|

ITALY. Travel retailing-to-catering giant Autogrill today posted a +19.2% rise in consolidated revenues for 2008, which it described as “in line with board objectives”.

The company said it was on course with previously announced targets, despite the downward trend in the global economic scenario, “which became particularly evident in the last quarter”.

“Autogrill organized itself to overcome the effects of the contraction in traffic caused by the global economic crisis,” said Autogrill Chairman Gilberto Benetton. “Our management has dealt with emergencies in the past and knows how to deal with them in the long term. In this new context we will maintain the cash flows we originally forecast in order to gradually reduce our net financial indebtedness.”

|

“Our management has dealt with emergencies in the past and knows how to deal with them in the long term.“ |

Gilberto Benetton Chairman Autogrill |

Key figures were as follows:

• Food & Beverage revenues: €3,924.6 million, up +1.2% on €3,877.6m in 2007

• Travel Retail & Duty Free revenues: €1,438.7 million, up +116.9% on €663.3 million in 2007

• Inflight revenues: €431.2 million, up +34.6% on €320.4 million in 2007

• Consolidated EBITDA: €601.5 million, up +7% on €562.4 million in 2007, after restructuring costs (€20.2 million)

• Investments: €337.3 million, up +21.2% on €278.2 million in 2007

• Net profits, Group: €123.2 million against €158.1 million in 2007, due to acquisitions

• Net financial indebtedness: €2,167.7 million against €1,162.2 million at 31 December 2007.

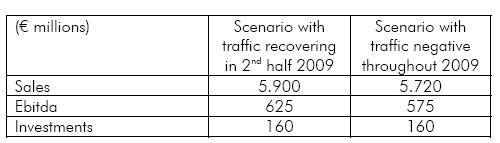

On the outlook for 2009, Autogrill said that consolidated revenues are expected to be between €5,720 million and €5,900 million, with EBITDA between €575 million and €625 million, on the basis of two forecast traffic levels (see below for full details and charts). “One sees a sustained contraction throughout 2009, the other a gradual recovery in the second half”, the company noted.

STRONG TRAVEL RETAIL EXPANSION

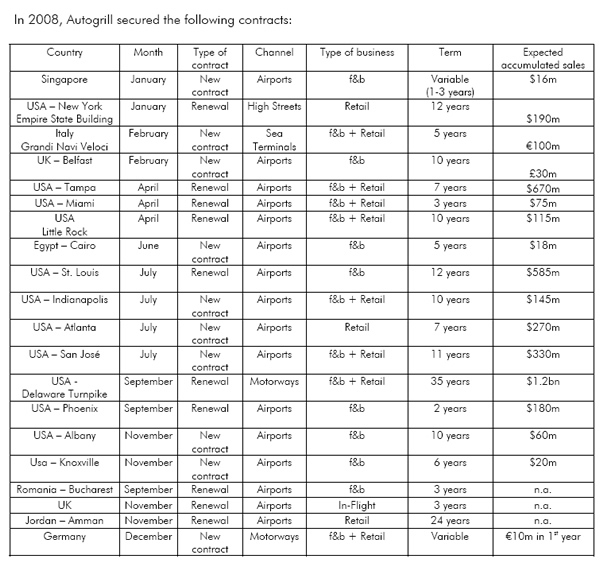

Autogrill said that 2008 saw strong expansion in the travel retail sector, thus enabling the Group to strengthen its global leadership in food & beverage (F&B) and retail services for travellers.

But it noted: “This phase coincided with a significant worsening in operating conditions: traffic levels, high volatility of energy and raw materials prices, and the effects of the financial crisis on the real economy in the countries most important to the Group – the United States, the UK and Spain.

“In this context, the Group acted rapidly to exploit stable conditions on the markets in the first half and launched a wide-reaching programme of re-organization across all its business sectors.”

