SPAIN/INTERNATIONAL. Aena has presented an updated 2022-2026 Strategic Plan, which has revised its commercial revenues forecast for the 46 Spanish airports it operates to +48% in 2026 against pre-pandemic 2019. The number is up from the +23% originally forecast when the plan was released in November 2022.

Aena presented the Strategic Plan update at an event led by Aena Chairman and CEO Maurici Lucena; Executive Vice-Chairman Javier Marín; Airports Managing Director Elena Mayoral; and Commercial and Real Estate Managing Director María José Cuenda.

The airport operator said the “positive evolution of the economy” and a faster than expected recovery in passenger traffic in 2022 are two of the reasons which led it to update the plan. Lucena said: “Surpassing the targets initially set is not only a consequence of a better economic situation, but also of a successful strategy.”

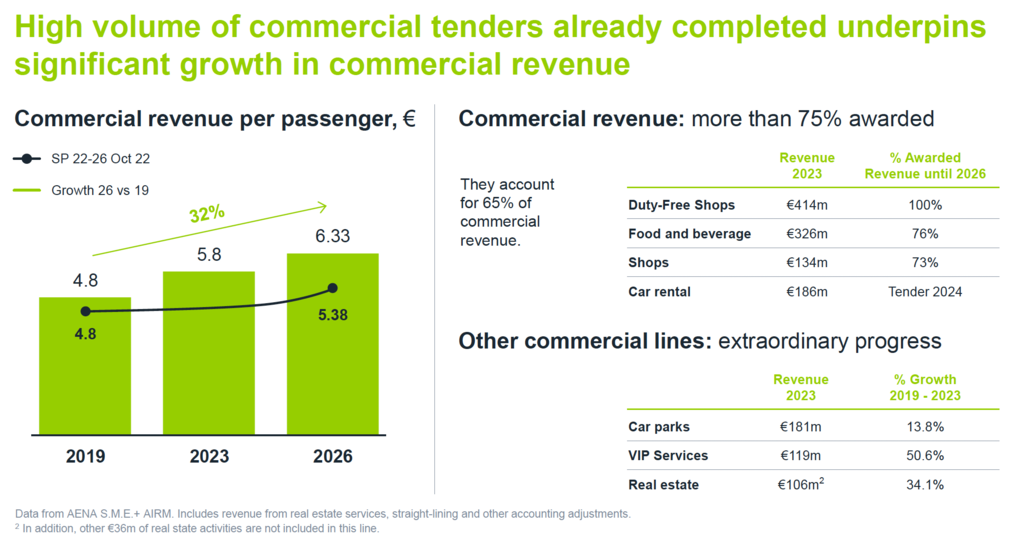

The revised forecast for commercial revenues includes an upwardly adjusted prediction for commercial revenue per passenger to reach €6.33 in 2026, up +32% from the €4.80 recorded in 2019. The original 2026 forecast when the plan was first released was €5.38 (+12%).

