EUROPE. Adapting to accelerated change in consumer behaviour and a reshaping of the business model were central themes of a compelling discussion between the CEOs of four leading travel retailers at the ETRC Business Forum in Amsterdam on Thursday.

Avolta CEO Xavier Rossinyol, Gebr. Heinemann Owner and Co-CEO Max Heinemann, ARI CEO Ray Hernan and Lagardère Travel Retail Deputy CEO Frederic Chevalier – in a conversation adeptly led by Heinemann Director Corporate Communications & External Affairs Nina Semprecht – addressed how to better create value for all parties in the industry Trinity, in one of the highlights of the annual event.

Summing up the speed of change in shopper habits and how our sector must adapt, Xavier Rossinyol said: “Yesterday doesn’t matter, tomorrow matters. The world has changed, not only with Donald Trump as US President, but the geopolitics of the last 20-30 years are gone, the way the different [political] blocs work are different, and everything from tariffs to interest rates has changed too.

“I’m not sure that we in Europe are aware enough that change means unpredictability, and that this is at an all-time high. We need to react. But I also know that if we embrace change early enough we can turn it to a positive.”

Ray Hernan also addressed the pace of change, noting that the business environment is becoming ever more complex.

“Loyalty to brands is not what is was, and for us as operators it will become even more challenging to keep pace with consumer behaviour.

“Our big cost is when we put a new store into an airport. In the past we expected to keep this as it was for five to seven years. Now we are having to adapt all the time, with high turnover of brands.”

Frederic Chevalier said: “Look at the change we have seen over the past five years. Covid plus geopolitical change means many Chinese, Russian, US passengers are not here in the same way.

“There are other factors. The roll-out of 5G has changed the way young people spend their time at the airport. The value of our industry is dwell time but if they use dwell time in a new way what does it mean for us? It means we need to have the agility to adjust the offer, manage market evolution and that is at the centre of our collaboration [with airports] for the future.”

Max Heinemann said: “Historically in Europe we saw the industry grow through the rise of air travel, we didn’t have to market our business too much and we also diversified to safeguard our business amid globalisation.

“Now nothing is stable any more. In fact that lack of stability is the ‘new normal’. Being agile means with the airports an understanding that we are all in this together – what we knew before doesn’t function any more.”

The business model

That theme of change led to a robust discussion about contractual relationships with airports.

Rossinyol said: “To do anything with the agility we require means investment. There is a lot of money in our system but not enough of it goes towards improving the business. You need to change constantly and to invest in change, but the contracting model of old does not work any more. Minimum guarantees will kill this business longer term. They need to be eliminated.

“It’s not because I want that money but I want to invest it back in the business, which in turn can at least double the size of the business. That means radical change, it means affordable trial and error that helps us create more value for us all.”

He added: “Our industry has sales and non-sales [non-spending travellers -Ed], but the non-sales portion is three times bigger than the sales we generate.

“We don’t focus on the non-sales enough. To unlock that we need to change the contracts, and the airport can make twice as much money if we do that. We take so many decisions based on what the contract says – but really we shouldn’t look at the contract from the day we sign to the day we need to tender again.”

Chevalier added: “There is money aplenty in our system to finance an industry that can be two, three, four times bigger than today. We know the money exists in the sales we do in our airports. It’s an advantage that other industries don’t have.”

He added: “For a given concession we know the risk related to it, whether that is geopolitical instability or the commercial risk related to traffic. We put a value to the risks. What makes the very big difference is how the concession contract is drafted for many years ahead. The more the risk is balanced against us, the more difficulties it creates and the harder it becomes to take risk, to swap out brands, to invest in the stores. The contractual risk is the biggest risk today for us to accept or reject.”

Max Heinemann said: “Concession fees are fine but what is the vision behind them? To put the word guarantee in a contract when you also include the word innovation, it simply does not work.”

On upgrading the experience in the context of challenging concession terms, Heinemann said: “Investment in the store has to give you immediate cash and that means risk. Yes we want to create experiences for the consumer but yet consumer-centricity has never been part of any contract. And we are somehow co-owners of the position we are in today.

