“It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us.” – Charles Dickens, A Tale of Two Cities

Travel retail in Hainan and South Korea, together with a soft Mainland China domestic market, continued to drag on L’Oréal’s North Asia region, the French beauty group revealed on Friday during a post-annual-results earnings call.

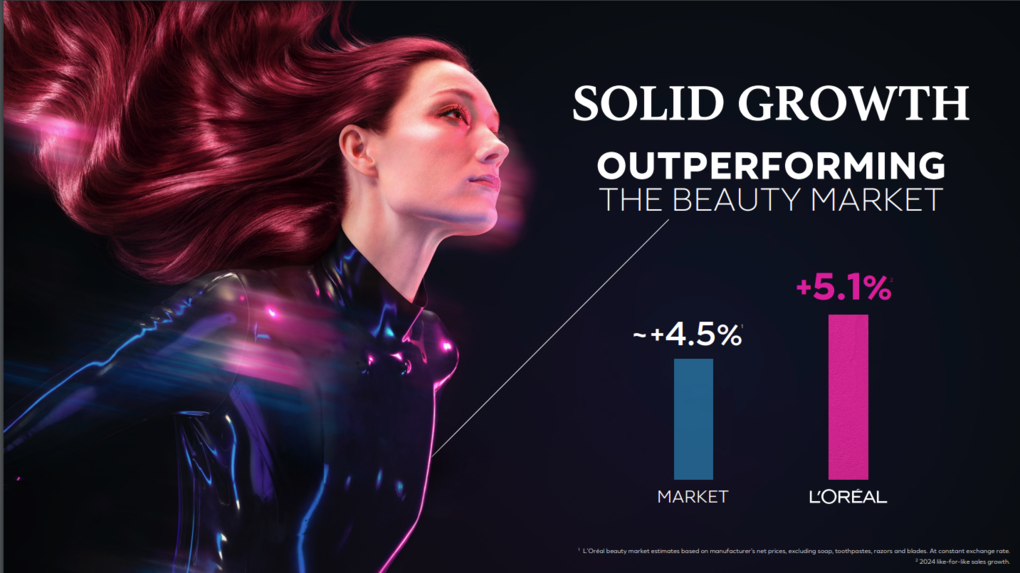

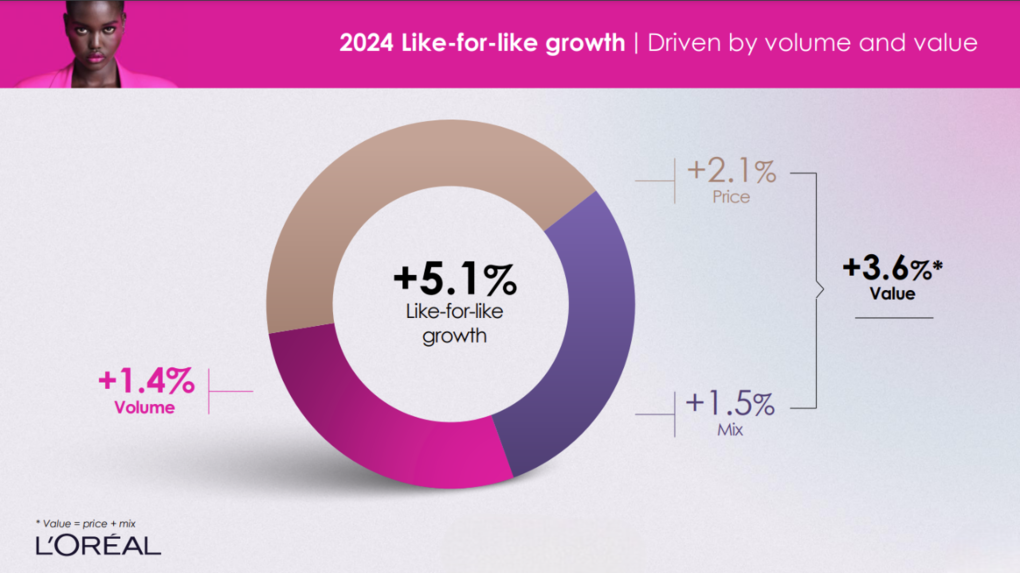

