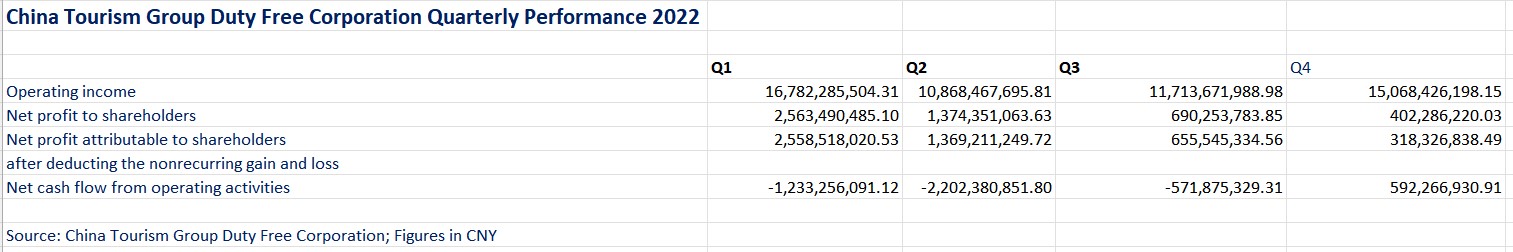

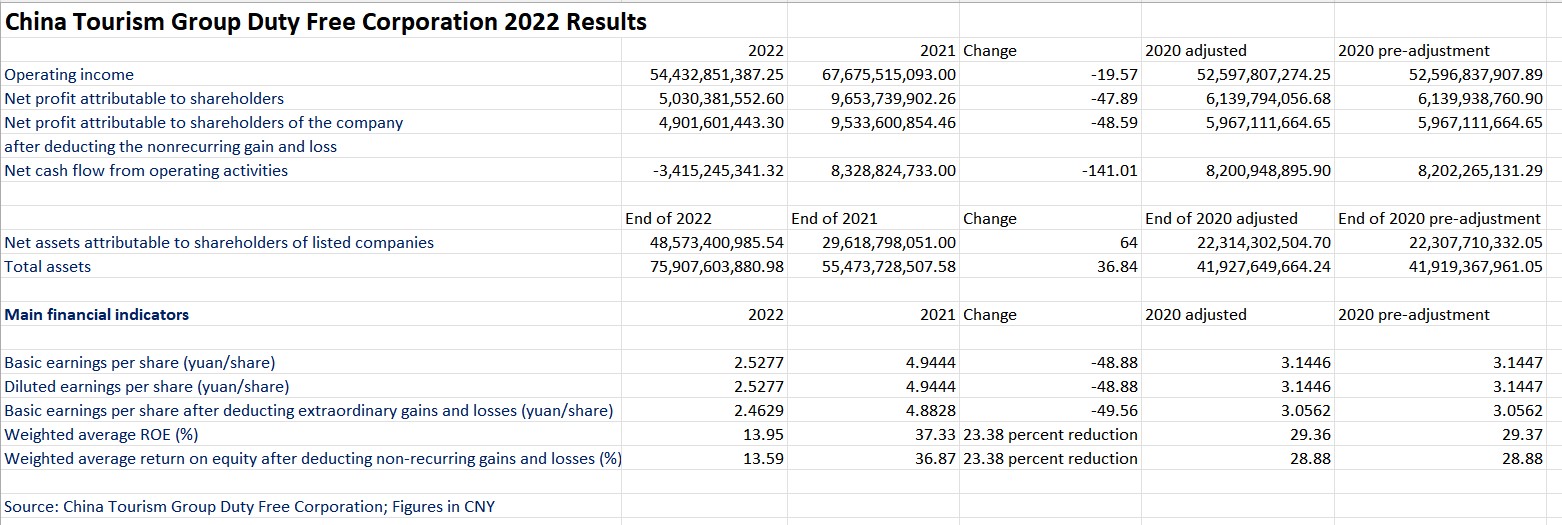

CHINA. China Tourism Group Duty Free Corporation (China Tourism Group/CTG) released its full-year 2022 results on Thursday, in line with its preliminary performance published on 3 February.

