CHINA. Insights from Dragon Trail’s latest Chinese Outbound Travel Trade Survey revealed year-on-year growth in outbound travel from China in the first half of 2025, alongside notable shifts in traveller preferences.

The biannual survey collected data from 280 active outbound travel sellers across mainland China between 17 and 23 June, covering key topics including market trends, B2B outreach, travel to Europe and AI technology.

Stronger outbound travel demand in 2025

Key survey findings point to a generally optimistic outlook, with 61% of travel agents reporting year-on-year improvement in outbound travel demand, underscoring the value of B2B engagement and outreach.

Respondents identified strong potential in family and study tours, emerging niche destinations such as Central Asia and less-travelled parts of South America, and bespoke travel trends.

At the same time, 17% say 2025 is more challenging than last year amid global headwinds.

They also pointed to the difficulty of catering to the rising preference for highly personalised and experience-led travel.

East Asia remains the best-selling region

The first half of the year saw East Asia remain the most in-demand region for outbound travel, while Western Europe overtook Southeast Asia to become the second top-performing region in sales.

Europe remains the top-selling region for 89% of travel agencies, while Asia is rated highest in sales performance by 62% of travel agencies.

France, the UK, Switzerland, Iceland and Italy emerged as top European destinations with high potential.

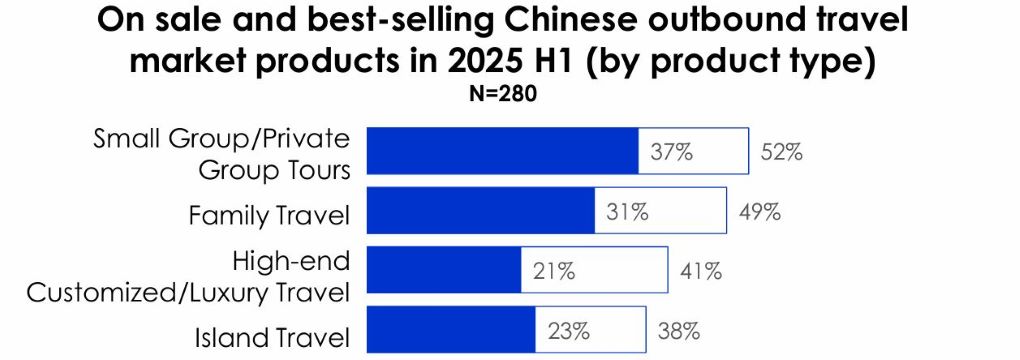

Small and private group tours are the most commonly sold and best-selling products (52%, 37%), followed by family travel (49%, 31%).

Of those travel agents surveyed, 41% offer customised/luxury trips and 38% sell island travel.

Travel agencies report strong demand for small-group outbound tours, with 82% of agents citing groups of 20 or fewer as the most popular format. The post-90s generation was identified by 69% of agents as their core market, followed by the post-00s and post-80s segments (41% each).

