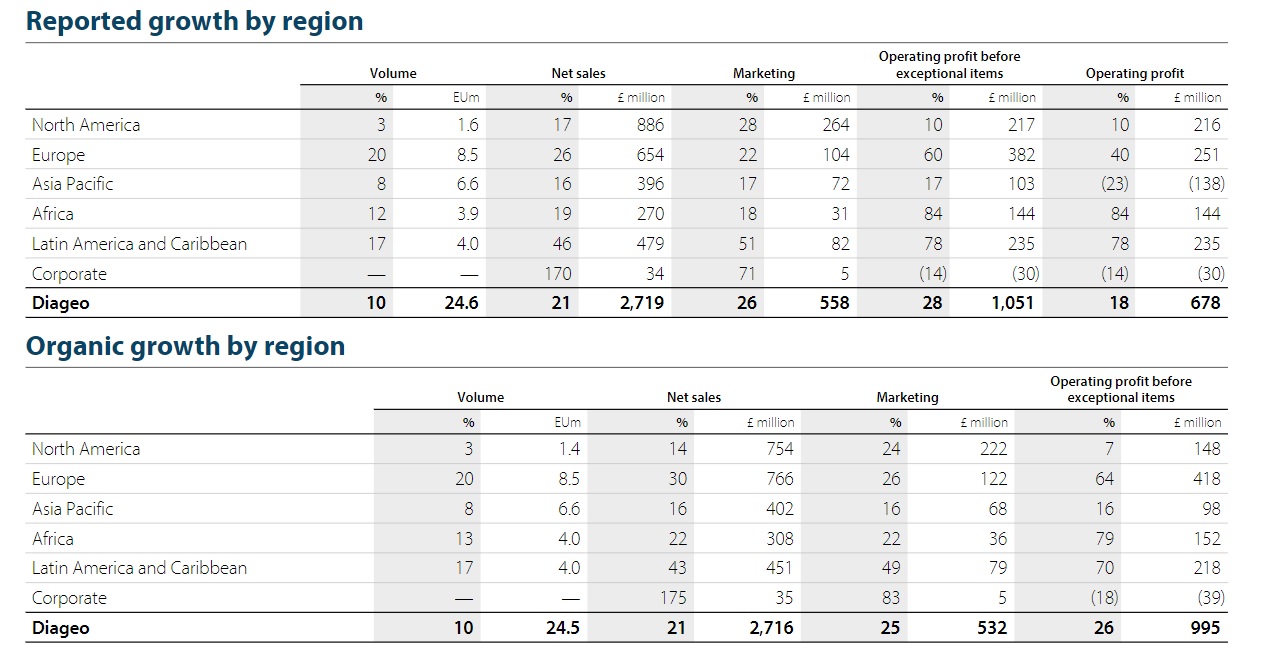

Diageo’s share price edged up this morning on a healthy full-year net sales rise of +21.4% year-on-year to £15.5 billion (US$18.9 billion), with strong double-digit growth across all regions. The rebound for the year ended June was strongest in Latin America and Caribbean (46%) and Europe (26%).

The UK drinks powerhouse reported encouraging results for the duty free business. The drinks giant said that as part of travel retail’s partial recovery “Scotch grew strongly” and noted: “Travel Retail Asia and Middle East net sales grew triple digits, following a significant decline in fiscal 2021. This reflects a partial recovery as international travel restrictions eased and was primarily driven by Johnnie Walker.”

The growth for FY22 reflects a continuing recovery of the on-trade, resilient consumer demand in the off-trade, as well as market share gains. The performance was assisted by some favourable industry trends showing that spirits have been taking greater share of the total beverage alcohol market, while premiumisation has continued . Sales of super-premium-plus brands rose +31%.

