Travel hospitality and services group Airport Dimensions has launched a series of reviews into consumer trends in the airport, released in partnership with The Moodie Davitt Report. Here, Global Strategy Director Stephen Hay discusses how travellers are open to new experiences, and says now is the time for the industry to challenge old norms to meet their expectations.

Author LP Hartley once wrote: “The past is a foreign country, they do things differently there”. The same could be said of pre-Covid airport retail.

This, the second in a series exploring the findings of Airport Dimension’s latest Airport Experience research (click here for the introductory article), looks at how the airport retail has changed, and what the contemporary airport passenger now wants from retail (and other experiences) at the airport.

The study found that it was practical factors that make a difference when it comes to improving the airport experience. A very significant 80% of those taking part in the survey said that comfortable seating was a priority, while 78% cited a queue-free journey, and 73% opted for better public transport to the airport.

It’s obvious that airports need to get these basics right, however, once we move beyond these, there are some interesting pictures emerging. Nearly three quarters (71%) say they would appreciate a single-app-enabled journey, while two thirds (66%) would like to order food from an app with collection. Some 62% said the possibility of being able to shop online with delivery to home, their destination or to the aircraft appealed.

Providing a seamless digital element is clearly an important win for airports when it comes to improving the experience.

Interestingly for the travel retail community, 59% – which is an increase of 2% since last year – said they were keen to see retail space used to provide other facilities at the airport.

This compared with just 7% (up from 5%) who said this would have a detrimental effect on the journey. The data also shows that travellers are open to new types of experience, with 64% fancying a visit to health and wellness facilities, and 61% opting for more grooming and showering facilities.

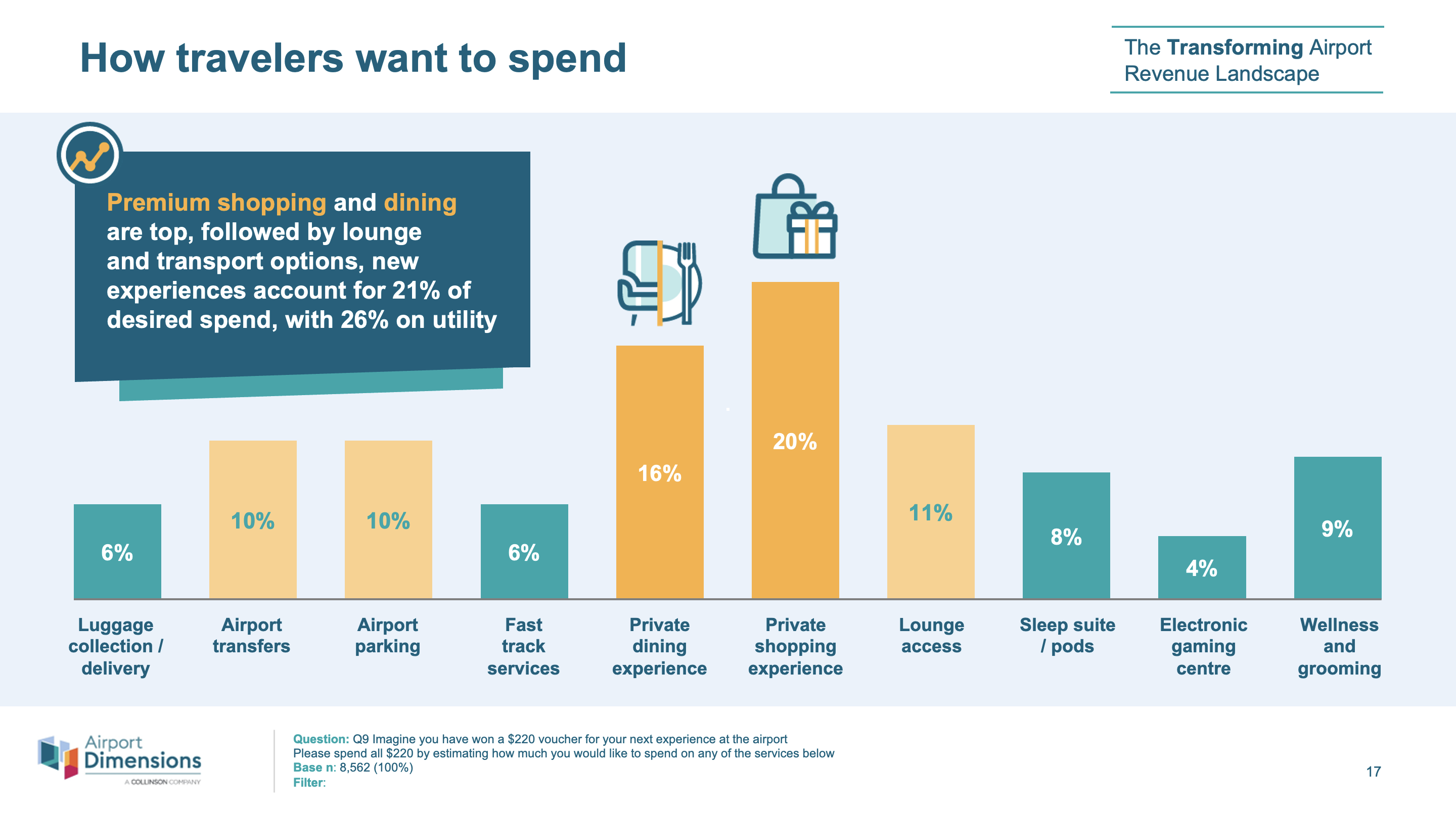

When it comes to what travellers want to spend their money on when they’re at the terminal, premium shopping and dining remain at the top of the wish list, with 20% and 16% spending on these areas respectively.

