15 April

Welcome to the final day of the Beauty Tech Live, the pioneering virtual event that brings together the joint worlds of beauty and technology. It is jointly organised by The Moodie Davitt Report and BW Confidential.

Have you had a chance to explore our Exhibition Hub Yet? If not, here is a dynamic walkthrough showcasing our exhibitors’ leading-edge businesses, products and services from the joint worlds of beauty and tech.

Here you can explore the latest innovations from Cutitronics, Arcade Beauty, Perfumist, im1ne, Revieve, mmi, Antares Vision, Business France and Beauty Care Brazil.

View this post on Instagram

KNOWLEDGE HUB

How To Sell Through Livestreaming

The Knowledge Hub sessions at Beauty Tech Live concluded on Thursday with some insights into the power of livestreaming as a beauty sales channel. It was led by Madison Schill, who leads communications at live shopping solution Livescale. She was joined by L’Oréal Canada Chief Marketing Officer Samantha Daude Di Nacera, Consonant Skin + Care Founder & President Bill Baker and Dermalogica Consumer Brand Manager Kyla Marsh.

Madison Schill outlined the power of live shopping – by way of illustration, 62% of China’s population engages with live shopping each week, she said. In 2020, live shopping represented 11.6% of China’s ecommerce revenue. She highlighted the recent rise of live shopping shows in Europe and the US, with beauty brands “leading the charge”. Sales conversion rates in beauty events are up to 28% from these events on Livescale, she noted. Key features that attract consumers are engagement and the personal connection one can make, even with a brand’s founder.

Samantha Daude Di Nacera highlighted the value to the L’Oréal group of embracing live shopping, illustrating the power of the platform, from an initial show with Urban Decay to hundreds of beauty events from skincare to make-up – and even fragrance and haircare. “It’s a new way of shopping online for beauty. We see great traction, consumer conversion, add-to-cart, it’s super interactive and a great way to recruit new consumers who can discover our brands at a time when it’s less easy to go to the store.”

Key lessons include finding the right ambassador for each brand; using the interactivity feature to address Q&A with audiences and create excitement; plus ensuring exclusivity of product.

Kyla Marsh discussed the impact of live shopping, saying “we saw more unique users in one hour than in nine masterclasses than we ran”, with strong success in conversion and engagement. Key elements will be to continuously test what works, deepen interaction with influencers, alongside a focus on education and product launches.

Speaking for Canadian start-up Consonant Skincare, Bill Baker talked about the importance of livestreaming as an educational tool. It helps build community at a time when bricks & mortar is closed, he noted. “We are believers in Livescale. It brings sales, but also what is unique is that we can build an intimate community and can scale it.”

Tomorrow’s Digital Beauty Trends & Emerging Tech

A wide-ranging discussion on digital trends and emerging technology and how they can be harnessed by beauty brands to showcase themselves took place in the Knowledge Hub on Thursday.

Talking to BW Confidential Editor-in-Chief Oonagh Phillips, Future Laboratory Trend Analyst Victoria Buchanan and Light Years Forecaster Strategist & Founder Lucie Greene discussed a number of key themes relating to content creation and ecommerce.

Asked what beauty brands should be doing to stand out online, both panellists agreed that the way forward is to be more experimental, to embrace emerging digital community platforms and reflect the changing nature of content forms and methods of content creation.

Greene said: “The pandemic has really accelerated the race to bridge the divide between the physical store and the at-home audience, and content has become a key part of that.

“Some brands are starting to think of themselves as media companies and are being much bolder in terms of the kinds of content that they produce.

“There are so many forms of content out there now, it could be a podcast, it could be an experience, it could be a video game. The most interesting beauty brands are being much more creative in how they approach it.”

Buchanan concurred with this view and said she believes there has been a big shift from an influencer culture to a content creation culture.

She said: “Now you’ve got these content creators on platforms like Tik Tok who are just testing, they’re being really creative, and the videos are going viral.

“It’s really changing how brands are thinking about content; it’s no longer something that’s just really polished and seamless content.

“In many ways there is a big switch away from the digital perfection and filters you see on Instagram, to a much more open source relationship.”

You can hear more about this and a wide variety of other digital trend themes by watching the session in full. The ‘on demand’ link will be shared here soon.

ENGAGEMENT LOUNGE

Scentys previews disruptive fragrance diffusion technologies

Fragrance diffusion specialists Scentys closed off the Engagement Lounge with a session that highlighted the company’s latest fragrance diffuser innovations.

The ‘Disruptive Fragrance Experiences: From Contactless to Artificial Intelligence’ session previewed the Scentys Hubble technology and its integrated fragrance diffuser platform.

The Hubble Technology leverages dry diffusion capsule technology to offer safe, easy to handle, contactless fragrance solutions for brands. It serves as an alternative to fragrance blotters, ceramics and sprays which customers and sales staff have to touch. The Hubble Technology device has over 2,500 spray loads and is reusable and reloadable, offering very directional and locational diffusion.

The on-the-shelf Scentys platform is a connected device that includes a fragrance capsule with NFC tag that can store and collect data and can be voice controlled or app-integrated.

The session was hosted by Scentys Executive Chairman Pierre Loustric and Scentys Founder and CEO David Suissa.

How to sell perfumes online

Perfumist CEO and Founder Frederick Besson opened this Engagement Lounge session with a consideration of the changes in the world of fragrance.

He noted the marked increase in online perfume sales and underlined the difficulties brands and retailers face trying to secure sales when customers are not able to smell the fragrances.

Besson described Perfumist as an app “developed by and for fragrance users”. It is free, available in 40 languages and has over one million users who are able to browse a database of some 40,000 perfumes and see olfactory descriptions. Users are encouraged to create personal profiles to discover a bespoke selection of fragrances.

According to Besson, Perfumist offers “anyone, anywhere in the world the opportunity to find the right fragrance”. “Perfumist is listening to what the users around the world and consumers of perfumes want and expect,” he said. “We are not selling anything; that is not what we do. We are here to help consumers.”

Besson believes Perfumist can trigger increased sales not only online but also in stores. He noted collaborations with leading travel retailers including Dufry and Lagardère Travel Retail and highlighted Perfumist Pro which is designed to empower sales staff to become fragrance experts.

Besson described the app as an “intuitive and engaging” tool which can assist in staff training and, at the same time, enhance customer experience. He also said that a new app will be launched soon.

Click here to follow the entire session.

KNOWLEDGE HUB

From Content to commerce: How traditional media can help beauty brands boost online business

BW Confidential Editor-in-Chief Oonagh Phillips chaired an engaging session with a panel from leading publisher Marie Claire Group, which today also specialises in shopping and customer engagement platforms.

Marie Claire Managing Editor Amalric Poncet considered the changes Marie Claire has made, and is continuing to make, to meet the needs of its international audience and supporting brands.

He focused on the group’s digital platforms, content and tech innovation and how Marie Claire, as a “content curator”, is optimising multi-source revenue.

Marie Claire UK Beauty & Style Director Lisa Oxenham considered how brands can remain relevant in a media world which is “saturated with content”. She noted the increasing importance of collaborations with influencers and the use of videos to “bring beauty to life”.

Marie Claire UK Ecommerce Director Emily Ferguson considered the role of the group’s ecommerce division and its mission to merge content with commerce and outlined her role in growing Marie Claire’s ecommerce revenue by +675% since 2017.

Ferguson created the group’s popular Marie Claire Edit, a fashion aggregator platform which offers online users a single-search bar. She revealed that a new Marie Claire Edit Beauty platform is ready to launch tomorrow.

Marie Claire China Digital Director Fionn Feng also joined the discussion to highlight new brand programmes and campaigns designed to drive business opportunities in a vital market for the title.

KNOWLEDGE HUB

Coty’s Jean-Denis Mariani on maximising the direct-to-consumer model

Coty Chief Digital Officer Jean-Denis Mariani opened Day Four of the Beauty Tech Live Knowledge Hub by offering his insights into the beauty group’s innovative direct-to-consumer approach.

Ecommerce currently contributes to 19% of Coty’s business, but according to Mariani, it will soon play an even bigger role. “Digital and ecommerce have been totally changed by the pandemic, accelerating its growth by three years,” he said.

“There are a lot of big changes to Coty’s digital transformation and in one year’s time our digital footprint will be very different to what it is today.”

Direct-to-consumer (D2C) was a major beauty ecommerce trend that emerged during the crisis. Commenting on Coty’s D2C approach, Mariani said: “The main goal of D2C is to have relevant interactions with consumers through personalisation and data.

“D2C needs to be your most beautiful brand shop, a digital flagship store that offers the best of everything from specialist guidance to live tutorials. We’re exploring a number of strategies to take our D2C strategy to the next level.”

Mariani adds that giving your customers a reason to purchase is key to creating an effective D2C strategy. “The most difficult part of D2C is giving consumers a reason to purchase on your platform. This is why personalisation, innovation, product exclusivity, services and new digital trends like livestreaming, tutorials and masterclasses are so important to creating strong D2C value.”

Click here to read the full story

Welcome to Day Four at Beauty Tech Live, the pioneering virtual event that brings together the joint worlds of beauty and technology. It is jointly organised by The Moodie Davitt Report and BW Confidential.

Alongside the exhibitor showcases in the Knowledge Hub, expect more engaging content across the Knowledge Hub and Engagement Lounge programmes.

The Knowledge Hub begins (0930 CET) with Coty Chief Digital Officer Jean-Denis Mariani speaking on the direct-to-consumer model. At 100 CET publishing powerhouse Marie Claire will lead a session titled on how traditional media can help beauty brands boost online business.

Later, at 1500 CET we will discuss digital beauty trends, followed at 1630 CET by a session on selling through livestreaming.

Click here for more and to register. For more on the latest Engagement Lounge sessions, click here.

14 April

ENGAGEMENT LOUNGE

Arcade Beauty underscores the importance of product sampling in the new online retail environment

Arcade Beauty and its digital division Abeo showcased its latest digital product sampling technologies at ‘The Importance of Sampling and Product Trial: Online and in the New Retail Environment’ webinar on Day 3 of Beauty Tech Live.

The webinar highlighted the increased importance of product sampling in the new online and offline retail environment. During the session, Arcade Beauty and Abeo showcased its turnkey sampling solutions, explored how product sampling has changed over the years, and what brands need to consider when developing their sampling strategy.

Arcade Beauty Senior Vice President Sales Larry Berman said, “We think digital is a great way to communicate and educate the consumer, but the last step of actually trying the sample is missing.”

Abeo Vice President Sales and Marketing Allie Sorensen added, “At Abeo, our end goal is to provide brands with contactless sampling solutions, robust insights and reporting to help them build their own database.

“Abeo is an intelligent digital-sampling agency. A one-stop platform to help brands get the right samples to the right consumers, using the most effective platforms to reach high-value audiences.”

Commenting on what brands need to consider when developing a sampling strategy, Berman said: “The biggest thing is to engage with us early. Many brands we’ve worked with think of sampling as an afterthought, but our true strategic partners bring us on at the product development stage and not the marketing stage, which really makes a difference.”