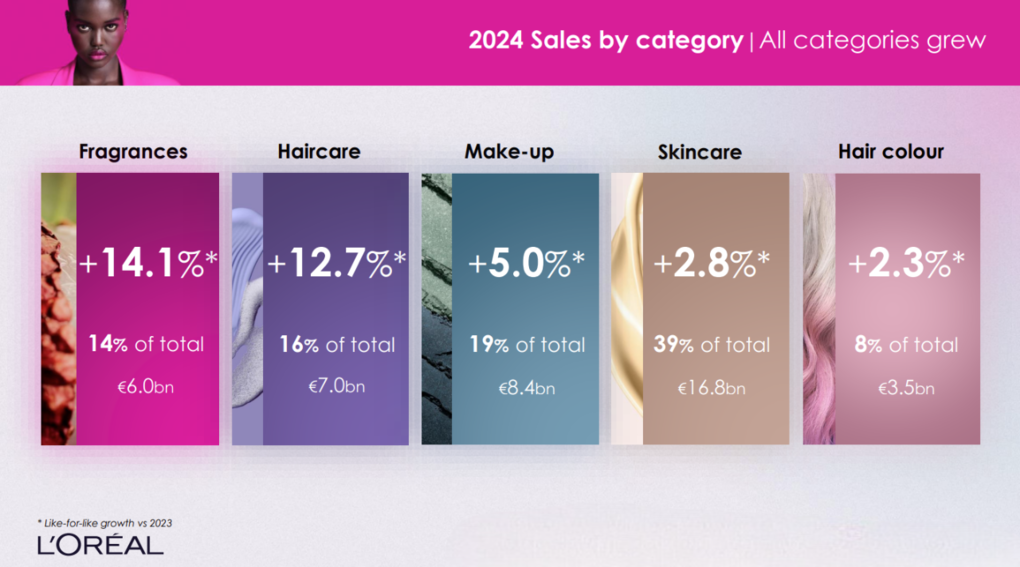

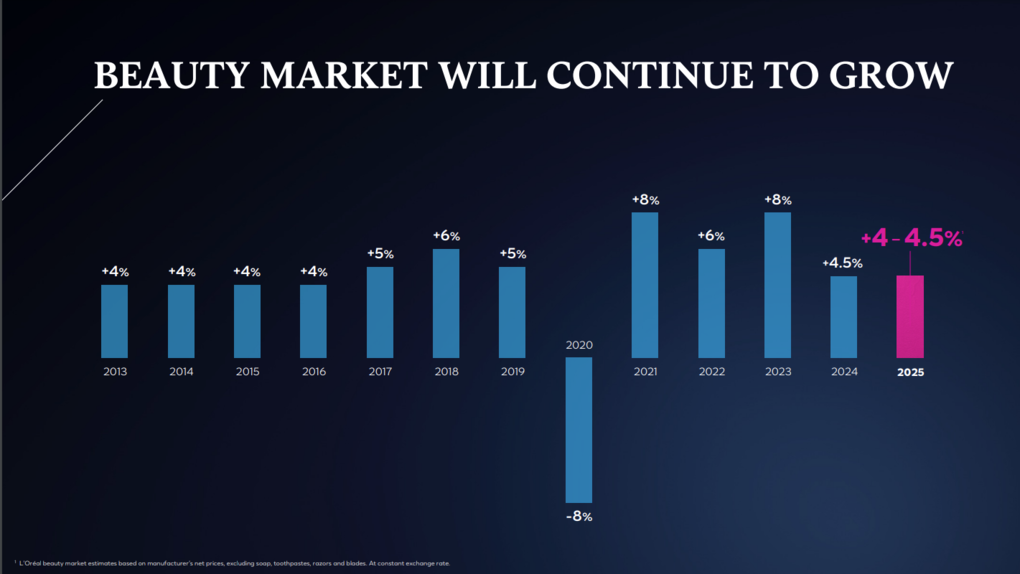

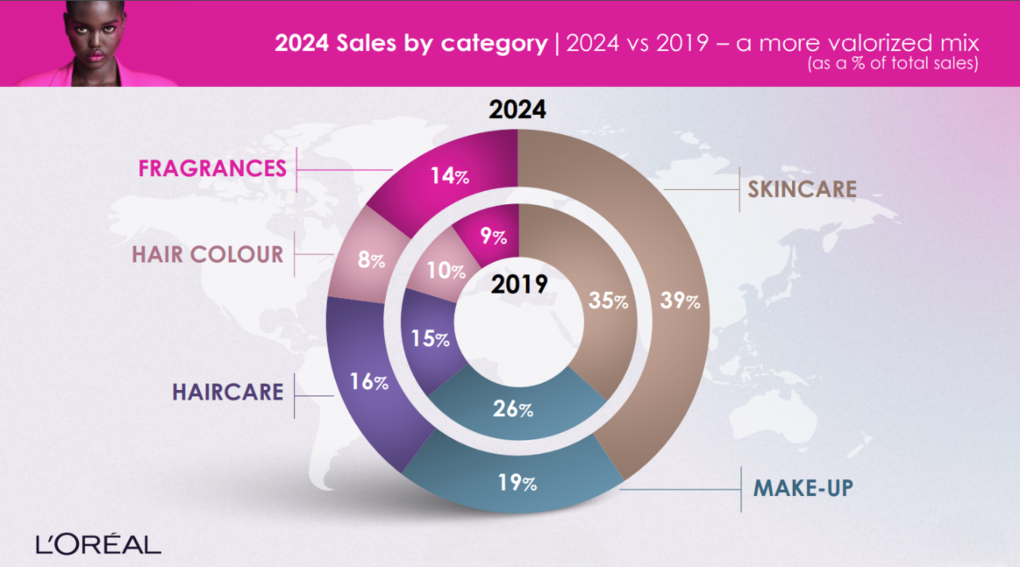

As reported, L’Oréal posted +5.6% (reported; +5.1% like-for-like) year-on-year sales growth to €43.47 billion in what it called “another year of outperformance in a normalising global beauty market”. However, Q4 growth was just +4.5% (+2.5% like-for-like) below