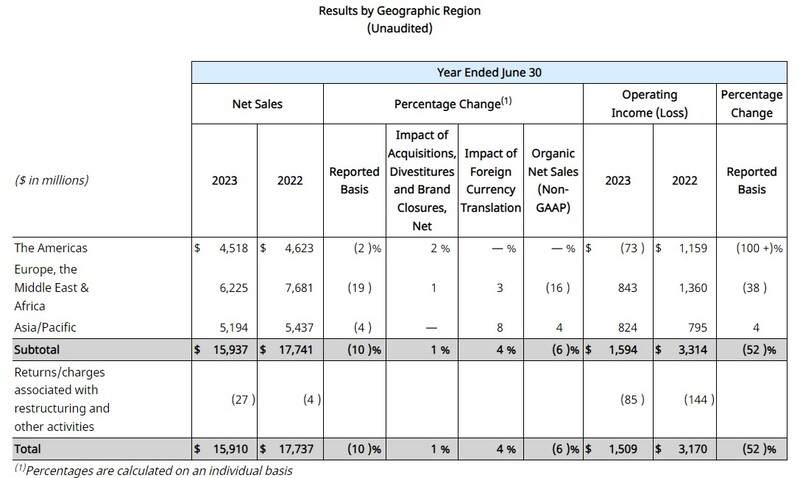

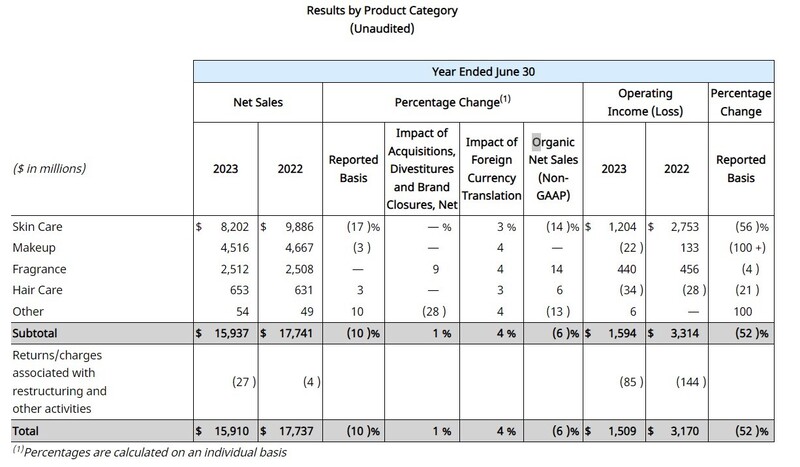

A fundamental restructure of the key South Korean and Hainan duty free markets hit The Estée Lauder Companies hard in its fourth quarter and full year ended 30 June but the US beauty powerhouse remains firmly upbeat about prospects in the channel.

That was among the key messages from a post-earnings call yesterday as the company spelled out the reasons behind travel retail’s role in a -6% fall in full-year net sales groupwide.

The startlingly sudden transition in Hainan from a heavily daigou-influenced market to a normalised one of selling to travellers rather than traders has been mirrored in South Korea. There, Korea Customs Service began exerting pressure on retailers to curb high commission payments to big daigou groups from December 2022.

The dual impact has been profound, first surfacing in The Estée Lauder Companies Q3 results and continuing into Q4, skewing the performance of both the travel retail channel globally and the company’s total performance.

Executive Vice President and Chief Financial Officer Tracey Travis said on the call, “Our global travel retail business decreased -34% organically in fiscal year 2023, solely driven by Asia travel retail. Our travel retail business in EMEA and the Americas soared, and our investment in activation and in-store Beauty Advisors drove strong performance as passenger traffic increased.” {Main story continues under the panel below}

Still attractive long-term growth potential – Goldman Sachs“One step forward and another step back.” That’s how Goldman Sachs Equity Research described the Estée Lauder Companies’ “as expected” weak Asia travel retail (ATR) performance balanced by the group’s strong local market performance in China. Net (domestic) sales in Mainland China increased, returning to strong growth in the second half of fiscal 2023 after low retail traffic as a result of COVID-related restrictions and the rise in COVID cases challenged the business primarily in the first half of fiscal 2023 (July-December 2022).. “China surprised to the upside,” the company wrote in a note. “That was important to us, as anecdotal reports of deep discounting of EL’s products in China by daigou resellers had caused us to doubt the strength of the company’s direct sales in the market and question whether there could be lasting brand damage; its strength in the market quells those concerns. “But on the other hand, its US business was set back this quarter with accelerating share losses. It has plans to rekindle growth with innovation, marketing, and channel expansion, but we expect that to come with investment expense. This, combined with a lower ATR forecast, causes us to cut our earnings and price target again,” Goldman Sachs wrote. “We still see attractive long-term growth potential and a powerful growth inflection ahead but expect investors to take a wait-and-see approach given the frequency of setbacks the company has endured this past year and uncertainty around the earnings level it will settle into when the near-term ATR draw-down passes.” |

The travel retail challenges were reflected in global travel retail’s internal share of reported sales, which Travis said stood at 20% [an 8 point drop in two years since the approximate 28% in fiscal year 2021 -Ed].