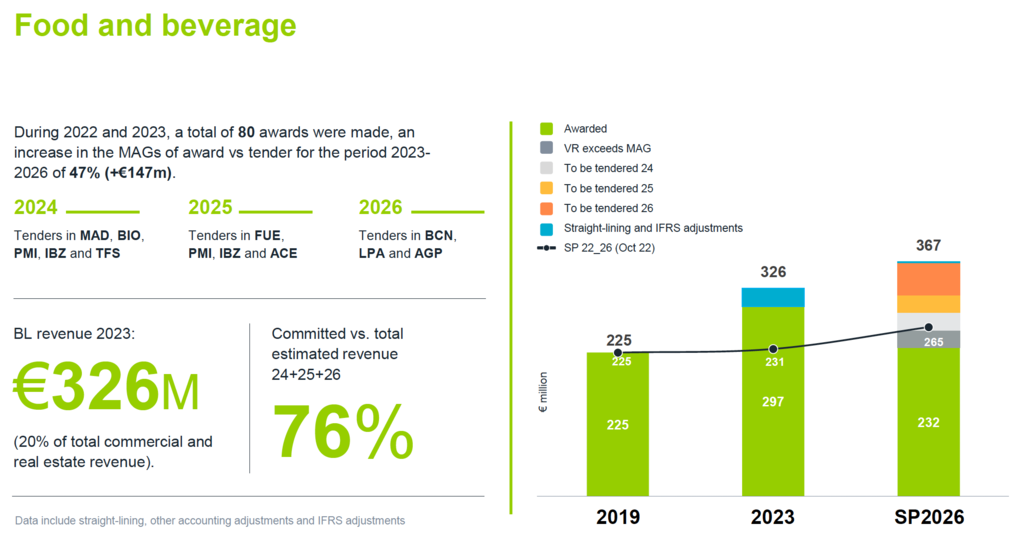

The predicted increase in commercial revenues is driven by factors including a significant upward adjustment in predicted passenger growth and improved terms in recently awarded contracts for duty free and food & beverage across airports in Spain.

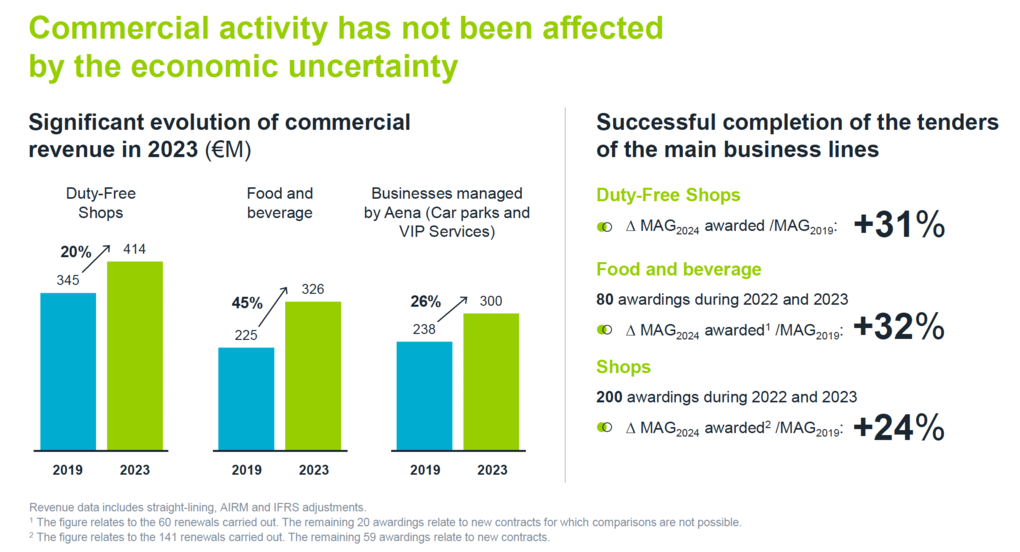

Aena successfully completed the tenders of the main business lines last year – duty-free shops, awarded in their entirety; food & beverage, with 80 awards; and other shops, with 200 awards during 2022 and 2023.

As a result of these tenders, the Minimum Annual Guaranteed (MAG) rents increased by +20% in 2023 compared with 2019 and are expected to increase further to +46% in 2026.

“As for commercial and real-estate activity in Spain, 2023 has been excellent not only in terms of income, but also in terms of the results of the tenders, which set the conditions for a significant growth in future rents,” said Lucena.

Aena noted it is developing concepts to attract new commercial operators to the airports, which is reflected in a significant increase in participation for recent tenders.