In-person engagement remains key for travel agents

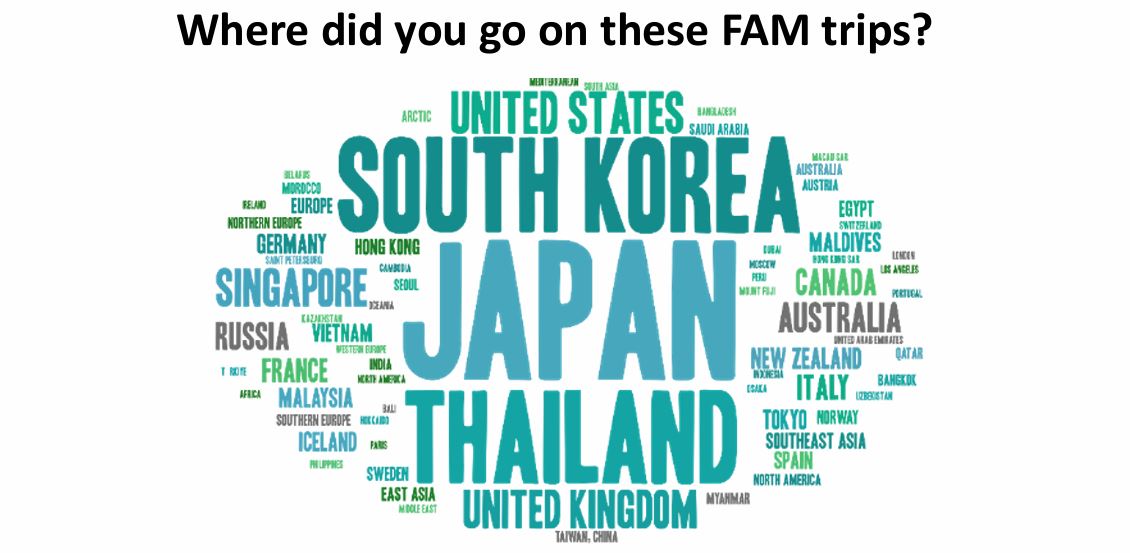

Reinforcing optimism in the outbound travel sector, 90% of travel agents have recently participated in a FAM (familiarisation) trip since China reopened, with 67% having joined between one and four outbound trips.

The findings reaffirm that in-person engagement remains a key factor in the performance of the outbound travel sector, with 45% of agents preferring offline training and 42% favouring FAM trips. While live streaming is the leading online resource (39%), traditional trade shows (37%) and a mix of online and offline training resources (28% each) also play a key role.

Outbound destination training

The findings also reveal a connection between agents’ sales potential assessments and the destinations they have explored through FAM trips.

Destination knowledge is a key focus, as 80% of surveyed agents took at least one outbound destination training programme in the past two years, with 45% completing three or more.

Top destinations include Japan, Thailand, South Korea, Australia and Singapore, with interest also rising in emerging markets such as Iceland and Ras Al Khaimah in UAE.

The survey also found that most Chinese travel agents prefer to join FAM trips in spring, with April, March and May as the top months, while winter is the least popular season.

European market profile

Europe tops the list of preferred long-haul destinations among Chinese travellers, with Western Europe emerging as the most preferred region. France and the UK lead on-sale travel products and growth potential, followed by Switzerland, Iceland and Italy. Russia remains a top choice among Eastern European destinations.

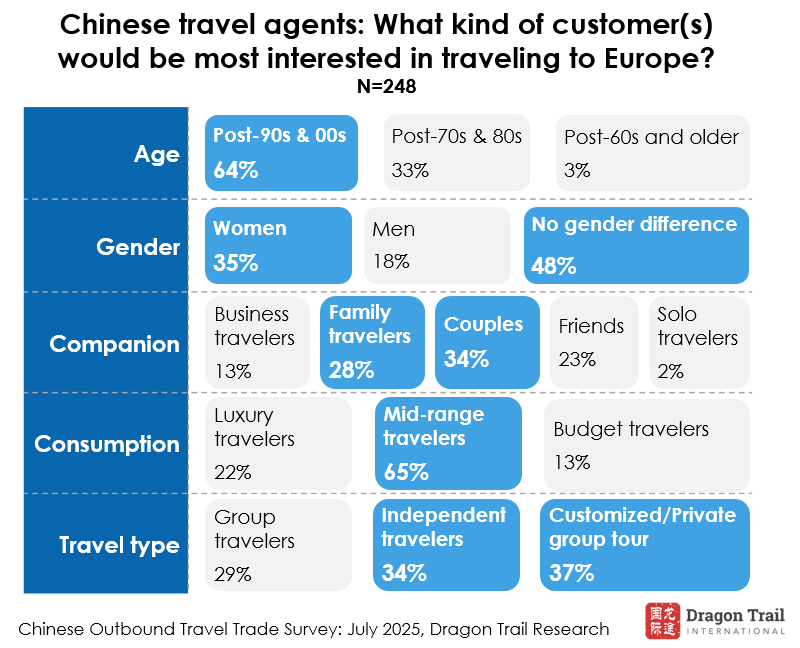

Among traveller profiles, Gen Z couples with mid-range budgets, travelling independently or on tailored itineraries, were identified by survey respondents as the most promising segment for Europe.

