INTERNATIONAL. Autogrill, the new owner of World Duty Free (Europe), today posted +23.7% in top line growth with consolidated revenues reaching €4,861 million for 2007.

Consolidated Ebitda rose +9.6% to €563.3 million, while net profits increased by +4.1% to €158.7 million.

Net financial indebtedness reached €1,162.2 million, of which €444.2 million was due to the Alpha Group acquisition in 2006.

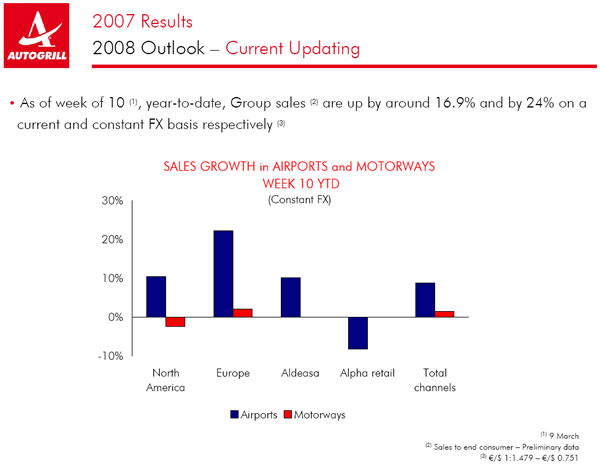

2008 has started well, the group said, with revenues rising by +16.9% year-on-year in the first 10 weeks of the year.

Autogrill said its consolidated revenues in 2008 should reach around €6 billion, including the remaining 49.95% of Aldeasa and 100% of World Duty Free Europe, the BAA retail subsidiary which it last week reached agreement to buy for £546.6 million.

|

Autogrill’s duty free and travel retail operations continue to grow in importance |

2007: A YEAR OF GEOGRAPHIC AND CONTRACT EXPANSION

In 2007, Autogrill saw significant growth through acquisitions, new contracts and contract extensions that strengthened its position in geographical regions where it had a low profile (such as Asia and the Middle East). And it consolidated its presence in markets it had already developed (Europe and North America).

| |

The composite ‘travel service’ businesses of World Duty Free, Aldeasa and Alpha Group should realise around €1.7 billion in sales | |

The acquisition of Alpha Group enabled it to expand in the UK airport concession market, boost its growth capacity in Eastern Europe and increase its geographical coverage, especially in India.

Spanish travel retailer Aldeasa continued to grow, buoyed by extensions to its airport agreements in Spain (other than Madrid Barajas, already extended to 31 December 2009).

Aldeasa also commenced operations in the US – in tandem with sister company HMSHost at Atlanta International Airport (the world’s biggest by passenger traffic) – and gained the contract in Saudi Arabia (in partnership with Al Musbah) to operate the country’s first five duty free stores.

REVENUE ANALYSIS BY REGION

Autogrill said its +23.7% gain in consolidated revenues (+29% at constant exchange rates) was driven by good results in North America and Italy and by Aldeasa producing organic growth of +12.4%.

Business in North America saw a +14% increase in revenues thanks to good results in the airport channel. The Alpha Group acquisition in the UK and the fall of the Dollar against the Euro changed the impact of this region on consolidated sales, which moved from 47.1% in 2006 to 39.8% in 2007.

Driven by good results in Italy and new acquisitions, Europe enjoyed +12.3% growth in revenues and which accounted for 39.6% of Group sales. Aldeasa contributed 8.5% of consolidated revenues, while Alpha Group (from June to December) produced 12% of total sales.

|

An early snapshot of 2008 performance: Aldeasa sales, driven by new business, are up; Alpha Group down (mainly due to the ending of an inflight contract with easyJet; HMSHost up |

REVENUE ANALYSIS BY CHANNEL

In terms of sales per channel, the increase in revenues was driven by the airport sector, which rose +25.8% (+34.4% at constant exchange rates) to €2,403.1 million.

The acquisition of Alpha Group also brought inflight business revenues. These generated consolidated sales of €320.4 million (6.6% of Group revenues) in the June-December period.

|

Autogrill underlines the strength of its ambition |

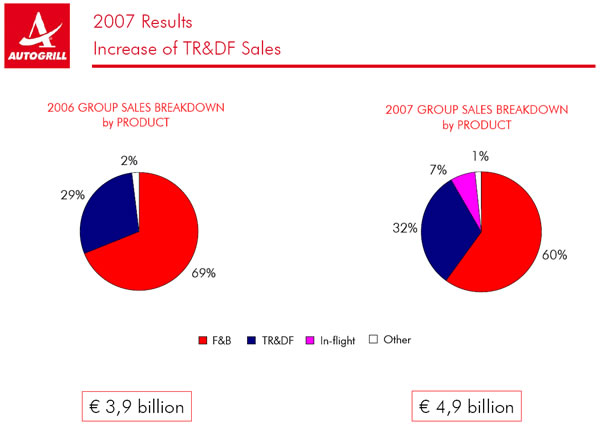

The biggest increases by business type across the group were in retail and duty free. Double-digit growth in Italy and by Aldeasa together with contributions from Alpha Group and CBR Incorporated upped the shares of revenues from retail & duty free from 29.3% (€1,150.7 million) in 2006 to 31.7% (€1,539.9 million) in 2007.