KNOWLEDGE HUB

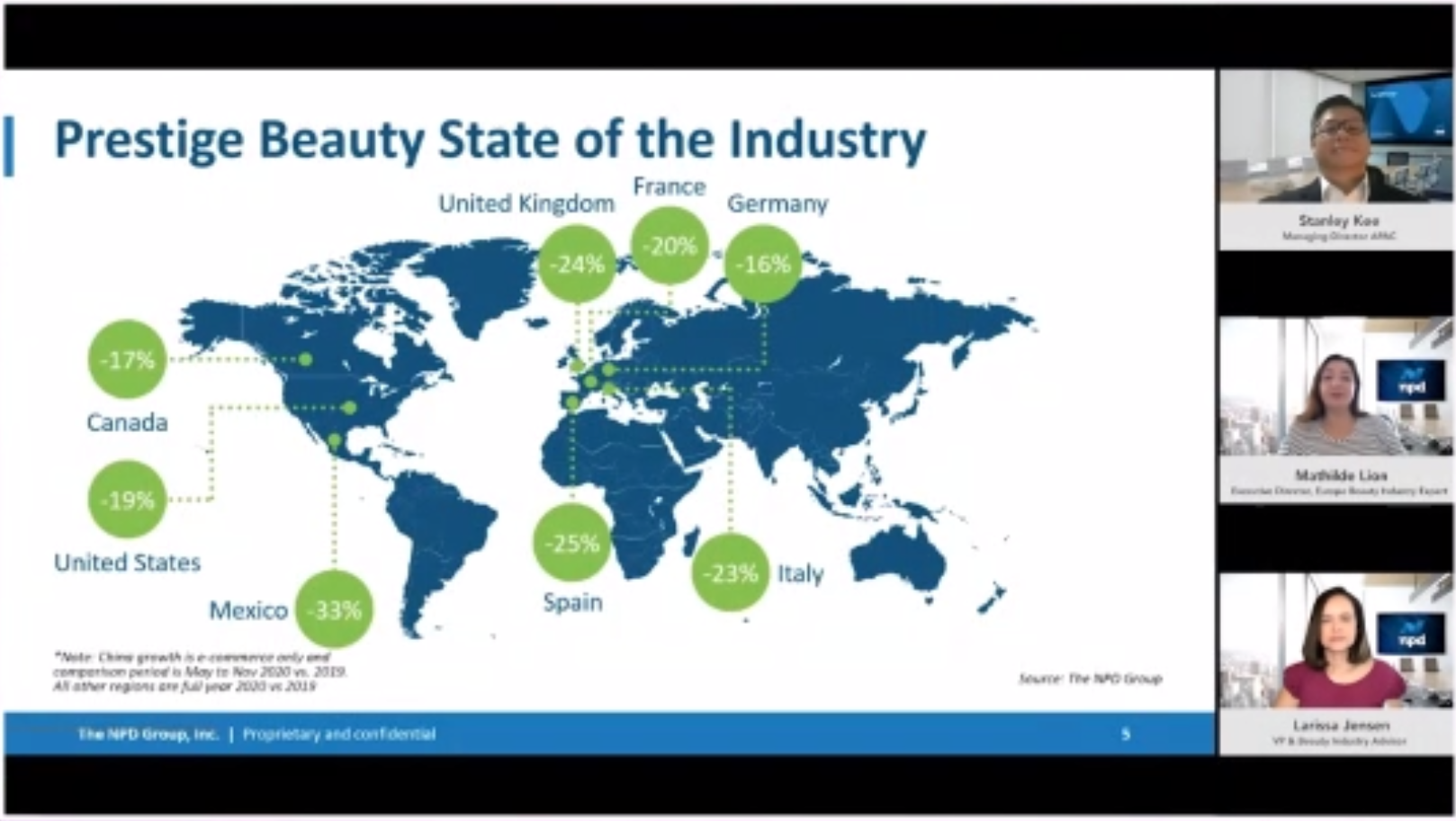

The NPD Group presents digital ecommerce data from around the world

Senior executives from leading market research company The NPD Group delivered a fascinating Knowledge Hub session which gave key data and insights on the global state of the beauty industry and highlighted key ecommerce trends.

The panel of senior executives comprise The NPD Group Vice President and Beauty Industry Advisor Larissa Jensen, The NPD Group Director and Beauty Industry Analyst (Europe) Mathilde Lion, and The NPD Group Managing Director (APAC) Stanley Kee.

Lion analysed online beauty sales in Europe’s top five markets, Jensen presented ecommerce data from the US and Kee gave the overall digital outlook in China and highlighted its biggest beauty trends.

Giving an outlook on how the pandemic affected the global beauty industry, Jensen said: “Beauty had a difficult year, unlike home, consumer technology and toys which saw growth during the pandemic. Some of the contributing factors include the closure of brick & mortar and also the decline of makeup, one of beauty’s most prominent categories.”

No other ecommerce market grew as much as China and so to give the Chinese perspective, Kee added, “In china, we’re tracking ecommerce and it is showing incredible growth. The prestige beauty ecommerce business in China reached US$10.88 billion and the market grew +71%.”

Jensen also offered some insight into the outlook of the beauty market in the US. She said: “The online channel captured huge share gains across all categories in the US, growing a total of +62%. It’s clear that brick & mortar and online channels experienced 2020 in different ways. In the US, the online channel grew in almost every category. Makeup and skincare, ecommerce penetration doubled, with haircare and fragrance reaching new heights.”

Giving the European outlook, Lion said, “In Europe online sales accelerated, growing +45% overall. In 2020 alone, the speed of European online growth tripled, and we are currently at a level of penetration that we wouldn’t have expected for another two to three years.”

However, Lion also notes that the picture isn’t the same across different member states in the EU. “The German acceleration is stronger compared to Spain and Italy,” she said. “The UK also became the number one channel for skincare and hair care, contributing to 44% of the total online market share.”

Lion added, “The shift to ecommerce needs constant innovation from the industry. Augmented reality, click-and-collect, online consultation and digital stores are flourishing, and livestreaming is coming to Europe after huge success in China.”

KNOWLEDGE HUB

Tech & Digital Learnings from Brazil

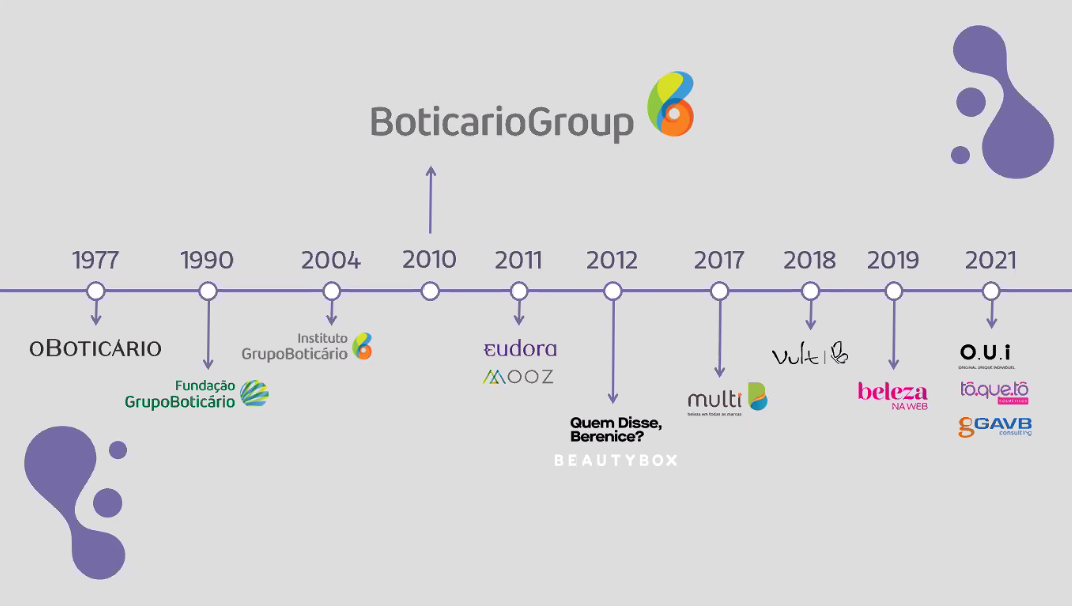

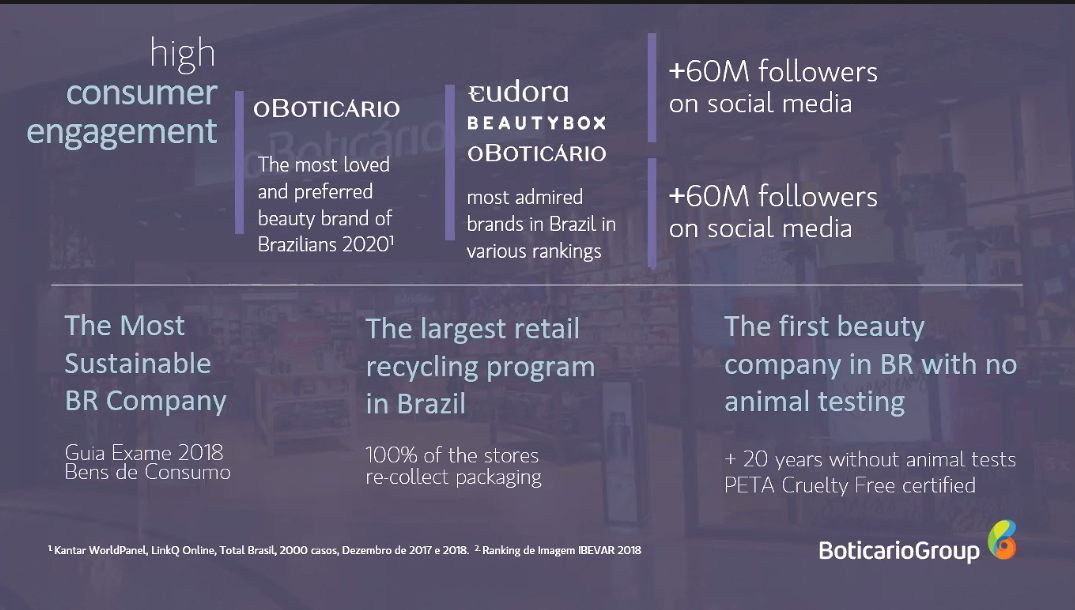

The Moodie Davitt Report President Dermot Davitt led this afternoon’s presentation on the digitalisation strategy of Brazil’s Grupo Boticário.

The group’s brands and stores can be found nationwide with close to 4,000 points of sale in 1,750 cities. As one of the world’s largest beauty franchises, Grupo Boticário offers products via ecommerce, direct sales and in partnership with other retailers.

Grupo Boticário Vice President of Digital and Technology Daniel Knopfholz and Technology Director Renato Pedigoni outlined the company’s digital transformation. Both describe digital as “the new way to work” and a “way to do business, and to achieve results”.

Grupo Boticário Vice President of Digital and Technology Daniel Knopfholz and Technology Director Renato Pedigoni outlined the company’s digital transformation. Both describe digital as “the new way to work” and a “way to do business, and to achieve results”.

Knopfholz offered an overview of the group, its evolution and expansion, underlining its status now as a “remote first” company.

He said Boticário believes in, and invests in, science and technology. 35% of revenue is invested in product innovation.

Knopfholz and Pedigoni identified four necessary changes to enable Boticário’s digitalisation process:

Knopfholz and Pedigoni identified four necessary changes to enable Boticário’s digitalisation process:

- To make decisions based on customers’ needs and feedback

- Shorter operation cycles to increase ability to react to customers’ needs

- To allow experimentation from scale: from centralisation to product-based teams

- To empower teams with autonomy and end-to-end responsibility.

The company’s strategy as it moves closer to digitalisation is based on five pillars:

- Internationalisation of digital product teams

- Focus on results

- Partnership with startups and innovation programme

- Talent attraction and internal skills improvement

- Evolution of collaboration tools and way of working

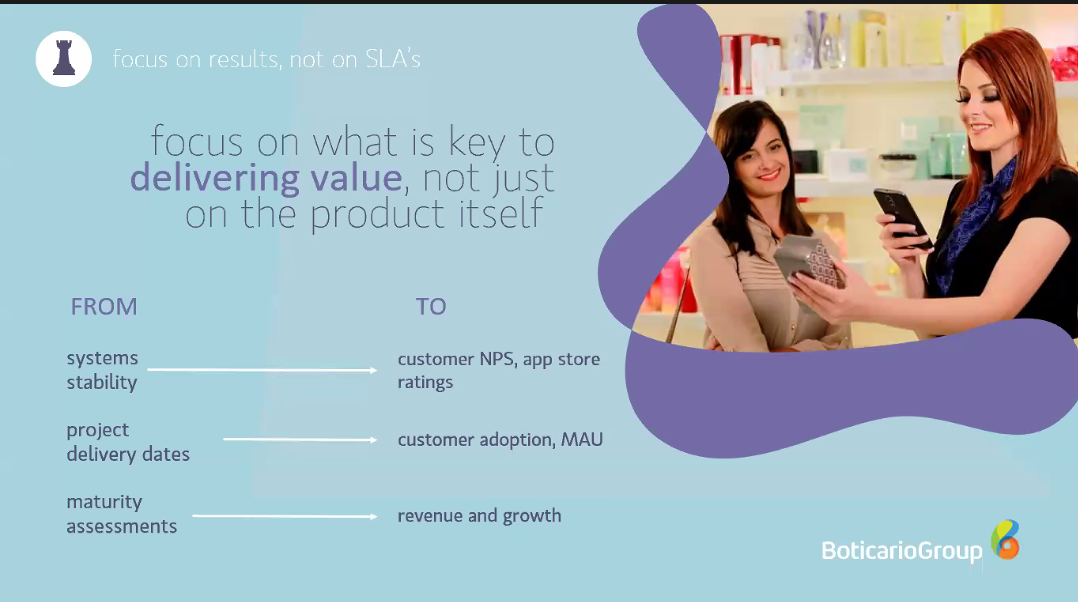

“To work as a remote first company we need to change the tools we use,” Pedigoni noted. He also underlined the need to “focus on what is key to delivering value and not just on products”.