But both these areas showed a decline over the last year with a pivot into new spend areas and 21% of spend going on new experiences, such as sleep pods, gaming and wellness.

We can also see that over the past year, passengers have shifted their discretionary spend to more practical areas, such as airport transfers (+27%) and parking (+18%). The desire to spend on lounge access was up by 13%.

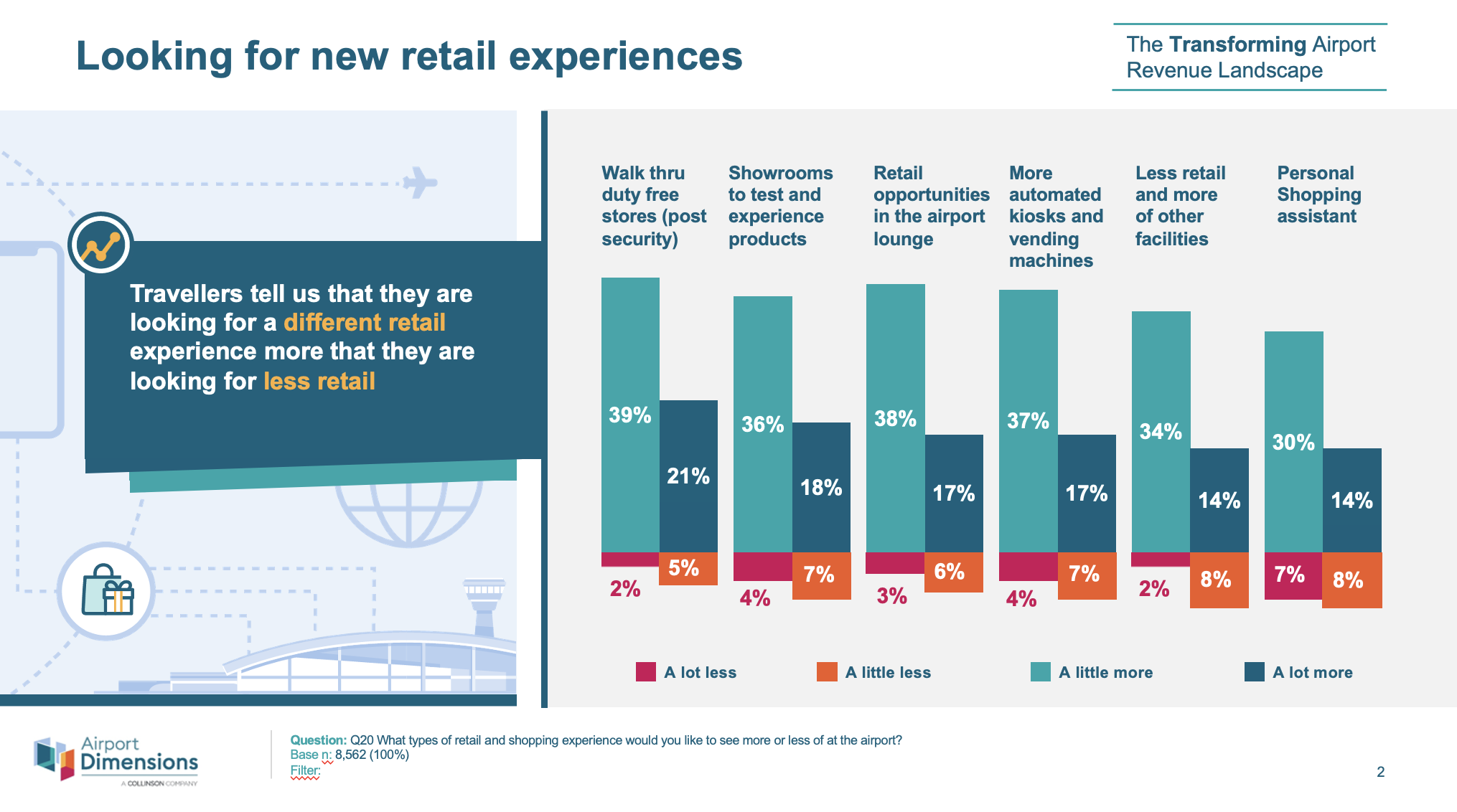

Across the airport, there is considerable appetite for different retail options. While 60% of those surveyed said they wanted to see more classic walk-through duty free, a comparable 54% were up for more showrooms to test and experience products. Over half (55%) wanted to see more retail opportunities in the lounge.

