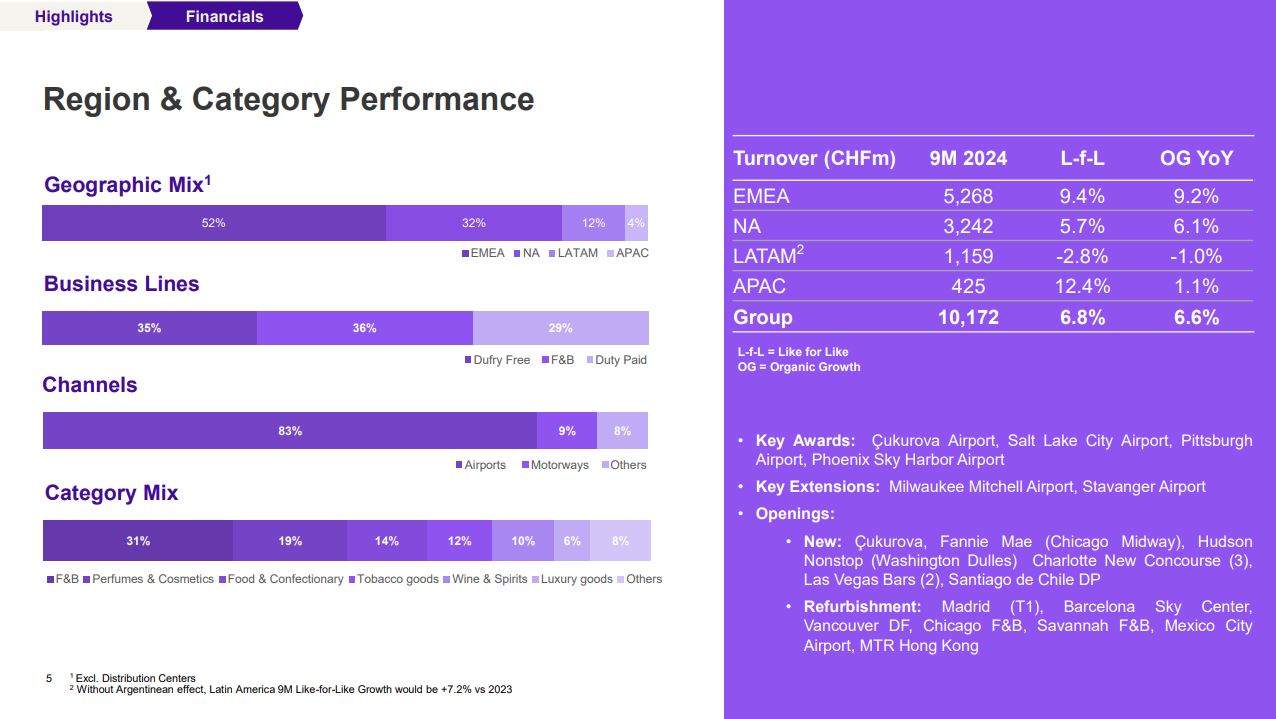

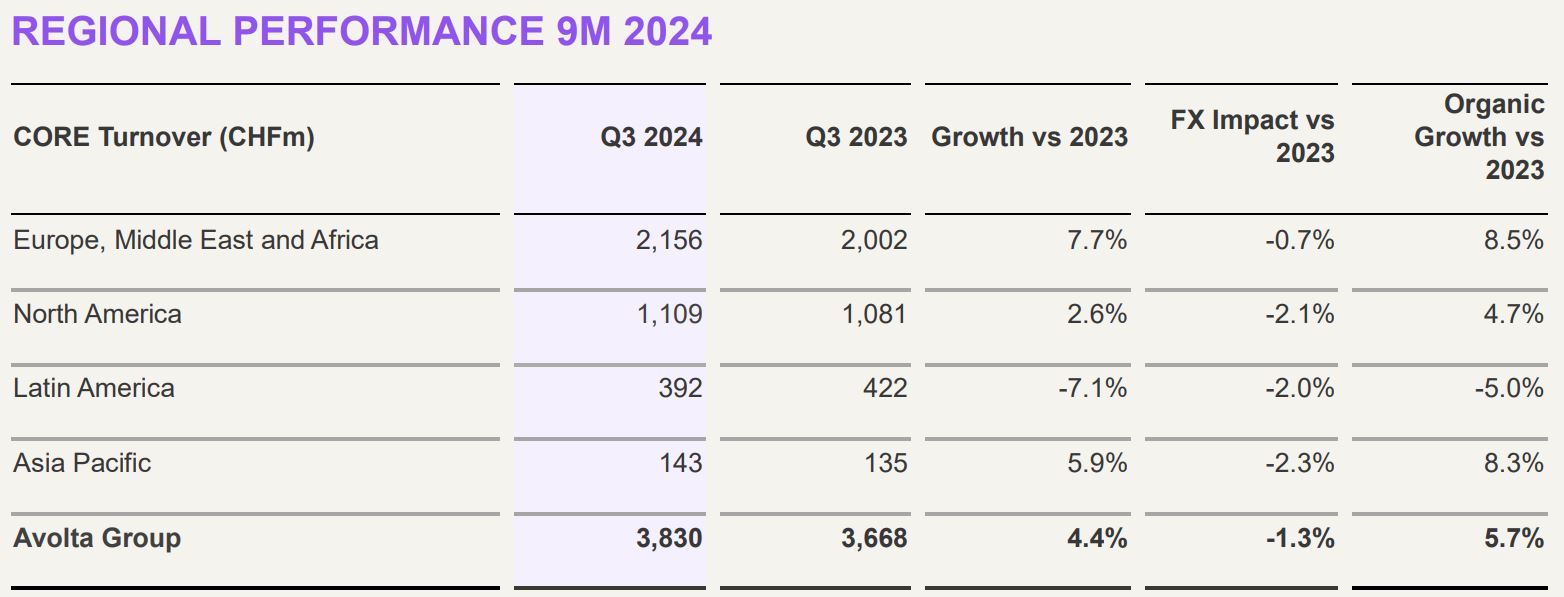

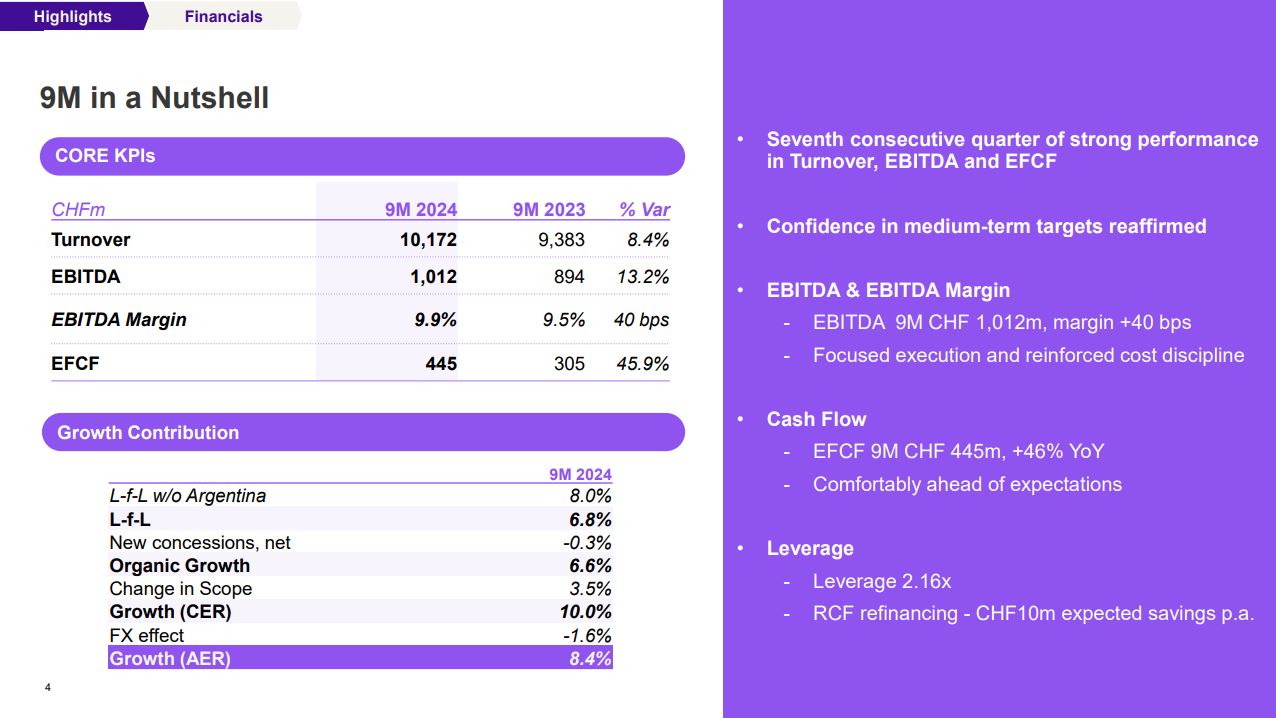

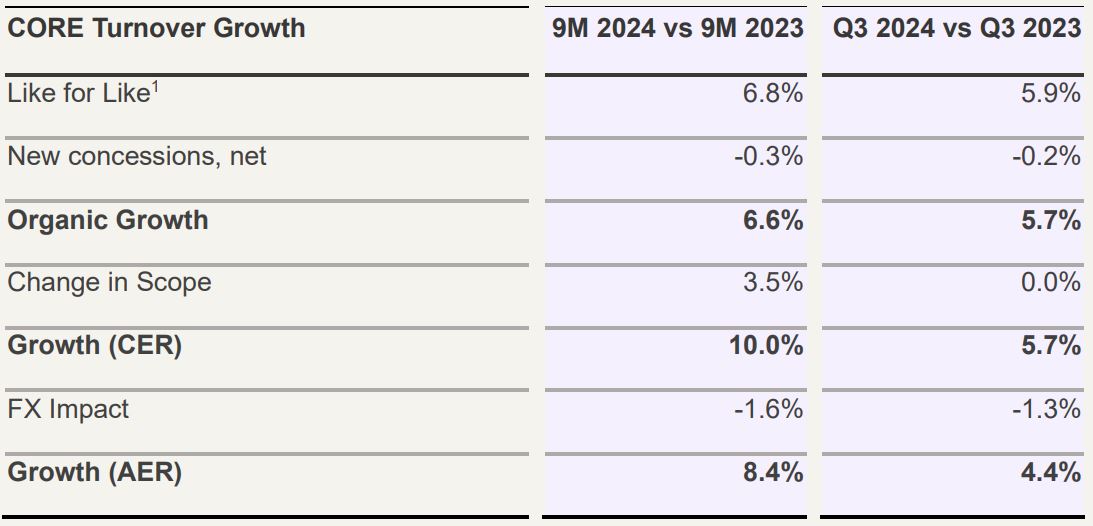

INTERNATIONAL. Travel experience player Avolta today reported nine-month results, with consolidated turnover reaching CHF10,371 million and core turnover of CHF10,172 million (US$11,743 million), up +8.4% year-on-year reported and +6.6% on an organic basis. Core turnover excludes fuel sales from the motorway business.

In the third quarter, core turnover climbed by +4.4% (reported) and +5.7% in organic terms. This was the seventh consecutive quarter of revenue growth.

Core EBITDA in the first nine months rose by +13.2% to CHF1,012 million (US$1,169 million), with EBITDA margin up 40 basis points to 9.9%. In Q3, the EBITDA margin was 11.6%, up +60bps year-on-year driven by commercial performance and productivity increases.

Equity Free Cash Flow climbed by +46% year-on-year in the nine months to CHF445 million (US$514 million).

Avolta also highlighted its capital allocation policy, under which it aims to return excess cash to shareholders via dividends and potential share buybacks over the coming years. In line with this, the company will cancel around 6.1 million treasury shares (4% of issued share capital) in 2024.

CEO Xavier Rossinyol said: “We are very pleased with our strong trading performance over the peak summer months which underscores our confidence in Avolta’s outlook for 2024 and the years beyond in line with our Destination 2027 strategy.

“Consistent with our strategy of traveller centricity, we have recently announced Club Avolta, a unique loyalty programme available in all our locations worldwide.

“Capitalising on our global platform, we have a clear focus to grow the business organically expanding our profitability and cash generation, while targeting leverage of 1.5x to 2.0x.”

