Travel hospitality and services group Airport Dimensions recently launched a series of reviews into consumer trends at the airport, released in partnership with The Moodie Davitt Report. In this fifth instalment, Global Strategy Director Stephen Hay talks about the new ‘tribes’ of airport travellers, and how the industry must do more to engage them.

Are labels helpful? The short answer is ‘yes’. When it comes to understanding travellers and what motivates their behaviour, the longer answer is ‘sometimes’. The classic ‘business’ versus ‘leisure’, ‘millennial’ versus ‘boomer’ definitions that are applied to airport passengers have their uses, but are something of a blunt instrument if we want to dissect and analyse who our customers are and what they really want from their airport experience.

Every traveller can be more than one type of person. We’ve understood for some time that Friday night’s business traveller wants something very different when that traveller is flying with their family on a Saturday morning. Similarly, sharing demographic markers such as age doesn’t mean passengers always have much in common.

A ‘boomer’ heading on a post-retirement round-the-world trip might want something very different from their airport experience to a person of the same age travelling home from a conference.

In our mixed-up post-pandemic world where most of the expected norms around the way people travel no longer apply, defining our passengers is an even more complex task, and the boundaries are even more blurred.

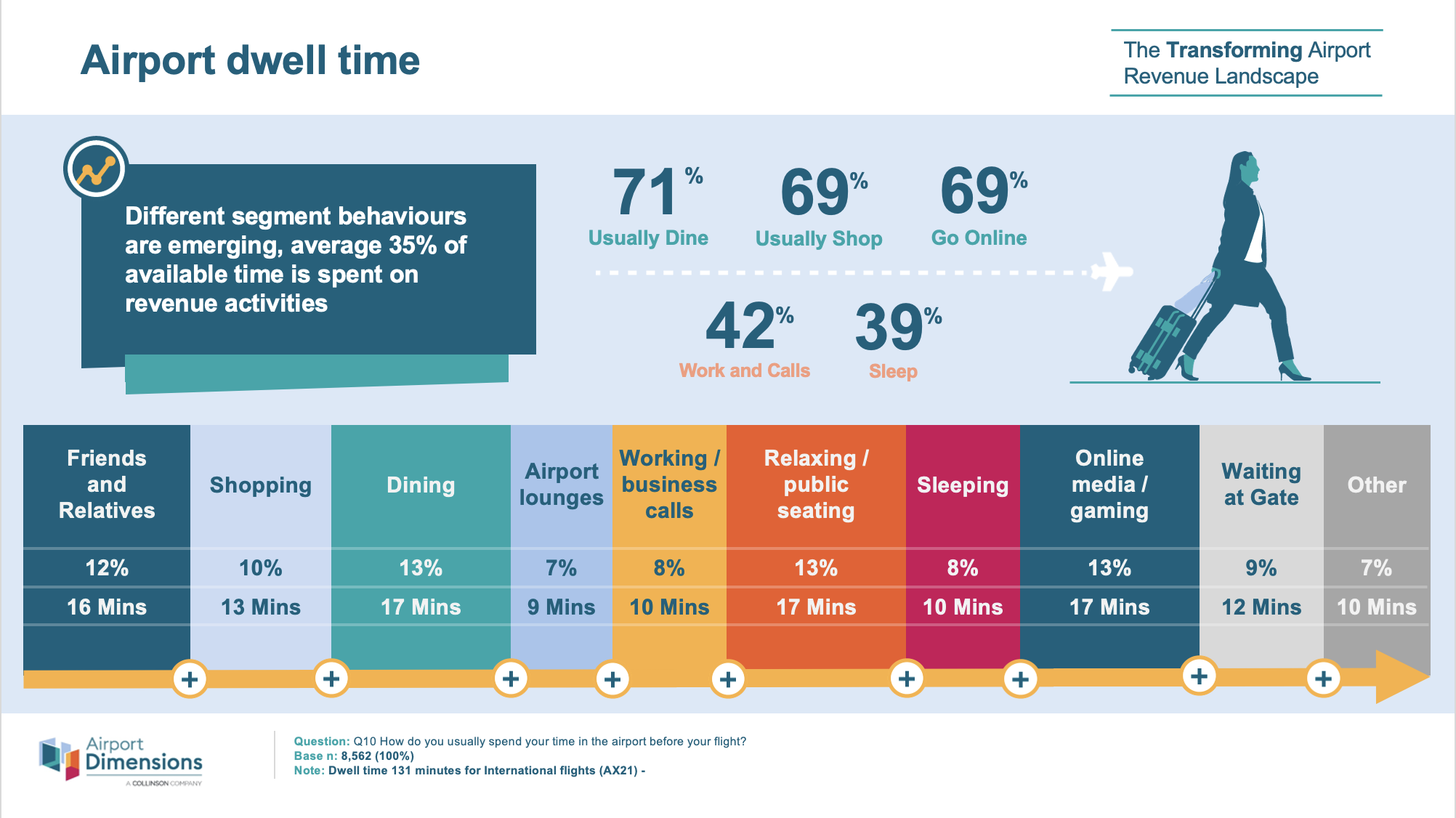

But if we can’t categorise and label our passengers, how do we know how to provide an experience they will want? To help provide a more robust blueprint for what the customer mix at a particular airport might look like, we have used the findings of our latest research to create a new system of classification.

