THAILAND. Airports of Thailand (AOT) today responded sharply to a report by Thai business media title Kahoon International suggesting leading commercial concessionaire King Power is facing liquidity problems that may prompt additional adjustments to its contract terms.

AOT emphasised it had not made any such adjustment and is proceeding in accordance with the contract and good governance.

The report contributed to a –21.27% fall in AOT’s share price (as at 10.30am Bangkok time 17 February) over the past five days.

“Airports of Thailand Public Company Limited would like to clarify that AOT has not made any adjustment to the concession contract with King Power Group and continues to proceed with such contract,” the airport operator said in a detailed statement issued by Corporate Secretary Krit Pakagij today.

The news report cited analysts’ opinions based on a meeting with AOT executives, the airport company said. It refers to CGS International Securities (Thailand) Company’s view (CGSI) that King Power Group’s “liquidity issues” may affect AOT’s revenue, and if the situation is prolonged, it may lead to the negotiation on adjustments to the concession contract, especially the minimum annual guarantee (MAG).

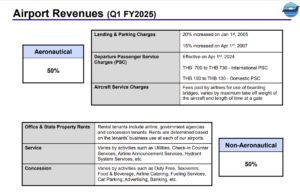

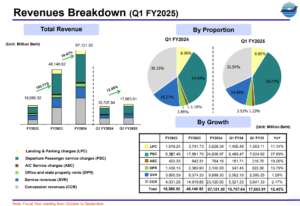

The MAG is regarded as AOT’s major source of revenue, with the concession currently accounting for approximately 33% of total projected revenue in fiscal year 2025, and also as AOT’s major source of profit.

“If there is any adjustment to the concession contract, AOT’s estimated net profit in terms of investment may be impacted,” AOT said in describing the CGSI view.

“CGSI views that such situation may expose investors to uncertainty and then loss of their confidence. They may exert negative pressure on AOT’s share price in the short run.

“Similarly, Kasikorn Securities Public Company Limited indicates that AOT is currently facing a problem of increased accounts receivable due to the concessionaire’s request for a postponement of MAG payment by 18 months. Meanwhile, the concessionaire will have to pay an 18% late payment penalty per year.”

In response to those views, AOT today issued the following detailed clarification:

King Power request for contract assistance

King Power Duty Free Company Limited (KPD) submitted a letter dated 26 August 2024 requesting a postponement of the MAG applicable to the duty-free contracts as Suvarnabhumi, Phuket International, Chiang Mai International, Hat Yai International and Don Mueang International airports.

In the letter, KPD stated the grave impact of the COVID-19 pandemic since early 2020, especially on the company and Thailand’s tourism industry.

Amid the COVID-19 crisis causing temporary closure of duty-free shops according to the government’s order, KPD made great efforts to sustain its business and employees, the retailer said in the letter. With AOT’s assistance that allowed the postponement of MAG payments, KPD had been able to continue its business and take care of its employees until now.

However, KPD said despite the easing of the COVID-19 situation, the company still faced “serious and continuous effects and cannot make a full recovery as projected”.

With its essential investments on improvements, constructions, installations of various systems inside the Suvarnabhumi, Phuket and Don Mueang passenger terminals, KPD had continuously suffered liquidity issues, the retailer said.

Other factors had also exposed KPD to payment burdens. They included:

- The policy of financial institutions on non-provision of new credit;

- The due loan payments to be made to financial institutions;

- The due MAG payments to be made to AOT (normal tranche payment and due tranche payment from postponement of payment);

- Payments to be made to suppliers.

Moreover, the MAG due to AOT is of a relatively high proportion as passenger spending growth forecasts were based on the pre-COVID-19 situation.

“The MAG then reaches a fairly high proportion compared to current revenue. Additionally, the sales volume of duty-free goods is not as estimated due to economic slowdown, resulting in passengers’ cautious spending. For all of those reasons, KPD’s revenue is not in line with the defined target, thus causing a loss,” AOT said, quoting the KPD letter.

In 2023, KPD recorded a loss of THB651,512,785 (US$19.3 million), AOT said, adding that despite a wide range of efforts to generate revenue, the travel retailer had been operating at a loss since January 2024.

Based on those facts, KPD asked for assistance from AOT to postpone the MAG payment due from August 2024 until July 2025 (totalling 12 tranche payments) by 18 months per tranche. This will allow KPD to have an adequate financial gap to restore liquidity to a normal state.

The reason for requesting the postponement of the MAG payment due in late August 2024 is that KPD expected to record more revenue from inbound tourists during the ensuing peak season.

KPD said it needed to be prepared for the additional purchase of goods by passengers at the three key reports and to be able to boost revenue as much as possible during the busy period. Additionally, such postponement of the MAG payment would save KPD from being exposed to additional burdens during the payment postponement period and allow the company to address liquidity issues.

KPD said in the letter it expected an increase in revenue and greater financial liquidity, respectively, and a business recovery “to the normal state” in 2026.

KPD said the requested MAG was attributable to a variety of simultaneous and sequential factors related to the unexpected COVID-19 crisis, a force majeure circumstance which was beyond KPD’s control until now (despite the ongoing sector recovery). KPD’s revenue was thus not as expected and led to inevitable financial liquidity issues, the retailer said.

The Airports of Thailand response

AOT duly considered the letter, examined operating results according to the contract and found that the proportion of KPD’s MAG was “considerably high compared to current revenue”.

Moreover, the sales volume of duty-free goods per passenger did not meet the target. AOT opined that KPD’s liquidity issues were valid and such action was considered as a notification of payment default according to the contract terms, without causing any damage to AOT.