the +4.4% like-for-like London Stock Exchange consensus, according to Reuters.

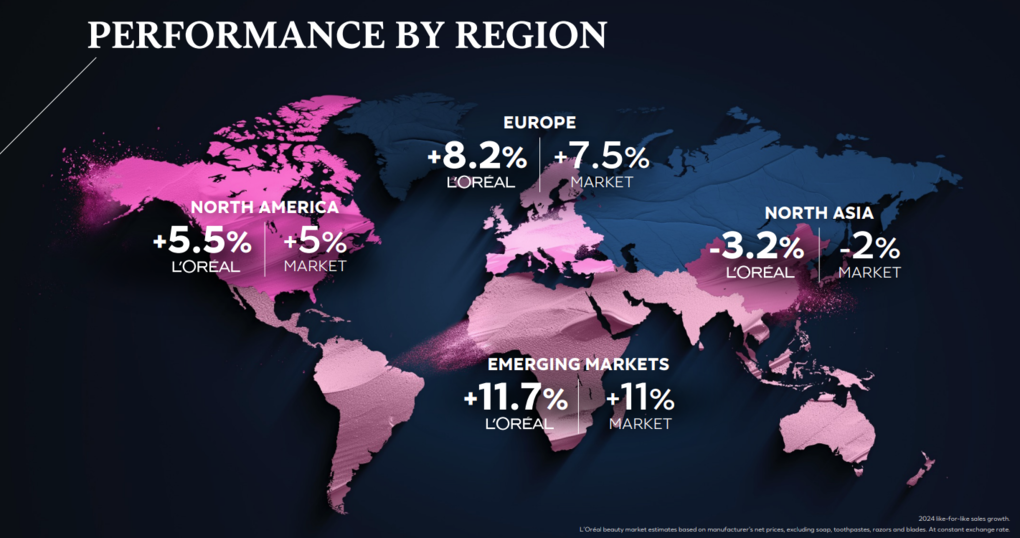

The company generated like-for-like growth in all regions except North Asia (-3.4% for the year; -3.1% Q4), which was negatively affected by the travel retail challenges [both reseller-related] in Hainan and South Korea, the channel’s two key markets of recent years.

