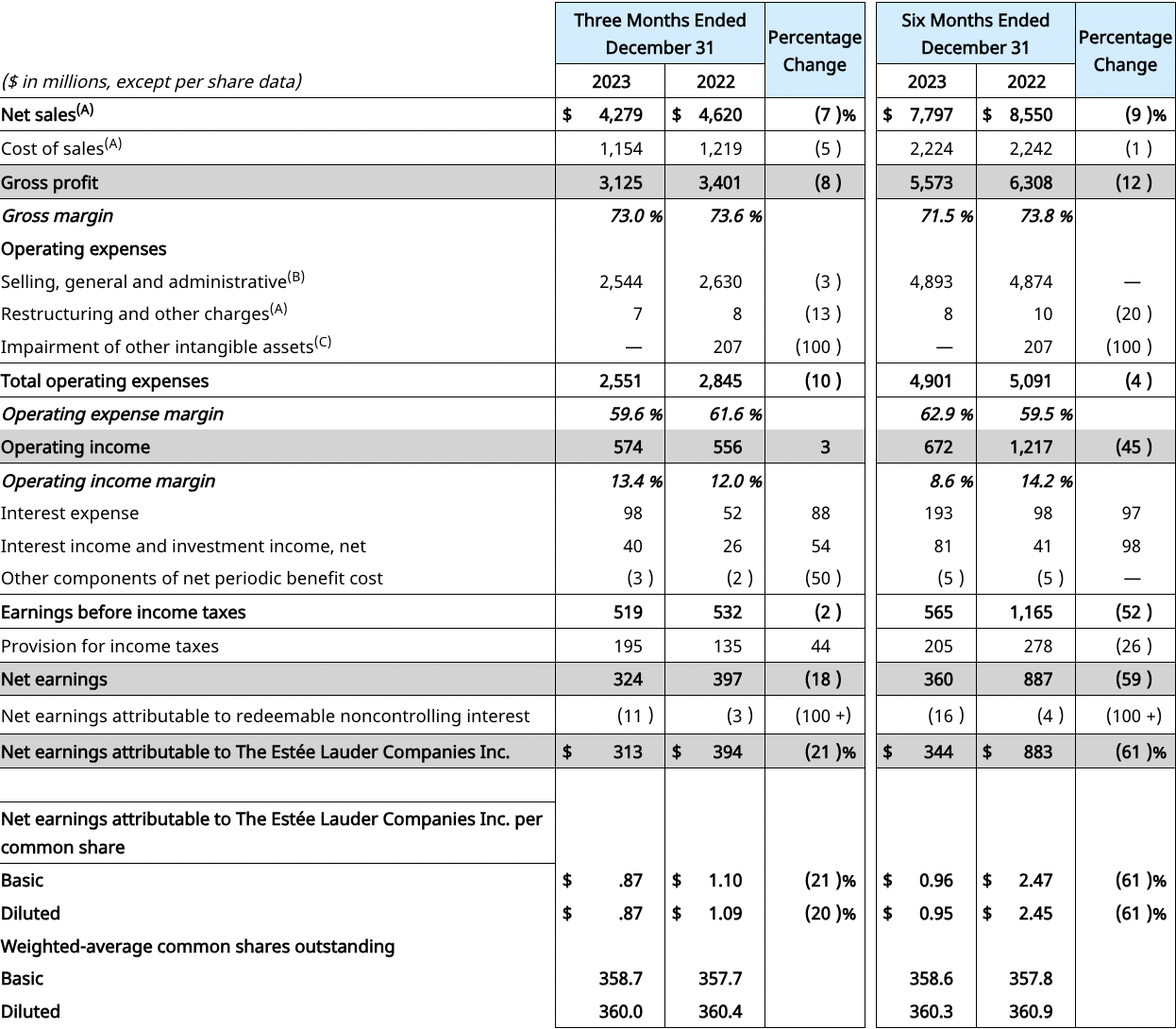

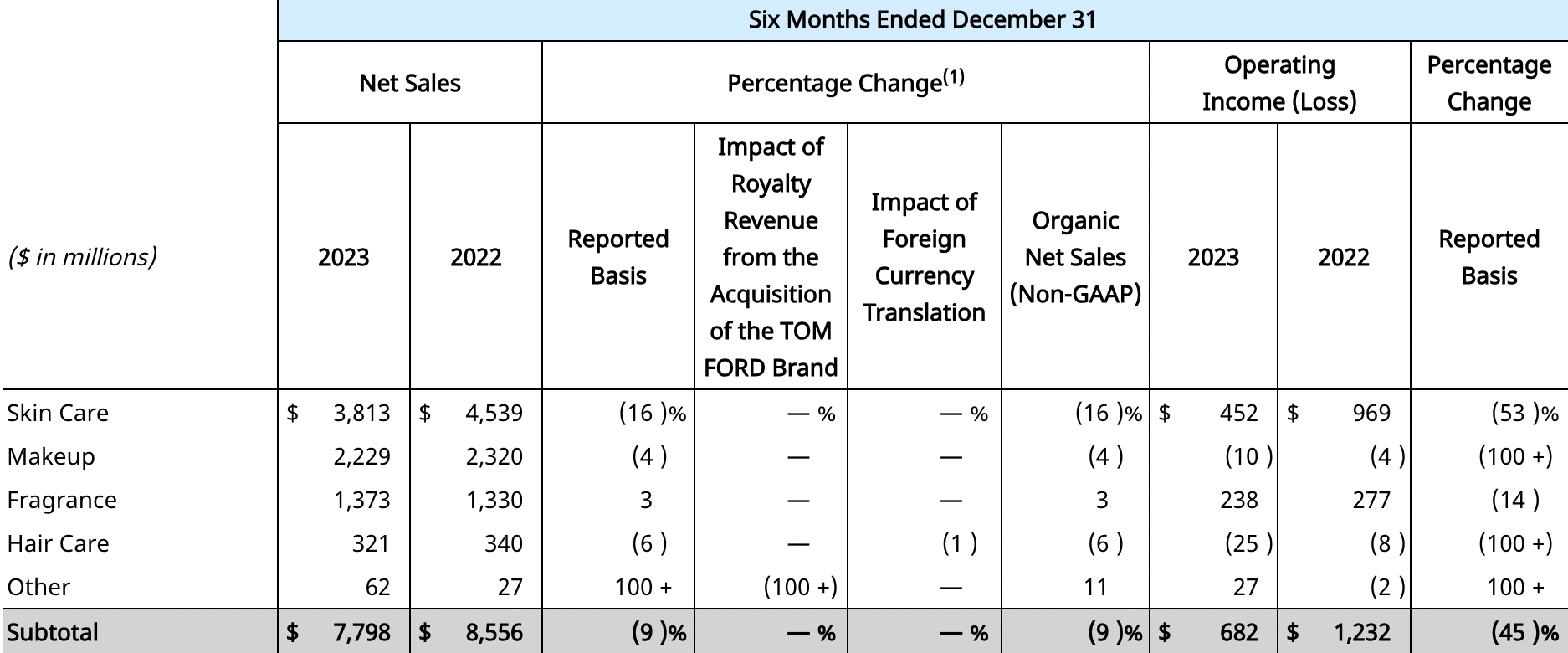

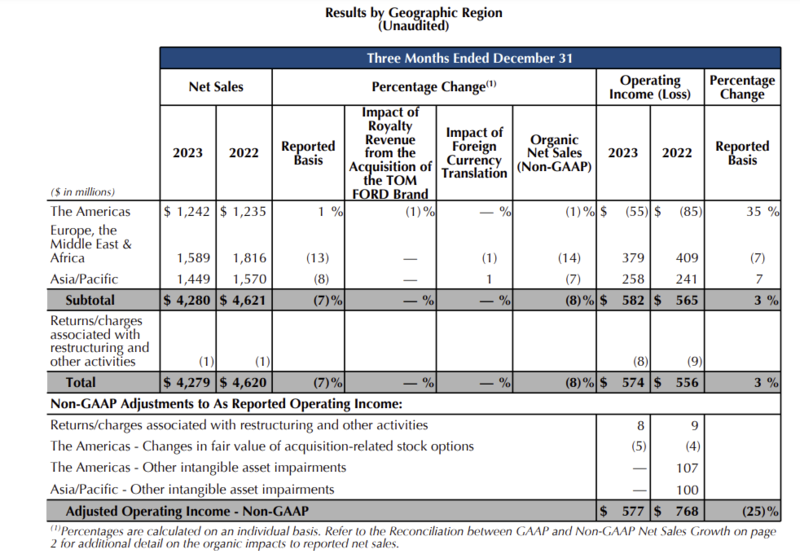

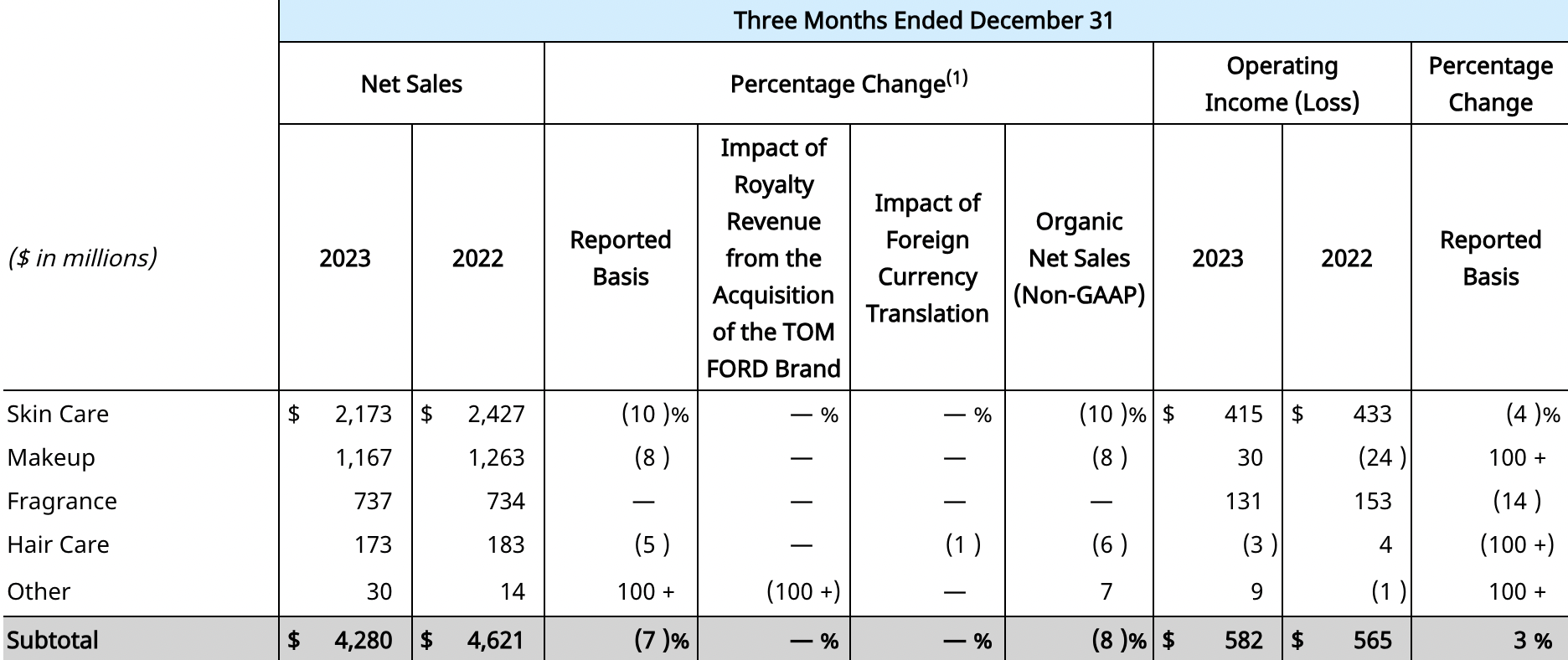

Ongoing travel retail challenges in Hainan and South Korea and a slowdown within Mainland China’s prestige beauty segment were the key drivers of an -8% year-on-year fall in Q2 organic net sales for The Estée Lauder Companies (see our results story here).

Speaking on a post-results earnings call yesterday, The Estée Lauder Companies President and Chief Executive Officer Fabrizio Freda said, “Organic sales in our global travel retail business decreased -28% with retail sales trends better than organic performance, reflecting both the execution of our priority to reduce trade inventory in alignment with retailers and efforts by various local authorities to contain unstructured [i.e. daigou -Ed] market activity.”

In a further reference to the challenges in North Asian travel retail posed by the respective 2023 crackdowns on daigou trading in Hainan and South Korea that led to the inventory glut, Freda said, “We made meaningful progress with trade inventory levels in Asia travel retail and continue to expect to be at normalised trade inventory levels by the end of the third quarter of this fiscal year.”