Short-term headwinds

The North Asia travel retail issues disproportionately pressured skincare, the group’s highest-margin category, she observed. The pressure in Hainan intensified over the course of Q4 as retail sales trends deteriorated and turned “steeply negative” in May and June following the local enforcement actions to control daigou activity.

“The implication of these [changes, i.e. the transition to a ‘normalised’ sector selling to travellers not traders -Ed] are favourable for sustainable long-term growth, but certainly create significant short-term headwinds through the transition,” Travis added.

Capturing demand from the returning individual traveller is one of the group’s four strategic imperatives for fiscal 2024, she explained. The others are reaccelerating growth in the key US market, driving momentum where the business is thriving, and rebuilding profitability.

Asked for more detail on the Hainan and Korean situations and particularly upcoming fiscal 2024 year-on-year comparisons, Travis noted, “So with what happened in the May and June time frame, we are seeing less traffic and less conversion in Hainan than we saw previously. That is impacting our Q1 certainly compared to last year when we saw more traffic and more conversion in Hainan and in Korea.

“That gets a bit better in Q2, as we anniversary some of the [COVID-driven] softness that began to materialise in Q2 last year in those two areas. And then we’re anniversarying, obviously, the softness that we experienced in the second half of our fiscal 23 in fiscal 24. So we are expecting that travel retail will get progressively better in the third and fourth quarter, certainly compared to the third and fourth quarter we had this year.”

That scenario is driven by the company’s current level of destocking in the island province. “The sudden change in daigou is making the retail traffic slower than what we had anticipated. And as a result of that, it’s changing our view on the shipments that we will need for Hainan in the first quarter and certainly a bit into the second quarter.”

Coordinating China travel retail and local market efforts

Freda pledged to “fix the TR issue”, including much better coordination between the travel retail and local market teams in China. But he cautioned that the volatility resulting from the transition of daigou-led to conventional traveller shopping – including the recently announced return of group tours to approved markets – remains “very, very high”.

Picking up on that transition, Travis said, “As the situation normalises and more travellers come back to travel retail, we are very confident in the strategy that we’ve had previously. Pre-pandemic, we were well on our way to those 20% operating margins. We don’t see any reason why, once things normalise, that we can’t get back to those 20% margins.”

Focusing on sell-through in Hainan

Asked whether the need to clear inventory in Hainan might impact brand equities and health in China, Freda returned to his point of increased collaboration between the in-market local and travel retail teams. This will spell better common decision-making in terms of the “balancing act” of creating value, while reducing the risk of non-coordinated actions, he contended.

Addressing the issue of sell-through in Hainan, Freda commented: “In May and June, Hainan was relatively weak, and that’s why there is an impact also on the first-quarter trend. But we are very focused on creating the retail activities that will facilitate the sell-through, and that’s the key focus of the team. So in that area we are very aligned. We have the organisation resources squared, and we are focused on all these issues very squarely.”

Asked how The Estée Lauder Companies planned to compensate for what shapes as a sharply reduced daigou channel in the long-term, Travis replied: “We don’t control it, right? We sell to our travel retail operators, and so the whole mix of who is buying in Hainan is really with our retail partners.

“Part of the adjustment that we are seeing right now is the timing of when … individual travellers return to Hainan, and some of the changes in enforcement and regulations that have happened in China. And so there is a disconnect in timing that certainly is impacting our sales, combined with the fact that we are reducing the inventory levels that we have in Hainan. So that is all having a disproportionate effect.”

High hopes for Hainan

Travis said the group remained upbeat about prospects for the conventional travelling shopper business in Hainan.

“Our expectation is that regular individual travellers will return to Hainan, and they will enjoy the fantastic shopping experience that has been created in Hainan. We have no concerns whatsoever about travel retail growing with traveling consumers.

“It’s a timing issue that’s having a big short-term, temporary impact for us. But we are not concerned at all about what we have shared with you in the past in terms of our strategy to continue to grow travel retail globally, and certainly in all of our markets in Asia.”

“Flying” EMEA and Americas travel retail

Freda built on that positive message about travel retail, commenting, “We have clear evidence that when the regulations and the retailers decide to focus on individual travellers and when individual travellers’ traffic is strongly growing, the business results are outstanding.

“Our business in EMEA travel retail in this moment is flying – I believe +36-40% and the same in the Americas. And now, the same will start in APAC, in Japan, in Australia etc. So wherever there is a post-COVID return to travel, there is a very exciting business growth.”

The return of Chinese group tours, to Thailand, for example, had driven very strong sales momentum, he added.

“So the travel retail channel, in our opinion, remains very, very high potential for the long term. And this business of selling to the travelling consumer during their travel is an exciting, profitable, equity-building business.

“What happened during the pandemic when this part of the business was closed has been a temporary distortion that will be rebalanced over time. That is our expectation and our belief.” ✈