JAPAN. To ease the burden of growing public debt and the cost of caring for its ageing population, Japanese lawmakers are set to increase consumption tax from 8% to 10% in October, writes Senior Retail and Commercial Analyst Min Yong Jung. Retailers and brands expect sales from locals to fall but hope an increase in revenue from foreigners enticed by tax free products will make up for some of the shortfall.

The decision to increase the consumption tax was postponed twice, in November 2014 and June 2016, but both local media sources and government representatives have since reaffirmed the government’s plan to proceed with the increase as planned in October.

Japan’s consumption tax

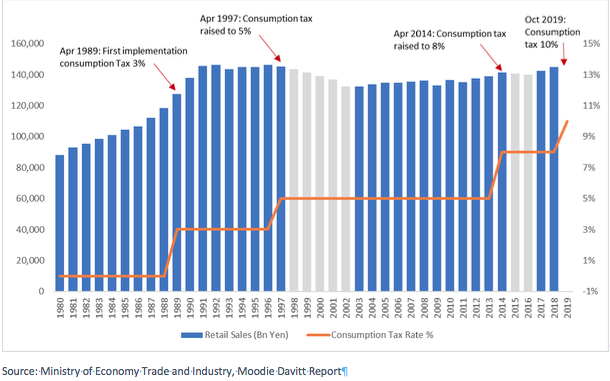

Japan first implemented the Federal Consumption Tax in 1989. Faced with a declining tax revenue and heavy dependency on income tax, the Japanese government looked to a new consumption tax to increase government revenue and improve public finances.

Unlike other tax systems around the world, Japan’s consumption tax is a regressive system that charges consumers a flat rate of 3%. Since its implementation and despite public resentment, the tax rate was hiked up to 5% in April 1997 and again to 8% in April 2014.

Prime Minister Abe was responsible for the latest increase to 8% and reaffirmed the government’s plan to increase the tax to 10% in October 2018. The timing of the increase to 10% is unfavourable for the Abe administration because of upper house elections scheduled for July 2019 and because the government assessment of the economy was recently lowered to ‘worsening’ for the first time since January 2013. This reflects a deterioration in the index of economic conditions compiled by Japan’s Cabinet Office.

Should the tax hike proceed as planned, 7.8% of proceeds will go to the central government and the remaining 2.2% will go to municipalities. Additional details announced in January 2019 shows that taxes on food and beverages taken out of stores for consumption will remain at 8% while the same food and beverage items will be taxed at 10% if consumed within stores.

This has prompted store owners to put up signs asking customers to specify if they will be staying on the premises or opting for a takeout. Starbucks Coffee announced last week it will charge 8% for take out and 10% for those staying in the stores. Others may follow or choose to apply the same tax rate for takeout or eating in.

The government states that the differences in the tax rate of food & beverage and other measures yet to be implemented will ensure no repeat of the economic recession following earlier increases in the consumption tax.

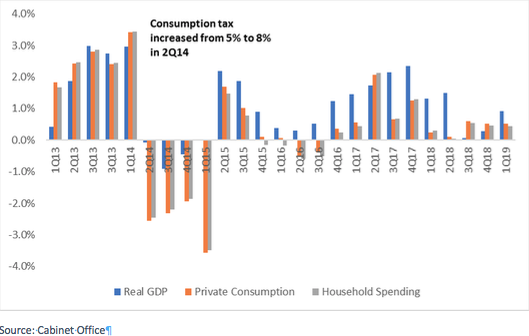

Following the last two consumption tax hikes in 1997 and 2014, Japanese consumers, known for favouring savings over spending, responded to the government’s action by tightening their belts and reducing spending. Retail sales declined for five years post the 1997 tax hike and for two years after 2014.

The Bank of Japan estimates that the tax burden from the increase to 10% in October would translate to about ¥2.2 trillion in additional tax costs for consumers and the overall burden this year will be lower than the 2014 consumption tax hike, which provided additional taxes of around ¥8.0 trillion.

While the government’s estimates could assure voters and legislators before the implementation, the public and political backlash against the government will worsen should it be proven wrong. The government was proven to be inaccurate in 2014 when the estimate for 1.4% GDP growth turned into a -0.4% contraction with lacklustre consumption and retail spending.

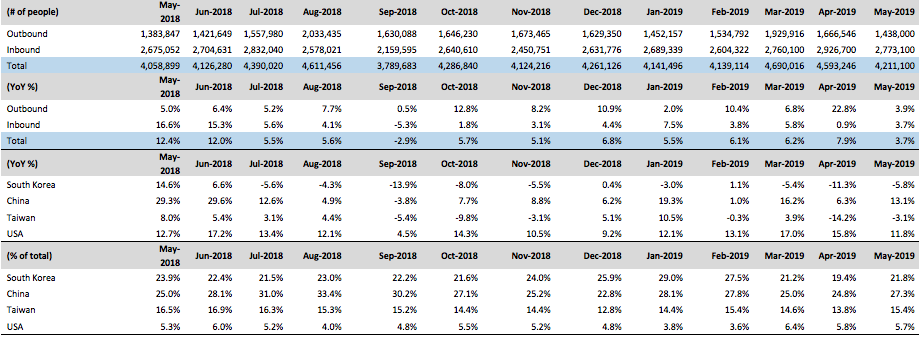

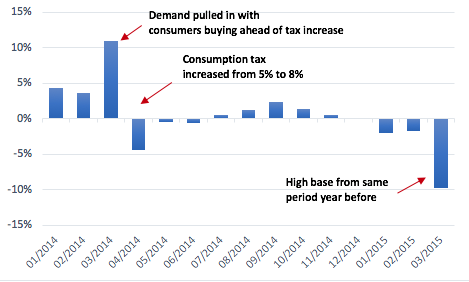

As the table shows below, consumption was pulled back into March 2014, the month before the consumption tax hike, suggesting consumer brand companies will focus product marketing and promotions to buffer against the negative months that will follow.