Since the contract indicates an 18% penalty, AOT then informed KPD allowing a late payment of the MAG due between September 2024 and February 2025 by 18 months of each deferred monthly payment without exemption from penalties collected from the postponement of the MAG payment.

Suffering shared by AOT concessionaires and airlines

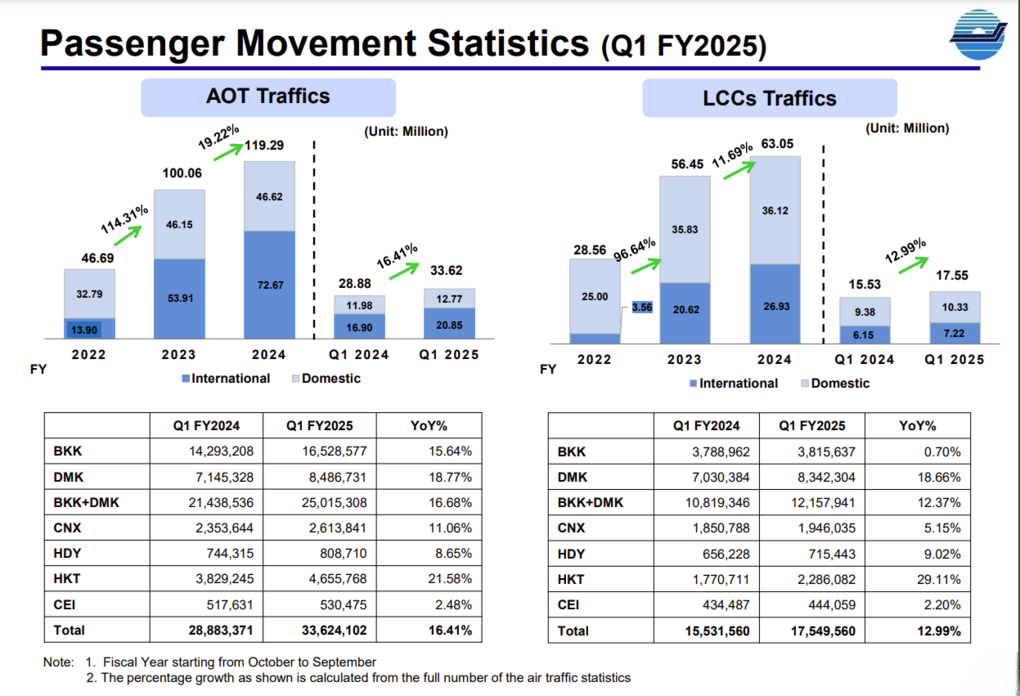

AOT said that in 2024, concessionaires and airlines operating at all six airports under its responsibility – including commercial operators, duty-free shop retailers, car rent operators, certain airlines and associated companies – has all suffered the same problem as King Power Group, the collective crisis causing over 70 operators to request a combination of delayed payment/tranche payment, cessation of operations, or request for space reduction.

“At present, over 50% of the average concessionaires pay MAG more than revenue sharing,” AOT said. “In this regard, some concessionaires showed an intent together with reasons and supporting information for tranche payment, payment deferral or restructuring of payment.”

AOT said that after consideration, it found the granting of permission for concessionaires for payment restructuring would be more beneficial to the company and better than contract termination and new bidding. In a new bid, AOT may be exposed to significantly lower minimum guarantees than previously received, the company noted.

In the past, AOT collected penalties from payment defaults indicated in the contract terms at 18% per year, a higher rate of those set by other state enterprises and significantly higher than interest rates in the Amendment to the Civil and Commercial Code B.E. 2564 (2021), stipulating 5% interest rates for default payment per year, the company noted.

Therefore, to allow AOT to retain concessionaires and airlines “with potential” but lacking liquidity due to the continuous economic recession stemming from the COVID-19 pandemic and the Russia-Ukraine war to continue their operations, the company carried out a project to extend payment terms for concessionaires and airlines facing liquidity problems at all six AOT airports of AOT, to be proposed to the AOT Board of Directors held on 22 January.

The meeting resolved to approve such project with the following criteria and conditions:

- 1.1 Concessionaires and airlines must submit a letter for project application in advance of the due payment date stipulated in the contracts as well as provide the reasons behind liquidity issues to AOT by 30 September 2025.

- 1.2 Participating concessionaires and airlines must have collaterals with limits covering a principal plus a 18% penalty per year.

- 1.3 Concessionaires and airlines will be able to postpone and/or split payment of MAGs or landing and parking charges. However, the postponed and/or split term of the last tranche payment must not be after the contract term and exceeding 24 months from the month AOT approves the project (January 2027).

- 1.4 Concessionaires and airlines must pay interests of delay payment and/or split monthly payments according to the rate set by AOT. The interest rate (% per year) is calculated by minimum loan rate (MLR) of five large commercial banks plus an additional 2% per year. Such interest rate must not be lower than weighted average cost of capital (WACC) of AOT.

- 1.5 In case of any payment default for a certain tranche or emerging debts is recorded by any concessionaire and airline, the eligibility for the project shall end immediately. AOT will further proceed with the contract’s terms and conditions.

- 1.6 AOT reserves the right to consider and cancel the project as appropriate. AOT’s consideration shall be deemed as final.

“From such clarification, AOT affirms that AOT has not made any adjustment to the concession contract entered into with King Power Group and continues to proceed with the contract in strict compliance with good corporate governance principles,” concluded Krit Pakagij. ✈