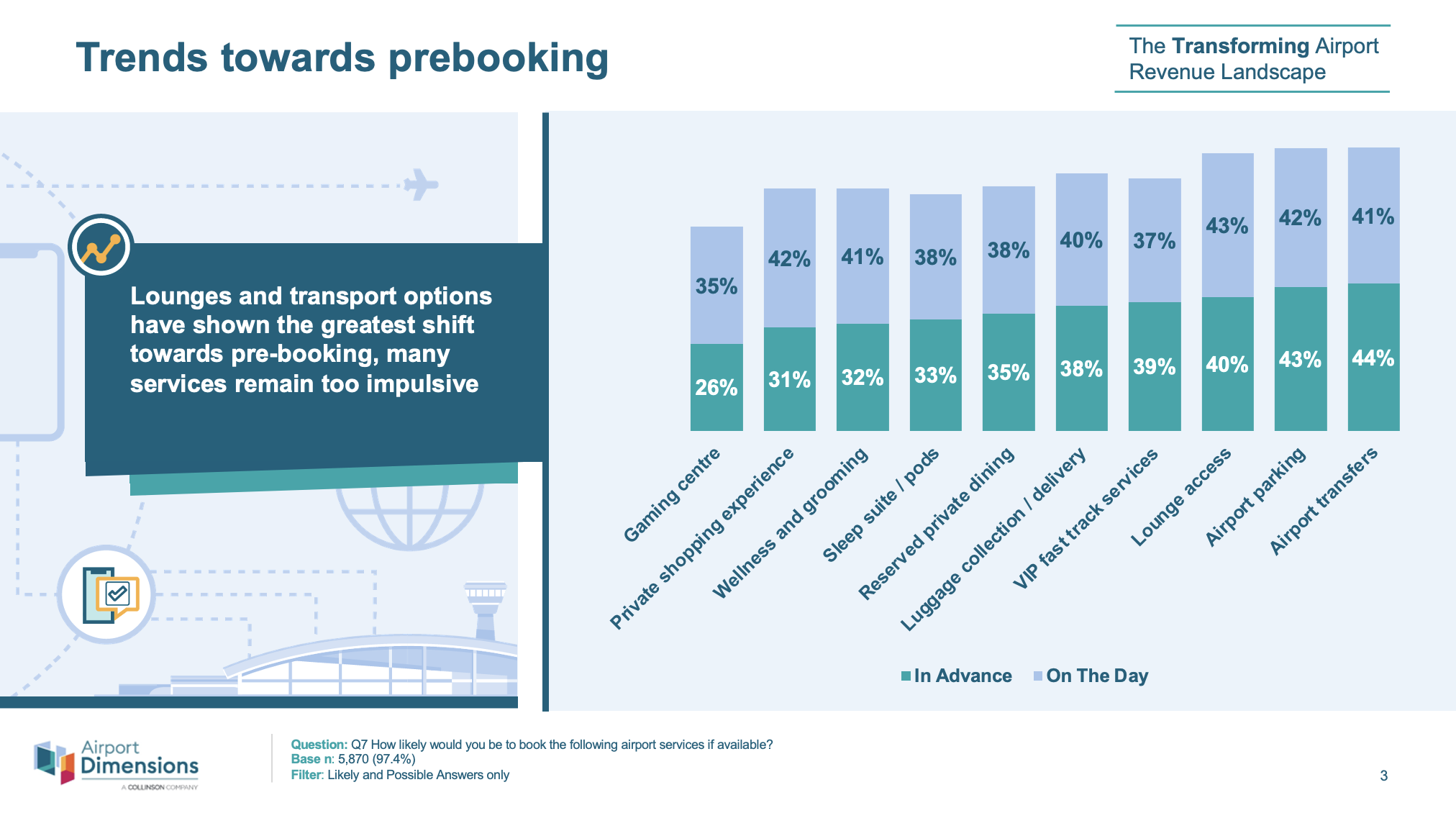

More needs to be done to encourage travellers to pre-book services, as too often the decision to buy is too impulsive. While options such as gaming (pre-booked by 26% and booked on the day by 35%), and wellness (pre-booked by 32% and booked on the day by 41%) might be expected to be last minute choices, even more practical services such as airport parking (pre-booked by 43% and booked on the day by 42%) and airport transfers (pre-booked by 44% and booked on the day by 41%) are often left to the last minute.

The retail landscape at the airport of 2023 is indeed a foreign country. Passengers are open to new experiences and want to spend their money in new ways. Airports need to understand this evolved landscape and make changes if they are to maximise revenue both today and tomorrow.

Note: The Moodie Davitt Report publishes a regular Newsletter titled Airport Consumer Experience, in association with Airport Dimensions, dedicated to airport guest services and experiences.

To subscribe free of charge please email Kristyn@MoodieDavittReport.com headed ‘Airport Customer Experience’. All stories are permanently archived on the Airport Consumer Experience page on this website.