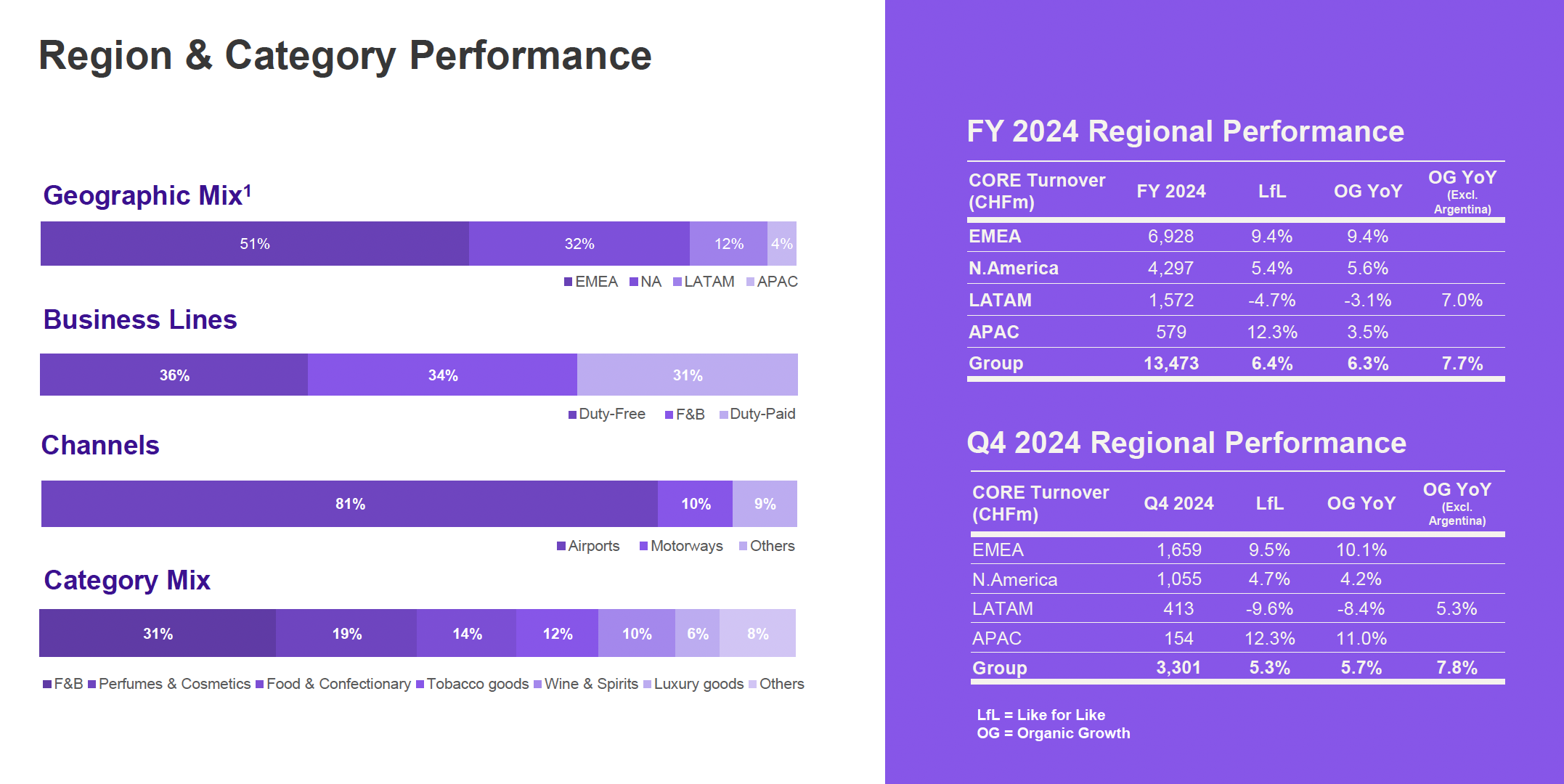

INTERNATIONAL. Avolta today revealed its full-year results for 2024, with consolidated reported turnover reaching CHF13,725 million (US$15,563 million) and core turnover of CHF13,473 million (US$15,271 million), up +8.9% year-on-year at constant exchange rates and +6.3% on an organic basis (+7.7% excluding Argentina). Core turnover excludes fuel sales from the motorway business.

In Q4, core turnover grew +5.7% organic (+7.8% excluding Argentina). The company said, “This momentum reflects continued strong business delivery on the base of passenger growth and demand across our main markets and channels.”

Core EBITDA climbed +12% to CHF1,267 million (US$1,436 million) with a margin of 9.4%, +40bps year-on-year. For Q4, a low season quarter, the EBITDA margin was 7.8%, +30bps year-on-year. Net profit to equity holders of the parent reached CHF386 million (US$438 million), up +25%.

Equity Free Cash Flow (EFCF) 2024 reached CHF425 million (US$482 million), +32% year-on-year.

CEO Xavier Rossinyol said: “Avolta remains committed to driving growth through innovative business development, commercial and digital transformation, capitalising on our global platform. By focusing on delivering exceptional value to our customers, concession and brand partners, we are revolutionising the travel experience.

“Our strategic approach emphasises cost discipline to achieve profitable and cash-generative growth, while simultaneously working towards deleveraging and enhancing shareholder value.

“For two consecutive years we have exceeded our expectations with strong organic growth, driving the travel experience revolution. The recent launch of Club Avolta epitomises our dedication, integrating travel retail and food & beverage into a seamless, data-driven loyalty programme that enhances customer experience. Leveraging our new shop and restaurant concepts, using our framework of Flexible, Smart, Local, Cross-selling and Hybrid, we adapt dynamically, infusing local flavours, entertainment, and design trends into our travel hubs.

“Looking ahead to 2025, despite global uncertainties and geopolitical challenges, our diversified presence in more than 70 countries gives us confidence in delivering on our medium-term targets and generating shareholder value. Our estimated reported revenue growth of +9.5% and +6% organic year-on-year as of 28 February 2025 further reinforces this confidence.”

By region, revenue growth (reported) was led by Europe, Middle East and Africa at +10.6% year-on-year, followed by North America (+8.2%), Asia Pacific (+3.8%) and Latin America (-5%). See above for regional performance details.

Avolta confirmed its organic growth target of 5%-7% a year, and said it remained committed to delivering +20-40bps of core EBITDA margin improvement and +100-150bps EFCF conversion per annum. At current exchange rates, 2025 currency translation is expected to be broadly neutral. ✈