“To work as a remote first company we need to change the tools we use,” Pedigoni noted. He also underlined the need to “focus on what is key to delivering value and not just on products”.

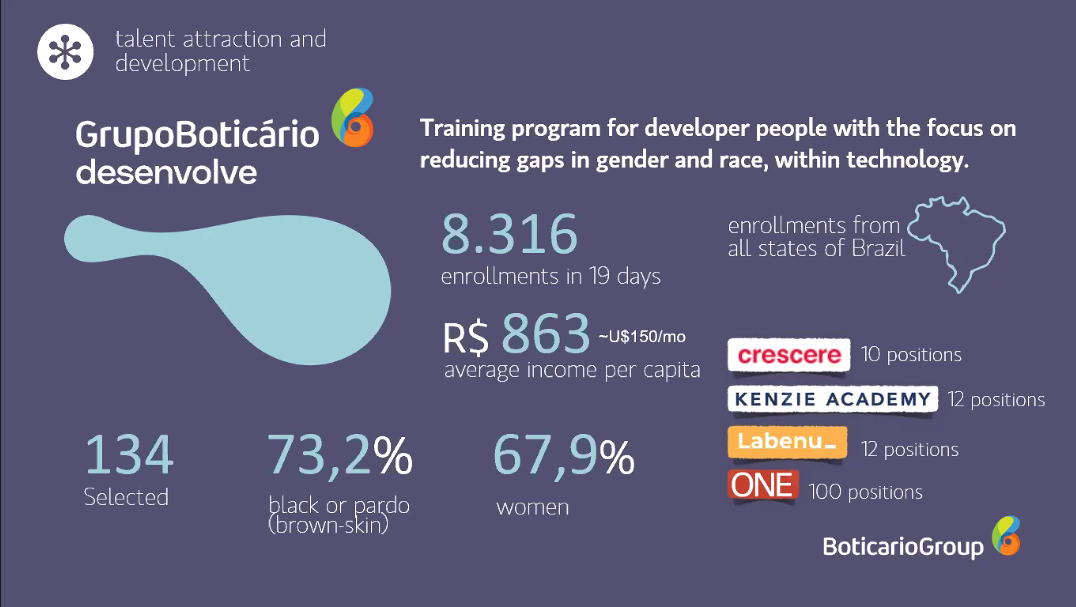

Pedigoni outlined the group’s decision to support startups through a programme which attracted close to 140 submissions and resulted in collaborations with 13 new ventures. He also highlighted Boticário’s ‘desenvolve’ development concept and, with Knopfholz, shared lessons from the group’s “unending” progress towards digitalisation.

KNOWLEDGE HUB

A.S. Watson’s Malina Ngai on why O+O is the core retail strategy for the number one health and beauty retailer

A.S. Watson, the world’s largest health and beauty retailer, took centre stage at Beauty Tech Live this morning, as Group COO & CEO of A.S. Watson (Asia & Europe) Malina Ngai took a detailed look at the category’s relationship with consumers across online and offline (O+O) channels.

She said: “The COVID-19 pandemic has completely reset the retail game within a year. Forget physical versus online. It’s not either or, O+O is the new standard for retail.”

“Simply, O+O describes how customers shop today. The customer journey almost always involves offline plus online. The traditional strategy of O2O (online to offline or offline to online) from the past generation drove customers from one channel to another.

“However, O+O is totally different. It is more about creating an integrated experience to better serve customers’ needs, that enables them to shop across any channel, anytime, anywhere.”

More on the O+O opportunity, how A.S. Watson has expanded its digital focus and why it will continue to pursue an ambitious store opening strategy can be seen in a full report on our website, coming soon.

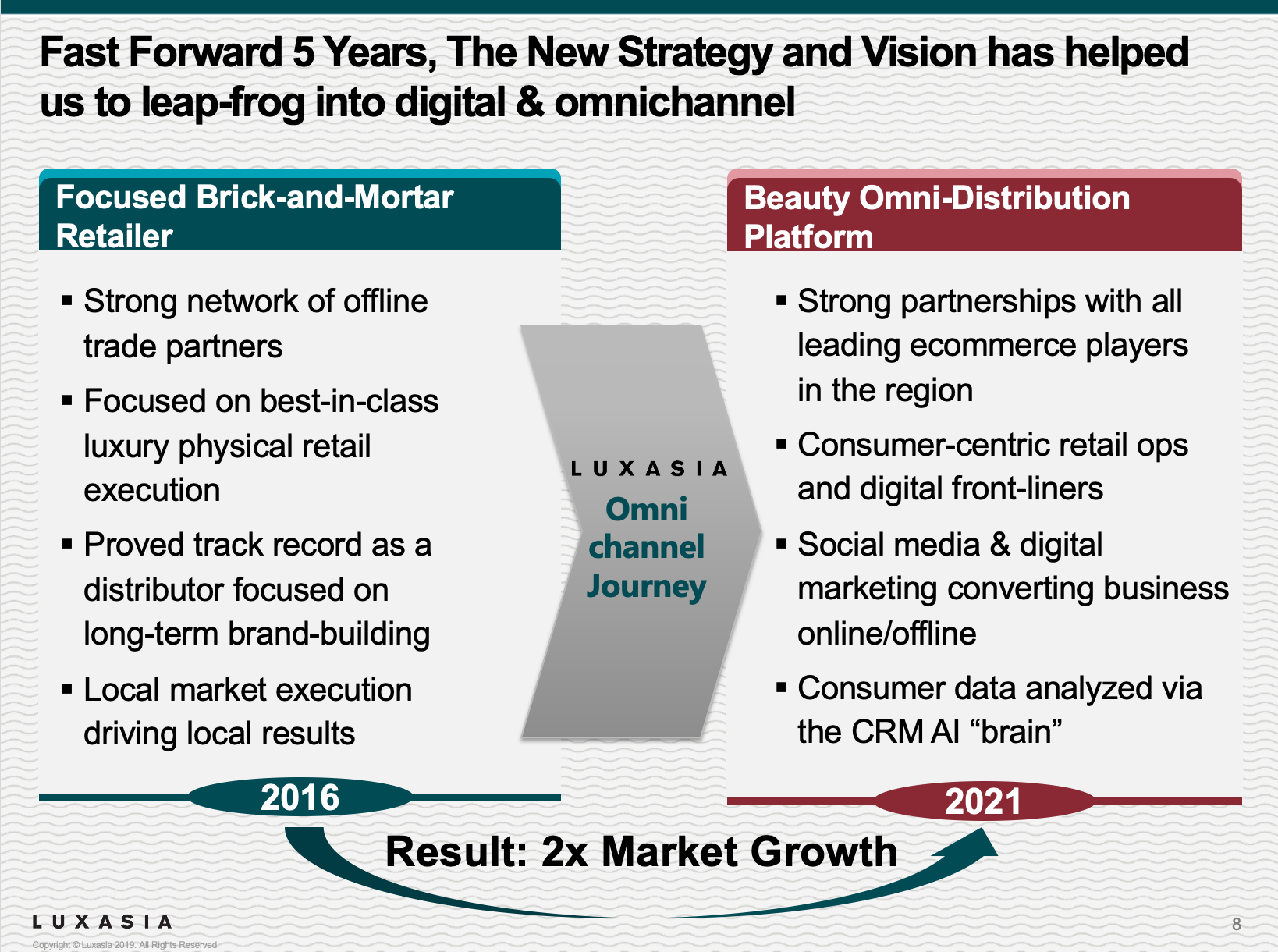

Luxasia Group CEO Wolfgang Baier on the future of omnichannel

Luxasia Group Chief Executive Officer Dr. Wolfgang Baier delivered an enlightening keynote address on the future of omnichannel beauty at the Knowledge Hub of Beauty Tech Live.

Dr. Wolfgang Baier was named the Group Chief Executive Officer of Luxasia in 2016. He helped develop the company’s omnichannel services and transform it into a leading beauty distributor in the Asia Pacific region.

He also enhanced Luxasia’s ecommerce and digital capabilities and implemented a consumer analytics-led approach to both its physical and online sales and marketing strategies.

Dispelling the mystique and jargon surrounding omnichannel, Baier defined what omnichannel means today and outlined Luxasia’s own hugely successful approach. He said, “Omnichannel means giving a 360* experience for consumers, where they can access all points of sale in parallel and have the ability to interact without losing data. This is where the future of beauty ecommerce lies.”

According to Baier, omnichannel needs to be the number one priority for businesses looking to gain an edge in the new retail landscape. “As a company, you need to make omnichannel a top priority,” he said. “To do this, you need to set a clear vision and strategy and invest in the right building blocks. It’s all about going on an omnichannel learning journey. You have to fail fast, to learn fast.”

Stay tuned for our full report

ENGAGEMENT LOUNGE

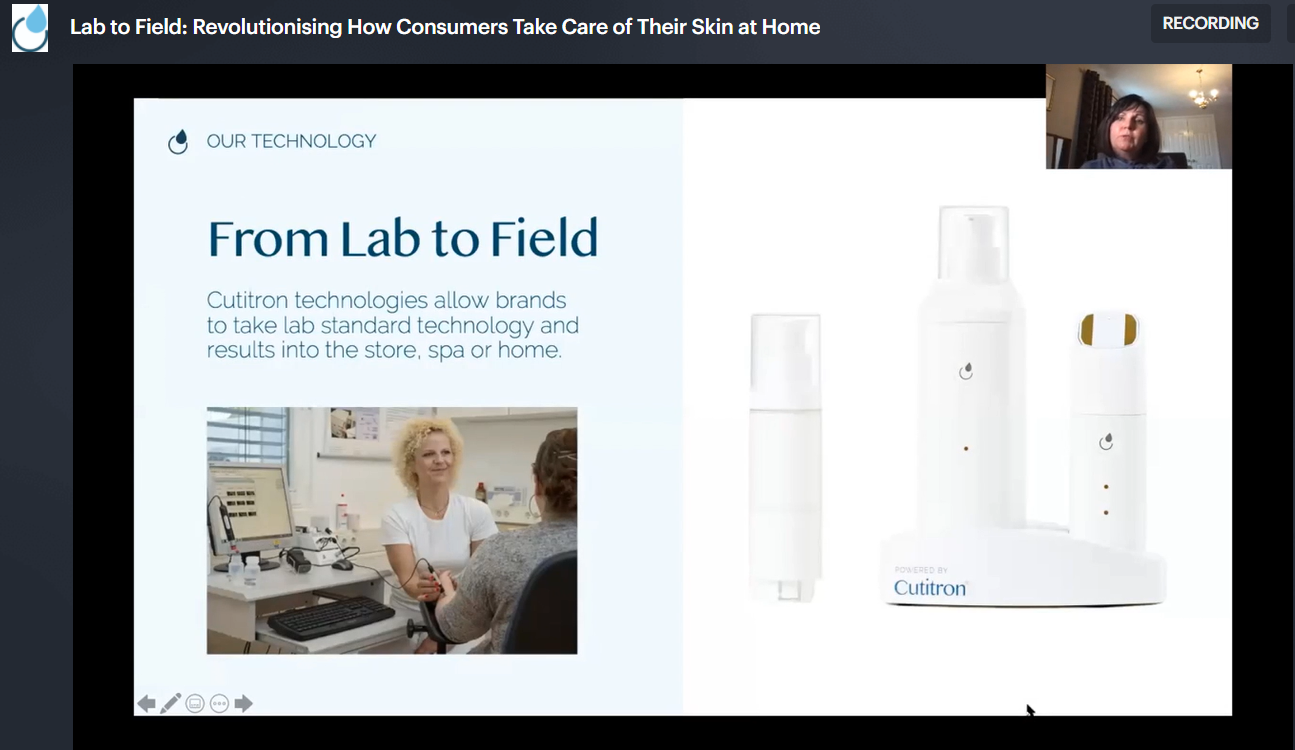

Lab to Field: Revolutionising How Consumers Take Care of Their Skin at Home

Cutitronics Commercial Director Wilma McDaniel presented fascinating insights into how the company designs and develops digital solutions for everyday skincare problems in this Engagement Lounge session.