Consolidated income results

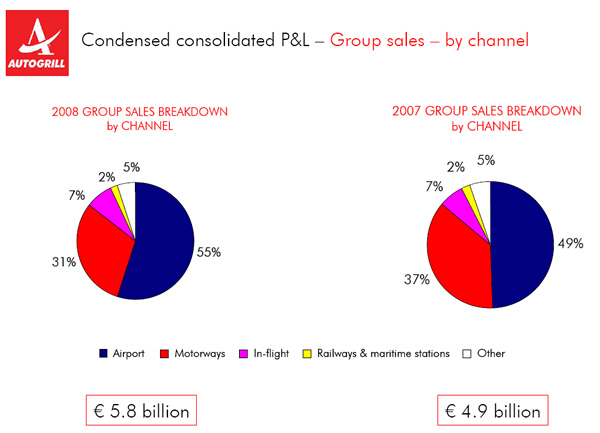

Autogrill closed 2008 with consolidated revenues of €5,794.5 million, up +19.2% (24.6% at constant exchange rates). The result reflects recent acquisitions – Alpha Group results were included for the full year (in 2007 from 1 June only), Aldeasa (from 1 April 2008) and World Duty Free Europe (since 1 May 2008).

Despite the tough macro-economic situation and exchange rate impacts, Autogrill posted organic growth of +2.5% (net of results by acquisitions).

Fourth-quarter dip

While consolidated revenues in the fourth quarter rose +15.7% (+16% at constant exchange rates) to €1,556.1 million due to acquisitions, a negative organic change (down -2.5%) reflected the “drastic contraction in traffic, especially in airports”, in the Group’s main countries of business in the last quarter, Autogrill said.

In the food & beverage sector, the Group posted sales of €3,924.6 million, up +1.2% (+4.7% at constant rates) year-on-year, against a negative trend in traffic levels, particularly in the last quarter. That quarter saw F&B revenues rise +3.5% (+0.7% at constant exchange rates) to €1,071 million.

The travel retail & duty free sector’s contribution to consolidated sales in 2008 reached €1,438.7 million, up +116.9% (+129% at constant rates) reflecting the flurry of acquisitions.

Autogrill noted: “This strong growth demonstrates how important the business has become for the Group. In the fourth quarter, travel retail & duty free contributed €394.4 million to group sales, up +108.8% (+124.5% at constant rates). Revenues arising from acquisitions amounted to €242.5 million.

In 2008, the Inflight sector contributed €431.2 million to Group revenues, up +34.6% (+56.7% at constant rates). Again consolidation skewed the figures – Alpha was stated for a different period of time; and Air Czech Catering’s results were consolidated under this sector as from 1 April 2008. In the last quarter, the sector was hit hard with sales down -24.7% (-8.2% at constant rates) to €90.7 million, reflecting the failure of the carrier Excel.

|

EBITDA affected by changing business mix

In 2008, Autogrill posted consolidated EBITDA of €601.5 million, up +7% (+11.7% at constant rates) over the same period in 2007. Results by acquisitions amounted to €90.6 million, while there was a non-recurring charge of €20.2 million for the re-organization plan.

The EBITDA margin, at 10.4% against 11.6%, also reflects the higher proportion of travel retail and duty free business, which yields lower margins than food & beverage. Net of these factors, the EBITDA margin in 2008 was 11.1%.

In the fourth quarter, consolidated EBITDA amounted to €141.9 million, up +17.2% (+14.5% at constant rates) year-on-year.

Net financial position

At 31 December 2008, the Group’s net financial indebtedness stood at €2,167.7 million against €1,162.2 million at 31 December 2007.

|

INCOME RESULTS AND DETAILED PERFORMANCE BY BUSINESS SECTOR

Food & Beverage

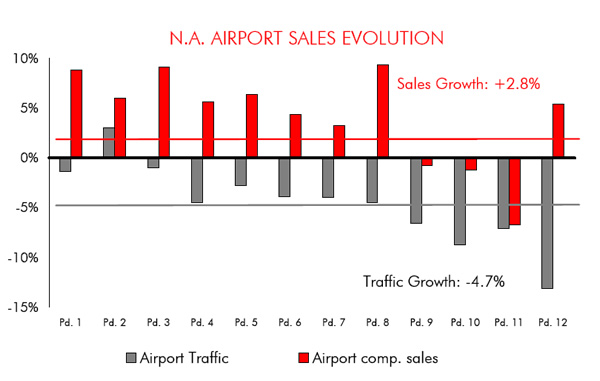

As mentioned, sales in the food & beverage sector in 2008 amounted to €3,924.6 million, up +1.2% (+4.7% at constant rates) year-on-year. The Group said it continued to outperform traffic trends in the main channels (airports and motorways) and countries (North America, Italy and Rest of Europe), with growth in sales even when traffic was slowing down, above all in the last quarter.

