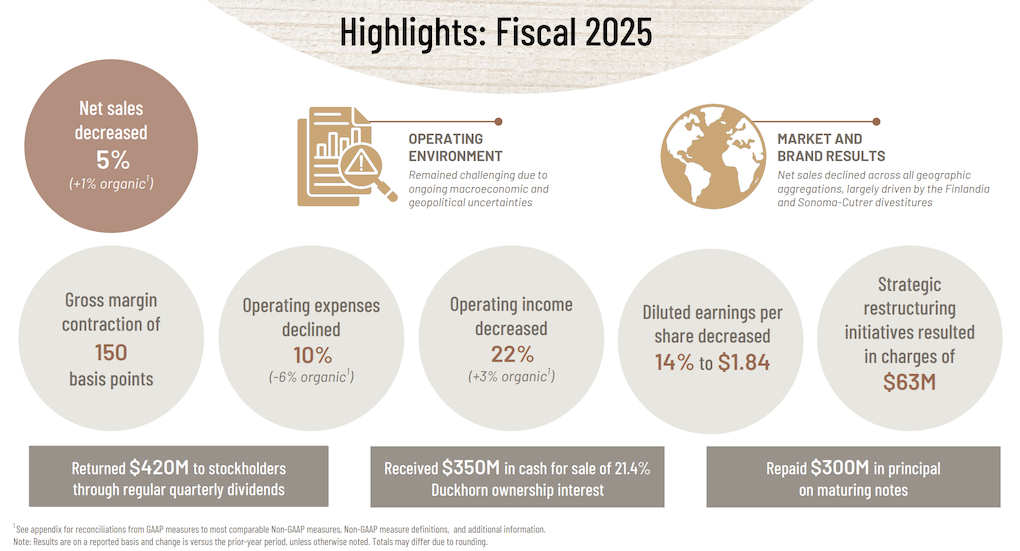

Brown-Forman Corporation has reported a -5% decline in net sales to US$4 billion (+1% on an organic basis) for the financial year ended 30 April.

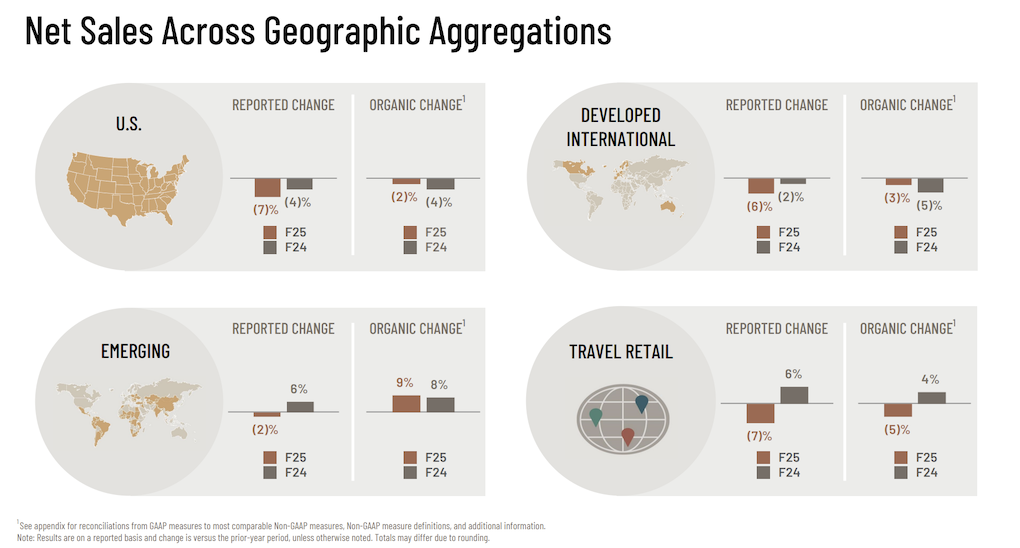

The travel retail business posted a -7% drop in net sales (-5% organic), driven by slower sales of super-premium Jack Daniel’s expressions and the impact from the sale of Finlandia in the previous year. The travel retail performance was partially offset by higher Diplomático volumes.

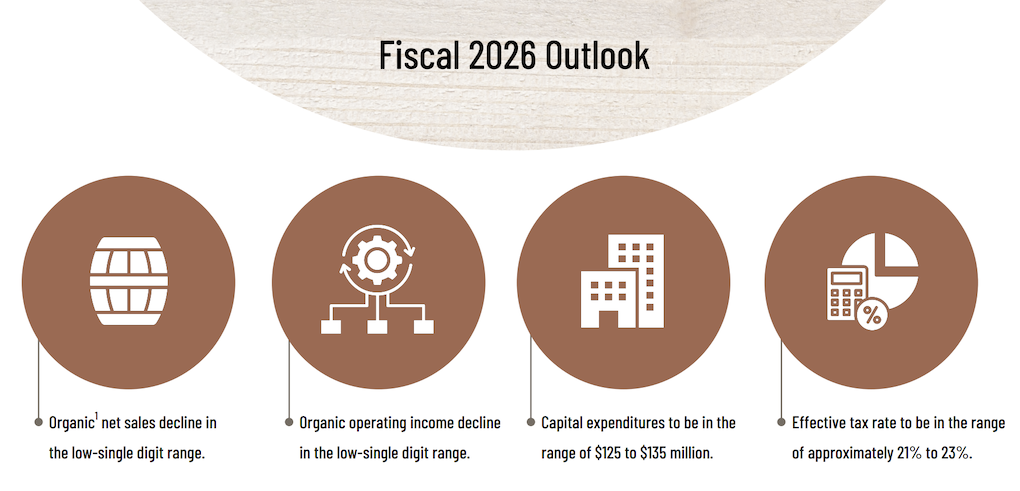

Brown-Forman said it has adopted a cautious outlook for fiscal 2026, citing continued macroeconomic and geopolitical headwinds, low consumer visibility and potential new tariffs.

