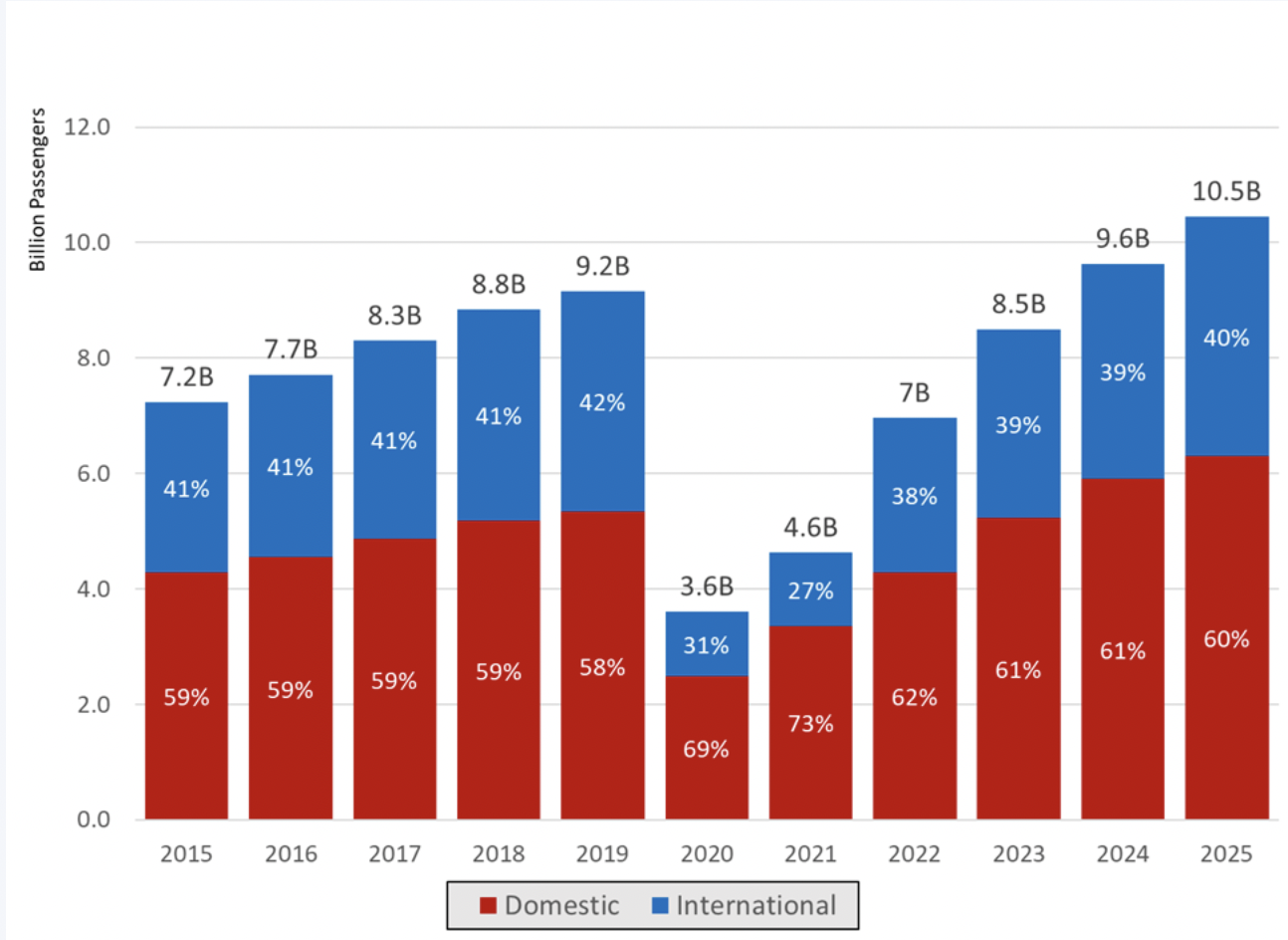

INTERNATIONAL. Airports Council International (ACI) World has said that global passenger traffic in 2022 is expected to reach 6.8 billion, or 74.4% of 2019 traffic levels. The figure is also -33.1% down on the projected baseline (pre-COVID-19 forecast) of 9.8 billion passengers.

