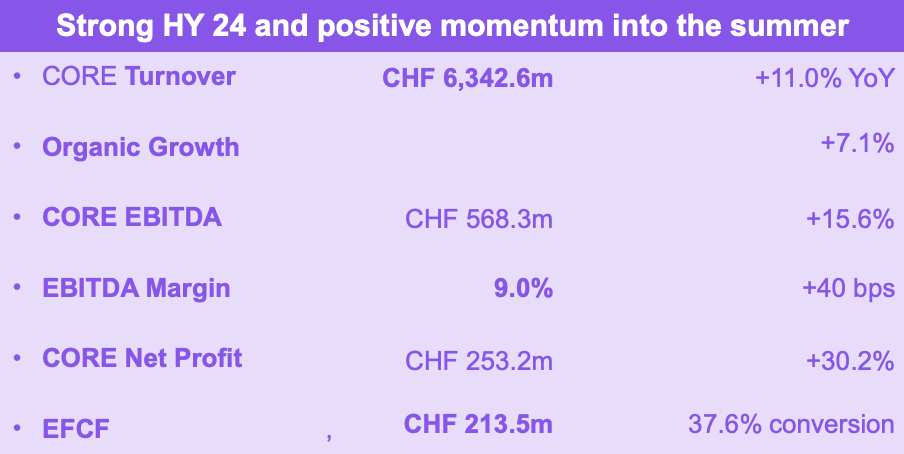

INTERNATIONAL. Travel experience player Avolta today reported first-half results to the end of June, with consolidated turnover climbing +11% to CHF6,462.7 million (US$7,285.3 million) and core turnover of CHF6,342.6 million (US$7,150 million), also up by +11%. (Core turnover excludes fuel sales from the motorway business.)

Core EBITDA increased +15.6% year-on-year in the half to CHF568.3 million (US$640.6 million), with a core EBITDA margin of 9%, up 40 basis points.

This was driven by higher turnover and gross profit, cost discipline and synergies, and is despite integration costs, noted Avolta. Core net profit climbed by +30.2% to CHF253.2 million (US$285.5 million) in the half.

Equity Free Cash Flow (EFCF) grew by +29.3% to CHF213.5 million (US$240.7 million), reflecting tight cost controls, said the company.

Organic sales growth reached +7.1% and +6% in the half year and second quarter respectively and reflected partly the shift in the timing of Easter this year.

In the half, new concessions (net) contributed -0.1% while currency translation, mainly related to depreciation of the US Dollar, Euro and UK Pound against the Swiss Franc, was a -1.8% headwind. This eased during the half with Q2 flat compared to -4.4% in Q1.