The group’s financial net debt stood at CHF2,617 million (US$3,022 million) at the end of September 2024, implying a leverage (net debt/CORE EBITDA) of 2.16x. This month Avolta refinanced its revolving credit facility, extending it by two years (through to 2029).

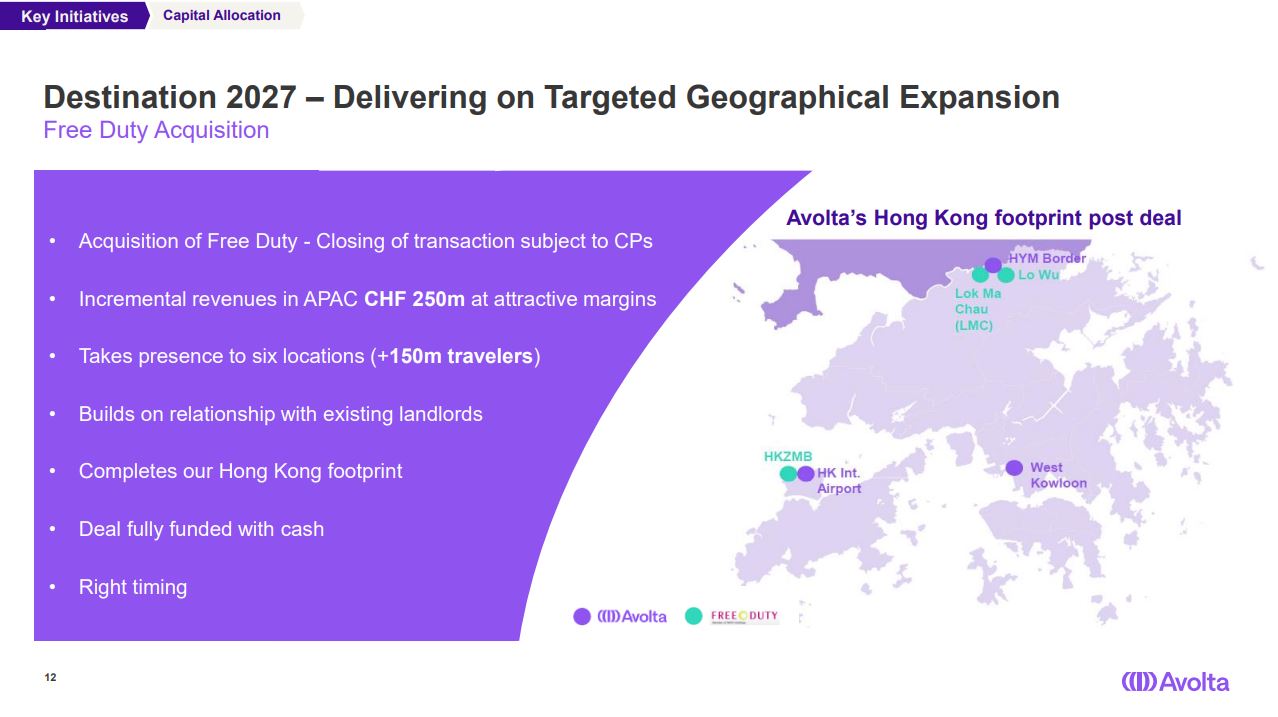

Avolta said its key strategic growth projects are advancing as planned. As reported it struck an agreement to acquire 100% of Free Duty in Hong Kong “at an accretive multiple, extending its presence to six locations, reaching an additional 150 million travellers, and significantly expanding its footprint in Hong Kong”.

Avolta added: “This regional acquisition, which is subject to customary conditions precedent to closing, accelerates the execution of Avolta’s Destination 2027 strategy in the APAC region, driving continuous revenue growth with attractive margins.”

Avolta also launched Club Avolta in October, with its updated loyalty programme bringing together duty-free, duty-paid, convenience, F&B, brands, airports, airlines, hotels and more across Avolta’s 5,100 outlets worldwide.

Avolta confirmed its core turnover growth target of 5%-7% per year on average at constant exchange rates in line with its Destination 2027 strategy.

Avolta said it remains committed to deliver +20-40bps of core EBITDA margin improvement each year as it continues to increase its operational efficiency, and +100-150bps EFCF conversion, with around 4% capex on core turnover per year. ✈