As previously reported, CTG, the parent company of China Duty Free Group (CDFG) revealed a COVID-hit -47.95% decline year-on-year in 2022 net profit.

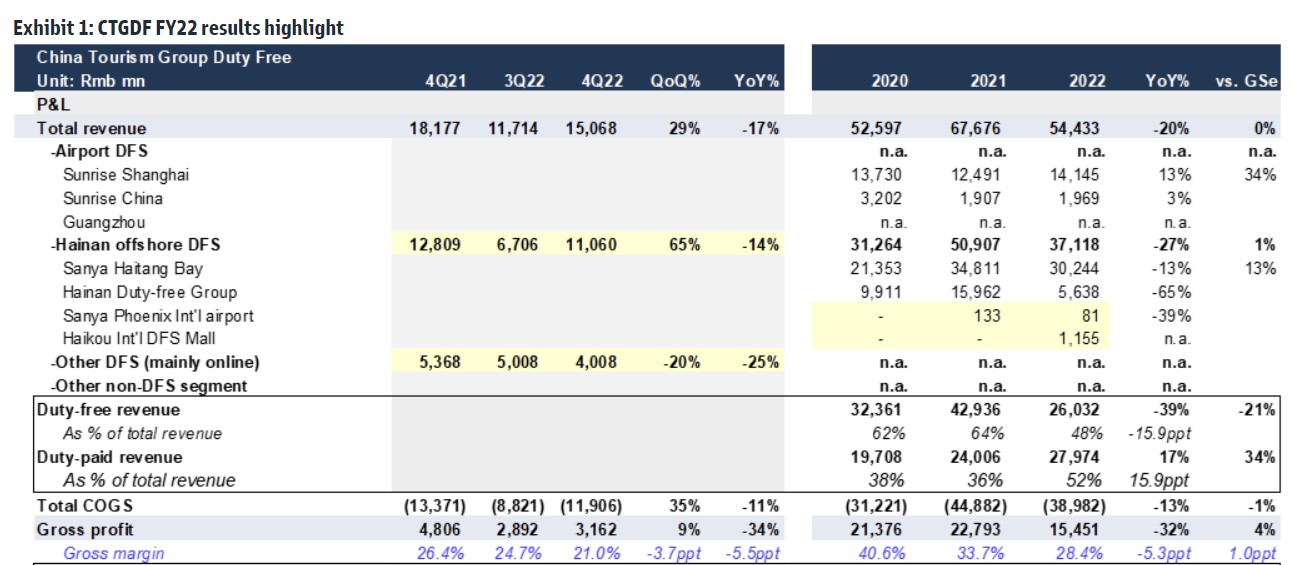

Operating income declined -19.57% year-on-year to CNY54.4 billion. Net profit reached CNY5 billion, which included a CNY551 million clawback of MAG expenses in H122 after a renegotiation with Guangzhou Baiyun International Airport. Thus, core net profit fell -43% year-on-year to CNY4.35 billion, Goldman Sachs said in a note.