Global domestic passenger traffic is expected to reach its 2019 level in late 2023. International passenger traffic will require almost one more year to recover and will reach its 2019 high only in the second half of 2024.

The latest figures were published in ACI’s latest assessment of the impact of the COVID-19 pandemic on airports, which highlighted continued strong demand for air travel amid heightened macroeconomic risks.

During the first two quarters of 2022, global passenger volume was 1.3 billion and 1.7 billion, which represented 62% and 75.2% of 2019 levels respectively.

Recovery was mainly driven by the sudden surge of air travel demand during the Northern Hemisphere summer of 2022, following the relaxation of travel restrictions.

Demand was uneven across markets. For instance, major aviation markets in Asia Pacific lagged behind their North American and European counterparts in the first half of 2022.

The best-performing markets included Colombia, Mexico and Nigeria, which welcomed a surge in demand and exceeded their 2019 levels in the half. The USA (87% of 2019), Spain (82%), Brazil (80%), and India (75%) were among other major aviation markets also closing the gap with 2019 passenger levels in the first half.

“The recent momentum created by the lifting of many health measures and the relaxation of most travel restrictions in many European countries and in the Americas has renewed industry optimism,” said ACI World Director General Luis Felipe de Oliveira.

“There is still an uneven recovery—a gap exists among markets, especially where strict travel restrictions are still enforced, COVID-19 vaccine availability and uptake are limited, and geopolitical conflicts are visible. This gap resulted in offsetting the impact of pent-up demand during the early Northern Hemisphere summer season on a global scale.

“Despite this, air travel should see a continued uptick overall in the second half of 2022, moving the industry closer to its full recovery – still forecast for 2024.”

Recovery 2022–2024

While many indicators are pointing towards recovery with strong pent-up consumer demand with the lifting of travel restrictions, historically low unemployment rates, and above 80% vaccination rates in major aviation markets, ACI said the industry is also facing headwinds ranging from the conflict in Ukraine to bottlenecks in global supply chains, that threaten to disrupt the pace of the post-pandemic recovery.

Rising prices, particularly in food and energy, are notable risks. This sudden rise in cost has in turn produced a tightening of global monetary policy, with central banks increasing interest rates to tame inflation, ACI noted. This will cause a decrease in economic activity and potentially impact consumer confidence. The potential for a recession as we approach 2023 may also represent an additional headwind for the aviation sector, it added.

Africa

- The Africa region is expected to reach close to 79.3% of its 2019 level in 2022.

- Due to its dependence on international traffic, Africa is expected to make a full recovery to 2019 levels only in mid- to late 2024.

Asia Pacific

- While some countries have reopened to vaccinated travellers, the international passenger market is not expected to see significant improvement before the second half of 2022. The region is expected to have the slowest recovery, reaching only 54.5% of 2019 levels in 2022.

- Full recovery to 2019 levels is expected by the end of 2024 but could slip into 2025 if some countries lag to lift the remaining COVID-19 restrictions.

Europe

- With the significant improvement in the first half of the year 2022, the region in 2022 will hit 82.5% of its 2019 level, said ACI.

- Despite some risks of a slowdown during the autumn and winter seasons, Europe full-year recovery to 2019 levels is expected in 2024.

Latin America-Caribbean

- The region is expected to continue seeing a positive uptick in 2022. The increase in leisure travel is forecast to bring the region to 91.9% compared to 2019.

- Full recovery for the region to 2019 traffic levels is expected in late 2023.

Middle East

- With the region’s high dependence on international travel and connectivity, the region is expected to reach 82.7% of 2019 levels by year end and be fully recovered in the first half of 2024.

North America

- The strong performance is expected to continue in 2022, helping the region to reach 89.6% of its 2019 level by year end.

- North America should be the first region to reach recovery to 2019 levels as early as 2023, said ACI.