The dragging effect of such an historically important channel of business for the US beauty group was underlined by Freda’s comment that outside travel retail, the global business decreased just -3% organically – mainly due to Mainland China.

“Our global retail sales growth excluding travel retail and Mainland China rose mid-single digits,” Freda said.

The -10% year-on-year fall in organic net sales for skincare was driven by the respective – and to some degree related – challenges in travel retail and Mainland China. Makeup’s organic net sales fell -8% year-on-year, affected by the “persistent” challenges in Asia travel retail.

Freda said, “We expect organic net sales for our third quarter to increase +3% to +5% as both our businesses in Asia travel retail and in Mainland China are expected to return to growth. In Asia travel retail, this growth assumes the continued reduction in retailer inventory as well as the anniversary of some business disruptions we experienced last year.”

Freda was asked on the call about structural changes in the key Chinese beauty market – including the consumer perception of the category, changes in daigou selling, promotional impacts and mass brand performance.

He responded, “We had some soft consumer sentiment in the recent period that drove this lower prestige sales growth. However… we remain very optimistic about the long term opportunity in China and continue to invest for growth.

“Our brands are really, really strong. The retail sales growth has been much better than the net growth. There has been extraordinary, double-digit growth on many of our brands, particularly in luxury – like La Mer, Tom Ford, Jo Malone, Bobbi Brown, Kilian, Frederic Malle and Aveda. Also, Le Labo continues to track.”

Commenting on the important balance between travel retail and domestic channels in China – a perennial tension for many leading brands – Freda said, “In the relationship with travel retail and in the managing of the overall pricing and promotions across the China consumer framework, we have dramatically improved the process between the China team and the TR team in making decisions about promotionality, pricing and channel prioritisation.

“This is working better and better for the future.”

Barclays Investment Bank Managing Director Lauren Lieberman raised the issue of the “unstructured” market in the future, asking, “What are you or aren’t going to do in terms of regulating the degree of participation? Because I think it has a lot to do with how we should be thinking about and modeling the absolute size of the travel retail business in dollar terms as we look out over the next several years.”

Freda replied, “Our focus is on travellers and travellers converting. That [passenger traffic] is getting better and better around the world. Apart from the China situation that we have discussed many times, in the rest of the world there is extraordinary progress in this area – double digits, in some cases triple digits in every market of the world. So this will happen more and more – also in China, also in Korea and also in parts that have been the slowest to recover.”

He said that while traveller numbers have been improving “very, very nicely” conversion to shoppers has been “below expectations”.

“The unstructured market as such is reducing,” Freda continued, partly because of government regulations in some cases [a reference to South Korea and Hainan], partly due to retailers’ responses and partly due to ELC’s own approach.

“So you should expect that the unstructured market will be reduced as a market and will be reduced for us. It will be reducing in a gradual way as the [number of] travellers improve and increase over time.” ✈

Travel retail headwinds but “we remain buy rated” – Goldman Sachs Equity Research Goldman Sachs Equity Research said The Estée Lauder Companies’ Q2 performance saw a sharp sequential improvement in gross margin driving an EPS (earnings per share) beat. This was coupled with revenue marginally ahead of the FactSet consensus estimate (US and China were soft while EMEA/global travel retail was less bad than expected), the firm said. “All-in, results were mixed but the outlook reaffirms management’s expectation for a sharp 2H inflection, while the bolstered productivity program supports medium-term EPS expectations. “Most investors we speak with were cautious going into the event and expected a more negative guidance revision; we expect the stock to trade higher in this context.” Given its historically high internal share, travel retail sales came under particular scrutiny with the firm noting the double-digit increase in sales through the channel. Asia Pacific came in below expectations with organic sales growth of -7.0% (vs. Goldman Sachs/consensus -2.0%/-4.0%) as declines in Mainland China more than offset gains in Hong Kong. Goldman Sachs remains Buy rated on EL with a 12-month price target of US$141. Key risks to both rating and price target include a more protracted-than-expected recovery in Asia travel retail sales, a “slower-for-longer” performance of its US business, weaker-than-expected ongoing growth in Mainland China and/or greater cost to compete in China than Goldman Sachs currently assumes in its model. |