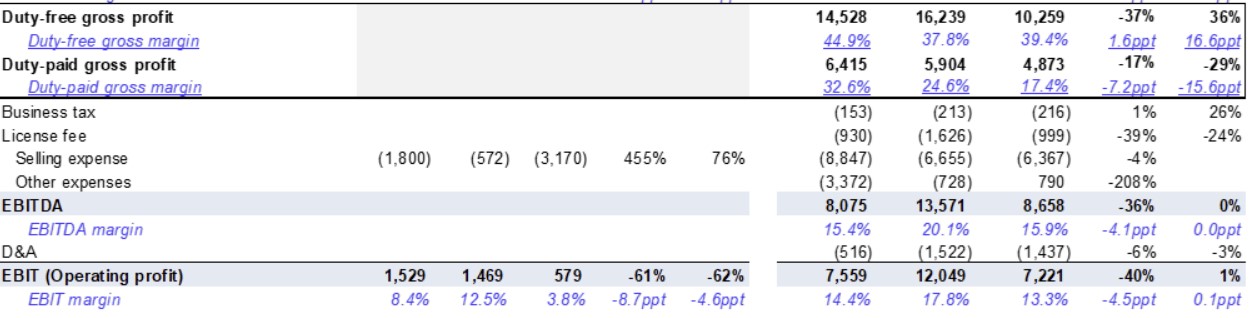

Q4 revenue rose +29% quarter-on-quarter to CNY15 billion but gross margin eased in the quarter by 3.7 points to 21% from 24.7 in Q3 (and 34% in Q2). Goldman Sachs attributed the slippage to a higher revenue mix from lower-margin online sales (on which CTGDF pays tax in line with other cross-border ecommerce operators).

Together with additional costs incurred for promotional activities during the peak season and related to the cdf Haikou International Duty Free Shopping Complex on 28 October, EBIT margin dropped to 3.8% in Q4

Goldman Sachs noted management’s optimism in a post-earnings call, partly based on healthy year-to-date duty free sales growth in Hainan (+11% year-on-year to CNY241 million a day in January and February).

In unveiling its results, CTG Chairman Li Gang said: “Looking back on 2022, in the face of a complex and ever-changing external environment, the company strengthened it strategy implementation and reform and innovation, all in accordance with the requirements of high-quality development.”

Li said the group remained committed to the concept of “management integrity and high-quality service”, as it strives to bring consumers better service levels and an enhanced consumption experience.

Highlights from 2022 included opening the world’s largest single duty free shop, cdf Haikou International Duty Free Shopping Complex, and the announced partnership with Swire Properties to build the third phase of the Sanya International Duty Free Shopping Complex as a world-class tourist resort. Online progress was rapid too with CDFG membership exceeding 26 million.

“In this critical year, the company will continue to firmly grasp the opportunities of new development, accelerate the optimisation and improvement of our store layout and business structure, and effectively improve operational capability,” Li said.

The company will also accelerate overseas expansion, he noted.

Strong start to 2023

Goldman Sachs’ daily tracking of passenger traffic for Sanya Phoenix International Airport and Phoenix International Airport shows inbound traffic to Hainan remained resilient in March (97% of FY19 levels, vs. 86%/90% in January and February).

“Although the company has not given any guidance on its margin trend so far year-to-date, they believe with the removal of travel restrictions, it would not need to offer as much pricing discounts and/or drive sales via online channels – both of which were the key culprits for its depressed margin last year,” Goldman Sachs said.

Commenting on investor concern that the resumption of Chinese outbound travel will impact Hainan’s offshore duty free sector, the note said: “Management believes the impact would be rather limited as Hainan has its unique competitive advantages; i.e. CNY100k annual quota limit for duty free spending, and attractive price points below those offered in overseas stores. They will also strive to stay competitive by introducing more product variety, enhancing customer experiences and launching new stores (i.e. Haitang Bay Phase 2 extension).”

In a positive read on CTG prospects, Goldman Sachs said, “We share management’s view that Hainan will gradually become one of the most popular shopping destinations for Mainland Chinese given its competitive pricing points, not necessarily only targeting at outbound tourists.”

When will pre-departure downtown duty free shops open?

The report also touched on the anticipated introduction of Korean-style downtown duty free shops in China, which would allow Chinese international travellers to shop pre-departure. As reported, CTG is to acquire a 49% holding in the Sinopharm-owned Chinese travel retailer China National Service Corporation (CNSC).

CNSC’s long-established downtown network is the big prize within that deal. It will have been particularly attractive to CDFG given the likely imminent introduction of the new pre-departure downtown duty free channel.

CTG’s preliminary 2022 full-year results showed that operating income fell -19.52% year-on-year to CNY54.463 billion. Realised operating profit decreased -48.63% to CNY7.605 billion. ✈