revenue plunge -62% (-60.6% organic) to CHF1,587 million (US$1,734 million) in the first half of 2020. CDFG ranked fourth in the latest annual rankings based on 2019 sales (see table below).

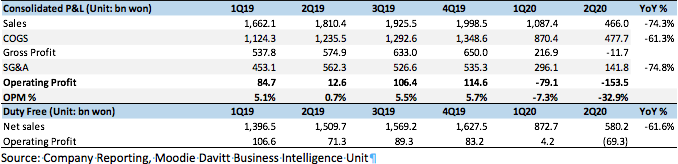

As reported, Lotte Duty Free, world number two last year, posted a -62% decline in sales year-on-year in Q2 2020 to KRW580.2 billion (US$490 million), bringing first-half sales to around US$1.25 billion based on today’s exchange rates.

After China Tourism Group Duty Free Corp posted revenue +64.6% higher than Dufry for the first six months of the year, Li Dan, an analyst at Zheshang Securities, declared that the company has “succeeded Dufry” and is poised now to be the industry leader in a “new era of duty free”.

However, despite the headwinds experienced by Dufry in 2020, the company is “well-positioned to benefit from increasing global travel flows,” Jelena Sokolova, an analyst at Morningstar, wrote in a report. She predicted the company would be able to expand by about +4% a year over the next decade through a mix of increasing passenger numbers and by the acquisition of new airport concessions.

After a difficult first three months of 2020, the CDFG parent reported a swift reverse in its fortunes in the second quarter of the year, as it delivered both a return to net profit and an increase in year-on-year revenue. Its second-half results are certain to be much stronger again, following the resurgence of Chinese domestic travel to Hainan, the home of China’s offshore duty free industry. Increased visitations and the introduction of a much-enhanced offshore duty free shopping policy on 1 July has in turn prompted a remarkable upturn in sales.

As reported, the annual offshore duty free allowance for shoppers visiting Hainan was raised from RMB30,000 (US$4,440) to RMB100,000 (US$14,800) from the beginning of July, while the range of categories was extended and the single purchase limit abolished.

Preliminary Hainan Customs figures indicate that sales across the island’s duty free shops rose +221.9% year-on-year in July and August.

In the three months to the end of June, China Tourism Group Duty Free Corp net profit was up +6.7% year-on-year at RMB1,051 million (US$156 million) while revenue rose +5.4% year-on-year to RMB11,673 million (US$1,728 million).

According to analyst Osbert Tang, who publishes on Smartkarma, this represents a solid rebound after the company generated revenue of RMB7,636 million (US$1,130 million) and a net loss of RMB120 million (US$18 million) in the first quarter of 2020.

