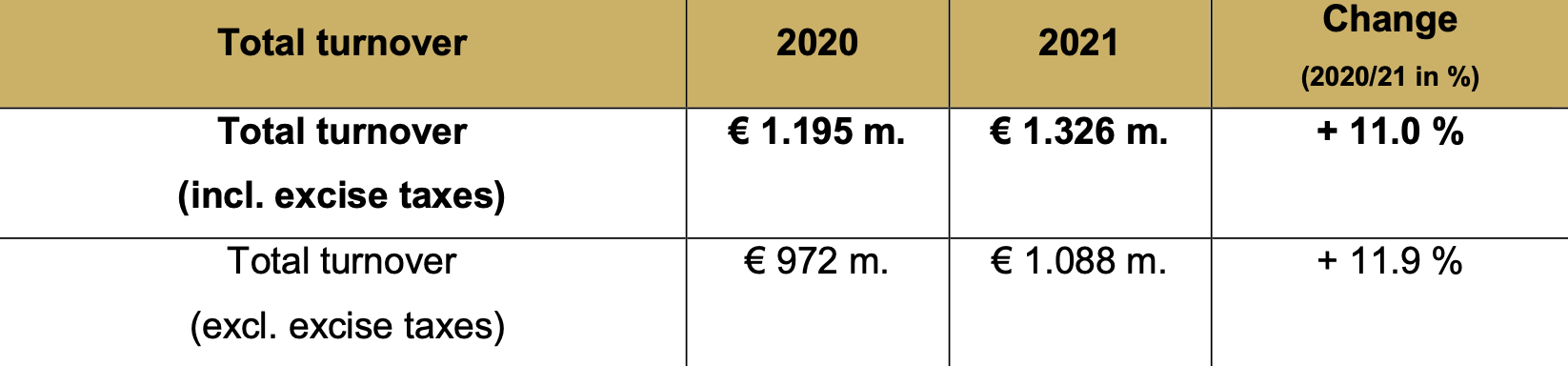

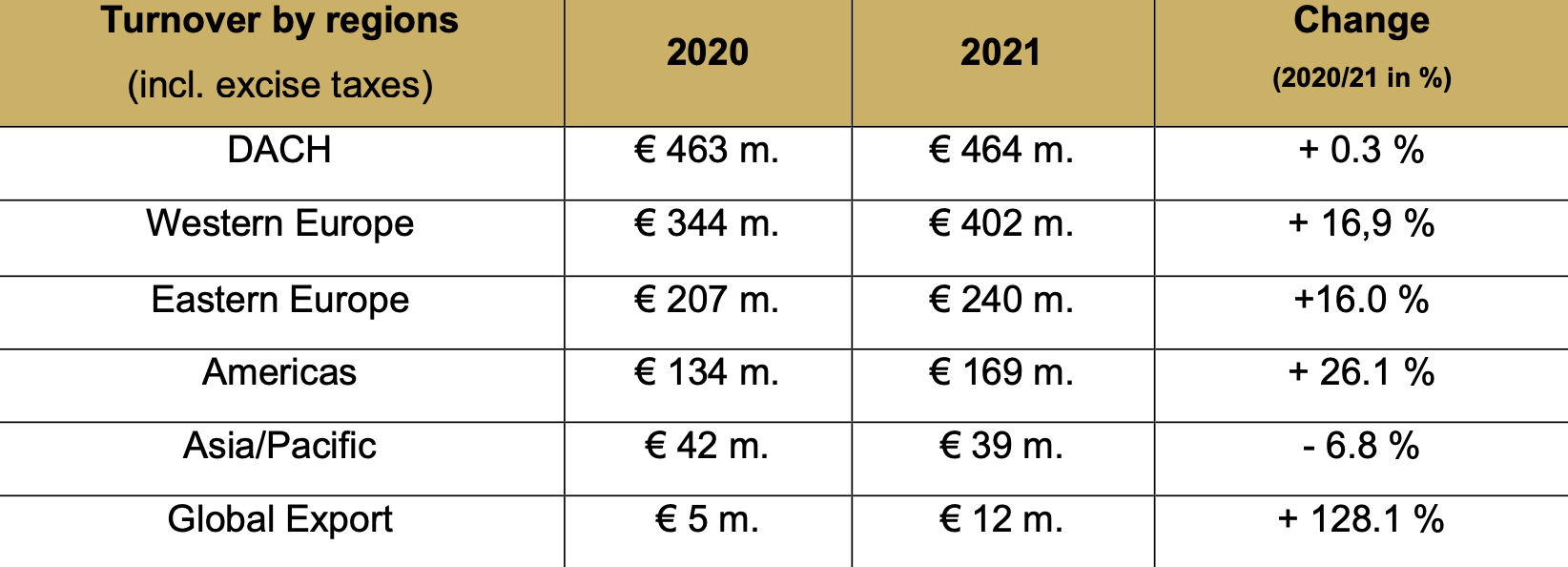

Henkell Freixenet today revealed annual results for 2021, with sales rising +11% to €1,326 million across its sparkling wine, wine and spirits business.

