Introduction: In this guest column, Category Insights Director Richard Timmis shares his thoughts on category management, the art of brands and retailers working together and sharing data to grow a category in terms of sales, profit and customer satisfaction.

This year will mark my 25th visit to Cannes and again I will meet brands and retailers and explain the inexact science of category management (CATMAN) to a sometimes-sceptical travel retail industry.

Thinking back to my first TFWA Exhibition in Cannes in 1997, I can’t recall any agencies offering category management solutions. Now there are several, of various ability, working with some enlightened retailers and brand owners.

However, with the constant employment churn it’s difficult to build a productive relationship. There are exceptions, of course, such as the pioneering work done by Stewart Dryburgh (now sadly retired) at Nestlé and the stellar relationships built by Kevin Brocklebank at One Red Kite.

Where has there been progress? The ability to share and collect large amounts of quantitative and qualitative data has improved dramatically.

My first CATMAN project with Heinemann involved receiving a disc, via the post, containing a monthly sales download for two stores. Contrast this with the 10 million pieces of data I received each quarter in my last project, containing PAX, shop, brand, category and sales for eight stores. This allows a deep dive into the data and with the right skillset of an impartial consultant, actionable insights are provided to both retailer and brand owner.

How do we achieve this sharing, trusting process? Sometimes it’s easier to explain what category management is not: i.e. a meeting of senior managers producing a planogram, range review or one-off project.

Both sides need to understand CATMAN and listen to what’s required of the partnership. Frequently, the most successful outcomes are not necessarily with the largest brands or retailers; more often success is achieved with smaller, more agile partners where each party understands what it needs to provide, when and in what format.

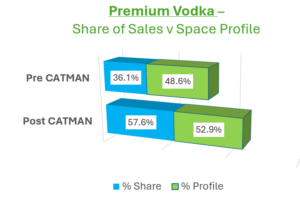

An example, and a great success of mine, involved analysing just the vodka category in an arrivals store, whereby, with some demographic profiling aligned to an understanding of profit, sales and space, the sales share of premium vodka increased from 36% to above 50%.

As a footnote, when challenged by the store manager as to the likelihood of the number one volume seller going off sale, it was clear to show that with an understanding of inventory and space this would not happen even on the busiest days. And of course, the success breeds trust and confidence to expand to other categories and/or locations.

Travel retail as a whole is still too cautious and continues to remain within its own bubble, generally devoting little time or resource to improving business by adopting category management. As the great Frank Zappa said: “Without deviation from the norm, progress is not possible.”

Self-scanning

With ever-increasing levels of competition and complexity in retail, such as digital communications, click and collect and Amazon collection points, travel retail is somehow going to have to generate new ways of attracting and improving business to facilitate the efficient and effective flow of products and customers.

One area where I believe technology is failing is with the current self-scanning model. Over the past two months I have been in several travel retail outlets and once I had made my purchasing decision I was required to walk out of the shop and queue at self-scanning. Then, as someone who is reasonably technically proficient, I needed help from the sales assistant.

In the UK there are signs of a backlash. According to the BBC: “After years of encouraging shoppers to scan their own groceries, some supermarkets are checking out a move back to traditional tills. Asda said it would put more staff on checkouts, while Morrisons admitted it might have ‘gone too far’ with self-scan. Northern upmarket chain Booths has got rid of them altogether.” (Source: www.bbc.co.uk/news)

And as Baby Boomer, I like to talk and interact with the sales team. Furthermore, this way of selling often removes the till-point impulse opportunity.

Research – conversion rates

UK domestic market research shows that for a main shop a customer will on average have 36 items in their basket and spend 45 minutes in store. They will take 20 minutes and have a basket of ten items for a ‘top up’ shop, while a visit to a petrol station forecourt store lasts a mere two minutes but results in an average basket of 1.7 items. (Source: TNS Consumer Panel)

Contrast this with travel retail where conversion rates can be as low 25% for some categories, and there is an obvious problem sitting alongside a fantastic opportunity. Imagine the revenue increase if every traveller who entered the store had a minimum of two items in their basket.

Category management is about collaboration, not confrontation. As a retailer or brand owner consider the following:

- Customer centricity: Walk around your store in your customer’s shoes (see The Moodie Blog for examples of how enlightening this can be)

- Clean and accurate data: With today’s communications there’s no excuse for a lack of data

- Alignment: Understand the role of each category and which products sit where

- Strategy: If you don’t have a plan, you will fail

- Measure: With any changes made, measure the outcome otherwise what goes before is wasted

- Retailers understand that a CATMAN resource is impartial and does not add to headcount

As with any change, brands and retailers need to weigh up the advantages and disadvantages of category management. It can all go wrong if there is an obvious cynical exploitation of the relationship. An example would be having the mindset of ‘taking suppliers for everything they’ve got’ or if there is a huge effort required in aligning goals and monitoring performance.

Moreover, many relationships break down or fail to start due to a critical lack of expertise and resource.

Category management advantages are numerous. First, companies who operate in isolation are inefficient by definition as they remain static and unresponsive to changes in their customers or environment.

Secondly, it brings together key strengths. For example, a retailer may have unlimited amounts of qualitative and quantitative data but no method of drawing out key insights that can help grow sales. This shortfall could be covered by suppliers who are able to look upon years of experience in domestic markets to draw out key findings and trends.

Allowing for the piloting of new ideas and initiatives is a further advantage that can be gained from properly managed category management, as too often many ideas are missed by operating in a ‘thought/idealess vacuum’ created by constantly having to firefight local problems. The sharing of new ideas will then lead to an increase in objectivity of decision making as both parties can maintain a perspective and transparency of the other’s opportunities and problems.

A collaborative partnership

Finally, an increase in transparency allows a wider basis for negotiation between the two parties, instead of resorting to the tried-and-tested method of debating margin and/or listings – which too often leads back down the path to an adversarial relationship and ultimately no progress.

For real progress and understanding, I would advocate that retailers considering a category management approach look for brand owners who demonstrate the following:

- Customer/outlet knowledge and focus

- Leadership in marketing and innovation

- Complete category orientation

- A desire to work as a team

For their part, brand owners should collaborate with retailers who:

- Share information and experience

- Understand and then act (not the opposite)

- Commit to growth for both parties

This would lead to a definite move away from the current practice of ‘information hoarding’ and into a collaborative practice of information sharing and, ultimately, customer satisfaction. ✈️

Richard Timmis will be at the TFWA Exhibition & Conference in Cannes. For more information, contact him at categoryinsights@outlook.com or on +44 (0)7814 978 994.