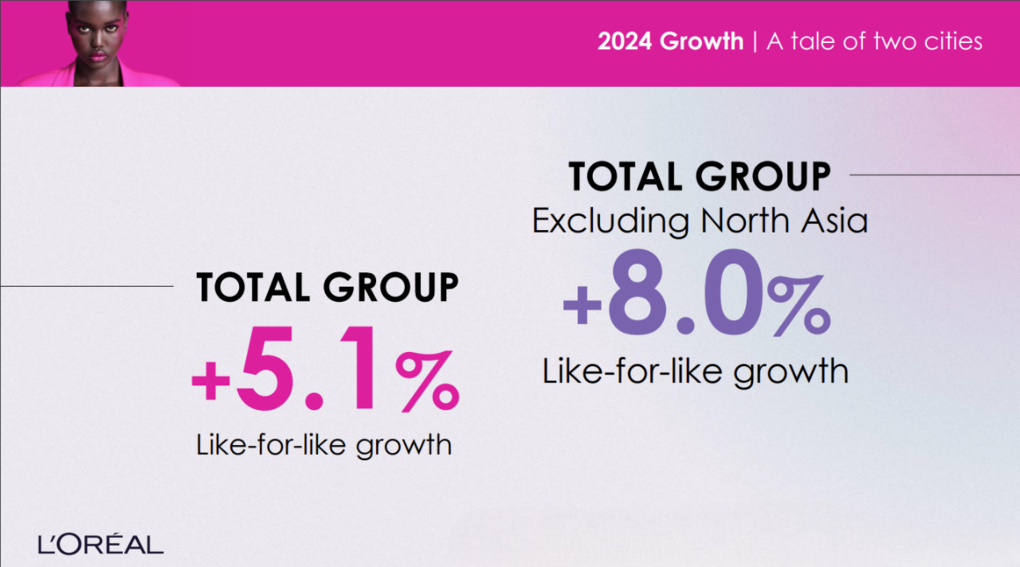

L’Oréal Executive VP & CFO Christophe Babule drew on a Dickensian allusion to describe the contrasting fortunes of North Asia and the rest of the world, commenting: “2024 was the tale of two cities, and our like-for-like growth stood at +5.1%. But excluding North Asia, it amounted to a very strong +8%. All other regions contributed to that growth, led by Europe and our emerging markets.”

And while Dickens’ famous ‘It was the best of times, it was the worst of times’ opening line from A Tale of Two Cities didn’t quite apply, there is little doubt how sharply North Asia’s performance varied from its geographic counterparts.

“Momentum was strong in three of our regions, helping offset the softness in North Asia… [where] sales declined by -3.2% on a like-for-like basis. This was due to the continued weakness in both Mainland China and travel retail,” Babule said.

Perhaps the CFO was anticipating the French rugby team’s off-colour second-half performance in losing against England a day later when he added: “But ’24 was also a tale of two halves as a strong first half was followed by a softer second.”

Once again, North Asia travel retail and Mainland China were integral to that variation. Overall growth in the global cosmetics market eased from a “dynamic” +5.5% in the first half to a more moderate +4.5% in the full year, an expected slowdown as inflation-driven pricing started to unwind.

But the shape of that slowdown differed from what the company had predicted, Babule said. “On the one hand, developed markets, especially Europe, held up better than anticipated. On the other hand, the Chinese ecosystem, which we had hoped will at least stabilise, did not.”

Hainan and Korean travel retail sales plummet from 2022 levels

In Asia travel retail, total beauty market growth went from -3% in the first half to -10% in the full year, driven by both Hainan and Korea, Babule explained. “Together, they are down -35% from 2022 levels, and then we chose to accompany this decrease in consumption with a reduction in our stock in trade.

“We believe that the resizing of the travel retail business in Asia is now largely behind us, and I’m happy to say that we are entering ’25 with healthy inventory levels across the region.”