“In the past for any tender everyone competed. Today it’s not the case. You filter out the opportunities much more quickly and not many companies are in tenders only for growth.”

Taking up the theme, Hernan said: “I don’t think we’ll change the airport mindset on contracts, even if Covid changed some from fixed MAGS to more now operating on a MAG per passenger basis. We as operators have created the stick to beat ourselves with. We compete for business and it only takes one to get out of line with a bid and the airport will take it. It’s easy to win new business, but it’s hard to win new business profitably.

“We also need airport support to manage the whole eco-system seamlessly. It’s shocking that only one in four people going through an airport spends in our stores. Part of it is that we don’t know who they are, but the airport often does through car parking, lounge booking etc. We need that data, which is low-hanging fruit, to be shared so we are no longer surprised by who is coming into our stores. That means earlier engagement with the customer and the airport has a big role in this.

“Spends won’t increase at the rate they did in past years and even then spend hasn’t really risen when you take into account inflation. So we need to get more people into our stores to shift the needle.”

Chevalier said that airport duty free could also learn lessons from other channels. “The rail business operates very differently, especially in its efficiency. The shoppers there welcome the ease of access and payment and we sometimes underplay this element at the airport under the pressure to magnify the brand experience. Yes we need the temple of beauty but we also need to ensure that our stores in duty free are not intimidating.

“At dining in airports, those locations have a very important contact point with travellers. These are the greatest stop points and it’s there we are building experiences for travellers. The dining areas help to make the airport a destination, where you can extend dwell time and thereby grow spend. If we cater for premium and luxury needs but are also affordable and efficient, we will improve the experience at the airport to the benefit of us all – but it needs that diversity.”

ETRC priorities

Earlier, to begin the day, ETRC President Nigel Keal addressed the key areas of focus for the organisation, including arrivals duty free, labelling and packaging, tobacco legislation and allowances.

“We must be fit for purpose and more self-sufficient as an association,” he said, adding that ETRC is striking alliances with other lobby groups in the wider EU eco-system, seeking to supply more data to members and to encourage membership.

Keal also saluted The Moodie Davitt Report naming ETRC Secretary General Julie Lassaigne among its People of the Year for 2024, saying the organisation and its members should take great pride in her recognition.

Chatham House Director & CEO Bronwen Maddox assessed the big picture for Europe in a fast-changing world. She highlighted the challenges of European competitiveness and cohesion, looming decisions on defence, sustainability, regulation and how the region interacts with the USA and China amid a contested, fractured global order.

“Europe is still a place where people want to travel to, work and live. The big question for Europe is whether it can act as one, and rise to the challenge of competitiveness, given the urgency by the uncertainty around geopolitics worldwide. But uncertainty also offers companies opportunities.”

A key session focused on how ready the industry is for the EU ‘green deal’ and meeting new sustainability requirements set by the EU.