The company exceeded pre-pandemic 2019 turnover, with the key sparkling wine business up by +15.2% year-on-year to €843 million. Major brands include Freixenet, Mionetto, Henkell, Mangaroca Batida de Côco and i heart wines.

Within these figures, travel retail sales grew by double digits compared to 2021 as some travel markets opened. Travel retail figures also exceeded 2019 levels, said the company.

Henkell Freixenet CEO Dr. Andreas Brokemper said: “Despite major challenges, the past business year was extremely successful. Led by our top brands distributed worldwide, we were able to grow significantly in practically all regions. Our ‘House of Brands’, with which we are consistently continuing our focus on strong global and local brands, was the driver for the double-digit sales growth.

“Freixenet sold more than 100 million bottles for the first time, while Mionetto grew by an impressive +33 % to 35 million one-litre bottles. Henkell also grew double-digit in 2021, led by international markets (+21 %, primarily in Austria and Australia). According to IWSR, we are the market leader for Cava in 98 countries, the market leader for Prosecco in 34 countries and the sparkling wine market leader in 29 countries.”

By region, in Germany, Austria and Switzerland (DACH), Henkell Freixenet closed the 2021 financial year with sales of €464 million (+0.3 % compared to the previous year).

Western Europe, the group’s second strongest region (including the UK, Spain, France, Italy, Benelux and Scandinavia) posted +16.9% sales growth to €402 million, aided by the reopening of gastronomy businesses, notably in southern Europe.

The Eastern Europe region (where business is led by strong local brands such as Bohemia in the Czech Republic, Törley in Hungary and Hubert in Slovakia) posted growth of +16% to €240 million.

Net sales in the Americas region increased by a sharp +26.1 % to €169 million, with double-digit growth from global brands Freixenet, Mionetto Prosecco and prestige brands Segura Viudas and Gloria Ferrer in the USA.

Asia Pacific sales slipped -6.8% year-on-year to €39 million, with COVID-related restrictions in Japan playing a part. Henkell sold more than 1 million litre bottles in Australia for the first time last year.

The Global Export business grew by +128.1% to €12 million; this includes importers and distributors, including global travel retail.

By key brand, Freixenet exceeded the 100 million bottle mark for the first time. By year-end, sales had reached 107.7 million bottles (+8.5%).

Mionetto Prosecco, the best-selling international Prosecco brand, grew by +32.6% to 35.2 million litre bottles, while German sparkling wine brand Henkell saw sales climb by +14.3% to 12.9 million bottles.

The i heart wines brand celebrated its tenth anniversary in 2021. The wine brand, developed in the UK, set a new sales record with 32.5 million litre bottles (+3%). The brand has proved a big success in duty free, noted the company.

Dr. Brokemper said: “We are experiencing increased quality awareness in all markets, greater interest in the origins and diversity of wine and sparkling wine. And we want to serve this increasing interest in enjoyment with our international portfolio, which stands for almost all origins and methods – from Cava to Champagne, Crémant, Prosecco and German Riesling.”

Interview: Dr. Andreas Brokemper

To coincide with the results announcement, Dr. Andreas Brokemper spoke to The Moodie Davitt Report Dermot Davitt about the annual performance, the contribution of travel retail and the wider prospects for 2022. He began by addressing the dynamics behind the strong annual sales rise.

“Whereas in 2020 we suffered, especially in the second quarter due to lockdowns, 2021 was almost the opposite. Consumers who had stopped buying sparkling wine returned and consumed even higher quality. The more premium the category, the higher the growth figure in 2021, from Champagne to Crémant to Prosecco.

“We see this in particular in strong brands such as Freixenet, Mionetto and Henkell internationally as well as Fürst von Metternich and Wodka Gorbatschow in Germany.

“Why did this move to quality happen? I feel it has to do with the pandemic also. If you have a celebration, you might have a large number in normal times. But last year as people came together they were maybe six or eight rather than 50 or 60. This more private celebration made it easier for people to go for a higher quality of consumption.”

