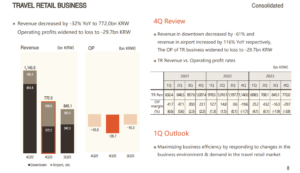

SOUTH KOREA. Hotel Shilla, parent company of The Shilla Duty Free, posted a -27% year-on-year decline in travel retail revenues to KRW772 billion (US$577.6 million) for the fourth quarter ended 31 December, the company reported on Friday.

Travel retail’s operating result deteriorated by KRW10.1 billion (US$7.6 million) compared with Q42022 to a loss of KRW29.7 billion (US$22.2 million).

Downtown duty free revenues, hit by the crackdown on daigou trading, tumbled by -61% year-on-year while airport sales, buoyed by recovering inbound and outbound tourism, climbed by +116% compared with a low base in Q4 2022.

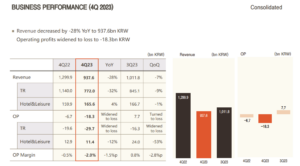

Groupwide, Hotel Shilla recorded a KRW18.3 billion (US$13.7 billion) operating loss in Q4 2023, up from a deficit of KRW6.7 billion (US$5 million) in Q4 2022 and a profit of KRW7.7 billion (US$5.8 million) in Q3 2023.

Group revenue decreased -28% year-on-year to KRW937.6 billion (US$701.5 million).

“The Shilla Duty Free and Shinsegae Duty Free are suffering from low sales at Incheon Airport, their situation accentuated by heavy investment in new stores, while downtown sales are staggering from declining daigou trade and weakened spending per head by Chinese customers,” an experienced market insider told The Moodie Davitt Report.

Commenting on the Q1 outlook, Hotel Shilla said it would aim to maximise business efficiency by responding to changes in the business environment & demand in the travel retail market. ✈