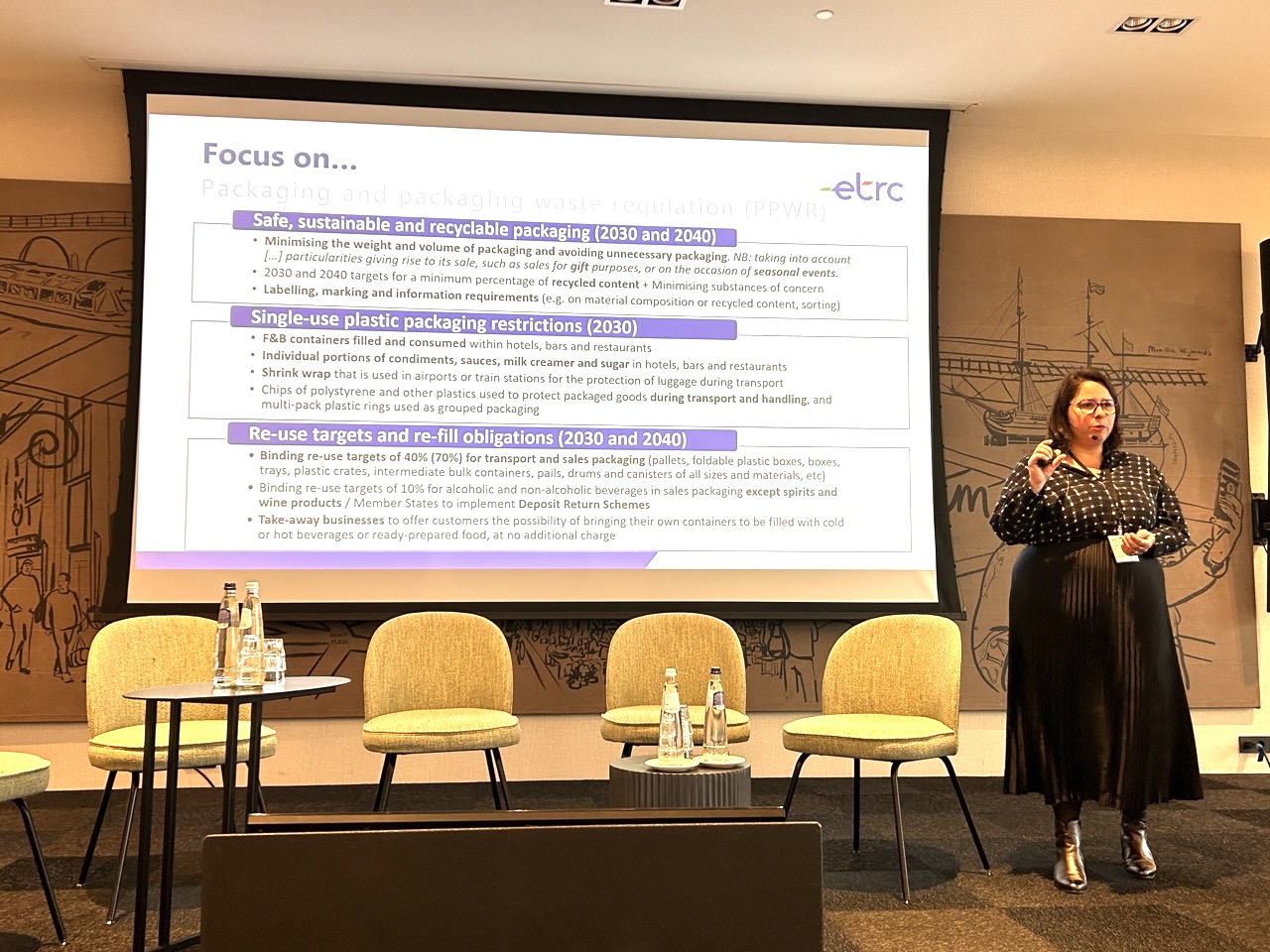

ETRC Secretary General Julie Lassaigne highlighted the role of businesses in driving the transition, with increased transparency, corporate governance and due diligence obligations emerging. She noted the challenges of adapting to the new rules on packaging and product re-use, alongside stringent reporting requirements.

Gebr. Heinemann Director Legal, Compliance & Sustainability Saskia Möller addressed the need to go beyond climate action as an industry and to commit to sustainability across the entire value chain, aligned with other business partners.

Avolta Chief Public Affairs and ESG Officer Camillo Rossotto outlined the company’s ‘ESG Strategy House’ and priorities around creating sustainable travel experiences, engaging local communities, respecting the planet and empowering people.

L’Oréal Travel Retail Chief Sustainability Officer Laurence Pardieu-Duthil highlighted how financial performance and being an exemplar in environment and social matters go hand in hand. “Sustainability is a competitive advantage for travel retail,” she said, citing the opportunity to convert consumers, to enhance commercial focus, to make corporate P&Ls more efficient and to anticipate regulation. She placed a strong emphasis on the opportunity in refillable fragrances, which address the demands of consumers for more sustainable goods as well as offering value.

