INTERNATIONAL. The BRICS Wealth Report 2024 has revealed that the total investable wealth from countries in the BRICS bloc amounts to US$45 trillion, with its millionaire population expected to rise by +85% over the next ten years.

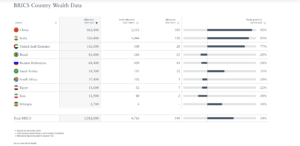

The report, published by international investment migration advisory firm Henley & Partners in partnership with global wealth intelligence firm New World Wealth, states that there are currently 1.6 million individuals with investable assets of over US$1 million in the world’s leading emerging economies. This includes 549 billionaires and 4,716 centi-millionaires, or ‘centis’, who have more than US$100 million in investable assets.

The BRICS cohort – which originally comprised Brazil, Russia, India, China and South Africa – last month added Egypt, Ethiopia, Iran, Saudi Arabia and the UAE to its members. It now represents more than 45% of the world’s population and accounts for nearly 36% of the global GDP, more than G7 countries at 30%.

Henley & Partners CEO Dr Juerg Steffen said BRICS states represent a highly influential group in the global economy and present attractive investment opportunities. He commented: “The inclusion of Middle East and North African countries is not just a political realignment but a recognition of their growing economic stature.

“The region, historically pivotal due to its energy resources, is now asserting a more diversified economic role. For investors worldwide, Middle East & North Africa’s growing participation in BRICS opens a realm of possibilities beyond the region, offering access to fast-growing consumer markets, strategic geographic positioning, and cultural and business environments.”

The evolution of private wealth in the BRICS cohort

The BRICS Wealth Report states that private wealth grew by +92% in China, which is now home to 862,400 millionaires, 2,353 centi-millionaires and 305 billionaires. India is second in the BRICS high-net-worth individuals rankings with wealth growth soaring +85% in the last ten years. India is home to 326,400 millionaires, over 1,000 centi-millionaires and 120 billionaires.

The UAE’s millionaire population increased by +77% since 2013 with the Middle East’s leading wealth club now home to 116,500 millionaires and 300 centi-millionaires. Saudi Arabia and Ethiopia’s millionaire populations rose by +35% and +30% respectively in the last decade.

The remaining countries have seen a decline in their millionaire populations since 2013. South Africa saw a -20% drop and Iran -38%. Brazil, home to 82,400 millionaires, saw a -28% decline; Russia a -28% decrease; while Egypt’s high-net-worth population decreased by -22%.

Personal finance and investment expert Jeff D. Opdyke commented: “Nations once considered ‘developing’ or ‘emerging’ or the pejorative ‘third world’ are now dynamic economies that are changing the global order. Economically, non-Western nations – with BRICS at the vanguard – are pushing the globe into a new reality: An emerging economic, social, and monetary status quo that is upending what the world has accepted as normal for nearly eight decades.”

IMD World Competitiveness Centre Senior Economist Dr José Caballero added: “BRICS as an organisation offers a set of dynamic markets with relatively stable political systems that could influence the future of the global economy. The strength of these economies lies for some in the dynamism of their SMEs sectors and for others in the agility of their political systems.

“As an intergovernmental organisation, therefore, the members of the expanded BRICS complement one other, which in turn ensures the sustainability of their creation of wealth.”

BRICS wealth growth forecasts

India leads the BRICS pack with a forecasted +110% increase in wealth per capita by 2033. Saudi Arabia’s wealth per capita is expected to grow by over +105% in the next decade, followed by UAE at +95%, China at +85%, Ethiopia at +75%, South Africa by +60% and Egypt at +55%.

Arab Gulf States Institute Senior Resident Scholar Dr Robert Mogioelnicki commented: “The new Middle Eastern member countries of BRICS do not represent a homogenous group. These countries exhibit divergent economic conditions: Saudi Arabia and the UAE enjoy robust economies, while Egypt and Iran confront systematic economic challenges.

“There are also major differences in each country’s respective positions in the international order and how senior government actors therein pursue political and diplomatic interests on the world stage.”

The top ten wealthiest BRICS cities

China is home to five of the top ten wealthiest cities in the BRICs cohort: Beijing (first), Shanghai (second), Shenzhen (fifth), Hangzhou (sixth) and Guangzhou (ninth). The UAE has two cities in the top ten with Dubai in third place and Abu Dhabi tenth; while India also has two with Mumbai coming in fourth and New Delhi ranking seventh. Moscow takes up the last spot in eight place.

There are five cities that didn’t make it to the top ten for 2024 but are expected to experience particularly strong (+80%) wealth growth over the coming decade. These include Bengaluru, which is projected to have +125% growth in millionaire population over the next ten years.

Sharjah in the UAE, Riyadh and Jeddah in Saudi Arabia, and Cape Town in South Africa are also cities with high wealth growth potential.

According to the Henley Passport Power Index, passport holders from BRICS countries can access just 21% of other countries visa-free compared to those from G7 nations, who collectively enjoy access to over 80% of global GDP without a prior visa.

Henley & Partners Group Head of Private Clients Dominic Volek commented: “Both for investors seeking greater access to BRICS member states and for those within BRICS countries looking to improve their global access and passport power. Residence and/or citizenship by investment programmes can play a transformative role in attracting debt-free capital and talent and fostering a more interconnected and powerful ecosystem.” ✈