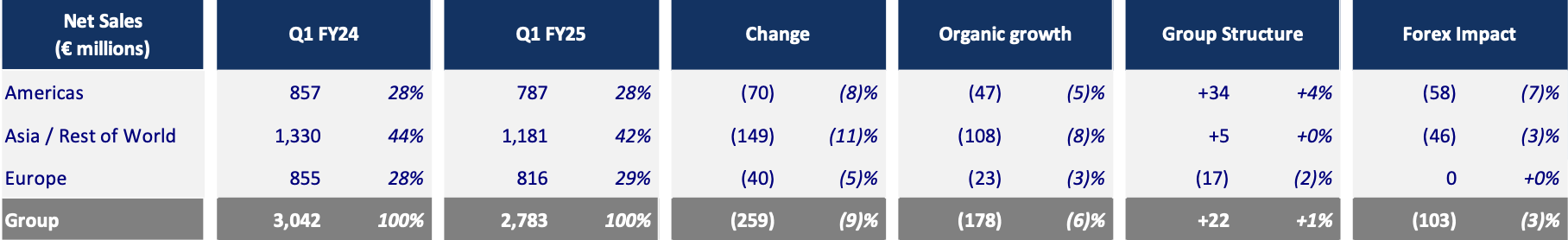

Leading drinks group Pernod Ricard today reported first-quarter sales, with the figure reaching €2,783 million, down by -5.9% in organic terms and -8.5% reported. The Global Travel Retail division posted +3% sales growth year-on-year, led by Europe and the Americas, with Asia hit by weakness in the China market.

Of the travel retail performance, the group noted that “weak consumer sentiment is affecting Chinese travellers’ spend, which we expect to persist for the full year”. Key brands that performed well in the channel in the quarter included Absolut, Jameson and Ballantine’s.

Overall the company said it experienced “a slow start to the year, notably with China in sharp decline, in a context of continuing macroeconomic weakness impacting consumer sentiment, and with the US in decline, reflecting underlying sell-out performance amplified by inventory adjustments”. The company did not disclose profit figures for the period.

Pernod Ricard stated: “The quarterly sales result is softer than previously expected as the weakness in China is also affecting Asia Travel Retail. In addition, in India, where the underlying growth is strong, we faced technical sales phasing, expected to fully reverse in Q2. Finally, markets in Europe endured adverse weather conditions over the summer.”

The company said its broad geographic base helped to deliver strong performances in some markets, partially mitigating those declines. Those markets included travel retail in Americas and Europe, plus Japan, Canada, Poland, Brazil, Turkey and Nigeria.

By region, sales in the Americas fell by -5% with the USA down by -10% year-on-year. Europe sales fell by -3% year-on-year.

Asia/Rest of the World saw sales fall by -8%, within which China declined -26% while India grew +2%. Of China the group said: “Given the current weak environment, we expect to see a more significant full-year decline than last year.”

Sales of Strategic International Brands fell by -10%, mainly driven by Martell in China, Royal Salute in Korea and The Glenlivet in the USA. ✈