Passenger forecasts

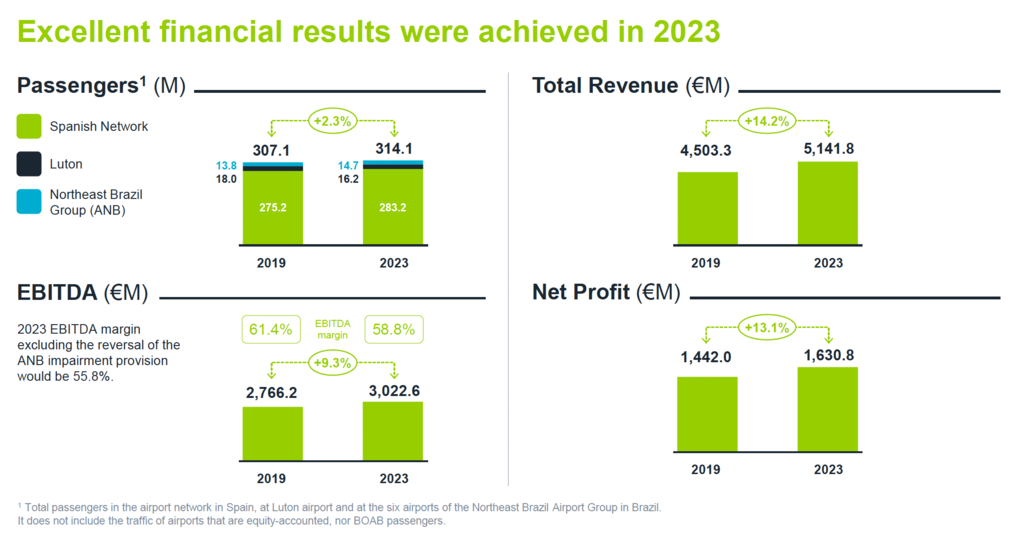

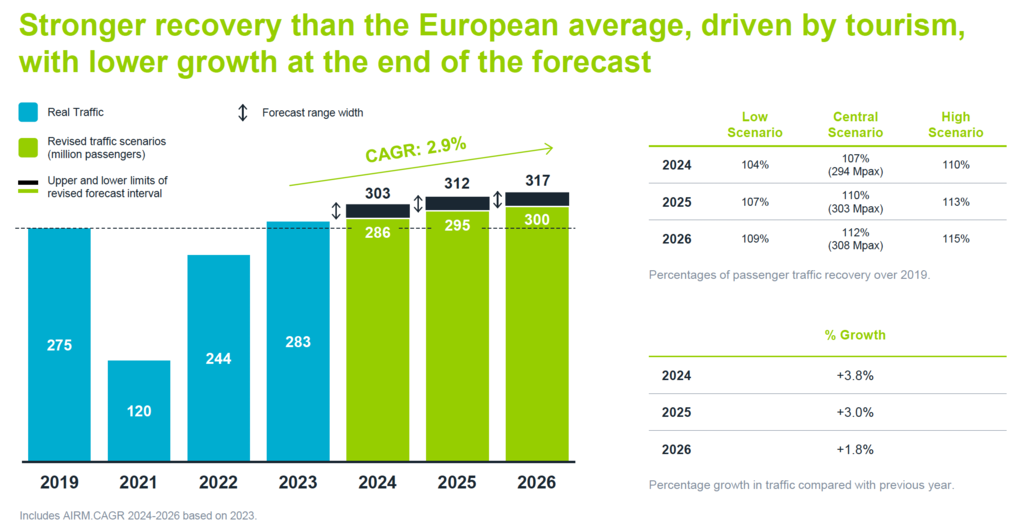

The airport company said it expects to serve approximately 310 million passengers in 2026 and break through the 300 million passenger barrier in 2025, one year earlier than forecast in the 2022 release of the Strategic Plan.

Including the overseas airports in the UK and South America which Aena subsidiary Aena International holds interests in, the company expects to serve more than 1 million passengers per day across all airports it operates worldwide.

In 2023, Aena beat its passenger record set in 2019 when its airports in Spain served 283 million passengers, exceeding the pre-pandemic level by +2.9%. Based on these figures, the airport operator expects to close 2024 with around 294 million passengers.

Aena said the projected increase this year is supported by good prospects for the summer season in 2024, with around a +7% higher schedule of flights for the period than in 2023.

EBITDA and international business

At the plan update event, Lucena also pledged that Aena’s EBITDA margin will remain at about 59% in 2026. Of this, the company expects international business to account for 15%.

At London-Luton Airport, government authorisation has been obtained to increase capacity from 18 to 19 million passengers per year.

In Brazil, the mandatory investments in six north-east airports have been completed. During the last quarter of 2023, Aena took control of what is known as the Block of Eleven Airports of Brazil – these include Congonhas in Sao Paulo, the airport with the second highest passenger traffic in Brazil.

This transition has been carried out without any operational impact, the company noted. In total, Aena already manages 20% of Brazil’s airport traffic. ✈