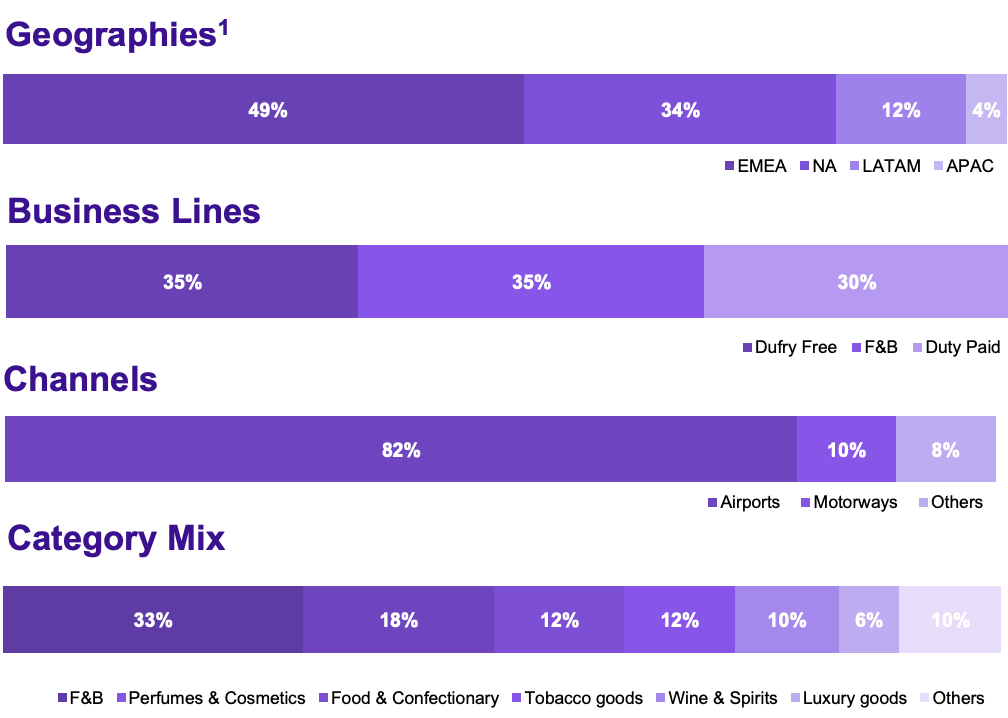

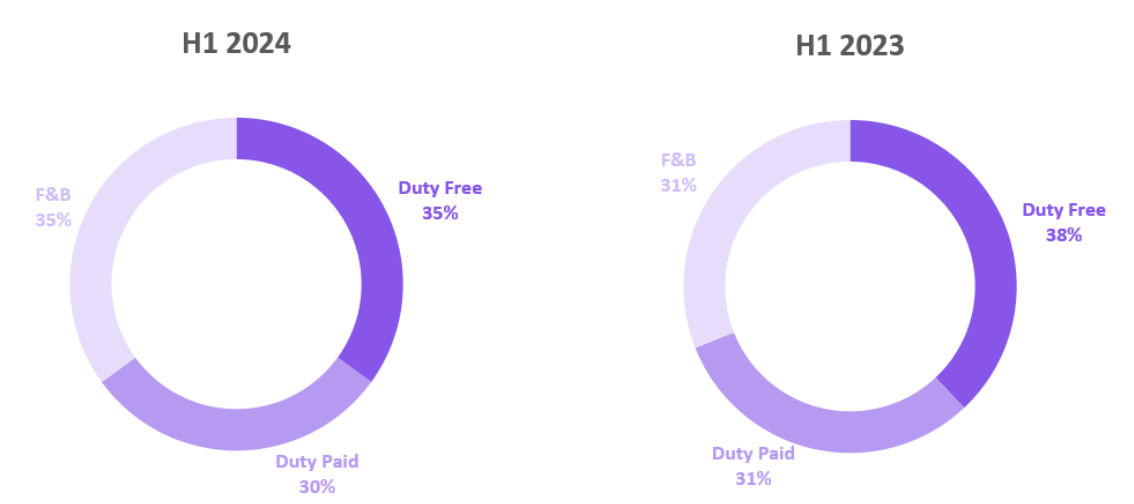

Duty free accounted for 35.1% of net sales, duty paid 30.3% and F&B 34.5%. By channel, airports continue to represent most of net sales at 82%, with motorways at 9.9%, while Avolta’s other businesses (railways, ferries, cruise ships, ports and other) represented 8.1% of net sales.

Avolta CEO Xavier Rossinyol said: “Today, in our sixth consecutive quarterly reporting as one group, we continue to deliver against our plan thanks to the strength of our proven, global business model, delivering strong financial performance across all key KPIs.

“Avolta’s half year tells the story of continued successful delivery of our Destination 2027 strategy. Across the board, our key performance indicators show a very positive development despite a more challenging base of comparison. Our focus on consistent cash-generative growth remains resolute. Market conditions continue to be favourable, and we see our strong performance continuing into H2 2024, reinforcing our confidence and positive outlook for 2024 and beyond.

“With strong business development across all regions delivering on our goal of consistent strong financial performance, we keep the traveller and their travel experience across our product and service offering at the centre of our attention. In Milan, we launched an innovative pilot programme with utu where travellers can convert VAT refunds into vouchers redeemable exclusively in our duty-free shops. With a global rollout, this VAT programme presents the opportunity to unlock over a billion in estimated unclaimed VAT refunds and open up a new, substantial revenue and income stream for Avolta.”

He added: “Avolta stands out with its diversified global platform, boasting more than 5,100 points of sale across 73 countries. Powered by our people, our half yearly results make 76,000 of us proud today, and I thank all our team members for their contributions around the world.

“With a global commitment to delivering best-in-class execution and performance, our teams continue to drive our operational improvement culture, integrating leading global systems and being recognised for both by the ACI North America Excellence in Airport Concession Awards as well as by The Moodie Davitt Airport F&B (FAB) Awards.

“Avolta’s ESG house has established an important foundation, honouring Eugenio Andrades, a leader in the travel industry, with the intention of supporting children with neurological disabilities. We have also partnered with DB Schenker to pioneer low-emission marine biofuel between Europe and the USA.

“We are delighted that our strong momentum continues into H2. We are confident of the way forward and in our ability to deliver strong results. While 2024 holds great promise, with long-term global air passenger traffic trends expected to grow 2.5x by 2050, the best is yet to come.”

Avolta said it has seen “strong demand into summer, especially across key holiday destinations”, noting that “these positive trends will persist throughout the remainder of 2024, underpinning expectations that 2024 organic growth and core EBITDA margin will come in at the top-end of mid-term trends”.

In the medium-term, the company reiterated its previously stated goal for core turnover to grow at a constant exchange rate of +5% to +7% annually on average, bolstered by its global diversification, alongside an annual improvement of +20-40bps in core EBITDA margin.