The performance of our sector through to Q3 2024 was the theme of a session that featured data from the latest ETRC Index, presented by Pi Insight Managing Director Stephen Hillam. The ETRC Index is compiled exclusively by Pi Insight with the support of ForwardKeys for passenger data. Highlights include:

- The European airport duty-free sector performed well during the first three quarters of 2024 from a value sales perspective, with total value sales of €7.14 billion, rising +7% on YTD 2019 levels and +10% on YTD 2023 levels.

- Unit sales overall continue to fall behind value sales and passenger growth while certain product sub-categories have not fully recovered.

- Spend continues to show a positive trend, with growth in the first three quarters of +1.3% and +7.1% compared to the same period on 2023 and 2019 respectively.

Commenting on the performance from their respective category viewpoints were Ferrero Head of Marketing TR Camelia Dau, Pernod Ricard Managing Director GTR Europe & Americas Simon van Moppes, Philip Morris International Global External Affairs Manager Duty Free Banu Eksi and Puig Executive Vice President GTR Kaatje Noens.

Noens commented on how resilient beauty is as a sector. She offered an upbeat view of the sector’s potential with growing passenger numbers as well as shifts in demand, with women and Gen Z travellers showing the greatest growth.

She also highlighted the importance of a focus on experience at the airport with strong consumer demand for areas to relax, work, be entertained, use health and wellness facilities plus other services. “The in-store experience has become the number one purchase driver for beauty in travel retail,” she said.

Simon van Moppes highlighted the rise of Irish and American whiskies, premium gin and single malts among the category trends in Europe travel retail, while also citing the surging consumer interest in tequila, mezcal and rum.

Prestige spirits account for 46% of sales in EMEA travel retail, with growth at +7% CAGR, with price a key driver both at the top end and among standard ranges. Downtrading has occurred against the backdrop of weak consumer spending but is likely cyclical, he noted.

In-store experience also represents a big opportunity for the spirits & wines sector, led by a focus on shopper interaction by staff and by intelligent store design, added van Moppes.

Camelia Dau homed in on consumer drivers such as sustainability – no longer a trend but now a mandate – and the premiumisation dynamic but also challenges such as rocketing cocoa prices. That challenge is “a reality that is here to stay” with continuing adverse weather conditions, agricultural diseases and disrupted supply chains, she said.

Our sector also needs to do more to encourage consumers to pause and engage with the offering – not easy in a world where we are competing for share of shopper attention and as many Gen Zers are not engaged by the traditional store, Dau noted.

We should elevate chocolate as a “showcase star” via immersive experiences, AI integration, leadership in sustainability and Gen Z engagement, she concluded.

Banu Eksi highlighted key category trends from new product evolution to experience-focused travellers as among the market drivers for today and tomorrow. Opportunities include leveraging the evolution of consumer demand to offer a more diverse portfolio of smoke-free alternative products – while Eksi also encouraged closer collaboration between suppliers, retailers and associations to address category challenges.

The day ended with an inspirational keynote from futurist Dr. Marc Schumacher, who articulated how we are being forced to unlearn what we know – against the background of accelerated change in consumer behaviour.

Key factors to think about include the attention deficit of people today; ‘Nowism’ or instant gratification and how what we know about the past does not translate into understanding the future.

For our sector, he focused on those elements that cannot be taken away by tech. These include playing on the senses; uniqueness and exclusivity of location; personal encounters; self-expression as a new currency; the importance of status; and the scarcity value of products.

The Forum attracted 170 delegates from the European travel retail sector. ETRC also revealed its new publication, ‘Duty Free & Travel Retail – A Unique Marketplace’, offering extensive data about the regional business.

Nigel Keal said: “We are delighted by the record-breaking turnout at this year’s Business Forum and networking dinner. The Forum continues to be a vital platform for exchanging ideas, addressing challenges, and shaping a sustainable and innovative future for European duty free and travel retail.

“ETRC aims to steer the industry towards a more collaborative approach, creating benefits for all business partners. We are in particular very proud for the trust the four European travel retailer leaders have placed in us resulting in a common roundtable to discuss the present and future of our industry.” ✈