UK. “The anger within the UK industry is palpable. This short-sighted proposal was announced without any discussion with industry, no impact assessment, and no warning. It places UK airports and retailers at a massive disadvantage and will simply send millions in retail revenue to airports in Europe and further afield.”

That was the reaction today of UK Travel Retail Forum President Francois Bourienne (also Chief Commercial Officer at AGS Airports, embracing Aberdeen, Glasgow, Southampton airports) to The Moodie Davitt Report when asked about the wide-ranging impact of yesterday’s UK government announcement about the future nature of UK airport duty and tax free sales. {Please add your comments via the DISQUS platform below, anonymously if preferred}

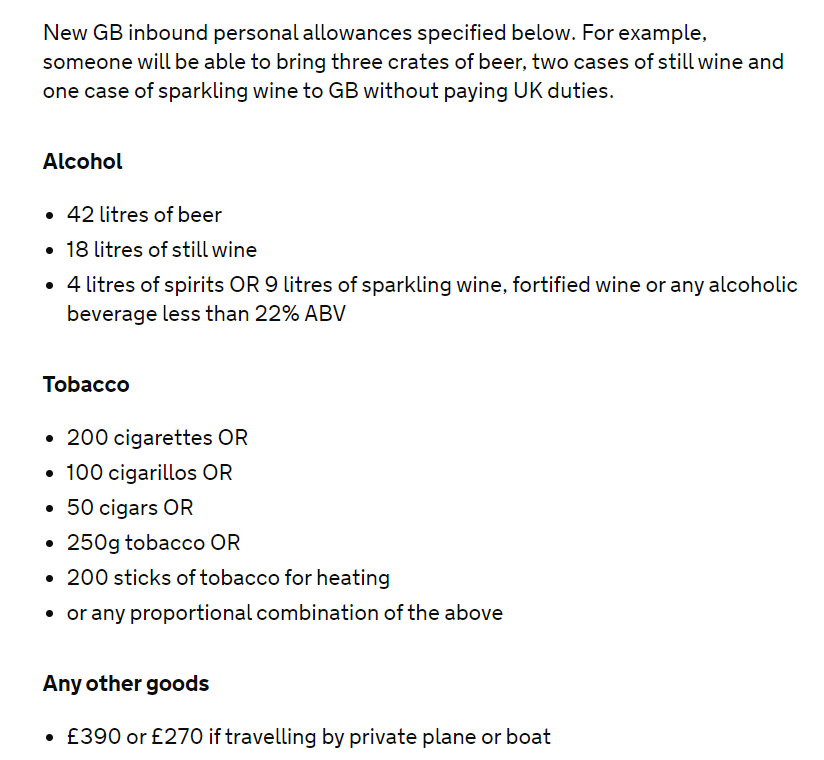

As reported (and as expected), travellers departing the UK for EU countries will be able to purchase duty free goods from 1 January 2021.

But in a bombshell addition to the legislation, tax free sales will be withdrawn for all outbound passengers [from airports – see note below about other travel operators] from the same date on goods other than liquor & tobacco.

In a potentially catastrophic development for categories other than liquor & tobacco, including the critical fragrances & cosmetics sector, the government announced, “We are also ending tax-free sales in airports of goods such as electronics and clothing for passengers travelling to non-EU countries, following concerns that the tax-concession is not always passed on to consumers in the airport. In some instances these tax-free goods are brought back into the country by UK residents, putting High Street retailers at a disadvantage.”

Key talking points about the new legislation

Source: The Moodie Davitt Report |

Bourienne told The Moodie Davitt Report today: “The Ministerial statement came out yesterday. We have not seen any draft legislation yet and are engaging with government at the most senior level to make our position clear.

“The anger within the UK industry is palpable. This short-sighted proposal was announced without any discussion with industry, no impact assessment, and no warning. It places UK airports and retailers at a massive disadvantage and will simply send millions in retail revenue to airports in Europe and further afield.

“If all tax free sales are to be ended (other than liquor & tobacco), it will have a substantial and immediate impact on UK airports. Hundreds of millions will be lost in sales, & thousands of jobs are at risk – at a time when the industry is already on its knees. This could be the final nail in the coffin of several UK regional airports.

“The UK government tells us they are working on a strategy to restart UK aviation. This outrageous move completely undermines any support package they claim to be developing.

“Also by ending the VAT-RES scheme in the UK, the government will simply be sending many thousands of high-spending Chinese and other tourists to France, Italy and elsewhere in Europe.

“Every effort will be made by UKTRF and all the UK airports to reverse this decision in the coming weeks. Aside from government engagement at the highest possible level, a legal challenge is also being investigated.”

An informed industry source told The Moodie Davitt Report: “This is an incredible move by the UK government. We have had umpteen meetings with all relevant government departments in recent months and this has never figured as a potential outcome.”

The same source noted, “Can you imagine the impact the loss of VAT-registration will have on [London department stores] Selfridges and Harrods? Chinese tour groups will simply spend their money in Galeries Lafayette [in Paris] rather than Harrods. They won’t even come to the UK anymore. Like us, those retailers were kept completely in the dark and this came as a complete shock. They are furious.”

Many urgent questions arise from yesterday’s announcement, which has potentially catastrophic repercussions for UK airports, travel retailers, and brands selling through those airports.

The Moodie Davitt Report Founder & Chairman Martin Moodie asked Bourienne some of those questions.

Martin Moodie: Can I absolutely confirm that there will be no tax-free sales of ANY items including the critically important perfumes & cosmetics categories for passengers departing English, Scottish and Welsh airports from next January?

Francois Bourienne: Our understanding is that the VAT exemption is being removed from all categories for departing passengers. This would include perfumes/cosmetics.

Ferries and airlines are excluded from the government text on tax free (not that of duty free). Does that mean they can still sell other categories tax free?

The text refers to airports. It is difficult to see how UK legislation could apply to ferries or airplanes as they operate in international waters/airspace. Clarification is needed here.

The inbound allowance for alcohol has received a huge hike. But who benefits (apart from the UK-bound consumer)? Only the offshore retailer surely? Does this not therefore mount an irresistible argument for arrivals shopping in the UK? Why not let devastated UK airports benefit from an increased inbound allowance? Where are negotiations at in terms of UK arrivals shops?

The UKTRF will continue to make the case for the introduction of arrivals shops in the UK. We understand from UK government that this remains under review.

What about Northern Ireland? The text says, “Duty free, personal allowance and the VAT Retail Export Scheme changes will apply in England, Wales and Scotland.” Does that mean the status quo prevails in Northern Ireland? Please clarify what would be the situation for someone flying from Belfast Airport to 1) A non-EU country; 2) an EU country; 3) England, Wales, Scotland.

Northern Ireland’s relationship with the EU is covered by a separate agreement to the rest of the UK. It is still uncertain as to whether UK or EU VAT & Excise duty legislation would apply.