The North Asia challenges weighed on L’Oréal Luxe and particularly its key skincare portfolio, according to L’Oréal Luxe President Cyril Chapuy.

“In North Asia, in a still challenging market context at -7%, we continued to gain market share evolving at -5.5%,” he said.

Skincare presented a contrasting picture, he noted with a challenging market context deeply affected by the situation in North Asia, balanced by several key positive moments included the worldwide launch of Lancôme Genifique Ultimate – “executed to perfection everywhere” – the launch of Kiehl’s on Amazon, and the strong performance of recent acquisitions Youth to the People, Takami and Aesop {main story continues after the panel below}.

Talking points: On the record with L’Oréal leadershipL’Oréal CEO Nicolas HieronimusOn Amouage: Sometimes you see a brand that you love, in an area of the world that you’re very excited about. And so you meet the founders of a brand, and there are many moments where founders are eager to continue to run their business and to be part of the adventure. And they, at the same time, are very excited to benefit from L’Oréal’s support. Amouage is exactly that. It’s a fantastic brand. It’s one of the most sophisticated fragrance houses in the Middle East, which we’ve been observing for years.

The founders were, indeed, eager to benefit from the support of L’Oréal and to welcome us in their shareholding structure. And then we’ll see what the future holds. In all these moments where you take a minority share in a company, you also learn to discover the management, they get to know us. And it is also a way to spread our risks in many, many small brands. On Jacquemus: We do not intend to go higher in the capital of Jacquemus. We do not intend to own fashion brands. We happen to have one, which is Mugler, but it was part of the acquisition from Clarins. But overall I think we are very good at doing beauty, and I’m not sure we’d be as good at doing fashion… but it’s a good way to show Simon that we are supportive and believe in this brand, and it helps him develop his retail project.

On other investments: We took two small shares in two small start-ups in fragrance in China, Documents and To Summer. We don’t know which one of these brands is going to be passing the test of time. Having a couple of fingers in different pots of jam allows us to make sure we’ll have probably, at some point, one that becomes a star.

