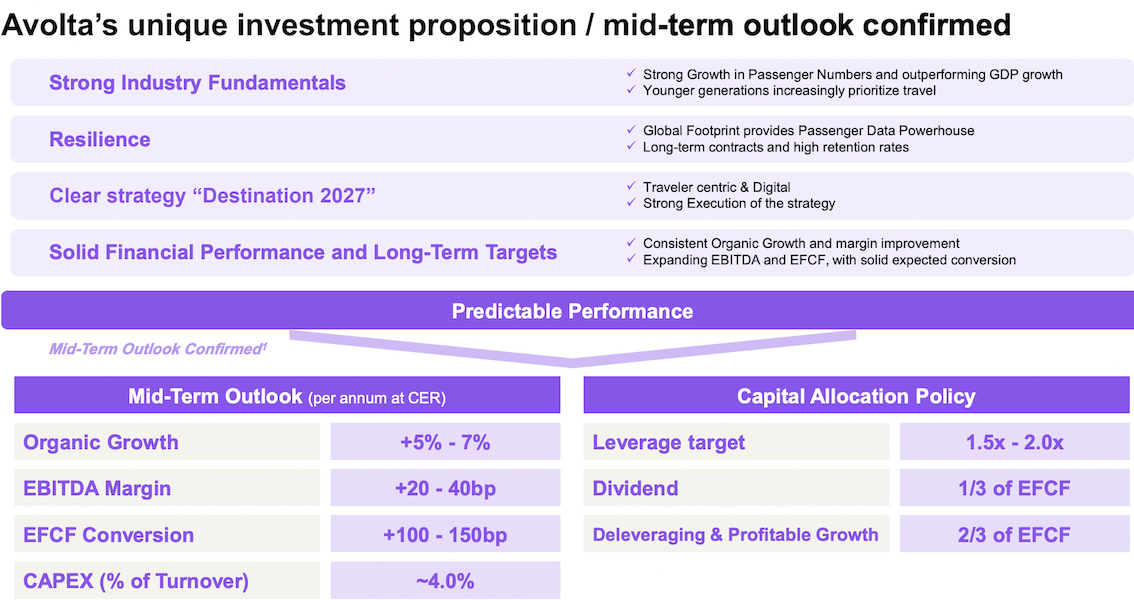

INTERNATIONAL. Avolta CEO Xavier Rossinyol has offered a bullish outlook for the business in the second half of 2024, after the travel experience player reported first-half results to the end of June, with turnover climbing +11% and net profits by +30.2%.

He told an investors’ call on Tuesday: “For the sixth quarter in a row we are presenting results that are in line with or ahead of expectations and in line with or ahead of our own outlook.”

He said that EBITDA margin growth (+15.6%) and Equity Free Cash Flow (+29.3%) were symptomatic of cost discipline and synergies within the enlarged business combining retail and food & beverage.

Rossinyol also highlighted the company’s focus on ‘active portfolio management’ and on exiting unprofitable contracts. “The combined number of wins, losses and exits is close to neutral. But with the timeline and the signings of 2024, 2025 and 2026, we believe that number will be on the positive side in the near future.”

He later added: “The number of voluntary [contract] exits will decrease over the next 12-18 months, and then the net wins will be more obvious.

“We want to grow but our commitment is to cash flow generation, so we are not going to rush into a contract to show half a point more of new concessions, if that is going to negatively affect the cash flow. First comes cash flow discipline and then new concessions.”

Addressing a further question on concession fee levels, which fell slightly in the half, Rossinyol said: “This is the consequence of several things. Number one is more rational behaviour, both among airports and operators. We expected that to happen, and it is happening. It means less Minimum Annual Guarantees (MAGs), more MAGs per passenger or even no MAGs.

“Second is our own active portfolio management, exiting unprofitable or deficient activities. I would rather not win a place if it is going to come with negative cash flow. So our discipline in bidding and exiting is also helping.

“Also now, because we have retail and F&B, we can also be more selective on where we grow. On concession fees, I do see less pressure than the before Covid, and that is helpful in maintaining and increasing our margins over time.”

Assessing the challenges facing the wider travel retail sector with acknowledged softer spends in markets such as China and Argentina, Rossinyol said: “The organic growth in H1 comes despite missing higher spenders in Europe, a more difficult Argentinean comparable and it shows we have been very strong.

“We don’t yet have full July numbers but we are seeing June numbers continuing. The trends continue even if not everywhere. Chinese consumption is not only not improving, it is worsening from last year. But our network makes us more resilient. And we have seen that the consumer who travels is also more resilient. Of course there are issues here and there but the trend on consumption in general is strong.”

On the mix of channels (duty free, duty paid and F&B) at around one-third each, Rossinyol said this diversification means the company is “resilient, predictable and constant in performance”.

By region, he said the +9.7% like-for-like growth in EMEA was especially noteworthy as the market lacked some high-spending travellers for geopolitical reasons and given the store refurbishments taking place across Spain currently. In the other strongest region, North America, duty free accelerated faster than duty paid and F&B, though from a smaller base.

In Asia Pacific, “Chinese are travelling less internationally and consuming less than last year”, said Rossinyol, though other nationalities are compensating in Asia and elsewhere, he noted.