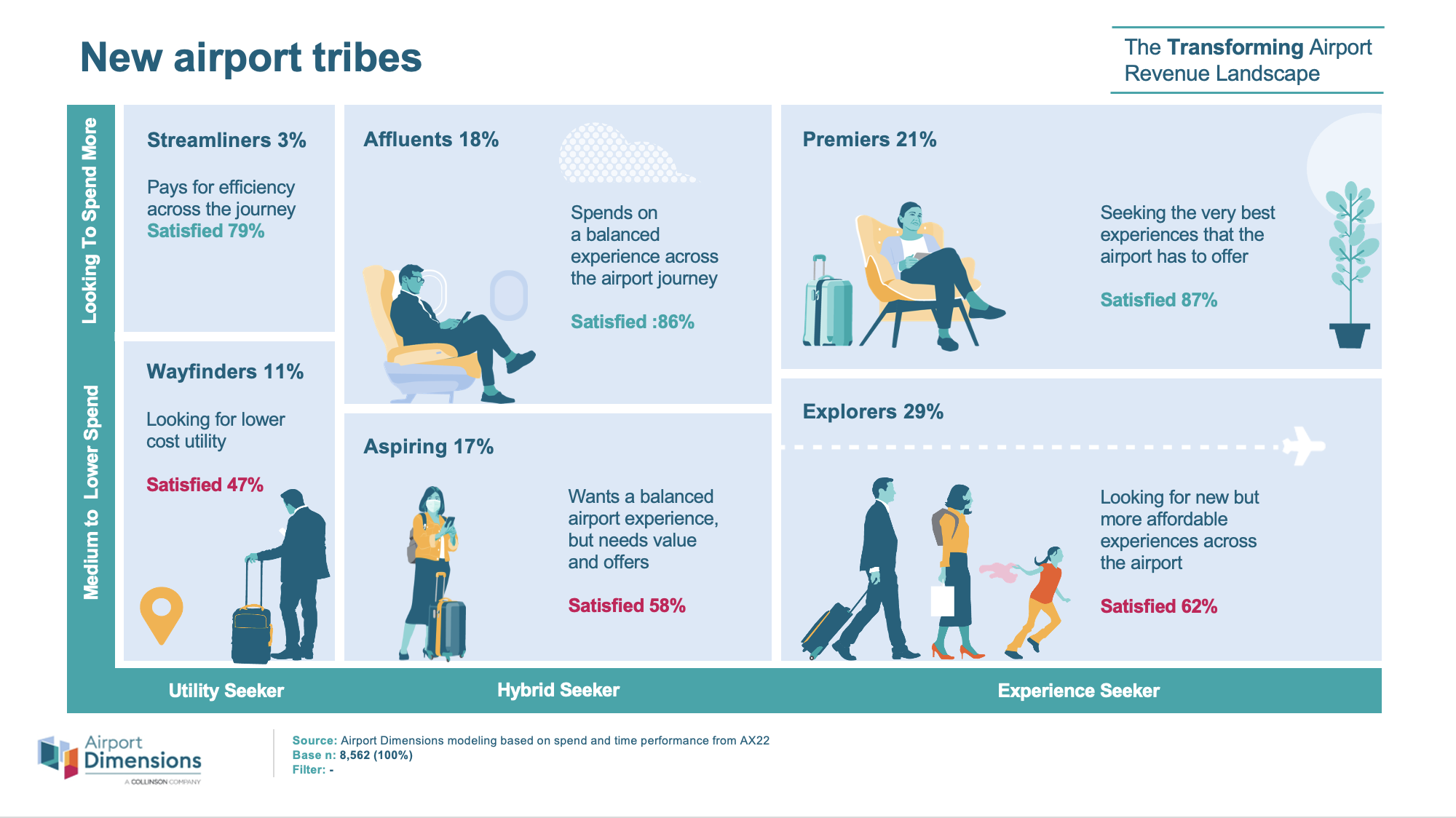

We’ve identified a number of ‘tribes’ defined according to the journey they look for across the airport; whether they are looking for ‘efficiency and utility’ or ‘better experiences’, and whether they are looking to spend the minimum or to spend more.

The tribe we call ‘Premiers’, which represent 21% of the passenger community, are looking for the best experiences the airport can provide and are happy to spend more to get it. While represented by all ages, they over index for Millennials and an impressive 87% is satisfied with their airport experience.

The ‘Affluents’ tribe, accounting for 18% of travellers, takes a more balanced approach, looking for both experience and efficiency across the airport journey, but characteristically they are happy to spend more. These wants support the correlation between higher spend and satisfaction, with 86% saying they were satisfied.

Our ‘Streamliners’ are a very niche group representing only 3% of travellers and are simply looking for the maximum efficiency across their journey. But importantly, they are happy to pay for that the privilege. Despite their need for utility as a group, they are generally happy, with 79% reporting they were satisfied.

It is among the segments who are less ready to spend where satisfaction is lowest. ‘Wayfinders’ (11% of travellers) look for low-cost utility and under half (47%) are satisfied. Only just over half (58%) of what we call ‘Aspiring’ (who want a balance of utility and experience and who make up 17% of travellers) say they are satisfied. Similarly, under two thirds (62%) of what we call ‘Explorers’ who seek low budget experiences and make up 29% of travellers say they are satisfied.