Food & beverage continued to be the Group’s biggest business with 60% (€2,916.6 million) of consolidated sales. Down from 68.8% (€2,703.7 million) in 2006, the internal market share reflects the reduced impact of acquisitions (all mainly affecting the retail sector) and the depreciation of the Dollar.

STRONG FINISH TO THE YEAR

The last quarter saw double-digit growth in the retail and duty free business (up 3+2.8% at current rates and +36.6% at constant rates), with revenues of €413.4 million against €311.2 million in the same period in 2006. Food & beverage generated revenues of €789.6 million, up +4% (+11.7% at constant rates) while inflight operations contributed €120.5 million

ANALYSIS BY REGION & OPERATION

NORTH AMERICA AND THE PACIFIC

HMSHost in the US closed 2007 with revenues of US$2,651.7m, up +14% year-on-year.

Continual improvement in the commercial offering and extension of service hours meant that growth outstripped the +1.4% increase in passenger traffic (+1.4%), with airport revenues reaching US$2,109.2 million, up +16.4%.

In the fourth quarter, when the impact of acquisitions was lower, revenues amounted to US$807.4 million, up

+11.7% on the same period in 2006. The trend over the first nine months was sustained throughout the last quarter despite a slight decrease in air traffic (-0.8%) with airport revenues of US$643.1 million, up +11.9%.

|

Note the impact of acquisitions on retail. Next year’s chart will be even more dramatic as World Duty Free is integrated |

ALDEASA

Of the Group’s main geographical-organizational areas, Aldeasa (until now a 50-50 joint-venture with Altadis consolidated on a proportional basis) enjoyed the strongest growth in revenues, rising +14.7% to €830.3 million in 2007.

Airport revenues amounted to €812 million, up +16% with good results in Spain (up +10.3%) and overseas (up +38.9%), where new openings in Vancouver and Atlanta strengthened existing operations.

The company posted a strong final quarter with a +13.7% rise in revenues to €202.7 million, driven by increases of +6.5% in Spanish airports and +45.6% in international airports.

|  |

Aldeasa’s new Vancouver Airport operation boosted its international presence | |

Aldeasa’s EBITDA rose +3.8% to €77.2 million. The ratio of the margin to sales moved from 10.3% in 2006 to 9.3% in 2007 due to the upward adjustment of rents in Spanish airport concessions (the extensions were signed in July but applied retroactively as of January) and start-up costs in North America.

In 2007, Aldeasa made investments worth €22.3 million against €28.4 million in 2006. Half the figure served international development, especially the opening of points of sale in North America and in Cancun Airport, Mexico.

In 2007, Aldeasa contributed revenues of €415.1 million and Ebitda of €38.6 million to Autogrill’s consolidated accounts.

ALPHA GROUP

From 1 February (the start of the UK company’s financial year) to 31st December 2007, Alpha Group posted revenues of £550.6 million, up +5.1% year-on-year, with positive results in both sectors of its business.

Its travel retail and food & beverage revenues were up +5.7% to £260.2 million. The UK market grew by +5.4% thanks to steady growth in traffic, while its international sales grew +3.6% overall, driven mainly by results in the US, Sweden and India offsetting the company’s withdrawal from Turkey.

Inflight revenues rose +4.6% to £290.4 million against £277.7m in 2006. The business saw a -1.4% contraction in its UK operations (due to the termination of a number of supply contracts) and a +35.5% increase internationally, mainly in Jordan, Central Europe (Romania) and Australia.

Thanks to the improvement in both inflight and concession business, Alpha Group’s EBITDA in the period February-December 2007 rose +46% to £40 million against £29.7 million in the same period in 2006, its EBITDA margin rising from 5.4% to 6.6%.

[comments]

Your post will appear – once approved – in The Moodie Forum on our home page

MORE STORIES ON AUTOGRILL

The Moodie Report PLUS: Autogrill’s bold ‘new game’ – 17/03/08

Autogrill wins race for World Duty Free in blockbuster US$1.1 billion deal – 09/03/08

Decision imminent on World Duty Free as three front-runners fight it out – 06/03/08