Reiterating how Avolta stands out in the channel, Rossinyol highlighted the company’s broad network. “That is reflected in the size of our concession portfolio, and very importantly, that portfolio is in duty free, duty paid and F&B, so we can cope with any movement in the market and we can benefit from any new trend better than anybody else.”

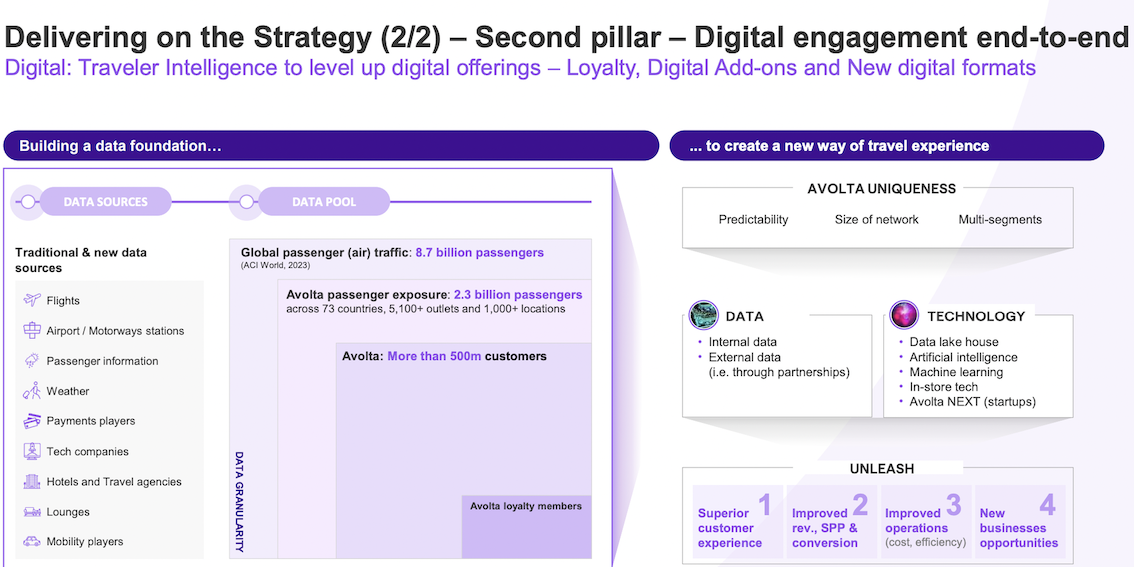

He cited scale too. “We are the largest, that is undisputed, and that gives us advantages in the relationship with the brands, and if we combine innovation there, we can attract more value from them. The other undisputed fact is that we have access to more data than anybody else.”

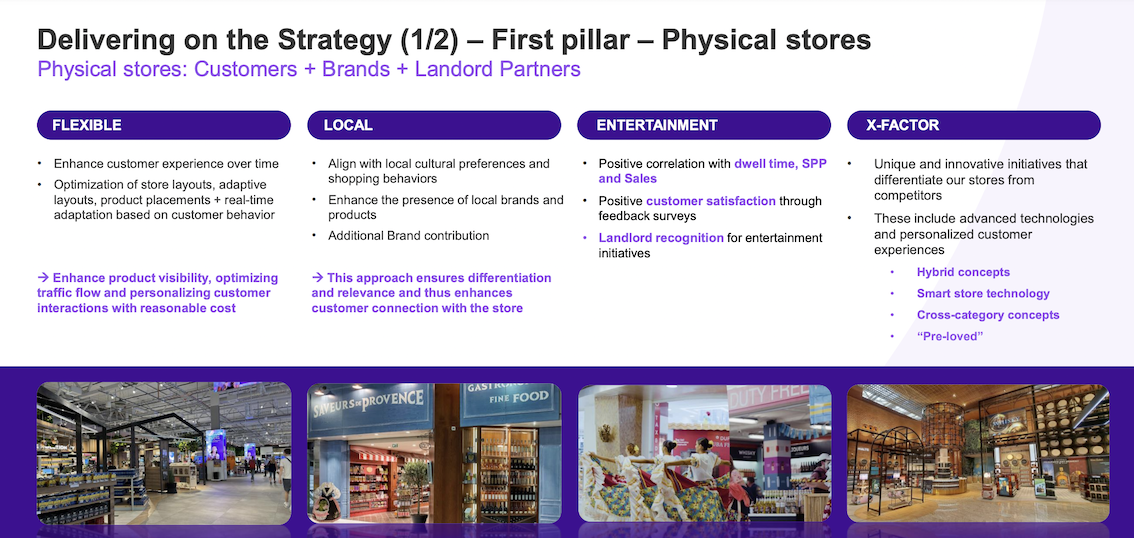

Rossinyol said that Avolta is using those strengths in several ways – becoming more flexible in its stores, adding more local touches, building entertainment into its spaces and adding ‘X-factor’ in hybrid concepts, smart store technology, cross-category and other concepts.

“We estimate the hybrid market will be between 10% and 20% of the overall market over the next few years, but it’s going faster than we initially anticipated,” said Rossinyol. “Among tenders issued this year in the US, 25% of them included hybrid concepts specifically, with around 20% of the space allocated to those hybrids.”

*Click here for our initial story detailing Avolta’s first-half performance. ✈