McDaniel pointed out that global beauty is an “extremely crowded marketplace”. Consumers are confused not only on how to choose the best products but how to use them to address personal skin concerns and deliver the best results.

McDaniel pointed out that global beauty is an “extremely crowded marketplace”. Consumers are confused not only on how to choose the best products but how to use them to address personal skin concerns and deliver the best results.

“As an industry we have solved this problem by providing trained expertise at the physical point of sale… what we have never really understood is what happens when the consumer goes home,” she said.

Cutitronics’ vision, McDaniel explained, is to collaborate with brands to “revolutionise how people take care of their skin at home”. It wants its skincare devices to bridge the gap between clinical trials and skincare at home and extend brand expertise into consumers’ hands.

McDaniel revealed the findings of a Cutitronics survey which indicated that 72% of consumers would consider using a smart skincare device. Over 70% said that the use of smart technology in the home makes life easier.

McDaniel revealed the findings of a Cutitronics survey which indicated that 72% of consumers would consider using a smart skincare device. Over 70% said that the use of smart technology in the home makes life easier.

She also emphasised that the device can be used by brands as a sales tool.

14 April

Welcome to Day Three at Beauty Tech Live, the pioneering virtual event that brings together the joint worlds of beauty and technology.

Today sees more engaging content across the Knowledge Hub and Engagement Lounge programmes. The Knowledge Hub begins (0930 CET) with Luxasia Group CEO Dr Wolfgang Baier discussing omnichannel beauty, and later (1100 CET) A.S. Watson (Asia & Europe) & Chief Operating Officer, A.S. Watson Group Malina Ngai will talk about the future for online and offline beauty.

We will hear about digital learnings in the beauty space from Brazilian powerhouse Grupo Boticário (1500 CET) and The NPD Group will lead a session on ecommerce in beauty from 1630 CET.

Click here for more and to register.

13 April

KNOWLEDGE HUB

Three entrepreneurs disrupting the online beauty market tell their stories

A fascinating session unfolded in the Beauty Tech LiveKnowledge Hub yesterday, as three beauty entrepreneurs who have built their independent brands using a variety of digital methods gave insights into how their ventures took off.

Sharing their stories were Rowse CEO & Co-Founder Gabriela Salord, Agora CEO & Co-Founder Riccardo Basile and Augustinus Bader Co-Founder Charles Rosier.

Asking the questions in the session – titled Doing Direct To Consumer & Building Communities – was Joel Palix, a former CEO of Clarins Fragrance Group and MD Europe of Yves Saint Laurent Beauty.

Palix operates his own consultancy, Palix Unlimited, advising beauty brands and financiers on funding and acquisitions, direct to consumer (DTC) and ecommerce strategies, innovation and beauty tech.

Setting the scene, he noted the rise of independent beauty brands, disrupting the market and quickly gaining market share. He said: “Why is this happening? Well, I think consumers have become somewhat alienated by big luxury brands and have been bored by many drugstore brands.

“What we see are Millennials and Gen Z favouring indie boutique brands, because such brands offer them greater inclusivity, better personalisation, stronger authenticity, and an active engagement in the brands they shop… this is what they’re looking for.”

He also observed that such brands are using a variety of methods – “no one model fits all” – to get themselves noticed using combinations of selling DTC, digital content, building online communities and influencer marketing.

Palix added: “In my role as advisor today, I see two major issues for indie beauty brands. One, how to find the right balance between commerce, content and community. This is particularly important when you want to go international. And the second issue is whether or not, and how to, transition DTC sales into other channels.”

The three beauty entrepreneurs under the microscope have found their own ways to negotiate a path through these challenges, with digital methods central to the rapid growth they are achieving.

In the case of Charles Rosier, the influencer route led to big things for skincare brand Augustinus Bader. It was a company he jointly founded with a prominent German professor, who gives his name to the brand. They went on to create a skincare range which has been voted ‘the greatest skincare of all time’ by an independent panel of 300 beauty experts and insiders.

With initially two 250ml moisturisers in the range retailing at US$265, the business partners headed to Los Angeles to seek Hollywood celebrity endorsement. Impressed with the premium product – containing active ingredients developed by Bader which reduce fine lines and wrinkles quickly – several A-list actors became early shareholders and their social media influence sent the product viral.

Rosier said this led to the recruitment of a second round of influencers – journalists. “We organised press days, telling the story of Augustinus and the credibility of his background in stem cell science and wound healing. It triggered the journalist community to have curiosity to try the product.”

Getting such attention is not easy to achieve, Rosier asserted. “One of the issues nowadays is influencers like [beauty] journalists receive hundreds of products to try, and no-one can put 200 products on their own face. There are so many indie brands and new brands launching that the attention span of the actors, celebrities, social media influencers, and journalists is limited.

“We were privileged, I think, to have an attractive enough story and product to get people to actually try it and create the interest. And that was really our first wave of community building, and that community was powerful and very helpful to us.”

Meanwhile, building an online community is at the hub of the success of Riccardo Basile, who revealed that his disruptive social beauty ecommerce project, Agora, now has more than 150,000 members in the UK alone.

Basile and his business partner had spent six years in Southeast Asia, developing the Lazada Group business, which they sold to Alibaba. “When we came back to Europe, we realised that the state of development of ecommerce when it comes to beauty is probably 5-10 years behind,” he said. “So we wanted to take the opportunity to build a platform which is very easy not only for users, but also for content creators and brands.”

The Agora community has been built by its members sharing beauty-related video content, attracting rapid user growth and the ability to sell an initial offer, a ‘beauty box’ containing various products, to the audience.

The idea has attracted significant outside investment and the platform will soon start to sell products through livestreaming, and there are plans this summer to start an online beauty marketplace, to which 50 beauty brands have already signed up.

“A big part of the user acquisition has been driven by our ambassador programme,” Basile said. “We have 300 content creators that we selected, typically small influencers with between 10,000 and 100,000 followers on Tik Tok or Instagram.”

The last entrepreneur to tell her story was Gabriela Salord whose Rowse skincare products are made from clean and effective plant-based ingredients. Using a variety of content creation methods – featuring collaborations with creatives such as artists and photographers – the brand has rapidly achieved success in the Spanish market.

Salord explained that she has pursued a deliberate strategy of organic growth, without the use of a significant marketing budget. She said that earlier in her career she had witnessed how quickly huge marketing budgets can disappear and wanted the business to create its own promotional momentum.

She said: “How we’ve done it is that we have played with the ‘cool kids’ first, we didn’t want to go mainstream right away. Because we feel that to be a very unique and authentic brand, for the first year or year and a half, you need to be a sort of secret brand. A brand that only cool people will talk about, only they get to try it, and then it takes off slowly.

“Then we have collaborations with content creators, with very curated people. We don’t want any mainstream profiles. And that’s been our force, our strength, I think, just being able to select the right people for us.

“We are building the hype. And then once you reach that level of sales expected for the country [Spain], then you can go a little bit more mainstream. We will look to France, the UK, Germany and Italy, which are key markets in Europe, and then the US, where 10% of our clients are today.

“I think the beauty of growing the brand organically is that it just takes you where you have to go.”

ENGAGEMENT LOUNGE

Optimising the Customer Journey by Combining Beauty Media and E-tail Data

In this presentation by MMI Analytics (formerly My Market Insight), the company’s CEO and Founder Christian Eckley, and Data Insights and Analytics Manager Sophia Rendora, considered the benefits of aligning media and e-tail data to offer customers a seamless shopping experience.

Eckley asked brands to consider how closely aligned their media, ecommerce and commercial teams were. “Is your organisational structure driving a combined media and e-tail strategy that shares a common vision? Would you consider combining departmental budgets?”

Eckley asked brands to consider how closely aligned their media, ecommerce and commercial teams were. “Is your organisational structure driving a combined media and e-tail strategy that shares a common vision? Would you consider combining departmental budgets?”

He touched on the evolution of media and the huge changes in publishing and online activity. “E-tail driven content is infiltrating consumers’ everyday scrolling… media, over time, has been wired for e-tail.”

He said the “interweaving of media and e-tail data is more pronounced across social media platforms where it is not just about driving consumers to the store but driving the store to the consumer”.

“It is crucial to align your media and e-tail strategy and layer. The conversion of data will highlight small incremental improvements that will then add up to significant success.”

Rendora presented statistics underlining the importance of media messaging and the use of price positioning to ensure brand stands out.

Rendora presented statistics underlining the importance of media messaging and the use of price positioning to ensure brand stands out.

She detailed customer journeys and highlighted MMI’s work with selected brands, emphasising how data analysis of both media and e-tail can help brands and retailers understand the effectiveness of their marketing strategies.

Click here to follow the session.

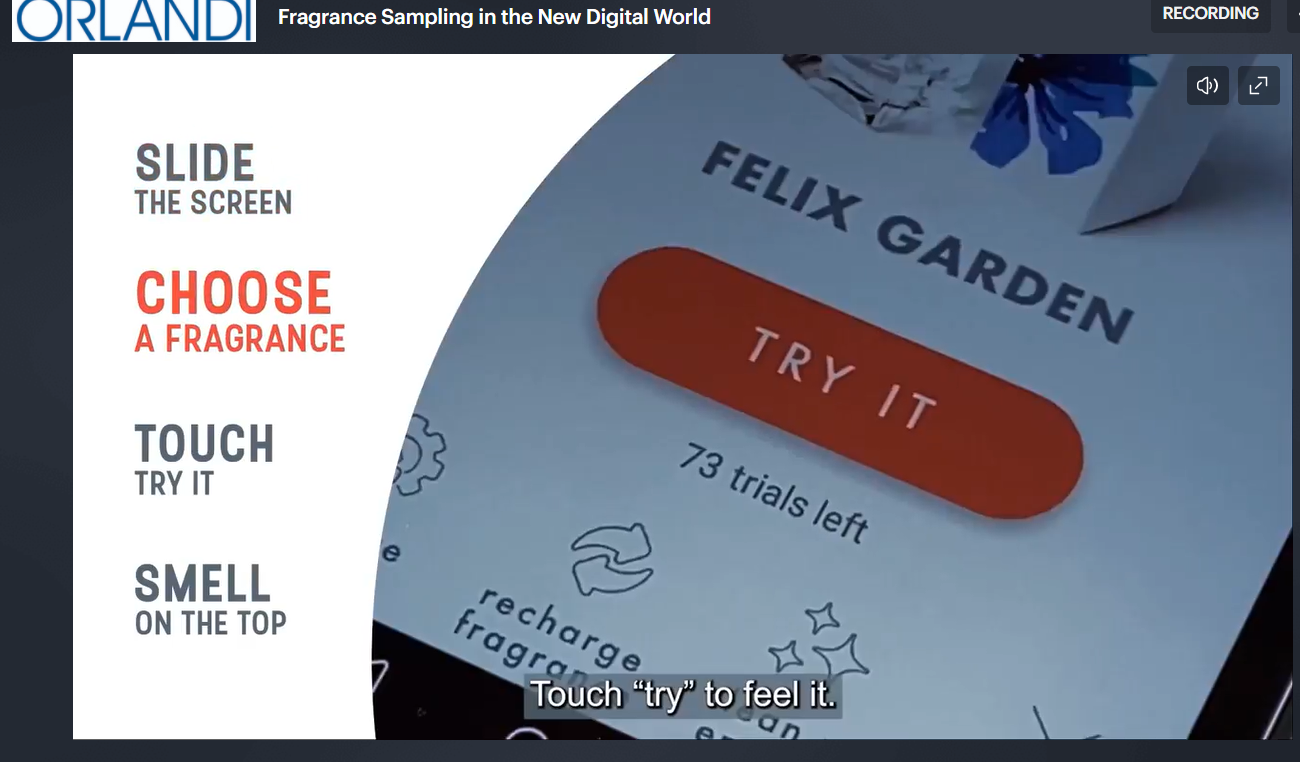

Leading this Engagement Lounge session, Orlandi – an international retailer in sampling and retail solutions for fragrances, cosmetics and personal care – highlighted its latest product, MultiScent 20, which it hailed as “a retail revolution”.

