|

“The group is travelling at different speeds and that is our challenge today.“ |

Gianmario Tondato da Ruos CEO Autogrill |

INTERNATIONAL. Autogrill Group’s Travel Retail & Duty Free division is “sprinting ahead” while the Food & Beverage arm is “jogging along” against the backdrop of a tough 2011. That’s the verdict of Autogrill CEO Gianmario Tondato da Ruos, speaking to analysts after the company delivered its annual results yesterday.

As reported, consolidated revenues rose by +4% to €5,844 million for the year ended 31 December 2011, and net profit rose by +26.7%.

The Travel Retail & Duty-Free arm generated revenues of €1,820.8 million, up +10% (+8.7% at current exchange rates) on 2010. Food & Beverage revenues in 2011 amounted to €4,023.8 million, up +1.5% (down -0.1% at current exchange rates).

Tondato noted: “2011 was a very tough year with rises in the price of fuel and in the cost of raw materials. It was a polarised year. We saw diverging trends. In terms of channels the airport business is doing better than well, with the motorways struggling. What we are seeing too is that North America [food & beverage] is speeding up while Europe is slowing down. So the group is travelling at different speeds and that is our challenge today.”

He added: “Travel Retail is sprinting ahead with an exceptional year, and is the star in our portfolio, while the F&B division is jogging along, not fully meeting the expectations that we had at the beginning of the year.”

He said that the Travel Retail performance of a +10% increase in sales and an +18.6% rise in EBITDA “confirms our strategy of four to five years ago” – when the company began its acquisitions of key travel retail businesses. On the other hand, “F&B is in a very difficult environment, although airports in the US are balancing that with a strong performance,” he added.

F&B strategy in focus

Autogrill Chief Marketing Officer Ezio Balarini outlined how the company was reassessing its F&B strategy. He homed in on the company’s deepening relationship with Starbucks, worth €350 million in sales in 2011.

“Brands are important because they are profitable, they give us variety and they make up an interesting package when we bid for space. In the case of Starbucks top brands mean top results and that’s why we work so well with them. It’s a profitable partnership, and we learn from each other.

|

“With them we share our experience on how to build and shape stores – the operational details – but in testing new formats and styles of shop. For instance we are testing a new kiosk with Starbucks in several locations. This is where a full store will not fit, in the main [passenger] flow at a rail station or in a small area at an airport.

“With Starbucks too we are developing a range of consumer pre-packaged products, which can add revenues to the stores we have.

“We are also highly relevant for Starbucks. We deliver higher sales per square metre [at our travel locations] than the city centre store can. We also offer capabilities in terms of our ability to gain entry to concessions for their brand. And we also have certain capabilities in our group in terms of food. Walk past any Starbucks store operated by us at an airport, and you’ll see a greater range of food than at their other locations. That’s part of what we bring to the alliance.

“We now have a strategic partnership with them to exploit synergies, and we have extended our long-term partnership from the US into Europe. In 2011 we opened up the Belgian market at airports, train stations and downtown with Starbucks. We are now bringing Starbucks to airports, railway stations and downtown in France, with the first airport store set to open soon at Marseille. And we’ll extend our cooperation in the Netherlands, where soon we’ll open Starbucks in our motorway network. In 2011 we doubled the number of our Starbucks outlets in Europe, and we’ll double that number again in 2012.”

|

Beyond the Starbucks agreement the company has also re-thought its coffee offer – it sells 150 million cups a year through its own internal concepts – and is relaunching the coffee product it sells at its own stores, beginning in Italy and then rolling out across Europe.

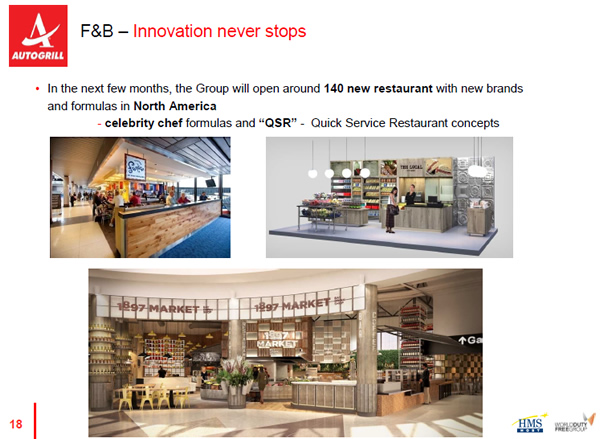

And in addition, it is working on new innovations around F&B concepts. In the US, in the coming months, Autogrill will open more than 140 new outlets. Among the new concepts it is introducing are further celebrity chef restaurants plus quick service concepts.

Balarini said: “In the coming months you will see a never-seen-before range of concepts in our US business, which we will gradually take to Europe, and it will change the shape of the business.”