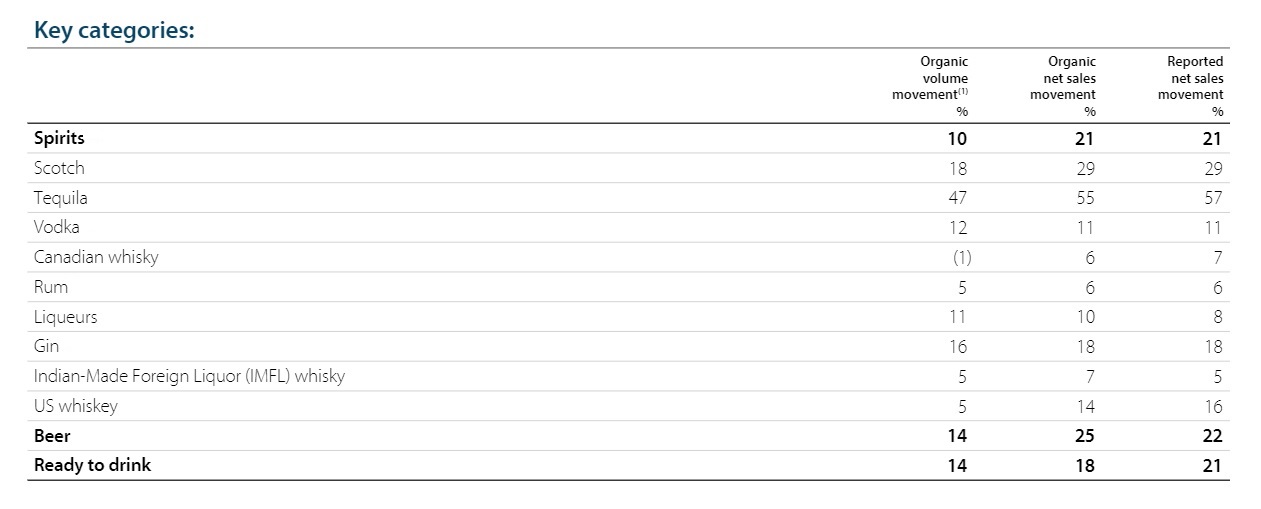

Across the categories, tequila had the biggest growth at +55% (but just 10% of total sales), while Scotch grew +29%, led by Johnnie Walker up by a notable +34%. Scotch was the lead category, accounting for 24% of all sales.

“Tremendous agility and resourcefulness”

CEO Ivan Menezes said in a statement: “We delivered double-digit organic net sales growth across all regions. We expanded operating margin while increasing marketing investment ahead of net sales growth and we used our strong cash generation to invest in long-term growth. I am very proud of what my 28,000 colleagues have achieved through their energy and creativity.

“In a year of significant global supply chain disruption, our double-digit volume growth demonstrates the tremendous agility and resourcefulness of our teams. Our net sales growth was across categories. We benefited from the on-trade recovery, continued global premiumisation, and from price increases across our regions.”

Those price increases, coupled with supply productivity savings, were more than enough to counter the absolute impact of cost inflation, and mostly offset adverse impact on gross margin as well.

The flagship Johnnie Walker brand was a particular success, delivering double-digit growth across all regions and surpassing 21 million cases globally. That milestone “exemplifies our world-class brand-building and execution capabilities”, Menezes pointed out.

Diageo believes its brand portfolio is sufficient to sustain growth across geographies, categories and price points but said that in fast-growing categories it would actively look to innovation and acquisitions to further shape the portfolio. Recent acquisitions have included 21Seeds, a rapidly growing flavoured tequila brand, and Mezcal Unión, a premium artisanal mezcal label.

On the marketing side Menezes commented: “We are staying close to our consumers. Our digital tools and data capabilities enable us to quickly understand trends and execute with precision.” Meanwhile, a focus on revenue growth management is being used to enact strategic pricing.

Bullish outlook

Despite new hurdles this year that include inflationary spirals and a squeeze on discretionary spending, Diageo is executing its strategic priorities, including an ambitious ten-year sustainability plan.

Menezes said: “Looking ahead to fiscal ‘23, we expect the operating environment to be challenging, with ongoing volatility related to COVID-19, significant cost inflation, a potential weakening of consumer spending, and global geopolitical and macroeconomic uncertainty. Notwithstanding these factors, I am confident in the resilience of our business and our ability to navigate these headwinds.

“Total beverage alcohol is an attractive sector with strong fundamentals and we are making good progress towards our ambition of a +50% increase in our value share to 6% by 2030. I am confident that we are well-positioned to deliver our medium-term guidance for fiscal ’23 to fiscal ’25 of organic net sales growth in the range of +5% to +7%, and organic operating profit growth sustainably in the range of +6% to +9%.”