Orlandi CEO Sven Dobler introduced “friend and inventor” Claudia Galvao, the founder of Brazilian tech company Noar. Noar’s digital scent technology enables consumers to smell up to 20 fragrances in an intuitive and sustainable way.

Orlandi CEO Sven Dobler introduced “friend and inventor” Claudia Galvao, the founder of Brazilian tech company Noar. Noar’s digital scent technology enables consumers to smell up to 20 fragrances in an intuitive and sustainable way.

Galvao pointed out that MultiScent20 can be controlled by the user’s smartphone or a store device, enabling a no-touch, safe sampling experience. The device offers dry scent diffusion to offer sampling without cross-contamination. It holds 20 fragrances for 2,00 fragrance experiences before refill. It can collect feedback and consumer sampling data to offer insights on consumer preferences and support digital marketing and in-store travel retail sales or training initiatives.

Galvao pointed out that MultiScent20 can be controlled by the user’s smartphone or a store device, enabling a no-touch, safe sampling experience. The device offers dry scent diffusion to offer sampling without cross-contamination. It holds 20 fragrances for 2,00 fragrance experiences before refill. It can collect feedback and consumer sampling data to offer insights on consumer preferences and support digital marketing and in-store travel retail sales or training initiatives.

Noar also drives touchscreen and POS units. All operate with a dry scent olfactory system that leaves no residue on the device or the user.

“A great advantage of the Noar device is how it fits the new demands created by COVID-19,” Galvao said. “With the pandemic people want more security when interacting with products and sales people… on touchscreens, for example, the device automatically locks for cleaning after usage.”

The Orlandi team described MultiScent20 as the “most innovative sales tool for retail, direct sales and for travel retail”. The device also targets sustainability; it is reusable and cartridges are refillable and it can contribute to a reduction in a retailer or brand’s carbon footprint.

The Orlandi team described MultiScent20 as the “most innovative sales tool for retail, direct sales and for travel retail”. The device also targets sustainability; it is reusable and cartridges are refillable and it can contribute to a reduction in a retailer or brand’s carbon footprint.

Click here to follow the Engagement Lounge session.

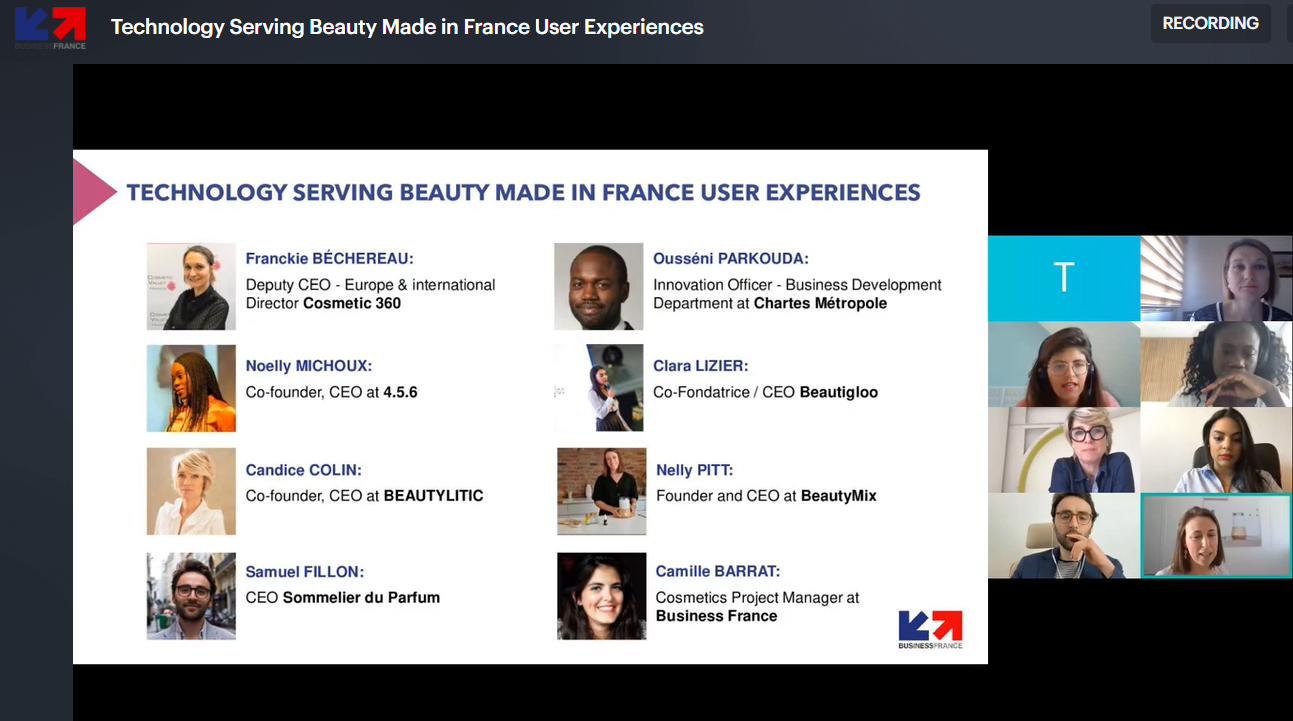

Technology Serving Beauty Made in France User Experiences

Business France Cosmetics Project Manager Camille Barratt lead this fascinating and enlightening session on French innovation in beauty tech. Key issues included transparency, clean beauty, traceability, environmental standards, customisations and customer experience. Participants included 360-Cosmetics Deputy CEO – European and International Director Franckie Bechereau.

Five startups were introduced: 4.5.6, Beautylitic, Sommelier du Parfum, Beautigloo and BeautyMix.

Barratt underlined that France is well known for exporting the finest luxury goods all over the world, especially in cosmetics and perfumery. “When it comes to talking about tech in this industry people talk about gadgets and goodies. Recently a new wave of innovators has been trying to revolutionse the market.

Barratt underlined that France is well known for exporting the finest luxury goods all over the world, especially in cosmetics and perfumery. “When it comes to talking about tech in this industry people talk about gadgets and goodies. Recently a new wave of innovators has been trying to revolutionse the market.

“Among them we have entrepreneurs but more and more engineers who are really bringing significant breakthroughs in the cosmetics market,” she said.

4.5.6 Co-founder and CEO Noelly Michoux introduced the brand’s skincare concept for melanin-rich skin while Beautylitic Co-founder and CEO Candice Colin explained her clean beauty concept.

4.5.6 Co-founder and CEO Noelly Michoux introduced the brand’s skincare concept for melanin-rich skin while Beautylitic Co-founder and CEO Candice Colin explained her clean beauty concept.

Sommelier du Parfum CEO Samuel Fillon outlined the brand’s ability to offer customers at-home sampling and Beautigloo Co-founder Clara Lizier introduced the Refrigerated Beauty Box which aims to boost the effectiveness of cosmetics while keeping them environmentally friendly.

BeautyMix Co-founder and CEO Nelly Pitt highlighted the brand’s robot that allows consumers to make their own cosmetics and cleaning products at home, easily and safely.

Click here to follow the session.

EXHIBITION HUB

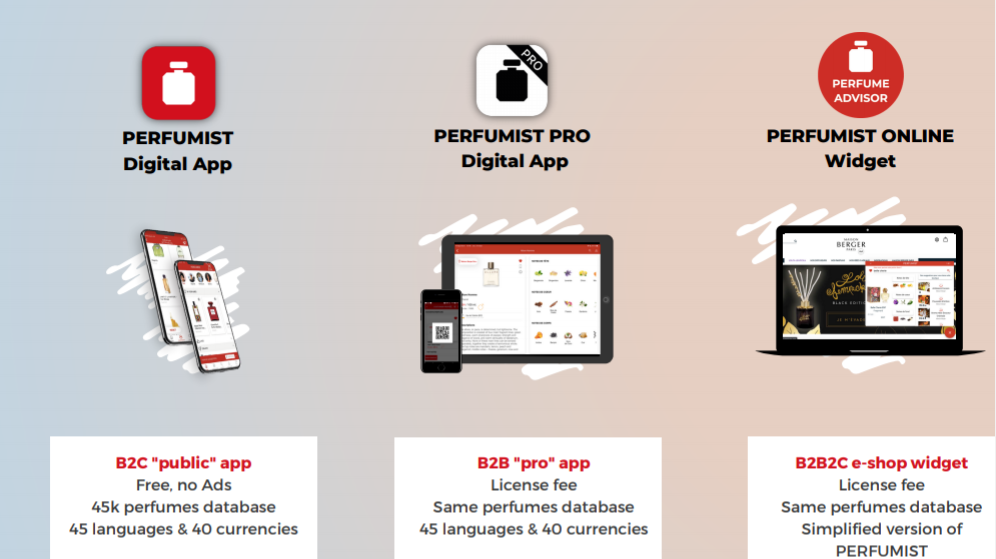

“The fragrance app made for and by consumers”

Perfumist aims to help consumers find their ideal perfume for personal use or as a gift.

Perfumist aims to help consumers find their ideal perfume for personal use or as a gift.

The platform targets both online and offline sales with three apps focusing on B2C, B2B and B2B2C. Visit the stand to get full details on how Perfumist Pro can be used in duty free stores.

The platform targets both online and offline sales with three apps focusing on B2C, B2B and B2B2C. Visit the stand to get full details on how Perfumist Pro can be used in duty free stores.

“Identifying travellers’ unique needs”: EPTECA highlights smart marketing

Epteca introduced its Marketplace Ecosystem which aims to “bring the perfect travel retail products and services directly to travellers at the right place and time when they are ready to buy”.

Epteca introduced its Marketplace Ecosystem which aims to “bring the perfect travel retail products and services directly to travellers at the right place and time when they are ready to buy”.

The platform uses Artificial Intelligence (AI) to match customer context and intent and to anticipate what they are likely to want, need or do during their trip.

KNOWLEDGE HUB

How brands can maximise the TikTok opportunity

Tribe Dynamics Co-Founder and President Conor Begley, Summer Fridays Director of Marketing Blair Badge and Youth to the People Senior Social Media Manager Madeline Davis delivered an illuminating panel discussion about how brands can inspire creators and reach new audiences on popular short-video application TikTok.

The panel highlighted data-driven strategies and key insights to help brands stand-out on the fast-growing platform.

Over the years, TikTok has grown from an emerging social media channel for teens into an established hub for online conversation and a powerful marketing tool for brands. It has over 1 billion users, with a unique audience almost 50% of which do not use Facebook nor Instagram.

Begley is the founder of leading fashion and beauty influencer marketing analytics platform Tribe Dynamics. During the session, he outlined some of the key TikTok basics like content structure, audience demographic and growth potential. He also highlighted some of the latest viral TikTok trends.

Commenting on the growing TikTok community, Begley said: “It’s big, it has a unique audience and it’s growing. Brands must be nimble, innovative and active to capitalise on TikTok trends.”

Badge said, “Our Summer Fridays TikTok launched one year ago, and we are still in the testing and learning phase to figure out what works in that platform. You really don’t know what’s going to work. You just have to throw everything against a wall and see what sticks.”

Davis commented, “There’s so much content on TikTok, from fantastic viral videos to educational content. There’s something for everyone and there’s less posturing and that’s really appealing for both consumers and brands.

“TikTok is a space for us to explore,” Davis added. “It’s a great place to build on our personality and on our relationships. We know that influencers are investing on this platform and so it’s a great proof point for the platform’s continued growth”

While TikTok is a growing platform, it doesn’t yet have the same analytical tools as more mature players like Instagram and Facebook. Although according to Badge, brands need to be agile while the platform is still relatively new. She said, “TikTok is only going to get bigger brands need to learn to capitalise on this space. The key takeaway is to get in early, regardless if you can quantify results, before the algorithm changes further.”

