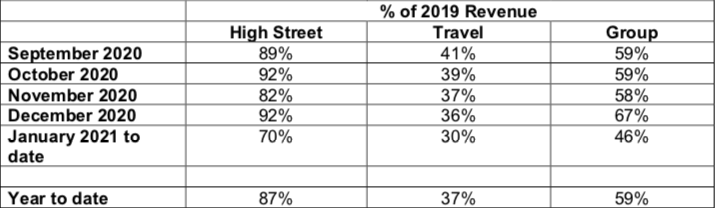

UK/INTERNATIONAL. WHSmith today issued a trading update for the 20-week period to 16 January 2021, with its Travel division reaching 37% of the previous year’s revenues in the period. Total group revenues (including High Street) reached 59% compared to the same period a year ago.

The company said it continues to focus on cost management, including renegotiating rents; increasing conversion and growing average transaction value and category development, by expanding its health and beauty and electrical accessory ranges to additional stores. In the UK market, WHSmith won a new specialist bookshop at Heathrow Terminal 2 and extended other contracts.

In North America, where around 85% of passengers are domestic, the company said it is seeing a faster recovery compared to the rest of the world. Revenue in that region for the 20-week period was at 43% of 2019 levels.

WHSmith said: “MRG (Marshall Retail Group) continues its strong track record of tender wins and, since the beginning of the financial year, has won a further four new stores across major US airports. In addition, InMotion opened its first store in the resort channel. We currently have 219 stores trading in North America. We have completed the integration of InMotion into the MRG head office and we are on track to deliver savings of around £5 million a year.”

Outside the UK and North America, passenger numbers remain well down year-on-year but average transaction value has grown. “Despite the environment, we continue to win new business and have recently opened a new unit in Perth Airport Terminal 2. We are currently trading from 160 stores across the rest of the world.”

Cash generation for November and December 2020 was “ahead of plan”. WHSmith ended December with cash on deposit of £90 million and access to £320 million of committed facilities. At that point, the group owed around £70 million relating to rent, restructuring charges and outstanding creditors as the third lockdown began in the UK.

WHSmith said it expects underlying monthly cash burn for the period January to March 2021 to be around £15-£20 million per month assuming current conditions continue.

On Brexit, WHSmith added: “We have not experienced any disruption as a result of the UK leaving the European Union and do not anticipate that it will have a material impact on our ability to import stock in the year ahead.”

WHSmith Group Chief Executive Carl Cowling commented: “Covid-19 continues to have a significant impact on the WHSmith Group, however we are pleased with our performance over the Christmas period which was better than anticipated.

“Our priority is the health and wellbeing of both our colleagues and our customers and continuing to provide a safe environment for them.

“In our Travel business, we saw little change in the environment prior to the current lockdown, as expected, with sales in December at 36% of 2019 levels. We remain focused on average transaction values which continue to grow, cost control, and operational efficiencies and I am pleased with the progress we are making, particularly given the backdrop of significantly reduced passenger numbers. In North America, we have seen a quicker recovery versus the rest of the world, given the higher volume of domestic travel.

“We remain well placed to navigate our way through this ongoing period of uncertainty and benefit from the recovery of our key markets in due course.”