In North America, the airport channel grew +5.4% against a -4.7% contraction in passenger traffic. In the Rest of Europe (excluding Italy), double-digit growth rates were seen in both airports (up +18.7% at current rates and +20.2% at constant rates) and railway stations (up +13.4% at current rates and +12.9% at constant rates).

In the troubled fourth quarter, when F&B revenues amounted to €1,071 million, up +3.5% (0.7% at constant rates) North American airport channel sales were down -0.4% against an -8.9% contraction in passenger traffic. In the Rest of Europe, airports were down sharply (-6.9% at current rates, -4.5% at constant rates).

|

Travel retail & duty free

Compared to full-year 2007, the travel retail & duty free sector posted revenues of €1,668.2 million, down -3.7% (but up +3.9% at constant rates), reflecting unfavourable exchange rates and traffic trends.

In Spain, traffic was penalized by the macroeconomic situation (down -3.2%), while the Group’s results were also aggravated by the depreciation of the Pound Sterling against the Euro (reducing the purchasing power of passengers to and from the UK).

In the UK, positive results at Heathrow Airport (with the opening of Terminal 5) and Manchester Airport helped offset slack traffic. The positive sales trend (+4.8%) was also favoured by the depreciation of the Pound Sterling, which stimulated purchasing by international passengers.

In the Rest of the World the positive results were mainly by airport operations in Mexico, Kuwait, Chile and Jordan.

However in the fourth quarter, the “spiralling economic crisis” further damaged traffic in Spain (down -12.7%) and slowed growth in the UK (Heathrow traffic down -3.6%). The quarter closed with revenues of €394.4 million, down -9.3% (-1.2% at constant rates).

The travel retail & duty free sector, which Autogrill noted now negotiates with suppliers on a global basis following integration [of Alpha, Aldeasa and World Duty Free], posted EBITDA of €143.1 million (net of a €10.9 million restructuring charge), up +2.4% (+9.3% at constant rates) on the previous year.

In Aldeasa’s heartland of Spain, the positive trend of cost of sales and the general policy of rationalizing costs made it possible to cushion the impact of the slowdown in business, Autogrill said.

In the UK, the sales margin was “more or less stable” despite a slight deterioration in the passenger mix (a higher proportion of European passengers).

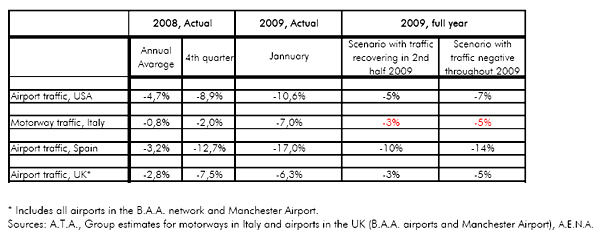

ASSESSING THE OUTLOOK

As mentioned, Autogrill said that uncertainty over how long it will take to recover from the serious recession affecting the world’s major economies makes it necessary to envisage two scenarios (see table) for 2009 based on possible trends in traffic in the main channels and countries – airport traffic in the USA, Spain and the UK; motorway traffic in Italy – in relation to 2009 and the last few months.

|

In the first scenario, the drastic slump in traffic seen in January continues for the whole year, whereas in the second the trend is still negative but with a gradual recovery in the second half of 2009.

On this basis, Autogrill expects to produce results in the following ranges (see table below):

|

2009 TRADING UPDATE

In the first nine weeks of 2009, the Group posted sales of €771.4 million, up +12.4% (+9.9% at current rates) on the same period in 2007. On an organic basis, there was a downturn of -5.9% due to the marked contraction in traffic in January.

[comments]