“For a brand, it’s no small feat to have a presence on TikTok because it is very trend-based,” Davis added. “We’re taking a creator-first approach and investing on influencer relationships to drive traffic back to us. Content creation is deceivingly difficult, especially when you’re trying to hit those big trends.”

The Role of Stores in Digital Business & Using Tech For Sustainability

In this engaging Knowledge Hub session, BW Confidential Editor-in-Chief Oonagh Phillips talked with L’Occitane Group Sustainability Officer and Director of the L’Occitane en Provence Brand Adrien Geiger about how ‘brick and mortar’ stores can use ecommerce to improve customer experience.

In this engaging Knowledge Hub session, BW Confidential Editor-in-Chief Oonagh Phillips talked with L’Occitane Group Sustainability Officer and Director of the L’Occitane en Provence Brand Adrien Geiger about how ‘brick and mortar’ stores can use ecommerce to improve customer experience.

Geiger was formerly the group’s Chief Digital Officer and revamped the brand’s ecommerce strategy. He champions sustainable causes and has spearheaded the company’s programmes for in-store recycling.

Considering the changing role of stores in a digital-dominated era, Geiger underlined the continued importance of creating customer experiences, including through human interaction.

“The way retail is evolving is to have our beauty assistants (BA) and our sales people at the centre of the retail experience. We are social animals and we need this interaction. In digital we can have a lot of things but the real human connection if something that you can never get anywhere other than in the store.”

L’Occitane’s vision, he said, is to maintain he interaction – “the bond that people really need so strongly” – and to enhance that with digital.

L’Occitane’s vision, he said, is to maintain he interaction – “the bond that people really need so strongly” – and to enhance that with digital.

Geiger considered logistical problems around the efficient delivery of online orders, noting that in the US, L’Occitane introduced changes to ensure that its network of stores could support delivery and enhance its digital performance.

“That’s a different story to the human approach but super important too,” he added.

Asked if L’Occitane was considering major changes to its store network – with stores acting as destinations and with the majority of sales online – Geiger said: “When I started with L’Occitane in 2014 I remember saying that our sustainable competitive advantage is our stores.

“We have 3,000 stores around the world; that was a strength we needed to leverage. Today I would say that our sustainable competitive advantage is our 10,000 employees, our 10,000 BAs.”

He noted the recent closure of some stores in the US but emphasised that L’Occitane was able to retain most of its staff members who use a clienteling app sales to maintain interaction with customers.

He predicted that L’Occitaine may downsize its network and the number of large shops to rely on smaller units where BAs can be present.

“Being a retailer takes year of experience; it’s difficult. But L’Occitane is in ecommerce for 20 years; it accounts for more than 20% of our business and is huge. So being on those two legs, and being able to link them, is key,” he added.

He noted new sales touchpoints, including social media and influencers, which L’Occitane uses to ensure new opportunities are not missed. He also underlined the need for brands to have updated information on locality and closing times available for search engines and the rise of voice-over tools such as Amazon Alexa.

Geiger said L’Occitane’s development of video interaction between its BAs and customers is proving successful. “It offers the extra connection people want and don’t really have in digital,” he said, adding that it also offers BAs the ability to link both online and offline experiences.

Asked how close L’Occitane is to creating a frictionless experience in their stores, Geiger said: “We have conducted many experiments and did not see a massive improvement on the customer experience stand point. At the end of the day 80% of the experience is the interaction with the BA so that’s what matters the most.”

“For us now digital is how we can reduce the burden that the BA has in order to make the store functional; how she can spend more time with the customer because that is what matters.”

Considering digital learnings related to the Chinese market, Geiger noted the heavy use of social media and WeChat to strengthen BAs’ interaction with customers and the “superfast” development of live streaming. Geiger added that L’Occitane has already included live streaming facilities in stores in Japan and Korea.

On L’Occitane’s significant sustainability efforts, Geiger said the brand was considering the heavy impact of ecommerce on its carbon footprint and outlined the use of digital and data to minimise this impact. The company is also reviewing its distribution and delivery strategies, he added.

EXHIBITION HUB

Have you had the chance to explore the Beauty Tech Live Exhibition Hub yet? If not, here is a dynamic video walkthrough which will preview the #Virtual Stands from some of beauty and technology’s leading innovators and disruptors.

Here you can explore the latest product innovations, tools and services from Scentys, Orlandi, im1ne, Perfumist, Les Parfumables, Revieve, Arcade Beauty, Reziena and Perfect Corp.

View this post on Instagram

ENGAGEMENT LOUNGE

The Beauty Tech Live Engagement Lounge opened with Revieve CEO and Co-Founder Sampo Parkkinen, who hosted the ‘Skincare Becomes No1: How to Personalise the Brand Experience in the Highly Competitive Beauty Industry’ webinar. The webinar offered an in-depth look at the future of the beauty industry and the role of personalised digital brand experiences.

It also debuted Revieve’s new personalised digital skin diagnostic tool SkinCoach, which uses selfie technology to curate a bespoke, data-driven skincare routine for customers. According to Parkkinen, SkinCoach was designed to create consumer engagement, elevate the brand experience and boost sales.

Parkkinen said, “The future of beauty is exciting, but connecting with consumers is more important than ever. As a market leader in helping brands enhance the skin health experience, we saw the COVID-19 crisis through a unique lens.

“We saw consumer appetite in digital engagement and new emerging solutions sky-rocket, and we developed SkinCoach with all these new insights and knowledge. We believe SkinCoach will transform how you create loyalty, retention with your beauty customers.”

KNOWLEDGE HUB

Puig’s Javier Bach on how ‘brilliant basics’ can elevate the online fragrance experience

Puig Chief Operating Officer Javier Bach opened Day Two of Beauty Tech Live with a compelling session on experiencing and selling fragrances online.

Family-owned fragrance company has Puig forecast that 30% of its business will come from digital by 2025. In a one-on-one interview with BW Confidential Editor-in-Chief Oonagh Phillips, Bach discussed Puig’s online acceleration, lessons over the last year, the role of brick & mortar stores and Puig’s ‘brilliant basics’ approach to standing out in a competitive digital marketplace.

“2020 was a year of learnings,” Bach said. “We originally predicted 25% of our business will become digital by 2025, but our ecommerce business in prestige fragrances went from 12-13% in 2019 to 24% 2020, reaching our projections five years early. It was five years of digital acceleration in one.”

With so much emphasis placed on digital, how must the brick & mortar store evolve to keep up? “The role of physical stores has to evolve. Online brings so much convenience, forcing brands and retailers to rethink how their stores operate. Brick & mortar needs to become more experiential and elevated. If they rely on a purely transactional approach, they will lose the race to online. An omnichannel approach is key. It’s not online vs offline, but instead how do you incorporate both to enhance the consumer journey.”

So, how can fragrance brands stand out in a crowded online marketplace? Bach said, it’s all about having brilliant basics. “You need to be excellent in terms of channel search, visibility, ratings and reviews to stand out. It’s really about having brilliant basics and having effective execution. Part of our strategy is mastering the omnichannel connection and conversion of consumers. Brands need to understand who their customer is and all the touchpoints of their shopping journey.

Welcome to Day Two of Beauty Tech Live, the pioneering virtual event that brings together the joint worlds of beauty and technology.

Today sees a rich and varied Engagement Lounge programme begin, with a series of engaging sessions from our partners from 1300 CET. Click here for more details.

The Knowledge Hub programme that began strongly on Monday continues today. At 0930 CET Puig Chief Operating Officer Javier Bach will discuss the online approach of the fragrance & beauty powerhouse, while at 1100 CET sustainability will be a key theme for L’Occitane Group Sustainability Officer and Director of the L’Occitane en Provence Brand Adrien Geiger.

A 1530 CET session led by Palix Unlimited Owner Joel Palix will explore direct to consumer selling, and at 1700 CET the challenge of marketing using TikTok will be addressed by a panel featuring Tribe Dynamics Co-founder & President Conor Begley, Youth To The People Senior Social Media Manager Madeline Davis and Summer Fridays Director of Marketing Blair Badge.

Stay tuned for more updates on this page from the virtual Exhibition Hub, Knowledge Hub and Engagement Lounge.

Click here to register for the event.

KNOWLEDGE HUB

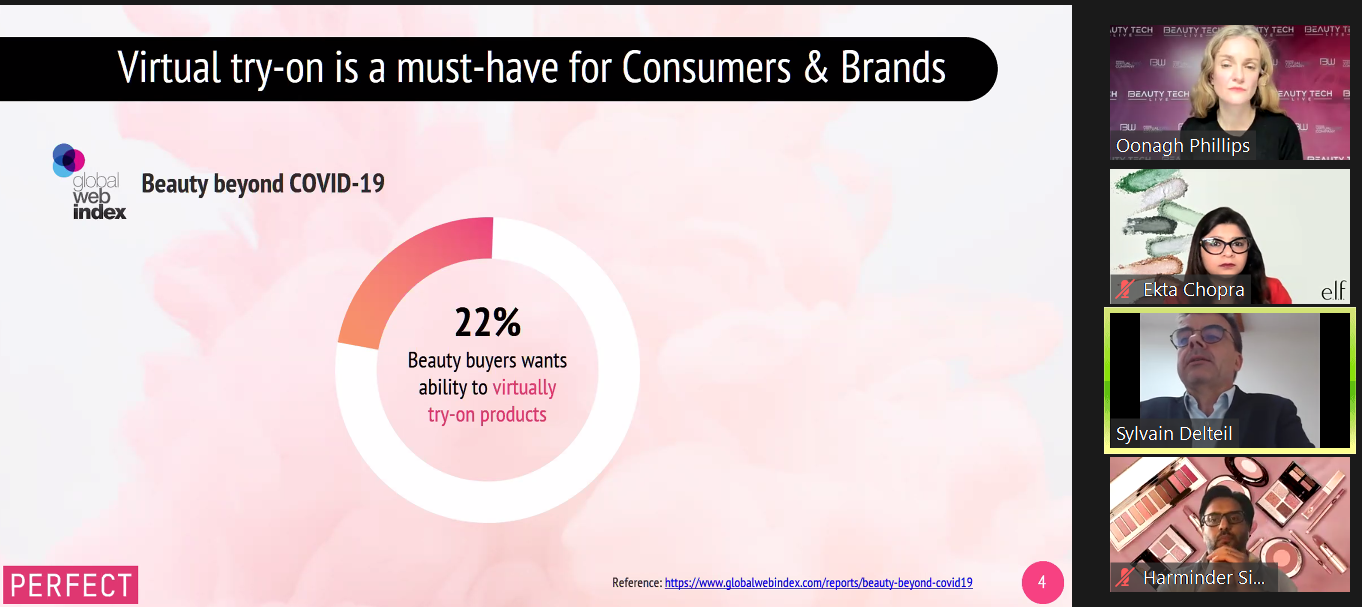

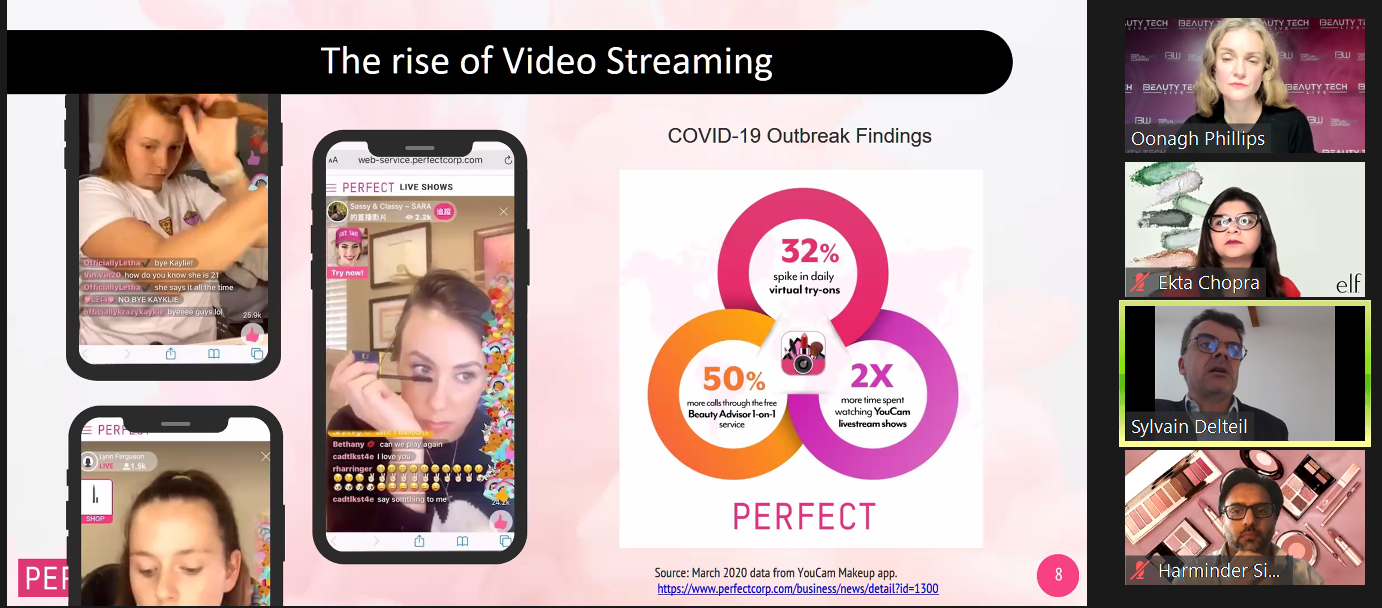

BW Confidential Editor in Chief Oonagh Phillips led a fascinating discussion on ‘shop-tainment’ in today’s final Knowledge Hub session. She was joined by Perfect Corp Europe AVP Business Development Sylvain Delteil, e.l.f. Beauty Chief Digital Officer Ekta Chopra and Charlotte Tilbury Director of Digital Harminder Matharu.