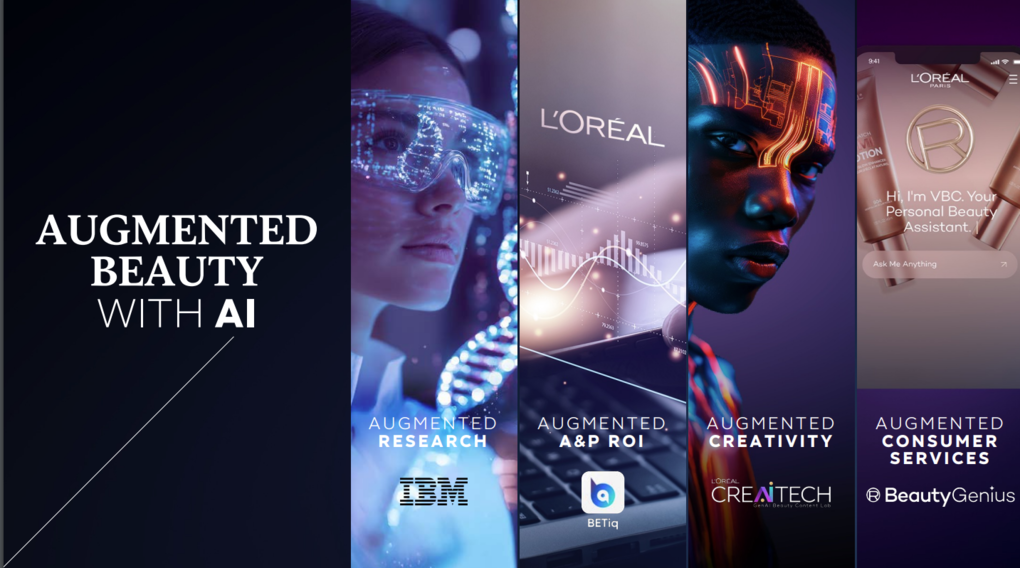

The beauty market has become extremely creative in a number of brands. We can’t buy them all. We can buy some of them, but we can also learn and discover and probably seduce a certain number in a later stage. On 2025 prospects: We expect market growth of +4% to +4.5%, and we are determined to outperform this market again. We expect our growth to accelerate progressively as the first quarter will face particularly tough comparisons. This acceleration will be supported by our beauty stimulus plan. On AI: We invested in further augmenting beauty with AI. In R&I, we leverage AI and our 10,000 terabytes of data to accelerate and strengthen our innovation processes, partnering with AI champions like IBM. Thanks to the gradual roll-out of our AI-powered BETiq [L’Oréal’s exclusive tool to measure and improve the return on its A&P investment] in more countries, we continue to improve the returns on our A&P. And the output of our creative teams is boosted by CREAITECH, our internal beauty content lab. All of this ultimately serves the consumer, enhanced by augmented services like Beauty Genius, which already boasts over 100,000 users in the USA.

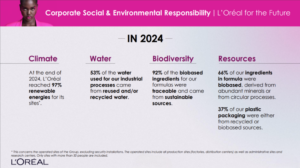

On generational opportunities: We estimate there are 4.2 billion potential beauty consumers in the world, and then we touch 1.3 billion of them today. Over the next decade, it is our ambition to reach 2 billion consumers. Let’s start with Gen Z. They already account for over one-fifth of our potential consumers, and it will increase by another 150 million in the next five years. What makes them attractive? Well, first, Gen Z are the biggest consumer clusters in emerging markets, and their rapidly rising affluence, digital savviness and beauty obsession make them a core target. Second, by 2030, 370 million Gen Z consumers will be over the age of 25, entering a new life stage with more disposable income and more sophisticated beauty routines. Third, 200 million Gen Alpha consumers will be coming of age in 2030. This matters as this cluster are what I would call the beauty-crazy generation, giving us the opportunity to nurture the consumer of tomorrow. On men: Male products contribute to less than 10% of the global beauty market, yet men account for one-quarter of global beauty usage, and they constitute half of our potential consumer base. The opportunity is huge. We will double down in fragrances where men already account for one-third of our sales. Recent launches like YSL MYSELF or Valentino Born in Roma are flying. We will offer more differentiated products in haircare, offering men more solution-driven products like Elvive Growth Booster. We will step up innovation in skincare to improve penetration rates and encourage more sophisticating plus-one routines. On 60+ consumers: The 60-plus cohort by the end of the decade will comprise over 1 billion of our potential consumers. That’s 200 million more than this year. Two-thirds of the 60-plus years old will be the boomers, one-third Gen X. More than half of them will live in developed markets. This makes them a very attractive cluster as consumers in developed markets spend more on beauty as they get older. The average boomer spends over US$400 per year, almost twice as much as a Gen Y and two-and-a-half times as much as a Gen Z. Today, over-60s account for 21% of the population but 28% of the beauty demand. On ESG: Beyond our financial performance, we were awarded the EcoVadis platinum medal rating, honouring the group’s determination to stay at the forefront of extra-financial performance. And I’m very proud of the three-year partnership we signed with Le Louvre entitled Of All Beauties, a guided journey of 108 selected works that perfectly illustrate the essentiality of beauty across the ages.