Travel Retail & Duty Free – towards a single company

Autogrill Chief Strategy Officer Silvano Delnegro commented on the Travel Retail & Duty Free arm, noting that “this is the first year we can definitely say we have one single company in this business.”

“We delivered healthy, balanced growth across geographies in Travel Retail, with EBITDA growing at almost twice the pace of sales, with an all-time high EBITDA margin of 12.5%.

“There is still some work to do [integrating the travel retail businesses] but from now on we’ll be talking more about cross-fertilisation within the group rather than synergies. We are sharing best practices with management both from Aldeasa and from World Duty Free.”

|

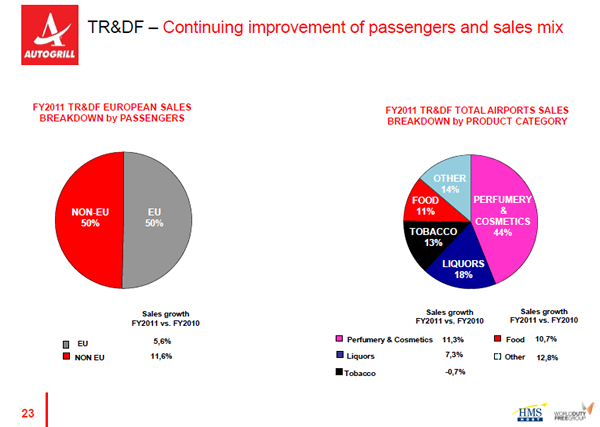

Delnegro also outlined some details of the passenger mix by destination, now split 50:50 between EU and non-EU. He noted: “This is important because the spend of a non-EU passenger is three times that of a domestic passenger, and also +50% higher than an EU destination passenger.”

Sales to non-EU destination passengers climbed by +11.6% in 2011, with sales to EU passengers rising by +5.6%.

Another key factor in sales and also margin terms has been the evolution of the category mix. Perfumes & cosmetics is now 44% of the business, and rose by +11.3% year-on-year in 2011. By comparison, liquor rose by +7.35, tobacco fell by -0.7% and food & confectionery was up by +10.7%.

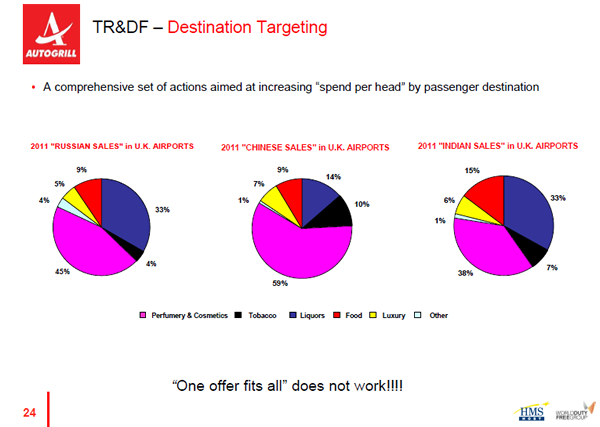

Delnegro also focused on how the group had improved its destination targeting of key passenger groups, notably Russians, Chinese and Indians.

Examples of promotions that worked through better targeting of passenger groups included a Chinese New Year promotion that delivered a +15% uplift in sales.

“Another example,” said Delnegro, “is where we target particular flights with gondola displays that we put in front of the passengers. So we might have a 5am flight to India, an afternoon flight to Tunisia and an evening flight to China. On promotions [of particular cigarette brands – Ed] we produced sales increase of +35% to +40% through this activity.”

He added: “This destination targeting has resulted in us growing spend per head by single digits among those passengers we targeted [in the UK].”

|

Crucially, Delnegro also cited the company’s interest in the Brazil airports privatization programme. He said: “Brazil is a very interesting market both for retail and for F&B. Regarding the privatisation process at the airports, we are following the market to see if there is any opportunity to exploit that.”

On Asia Pacific, Tondato added: “China is on our radar screen and is an important market. We are working hard to understand which are the right opportunities for us. Expanding on Asia, we are already doing well in India, where we are market leader in the airport F&B business, although the average ticket is still small compared to other parts of the business. But it is growing well. The Middle East and Asia is in our future, definitely.”

Outlook

Looking ahead, the company said it was expecting Travel Retail & Duty Free to “compensate” for the weaker performance in F&B in Europe in particular. It also forecast “flat” results for 2012 versus 2011 for the group as a whole.

For 2012, growth was possible if there was a recovery in EU consumer spending, a deceleration of raw material price growth, increases in tourism flow to Spain and continued growth in Latin American economies, the company said.

But it also noted potential risks on the flip side, including a worsening of the European macro-economic situation, a slowdown in US recovery and oil price increases hitting traffic growth.

Tondato said: “Although the market is tough I think we can still do better every day, and there is still growth to come from our existing businesses. Now it’s time to really exploit the potential of the two very different divisions that we operate.”