The discussion centred on how to make online shopping fun and on boosting sales through three keys: Augmented Reality (AR), virtual try-on and livestreaming.

Perfect Corp has a “Beauty, Reimagined” tagline and specialises in Artificial Intelligence (AI) and AR to reimagine customers’ shopping experiences.

Delteil pointed out that “five years ago no one was aware that you could try on virtually”. “Now,” he said, “AR is a must have”, which secures not only increased sales but also encourages customers to stay longer online.

He detailed the impact that increased video streaming can have on sales and brand engagement and underlined the role of social media in shop-tainment.

He detailed the impact that increased video streaming can have on sales and brand engagement and underlined the role of social media in shop-tainment.

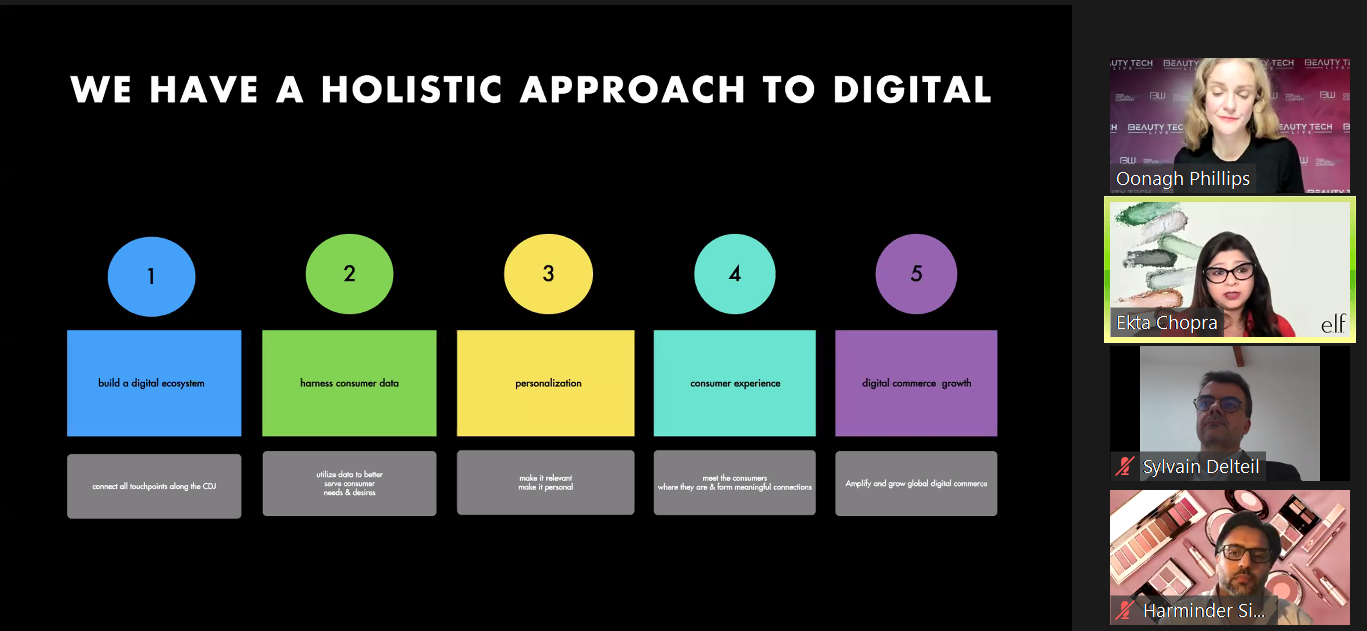

Chopra introduced California-based e.l.f.’s mission to offer affordable cosmetics and its holistic approach to digital, with an emphasis on building a digital eco system, harnessing consumer data, personalisation, consumer experience and ecommerce growth.

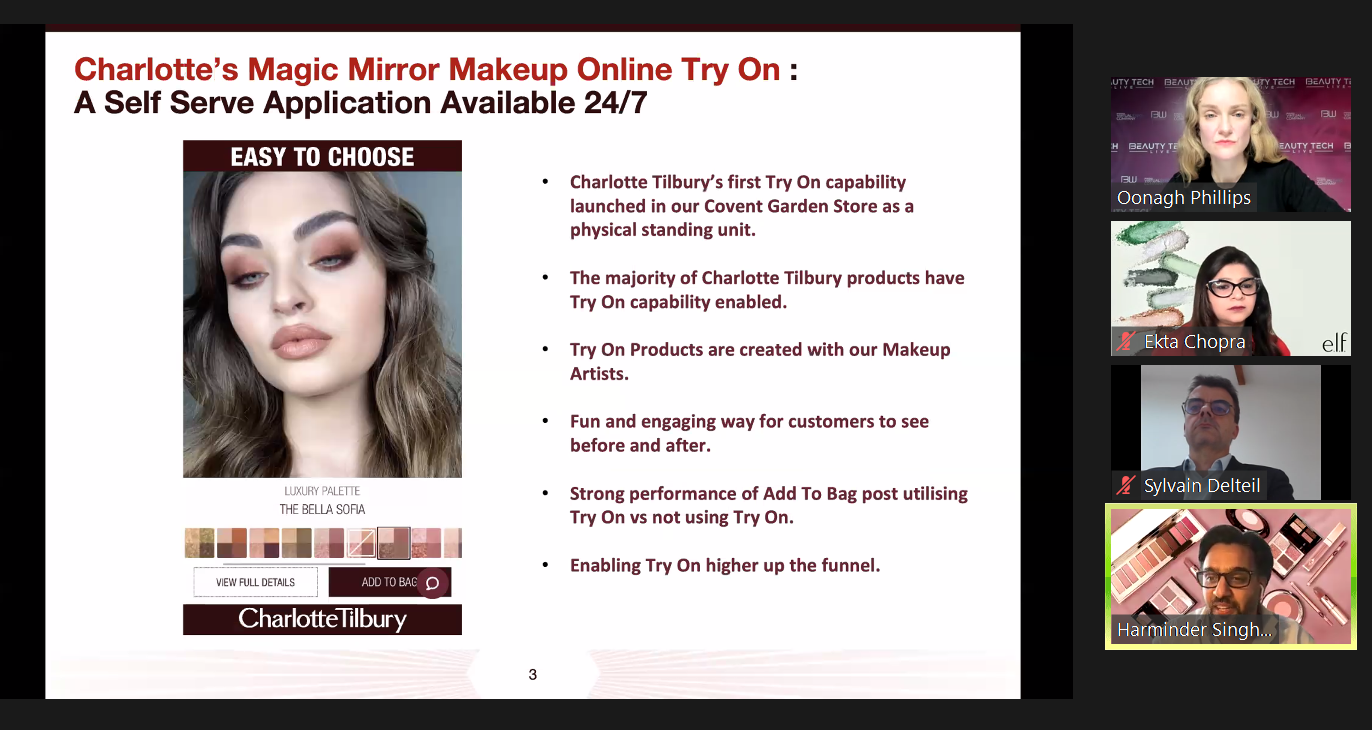

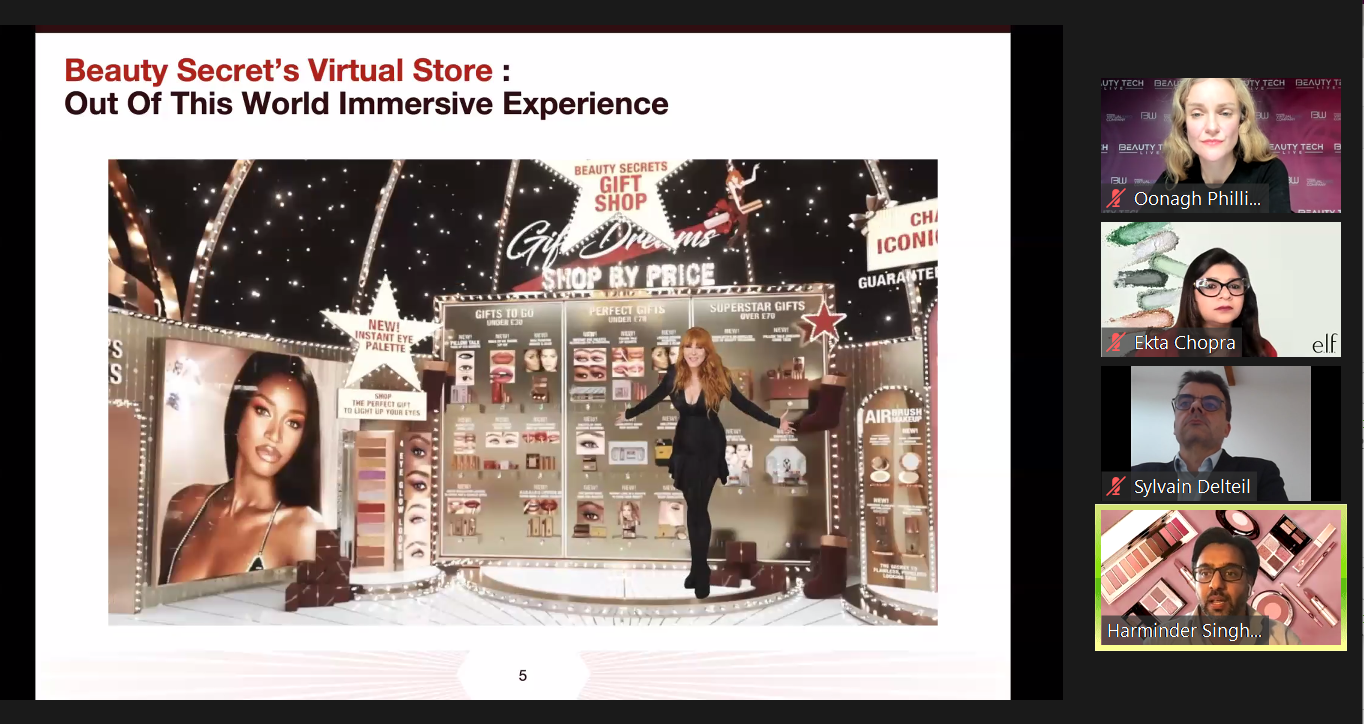

Matharu highlighted the success of Charlotte Tilbury’s Magic Mirror service which is available 24/7 and the role of its Virtual store in ensuring that customers were offered a fun, immersive brand and shopping experience.

Matharu highlighted the success of Charlotte Tilbury’s Magic Mirror service which is available 24/7 and the role of its Virtual store in ensuring that customers were offered a fun, immersive brand and shopping experience.