Regional performance: Europe, Middle East and Africa (EMEA)

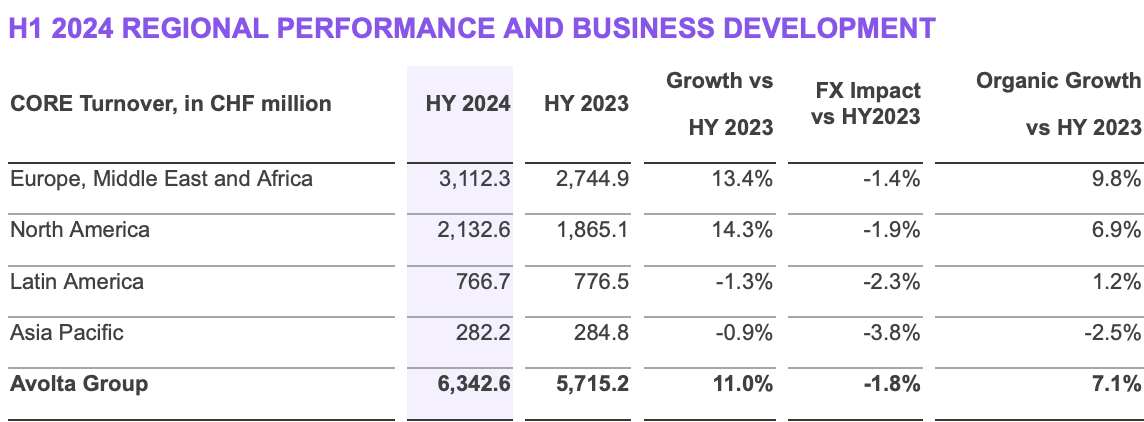

First-half reported turnover increased to CHF3,232.4 million (US$3,643 million), with core turnover at CHF3,112.3 million (US$3,507.4), representing organic growth of +9.8% year-on-year (+9.7% like-for-like).

The performance was underpinned by continued strong leisure demand, benefiting holiday destinations in Southern Europe, Middle East and Africa in both travel retail and F&B. In addition, the UK, Nordics and Central Europe continue to benefit from the recovery in international travel, said Avolta.

During the second quarter, Avolta extended its partnership with Athens International Airport as it struck a ten-year extension for more than 30 travel retail stores; it also confirmed an additional outlet for a six-year term at Copenhagen Airport.

New openings and significant store upgrades in the region included, among others, a Feistritz opening on Germany’s motorways, national convenience label Febo as well as Deli and Grand Café units in Amsterdam, Samla and Bread in Stockholm, KFC in Rome, plus a Ferragamo store as well as Naughty Burgers outlet in Helsinki.

Notably, this quarter included the opening of Taberna Atlántica at Tenerife Airport, the company’s first F&B outlet in Spain, as well as Avolta’s first Costa Coffee in Rome as it brings the brand to Italy, plus a walk-through store at Sofia Airport featuring integrated hybrid concepts.

North America

Core turnover increased to CHF2,132.6 million (US$2.403.4 million) in H1 2024 with organic growth of +6.9% year-on-year (+6.3% like-for-like). In the US, growth across both F&B and travel retail was “robust”, supported by traffic trends and solid demand from domestic and international passengers. Canada continued to benefit from the progressive recovery of Asian travellers over the quarter.

During the second quarter, Avolta expanded its presence in the USA, with 15-year contracts across dining and retail at John Wayne Airport, corresponding to nearly 3,500sq m of combined concession space.

HMSHost’s F&B business won a 15-year contract to bring nine F&B concepts at Sacramento Airport. In retail, Hudson had new openings and significant store upgrades including a Hudson Nonstop at Washington Dulles. HMSHost’s F&B business opened a bar in collaboration with BrewDog in Ohio, as well as local empanadas hero Half Moon in Chicago. Also of note was a NASCAR Drafthouse opening in St. Louis.

Latin America

Core turnover reached CHF766.7 million (US$864.1 million) with year-on-year organic growth of +1.2% (-1.3% like-for-like). Avolta said: “Trends in this region continue to be hit by the adverse situation in Argentina while all other markets continue to see positive growth momentum. In particular, Central America and the Caribbean benefited from leisure demand while Brazil continued to improve as international traffic further returned. The cruise line business progressed further.”

During the second quarter, Avolta was awarded a contract as Norwegian Cruise Line’s main retail partner, strengthening the company’s position in cruise channel.

Asia Pacific

Core turnover reached CHF282.2 million (US$318 million) in the half with year-on-year performance of -2.5% (+13% like-for-like). Q2 was adversely affected by the exit from Avolta’s Melbourne Airport duty free concession while a challenging high-end liquor market plus a tough basis of comparison proved a drag on sales in Hong Kong and Macau. Trends in Indonesia, Vietnam, India, amongst other countries, remain robust, said the company.

During the second quarter, Avolta extended its footprint in the region, with a seven-year contract for two new travel retail stores, including key categories, at Macau International Airport, as well as a ten-year contract for two stores at Medan Airport, Indonesia.

New openings and significant store upgrades in the region included, among others, the opening of four Hudson travel convenience stores, plus Wolfgang Puck Kitchen + Bar and Fresh & Healthy concepts at Bangalore Airport, Taste of India and Café Espresso at Kuala Lumpur Airport and Hungry Jacks, Artisan Kitchen + Bakery, Fresh, Asia Street Cooking, Schnitz and Two Tigers at Gold Coast Airport.

The second quarter included the opening of the company’s two new travel retail stores at the Macau Ferry Terminal in downtown Hong Kong. ✈