By region, growth was strongest where on-premise sales came back, led by Italy and Spain where restaurants that were closed in 2020 opened again.

Brokemper added: “If we look at the US or other markets including travel retail, many of our partners reduced stock in 2020 due to cash need. While there was a strong de-stocking then, the situation changed in 2021, people ordered as much as possible to rebuild stock to allow for supply, even with issues around logistics.”

On key regions, DACH (Germany, Austria, Switzerland) was flat while in Eastern Europe, business climbed sharply in part because consumer tastes moved from generic products to more branded goods, explained Brokemper. Prosecco in particular has benefited in this region.

On travel retail, Brokemper said management was surprised by the bounceback in business. “We attribute this to our growing share even if traffic is not yet back to 2019. So we saw strong growth. We also include cruise and airlines and these came back too.”

Henkell Freixenet Global Export Head of Brand & Business Development Vanessa Lehmann added: “Sales at the airports are not yet back but we saw good increases inflight, especially in Europe and the US last Summer. There was a strong business in the smaller Piccolo bottles that are very popular. Overall, as a group GTR grew due to existing business and also new business that we opened in ferries and cruises.”

Henkell Freixenet is among the latest prominent brands to associate themselves with the electric vertical takeoff and landing (eVTOL) infrastructure trailblazer Urban-Air Port, which this week opened Air One, a world-first fully-operational vertiport hub for passenger air taxis and delivery and logistics drones in Coventry, UK.

Lehmann said: “It’s a long game and it shows us a vision of how travel might look in the future. We are following that vision closely and with interest. It’s a different approach to travel retail, and the whole area of digital ordering which features there will be part of that future too. We cannot yet scale the future of this, but we believe in taking it into consideration, also with its links to sustainability.”

On the wider digital and ecommerce opportunity, Brokemper said: “We are consolidating our structures across our IT platform to allow us use data effectively. We have brand-owned ecommerce shops, selling online in most countries, and we have started to internationalise too.

“While consumers became used to buying online after March 2020, many have now moved back to the way they used to buy at retail. We need to find out how the digital business will develop now.

“We want to come to a situation ideally where we can use our international structures. That means ensuring a visitor to our Freixenet winery in Sant Sadurní d’Anoia, even if they won’t take two or three bottles back on their flight, will be able to order close to home and take a delivery, no matter where in the world they are.”

Looking ahead, Henkell Freixenet said that “the economic impact of the Russian war of aggression in Ukraine will be decisive” in 2022.

The company stated: “In addition to the strong political uncertainty, the war is causing significant price increases and supply bottlenecks throughout the supply chain. The price developments for glass, packaging materials, energy and logistics are particularly burdensome. In addition, wine has become more expensive due to the harvest, and in some cases availability is limited or non-existent. Added to this is the inflation associated with the tense overall situation.”

Dr. Brokemper commented: “The decisive factor will be mastering the entire supply chain from grape, wine, casing and packaged goods purchasing to delivery to our global customers. All in all, the year 2022 will present us with enormous challenges.”

Brokemper told The Moodie Davitt Report: “People had money to consume over the past couple of years even with the pandemic. But if you add supply chain, inflation and the conflict, it’s hard to know how that will continue. Our challenge is to ensure supply, to produce and deliver the orders we have on hand. Usually you focus on getting the orders in; now it’s the opposite, it’s about how you can fulfil and deliver.”

On the plus side, Brokemper highlighted the continuing powerhouse performance of Freixenet in particular after its 100 million bottle milestone in 2021. “We have innovated around Freixenet; it was previously a Cava brand but is now a full range, and that is helping it grow faster than the market.”

The company has continued to grow organically and by acquisition – a recent addition was Bolney Wine Estate in the UK. English sparkling wine is a growing category and has been described by some experts as “the new Champagne”. Bolney Wine Estate is one of the pioneers of the category in the country.

Brokemper said: “The feedback has been very positive. Our focus is on supply now. It is a premium niche brand, and shows how good the quality of English sparkling wines is today. In blind tasting people confuse it with Champagne, and part of that is that we see the same terroir as in Champagne 30-40 years ago, due to climate change. We don’t expect a payback in two or three years but we do want to develop that category.”

On further growth, Brokemper added: “In 2020 and 2021, our House of Brands helped lead our growth. The commitment of our whole organisation to these brands will see us develop a stronger market share.”