INDIA. Adani Airport Holdings posted a +25% year-on-year rise in total income to IR2,715 crore (1 core = 10 million) for Q1 of its 25/26 financial year.

EBITDA surged +61% to IR1,094 crore.

The performance, revealed amid parent company Adani Enterprises’ first-quarter results, was lauded by Adani Group Chairman Gautam Adani.

“Adani Enterprises has established itself as one of the world’s most successful infrastructure incubators,” he said.

“The substantial rise in EBITDA contribution from our incubating businesses reflects strength and scalability of our operating model. This performance has been led by our airports business, which delivered an exceptional +61% year-on-year growth in EBITDA.

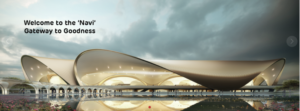

“With landmark assets like the Navi Mumbai International Airport, the Copper Plant and the Ganga Expressway set to become operational, we are accelerating our mission to build next-generation infrastructure platforms that are globally benchmarked, technologically advanced and strategically vital to India’s growth story.”

Total passenger numbers at Adani-controlled airports rose +3% year-on-year to 23.4 million.

On a post-results earnings call, Group CFO Robbie Singh said the much-anticipated Navi Mumbai International Airport is expected to receive operational clearances by October with a ramp-up to full capacity within six months.

On a post-results earnings call, Group CFO Robbie Singh said the much-anticipated Navi Mumbai International Airport is expected to receive operational clearances by October with a ramp-up to full capacity within six months.

As reported, Adani Airport Holdings recently raised US$750 million via External Commercial Borrowings from a consortium of international banks.

The proceeds will partly be used to refinance existing debt and invest in infrastructure upgrades and capacity expansion across six Indian airports – Ahmedabad, Lucknow, Mangaluru, Jaipur, Guwahati and Thiruvananthapuram.

Additionally, the company plans to scale its non-aeronautical businesses, including specialist and duty-free retail, food & beverage and other services across the airport network. ✈

ABOUT ADANI AIRPORT HOLDINGS

Adani Airport Holdings Ltd (AAHL) was incorporated in 2019 as a 100% subsidiary of Adani Enterprises Ltd, the flagship company of the Adani Group.

In line with its vision to be a global leader in integrated infrastructure and transport logistics, the Adani Group emerged as the highest bidder for the operation, management and development of six airports: Ahmedabad, Lucknow, Mangaluru, Jaipur, Guwahati, and Thiruvananthapuram. It signed concession agreements with Airports Authority of India for all six airports.

The group also holds a 73% stake in Mumbai International Airport Ltd, which in turn holds a 74% stake in Navi Mumbai International Airport Ltd.

With eight airports in its management and development portfolio, Adani Airport Holdings is India’s largest airport infrastructure company in terms of passenger footfall and air cargo traffic.

The company also has a series of joint ventures in place across its duty-free, specialist retail, food & beverage and hospitality businesses.