|

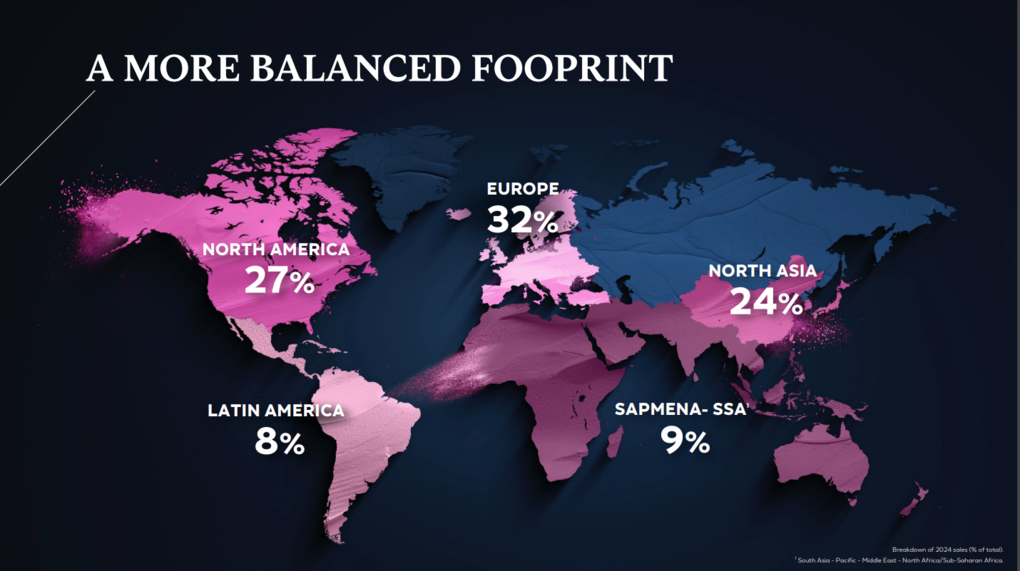

L’Oréal CEO Nicolas Hieronimus noted the company’s exposure to the Chinese ecosystem had significantly diminished over the past two years, now accounting for 17% of sales, well below the 2022 level. “We continue to believe in its future but are less dependent on it as our global footprint has become a lot more balanced,” he observed.

That rebalancing has been highlighted by the encouraging growth of emerging markets which contributed to 36% of growth and now account for over 16% of sales, overtaking Mainland China for the first time, Hieronimus said.

“The results I’m most proud of this year is our financial performance, our capacity to keep our P&L virtuous and deliver steady improvement in operating profit despite the turbulences in China and travel retail,” he commented.

“Our gross and operating margins reached new record highs. At 20%, our operating margin was up 20 basis points or 40 basis points if we exclude the impact of Aesop [acquired in April 2023]. On a comparable basis, our brand fuel increased by ten basis points.

“As a group, we have once again proven our ability and determination to consistently deliver on our promise to steadily improve our operating margins, all the while providing the fuel for our long-term growth. We are confident in the future, and we increased the dividend to our shareholders by +6%.”

Asked during the question and answer session about L’Oréal’s “exposure” to the travel retail channel and the company’s apparent cautiousness despite the expected realignment of sell-in and sell-out in North Asia, Babule responded: “You’ve seen that the consumption in travel retail has been decreasing now for more than two years in a row. And of course, the weight of travel retail [internally] now has decreased quite sharply.”

However, he pointed out, L’Oréal’s travel retail performance in Europe and North America is still increasing and Hainan represents less than 1% of group sales.

“So the exposure to those difficult markets has dramatically decreased. That’s why we are confident that in 2025 we should expect – we don’t know when – probably a progressive recovery in the coming semesters.”

Hieronimus explained that the fact he remained “not super positive” about travel retail was partly driven by a disparity between passenger traffic growth and consumer spending, noting: “We’re particularly seeing Hainan not growing in terms of sell-out.”

He added: “We see passengers increasing [globally]. The trend of air traffic is very positive. It should grow by +9% again in 2025. We think, by the way, that the market will be very dynamic in the west. In the east, over the holidays, the Hainan sales for all categories, not just beauty, were still negative. Korea is managing their inventory. So… we’re hoping for a stronger rebound.

“We think we can have positive sell-out across the year. We have a healthy inventory, but we don’t see travel retail being a powerful growth engine, particularly at the beginning of the year. The more we move into favourable comparatives, the better it may be. But I would say that one of the bad results of Q4 is that it went back into negative territory when we were hoping it wouldn’t.

“What’s important for us is – and that’s very key – is that we’re paying a lot of attention to inventory management to make sure that we stay always on the healthy side. And that’s where we are today.” ✈

Talking points: On the record with L’Oréal leadership

|

L’Oréal Executive VP & CFO Christophe Babule

L’Oréal Executive VP & CFO Christophe Babule L’Oréal Luxe President Cyril Chapuy

L’Oréal Luxe President Cyril Chapuy