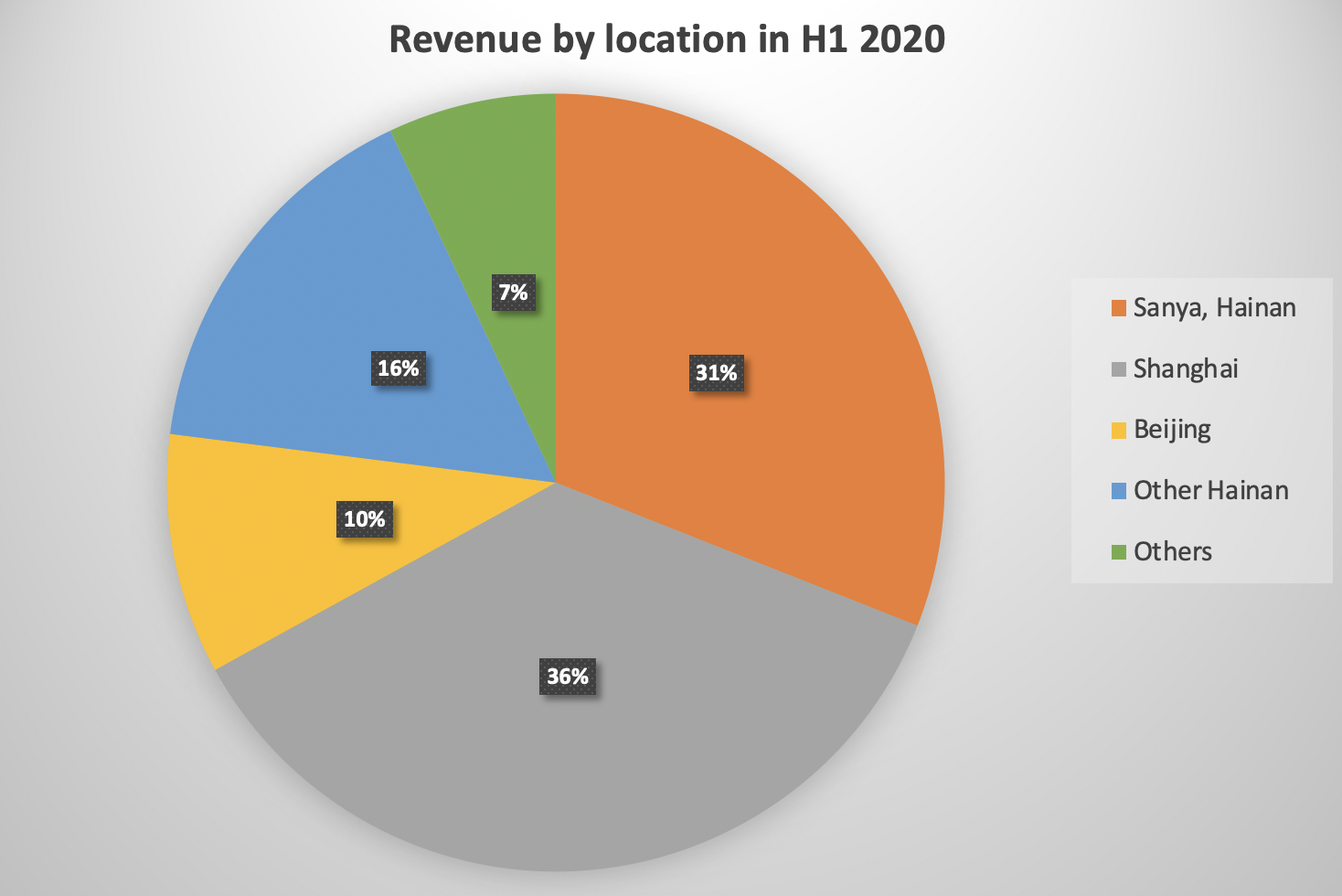

The resurgence for the CDFG parent company in the face of the COVID-19 pandemic was primarily driven by sales on Hainan, which accounted for 47% of the company’s revenue in the first half of the year. In the six-month period, the company’s operations in both Sanya (revenue up +12.2% year-on-year) and Haikou (revenue up +136% year-on-year) performed ahead of expectations.

“The great Q2 results show that the underlying duty free demand in China is tremendous,” Tang from Smartkarma said in his analysis. “With demand for overseas outbound travel remaining weak due to the pandemic, we believe domestic travel will stay as the focus in the second half of 2020 and Hainan is definitely a prime destination choice. This will surely benefit China Tourism Group Duty Free Corp’s revenue outlook.”

Smartkarma anticipates China Tourism Group Duty Free Corp’s revenue for the second half of the year will be RMB28,700 million (US$4,247 million), a +23.8% year-on-year increase.

NOTE: China Duty Free Group is a Diamond Partner of the Moodie Davitt Virtual Travel Retail Expo (12-16 October).

The event is a pioneering virtual trade show and symposium, complete with Exhibition Hub, Knowledge Hub (Symposium and Workshops) and Experience Hub (an immersive engagement zone).

CDFG President Charles Chen will deliver an eagerly awaited keynote interview with The Moodie Davitt Report Chairman Martin Moodie, together with news and visuals of some of CDFG’s latest achievements and future projects, in the Expo’s Knowledge Hub.