KNOWLEDGE HUB

14:00 CET

Using digital methods to boost sales in the travel retail beauty category

The first panel session of Beauty Tech Live – Travel Retail’s Tech Transformation – revealed a wide variety of insights into how digital is influencing the promotion of the beauty category in the travel retail channel.

Au Coeur du Luxe (ACDL) President Laurence Ouaknine, iClick Interactive Asia Limited VP International Business Cody Chan and CircleSquare Managing Partner Stéphane Zermatten spoke to Martin Moodie about how beauty brands can make the most of the fast-evolving variety of digital tools available to target consumers in the COVID-shaped world.

Discussing omnichannel strategy, Zermatten – whose company is a leading retail marketing, brand experience and consumer engagement agency – urged a customer-centric approach which marries digital targeting and communication with physical retail experiences across the entire shopper journey.

He said: “If you focus on the people, rather than the channel, you come up with an overarching concept [featuring both digital and physical elements] that’s going to be the backbone of the conversation you will have with your customers.”

On the use of digital in this strategy, he said: “Reaching and targeting customers and getting them into your brand world is a lot easier done online, with all of the data that we have available, all of the social media and all of the different digital marketing means at our disposal.”

He explained that from this, you can then plan a content strategy to be delivered at each of the touchpoints in the shopper’s journey, including travel retail.

He added that while digital shopping has risen in importance as a means of convenience and to complete “the mission of replenishment”, physical travel retail has a key role to play in what he describes as the brand or product “discovery mission”. But, he stressed, using digital means to drive footfall into travel retail stores and personalise the experience is crucial.

Meanwhile, ACDL’s Ouaknine – whose app-based technology trains the front line staff of major brand owners including Estée Lauder – explained that the use of digital methods to provide training is vital to maximise basket size and conversion rate in travel retail in the COVID-19 era.

She said: “Recently more and more companies have decided to train front-liners with app-based e-learning because it’s very convenient in their day to day duties, and at the same time, it’s very scalable and effective. Also, the cost is low which is obviously very important at this time.

“Through our app we can identify performance and knowledge gaps and push the relevant training, engaging people to create a community of learners and to make them closer to the brand than ever. It can also be used record their performance and at the same time to connect and communicate internationally.

“The front-liners are representing your brand and your store network, and they have to be in the core of your strategy. It is a prerequisite that people are fully trained in order to leverage the five senses [in the travel retail environment].”

Ouaknine also acknowledged the rise of livestreaming in travel retail and added that app-based e-learning has a key role play here too. She said: “Livestreaming is a great tool [to generate beauty brand sales] but it is very important that brands and retailers use e-learning to turn their brand ambassadors and front line staff [who are presenting livestreams] into KOLs. They learn how to promote a brand’s products and present it well in livestream.”

With the help of strong product knowledge for front line staff, she said she foresees that “in the future when I travel, I will be able to have the right service, from people that would be able to answer my questions about products, and provide me with the experience that I deserve as a traveller.”

The final contribution of the session came from iClick Interactive’s Cody Chan, whose company’s digital platform, iAudience, provides brand clients with insights into the characteristics of 940 million Chinese consumers, covering 98% of the country’s netizens.

Leveraging such insights, Chan explained, helps brands to better understand the specialist nature of the Chinese market, enabling them to shape content and hit the right digital touchpoints to communicate with native consumers, including when they travel.

He said: “Trying to market a product in China can be difficult for brands, because of the media landscape, the cultural differences to Western countries, and maybe the policies as well.”

Chan said iClick has a specialist business unit dedicated to overseas and travel retail clients to assist in this regard, which uses iAudience data to help drive footfall to stores, target consumers using ecommerce and use the right media to reach them.

Chan noted the scale of the opportunity for beauty brands in China, revealing that there are more than 300 million females in the country aged between 20 and 50.

He said: “Many of us see the opportunities, but at the same time the market has a lot of challenges as well. It is basically our role to resolve their [the brand’s] challenges. For example, you may know the number females in China, but how do we locate them? How are we able to identify them?”

Chan continued: “What if I only want to target 20-30 year olds? How about 30-40? So, these are all the questions that brands want answers to and they also want to see what kind of [digital] platform should they use in China. It really depends on the client situation and what their needs are. There is absolutely no one size fits all solution.

“We use insights and knowledge that we capture from iAudience, so that we know how to plan for our brands strategically, and how they can use this information to slot into different touchpoints.”

1100 CET

L’Oréal Group Chief Digital Officer Lubomira Rochet delivered an illuminating keynote address at the Beauty Tech Live, which officially opened its doors today.

In conversation with BW Confidential Editor-in-Chief Oonagh Phillips, Rochet analysed the fast-changing beauty ecommerce landscape and highlighted the trends and tools that will shape the industry in the years to come.

Rochet, a Franco-Bulgarian economist, has been Chief Digital Officer of the L’Oréal Group since March 2014. She is also a member of the Group’s Executive Committee.

L’Oréal Group’s ecommerce business increased +60% through 2020, and now represents 25% of its total revenues. Rochet discussed L’Oréal’s digital and ecommerce strategy and how the beauty giant is managing its incredible digital acceleration.

“Ecommerce has always been a part of our strategy, but the magnitude of our recent growth has been spectacular” Rochet said. “For example, we’ve seen 200-300% growth day after day in the hair care category. So, one of the first things we did to manage this growth was to invest in real-time analytics. This is so that we can manage data and insights daily instead of just every quarter.

“We built entire analytics systems and increased e-tailer partnerships to better understand categories, product evolution and reorganised our media spend.”

Stay tuned for our full report

Beauty Tech Live officially opened its doors today, welcoming almost 2,500 visitors. Visitors can meet with colleagues, network and also discover the latest beauty tech innovations from almost 30 leading companies in beauty, fragrance, skincare, cosmetics and wellbeing.

Watch the video below for everything you need to know about the pioneering all-digital event.

View this post on Instagram

1000 CET

Tmall Global Beauty Alibaba Group Managing Director Jun Dong opened the Knowledge Hub sessions at Beauty Tech Live with invaluable insights about how brands can use the Tmall platform to build their business in China.

She told BW Confidential Editor-in-Chief Oonagh Phillips: “We are evolving our Tmall business model to help brands reach their Chinese consumers. We shifted from an invitation-based model to an open platform in 2019. Authorised brands can launch on the platform in three ways. They can use the Tmall Global Platform to sell directly; Tmall Direct Import, where Tmall is the distributor or buyer, and Tmall Overseas Fulfilment, a consignment model allowing brands and suppliers to benefit from our global warehouse network and test the China market.”

Asked about the power of digital to engage consumers, Jun said: “The pandemic has had a lasting impact on relationships between consumers and brands, accelerating innovation. The consumer wants unique, interactive shopping experiences online. We have seen a massive shift in China; 52% of all Chinese sales are expected to come through digital this year, outstripping bricks & mortar for the first time.”

She also discussed the rise of livestreaming and influencers in selling to Chinese audiences: “Livestreaming is an incredible tool. Originating in China, it is among the most popular ecommerce platforms. For brands, livestreaming is a vehicle for education and launches, not only sales.

“Today, brands are using KOLs in conjunction with celebrity ambassadors and creating viral social moments using livestreaming. Most sales are skewed towards top KOLs such as Austin Li, but other smaller ones are developing their relevance and popularity among the Gen Z audience. In coming years we’ll see a healthier balance between top and smaller KOLs.”

A key question for many brands is how best to use Alibaba’s online shopping festivals to engage with new consumers and build their existing audiences.

Jun said: “Shopping festivals have been a key part of the consumer psyche for a decade now and show the clear strength of China’s retail consumption. For brands the rewards will only come from significant planning to understand the target consumer. This is a competitive time for brands so they must have a clear strategy. For consumers, while value plays a role, other factors include personalisation and exclusivity of product,” she added, citing special editions launched for recent festivals by L’Oréal’s Shu Uemura and 3CE brands.

“Promotion is a driving factor, as that’s how these festivals came into being. But now consumers are asking for more. Many brands now see it as a chance to introduce new innovations.”

Addressing how brands can do better in understanding the digital eco-system in China, Jun said: “Brands need to invest in research. Marketing and consumer behaviour differ greatly from the West. That’s a stumbling block for many companies that apply strategies that work in Europe or the US. Consumer confidence is there [in China] and that can translate into strong sales. Also there is no such thing as being too small. Being niche is positive if it aligns with consumer demand in China. But it must be tailored to the ecommerce and livestreaming market.”

She reinforced the message that smaller, emerging brands could succeed in the Alibaba eco-system without huge budgets.

“There is a support system for brands, large or small. Our focus is to make it easier and increase participation in our festivals and serve the Chinese consumer. We have arranged events with large and smaller KOLs, to help them learn about the niche brands. We have a team to teach those brands about what they need to do to operate in the eco-system. Over 1.2 million new brands were offered last year through shopping festivals to Chinese consumers. We help them reach new consumers.”

Within the key beauty categories sold through Alibaba, Jun noted the rise and rise of anti-aging serums (+320% year-on-year during the 2020 Global Shopping Festival and +88% in Q1 2021). Basket size in the beauty sector has leapt by +20% over the past year, with a focus on “premium priced brands that have taken off post-COVID-19.” Importantly too, she highlighted the emergence of fragrance as a fast-growing sector within beauty, notably among younger consumers.

“The tide is turning for fragrance. Its price point is accessible for the new middle class and the world of perfumes still offers an open playing field. But brands should consider logistical problems that arise. Perfume suppliers are often refused by air carriers; maritime is the most common option but hard for smaller brands to ship by sea at smaller volumes. Tmall’s global logistics unit has launched its first perfume route, a dedicated flight for perfume from Europe and China daily.

“Gen Z is the group that is willing to try new brands and new categories so they are interested. Fragrance is smaller than the other major beauty categories but we have seen it among the fastest growing in the past 12 months.”

Skincare, including face masks and moisturisers, is another growth sector, with lipstick & beauty also driving growth. Men’s cosmetics, buoyed by KOLs such as Austin Li, are building on that trend. Overall, she noted, “since COVID-19 the trend of wellness and self-care is on the rise”.

Asked about the rise of Chinese brands, Jun said: “There is demand as these brands address value for money; social awareness and after sales service. But there will always be strong demand for international brands due to provenance, brands’ DNA and their quality.”

A further trend is penetration among consumers in lower tier cities in China. Jun said: “These are an important business strategy with potential for growth. Consumers can make frequent purchases; we had 1 million new users during Shopping Festival 11.11 from lower tier cities, where China’s biggest consumption growth is coming. The off-season bargains from brands at competitive brands could be used to help international brands penetrate the market in lower-tier cities.”

12 APRIL 0840 CET

After many months of build-up by co-organisers The Moodie Davitt Report and BW Confidential, in collaboration with Stand & Experience Partner FILTR.QINGWA, Beauty Tech Live begins today.

The pioneering virtual event is a showcase for the joint worlds of beauty and technology. It is the first virtual expo of its kind in the sector, bringing together the latest tech innovations and solutions across all stakeholders.

The Knowledge Hub sessions begin today with an address from Tmall Global Beauty Alibaba Group Managing Director Jun Dong about building business in China (0930 CET). This will be followed by a keynote address from L’Oréal Chief Digital Officer Lubomira Rochet (1100 CET) and at 1400 CET, a panel featuring Au Coeur du Luxe (ACDL) President Laurence Ouaknine, iClick Interactive Asia Limited VP International Business Cody Chan and CircleSquare Managing Partner Stéphane Zermatten will discuss tech transformation in travel retail.

Shop-tainment will be the theme at 1630 CET in a panel featuring e.l.f. Beauty Chief Digital Officer Ekta Chopra, Charlotte Tilbury Director of Digital Harminder Matharu and Perfect Corp Europe AVP Business Development Sylvain Delteil.

Almost 2,500 beauty and tech executives have registered to attend this week. Visitors can meet with colleagues, network and also discover the latest beauty tech innovations from almost 30 leading companies in beauty, fragrance, skincare, cosmetics and wellbeing.

Stay tuned for live updates from the virtual Exhibition Hub, Knowledge Hub and Engagement Lounge throughout the week.

Click here to register for the event.