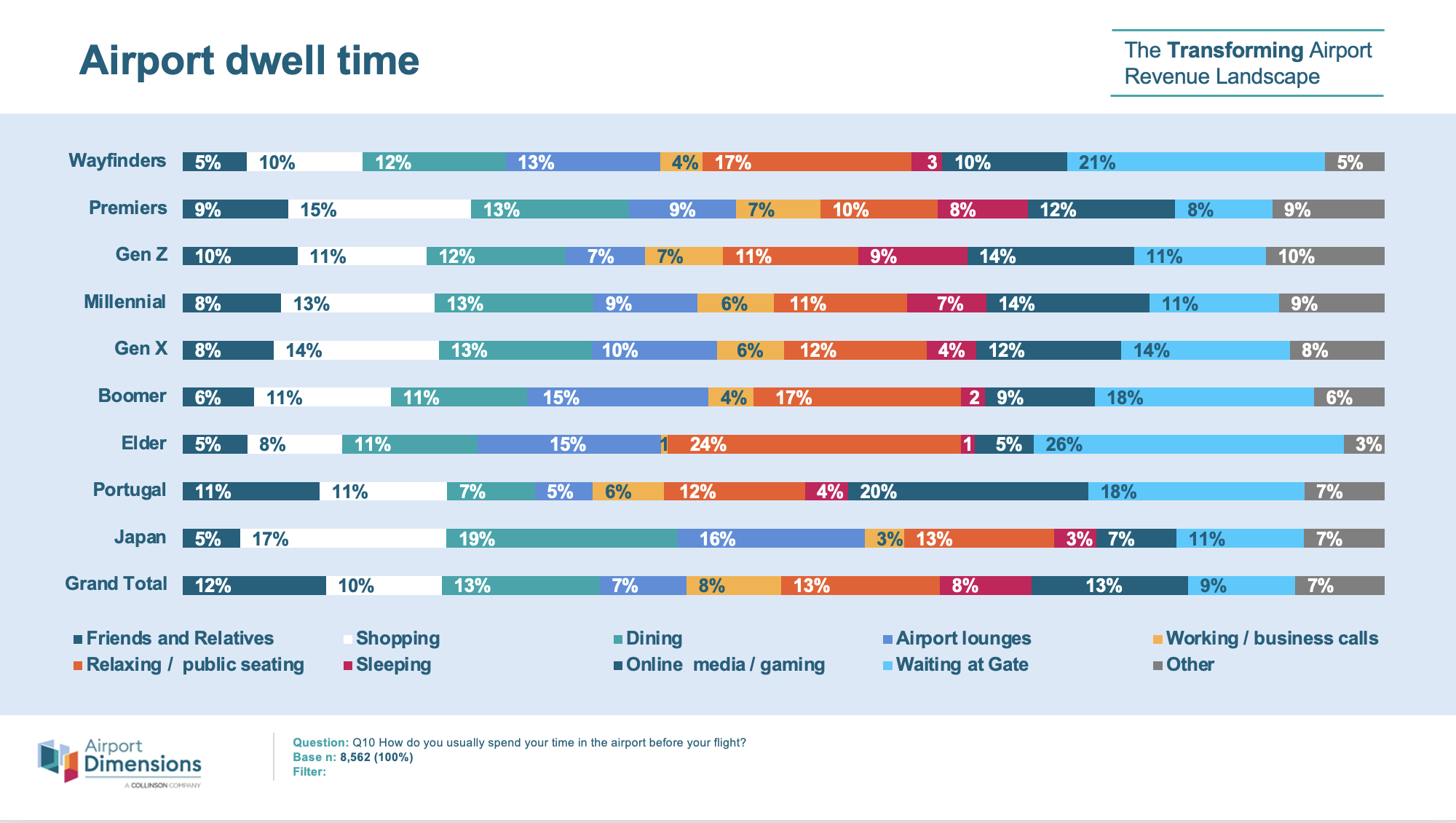

There are significant differences in how each of these tribes want to spend their time at the airport. Premiers spend on average 15% of their time shopping, compared with the 10% spent by Wayfinders.

Wayfinders are much more likely to head to the gate, and pass 21% of their time there, compared to Premiers who cut it much more finely and are there for just 8% of their time. Interestingly, the amount of time spent in lounges is not dissimilar – 10% for Wayfinders and 12% for Premiers.

Airports need to be better at capturing data about their customers so they understand what they want from their own travel experience, so they can offer them the right proposition at the right time. Only by really getting to know their passengers, (by giving them the right ‘labels’), can they increase satisfaction and make their passengers love them a little more.

*Click here for the first, second, third and fourth parts in this series that explores the findings of Airport Dimensions’ latest Airport Experience research.

Note: The Moodie Davitt Report publishes a regular Newsletter titled Airport Consumer Experience, in association with Airport Dimensions, dedicated to airport guest services and experiences. To subscribe free of charge please email Kristyn@MoodieDavittReport.com headed ‘Airport Customer Experience’. All stories are permanently archived on the Airport Consumer Experience page on this website.