Group gross profit declined -7% (-2% organic), with gross margin contracting by 150 basis points primarily due to increased input costs, unfavourable fixed cost absorption from lower production volumes and adverse currency movements. These were partially offset by favourable price/mix effects.

The company’s reported operating income fell -22% to US$1.1 billion, while organic operating income grew +3%. Net income fell -45% to US$146 million.

In the fourth quarter, reported net sales dropped -7% to US$894 million (-3% on an organic basis), and reported operating income in Q4 was down -45% to US$205 million, impacted by the absence of a one-off gain from the previous year’s sale of the Sonoma-Cutrer wine business.

“Our ability to deliver organic growth on both the top and bottom line in a year of softening consumer demand is a testament to the strength and resilience of our team,” commented Brown-Forman President and Chief Executive Officer Lawson Whiting.

“While our results did not meet our long-term growth aspirations, we made important progress in an exceptionally challenging macroeconomic environment. Looking ahead to fiscal 2026, we expect continued headwinds. Still, we are confident that with agility, innovation, and a clear focus on execution, we are well positioned to navigate uncertainty and unlock new opportunities for sustainable long-term growth.”

Regional and category performance

Reported net sales declined across all regions driven by the divestment of Finlandia and Sonoma-Cutrer and continued macroeconomic uncertainties.

In the US, sales were down -7% (-2% organic) due to the divestitures and volume pressure on key brands. The declines were partially offset by growth of Woodford Reserve as the brand continued to gain market share outperforming the whiskey category in the USA.

Developed International markets reported a -6% decline (-3% organic) due to the absence of the Finlandia brands and softness in Italy, South Korea, and the UK. Japan showed positive momentum thanks to higher volume sales for Jack Daniel’s Tennessee Whiskey.

Net sales in emerging markets slipped -2% (+9% organic). Strong growth for Jack Daniel’s brands in Türkiye, Brazil and the UAE offset currency headwinds, the Finlandia divestiture and Tequila declines in Mexico.

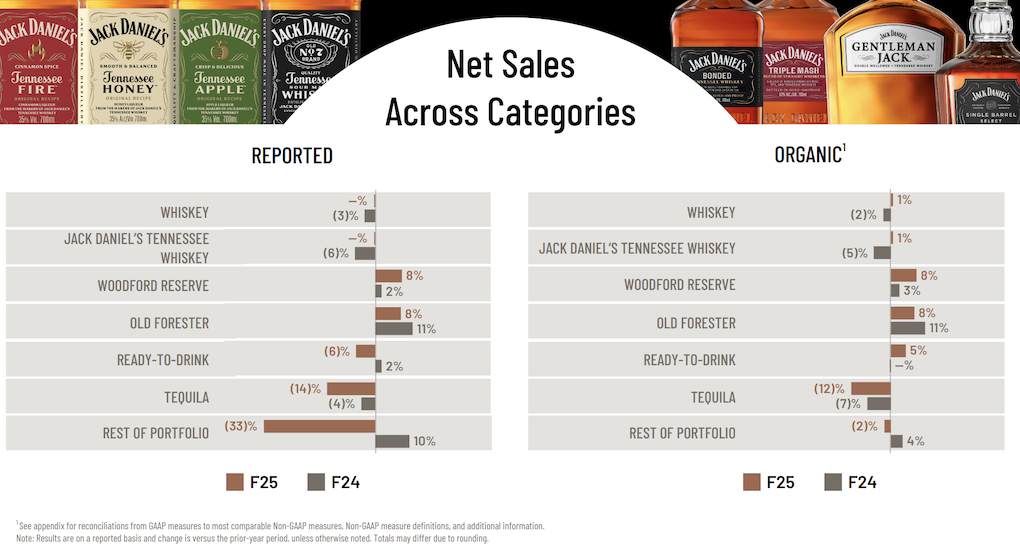

Whiskey net sales were flat on a reported basis and up +1% organically, with negative effects of foreign exchange and declines in super-premium lines offset by growth from Woodford Reserve and Jack Daniel’s Tennessee Whiskey.

The Tequila portfolio saw a -14% drop (-12% organic) due to softness in Mexico and competitive pressures in the US. el Jimador’s net sales decreased -13% (-11% organic) and Herradura’s net sales decreased 13% (-10% organic).

Ready-to-Drink (RTD) net sales fell -6% but increased +5% in organic terms, driven by a business model change for Jack Daniel’s Country Cocktails. Net sales for the rest of the portfolio declined -33% (-2% organic), reflecting the Finlandia and Sonoma-Cutrer divestitures and lower volumes of Korbel California Champagnes in the United States.

A cautious outlook for fiscal 2026 amid global volatility

The company expects organic net sales and organic operating income to decline in the low-single-digit range in FY2026, reflecting the challenging external environment and lower non-branded used barrel sales.

Despite these pressures, the company remains focused on long-term growth through strategic initiatives including a major evolution of its US distribution model, restructuring measures and a robust pipeline of new product innovation. ✈