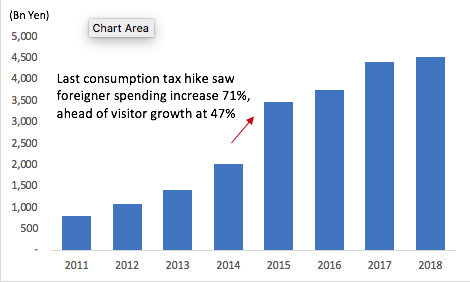

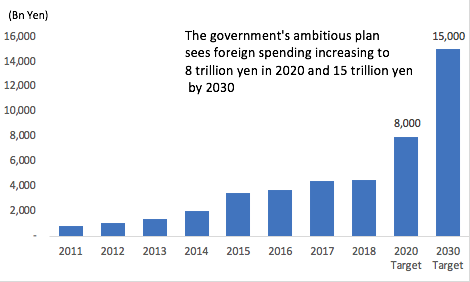

Despite the difficulties that are expected from the planned tax hike, some reprieve should follow from growing sales from visiting foreigners. According to the Japan Tourism Agency, spending by foreigners grew to JPY4.5 trillion in 2018, up 123% since the last consumption tax hike in 2014. The government has ambitious plans to grow tourism receipt from foreigners to JPY8 trillion yen in 2020 and JPY15 trillion yen by 2030.

Retailers who continue to prioritise gaining share of growing foreign spend expect to grow in line with the market while the consumption tax rate helps make spending more appealing to foreigners who have added incentives to purchase products that are relatively cheaper after the tax increase. Retailers remember the last consumption tax hike fondly; despite local spending declining, spending from foreigners increased 71% in 2015, well ahead of visitor growth at 47%.

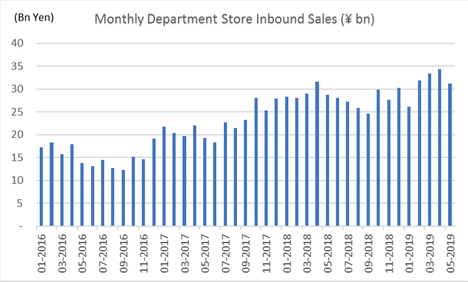

Department stores have benefited from the growth of Chinese visitors and resellers who use the channel to purchase cosmetics and luxury products. Buoyed by Chinese spending, cosmetics purchases have grown for 49 consecutive months, in sharp contrast to local spending that has declined for much of that period.

Despite a brief setback in January 2019 when department store sales declined 8.1% with resellers and visitors cautious following the implementation of China’s new e-commerce law, inbound sales growth has recovered to 14%, 15% and 9% in February, March and April 2019. The latest commentary and data published by individual companies ahead of the Japanese Department Store Association suggests May is well ahead of expert predictions of a much more difficult scenario.

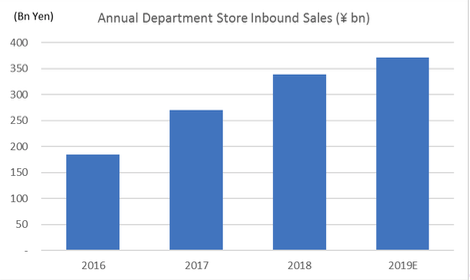

Should the current run rate hold, inbound sales at department stores could record JPY372 billion in the year, up 10% from last year. The emphasis on inbound sales will grow as the impact from the consumption tax increase is expected to dampen local consumer sentiment.

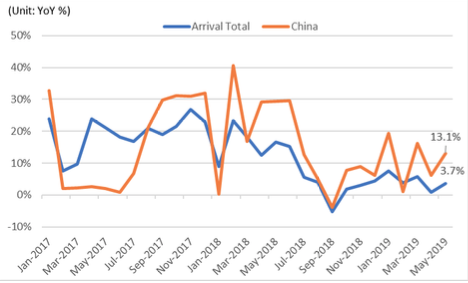

Chinese visitor arrivals to Japan remains robust, aided by visa deregulation that allows for multiple-entry visas and the ease of obtaining student visas. According to the Japan National Tourism Organization, Chinese arrivals to Japan grew 13.8% year-on-year in May 2019, surpassing 756,400 and growing at a faster pace than the total arrivals growth rate of 3.7%.

The higher price of travel and accommodation during Japan’s Golden Week Holiday (28 April to 6 May) dissuaded some visitors from two key source markets (South Korea was down 5.8% year-on-year and Taiwan 3.1%) from visiting Japan but this seemed to have little impact on Chinese visitors.

Chinese visitors, as a share of total arrivals to Japan, reached 27.3% in May, up from 25% in the same period last year, underlining the growing reliance of Japanese travel and travel retail on China.