According to Chinese travel agents, younger travellers born in the 1990s and 2000s show the most interest in Europe (64%), while mid-range travellers account for the majority (65%). Women are more likely to travel (35%) than men (18%), though 48% see no gender difference. Couples (34%) and families (28%) stand out as key segments. Private/customised groups (37%) and FIT (34%) now outpace traditional group tours.

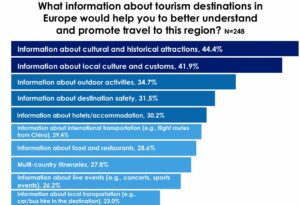

Cultural understanding emerged as the top priority for travel agents seeking to enhance their recommendation quality and itinerary planning, with 44.4% wanting information on cultural and historical attractions and 41.9% on local customs. Multi-country European itineraries (27.8%) are significantly more popular than single-country trips (16.5%).

The growing impact of AI on travel

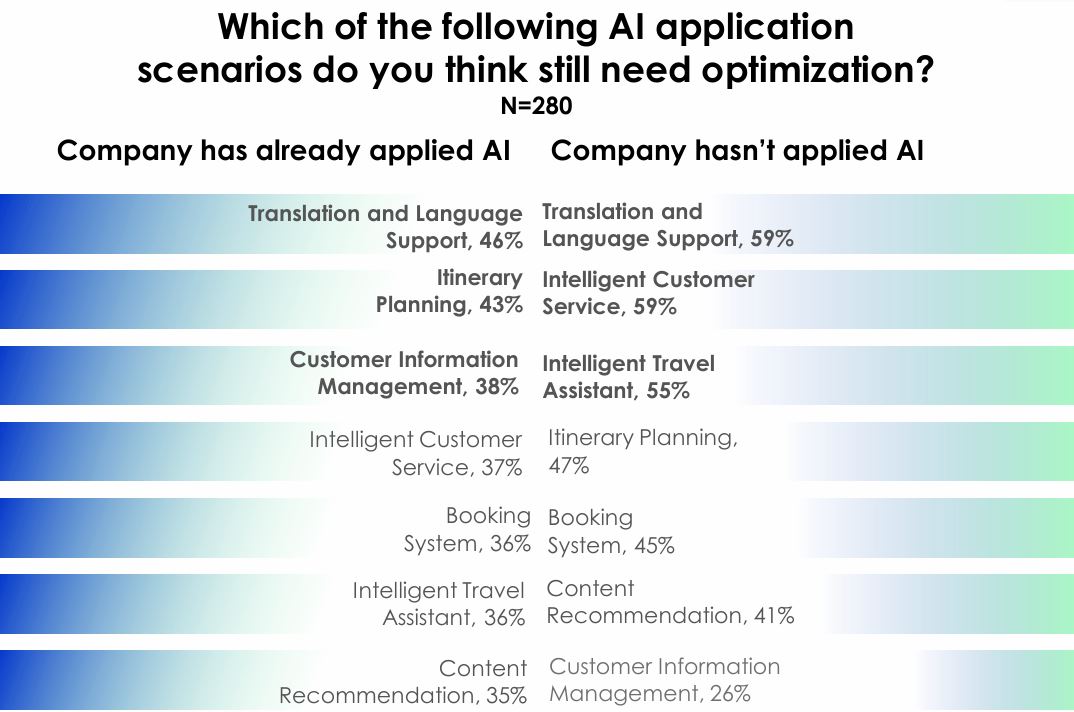

The survey reveals AI integration is becoming standard practice in the travel industry, with 82% already using intelligent assistants and language support tools.

Respondents also identified the need for enhanced dialect translation.

In addition, 43% said they want improved itinerary planning features, such as personalised suggestions and weather-based adjustments, while 38% highlighted better customer data management as a priority for more accurate recommendations.

Click here to download the full Dragon Trail International report. ✈