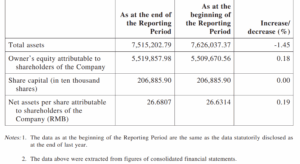

CHINA. China Tourism Group Duty Free Corporation (CTG), parent company of China Duty Free Group, reported a -9.96% year-on-year decrease in operating income to CNY28,150.75 million (US$3.9 billion) for the half year ended 30 June.

Net profit declined -20.81% to CNY2,599.75 million.

CTG said, “In the first half of 2025, the company accelerated its strategic transformation and development when its performance was under pressure.

“It proactively expanded ‘duty-free+’ coverage [a reference to linking commercial sales to wider aspects of tourism, including culture –Editor] while deeply developing the duty-free business.

“It also leveraged its exclusive, debut and co-branded customised products to stimulate the consumption and promoted the innovation and development of its own brand CDF Health (中免健康).

Hainan to turn positive; airport spending soft – Goldman SachsCommenting on the results, Goldman Sachs Equity Research said: “Headline net profit fell -20% year-on-year to RMB2.6 billion, implying RMB662 million in 2Q25 (-32% year-on-year or vs. RMB1.9 billion in 1Q25), weaker than our and market expectations mainly due to ongoing weakness in online and airport channels (we estimate -13% year-on-year in spite of further recovery in international air passenger traffic +20% year-on-year or +5-10% quarter-on-quarter).  “While the monthly sales data remain choppy (-7%/-1%/-5% year-on-year in April/May/June), we believe the base will become favourable from July onward, such that year-on-year comparison may soon turn positive after posting declines over the last 1.5 years. We maintain our Hainan DFS store growth forecast of -3%/+7% year-on-year in FY25/26E (vs. -7% year-on-year in 1H25), implying +6% year-on-year recovery in 2H25.” Mirroring the views on Chinese spending expressed by Lagardère Travel Retail Chairman and CEO Dag Rasmussen on a H1 earnings call last week, Goldman Sachs said: “Amid further air traffic recovery at the three major airports (i.e. +21%/19%/21% year-on-year at Shanghai Pudong/Beijing Capital/Guangzhou Baiyun airports), we suspect per-shopper spending at airports was still under pressure at ~RMB80-120 and that CTGDF’s online sales might have suffered as well due to ongoing competition from other ecommerce platforms, where price points are generally comparable or even below those offered at DFS channels for select items, particularly during the past 618 shopping festival.” Commenting on last week’s announcement of Hainan’s island-wide independent customs regime to be implemented on 18 December, Goldman Sachs wrote, “While successful implementation of free trade port policy could mean larger market size by attracting more shoppers to Hainan, CTGDF may face increased and more direct competition from brands who may plan to establish their own stores/presence in Hainan. “To a certain extent, we believe the company has prepared for such policy change, transitioning itself from a pure DFS operator procuring products from brands to more of a landlord leasing out store space to them.” ✈ |

“During the reporting period, offshore duty-free sales in Hainan showed signs of stabilisation, and the company’s dominant position in the Hainan market was further consolidated, with its market share increasing by nearly one percentage point year-on-year.

“The company continued to improve operational efficiency, with the inventory turnover rate increasing by +10% year-on-year.”

China Tourism Group Duty Free pledged to continue strengthening strategic guidance, promote strategic transformation, and continuously promote corporate reform and innovation through adjustment of business layout to achieve high-quality development. ✈