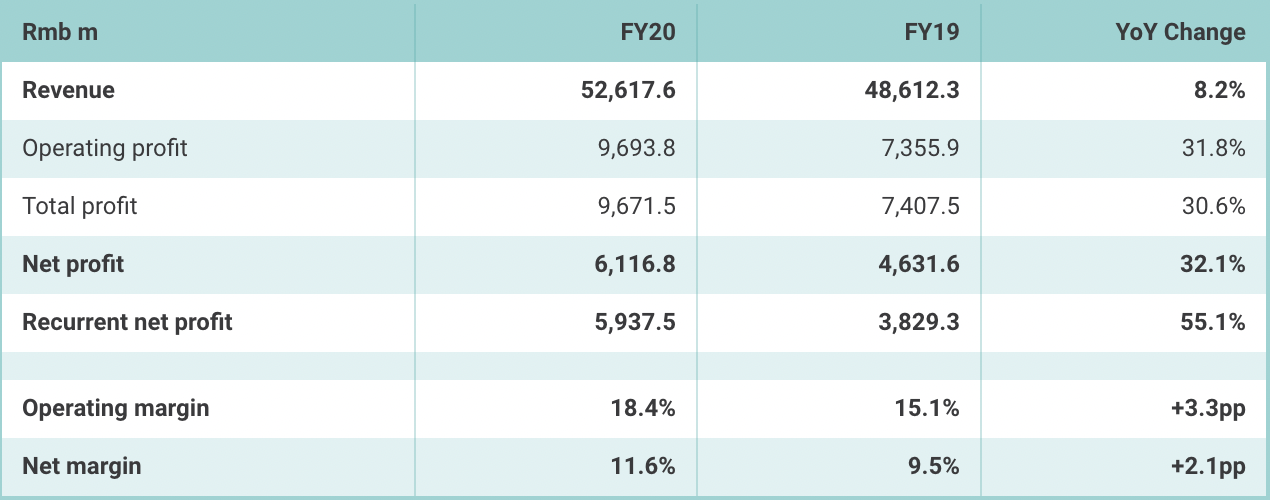

CHINA. China Duty Free Group parent company China Tourism Group Duty Free Corp has revealed its preliminary results for FY2020, with revenues climbing by +8.1% year-on-year to RMB52.6 billion (US$8.1 billion) and a +32.1% leap in net profit to RMB6.1 billion (US$947 million).

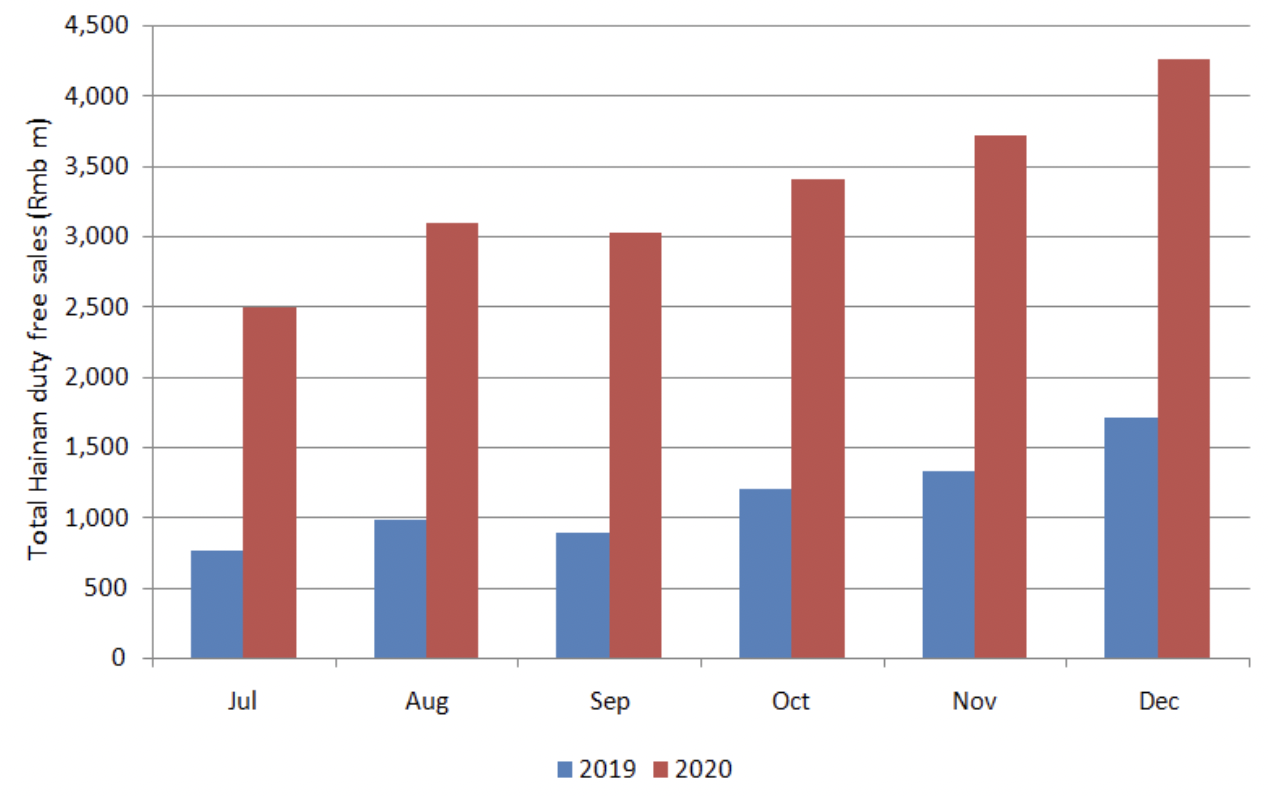

The company attributed the strong earnings performance to several factors including the enhanced offshore duty free policy in Hainan Island since 1 July; growth in high-margin goods including luxury bags, watches & jewellery and reduced rent to be paid to Shanghai Airport Authority under a just-announced new contract agreement (more details to follow).

Commenting on the performance, CFA Analyst/Insight Provider Osbert Tang, who publishes on Smartkarma, said the above factors should also have a positive impact in H1 2021.

He added: “The recent resurgence in local COVID-19 cases will negatively weigh on sales performance during the upcoming Chinese New Year (CNY) holiday, which is traditionally an important peak season.”

Tang said: “As for FY21, CTG Duty Free will benefit from the government’s support of domestic consumption, improved portfolio of premium brand names and the slow recovery of outbound overseas travel appetite. While the Chinese New Year sales may be negatively affected by the resurgence of local COVID-19 cases, we expect the full-year effect of the new Hainan duty free policies will help lift bottom line with an impressive earnings growth of over 80%.”

Looking at prospects ahead, the analyst noted: “It is positive to see CTG Duty Free beating expectations in FY20, and we expect the Street to upgrade earnings forecasts for the next two years. We expect the full-year benefit of the new Hainan duty free policies to be realised in FY21, and the signing of a new duty free agreement with Shanghai International Airport is also favourable.

“We expect CTG Duty Free to register an +82.2% growth in earnings in FY21 to RMB10.8 billion. This is forecast to be followed by around +30% annual growth for FY22 and FY23. In H121, we believe the stock will be driven by positive news flow on the good YoY growth momentum; though as we said, CNY sales are likely to be not as good as originally expected.

“Looking further ahead, there will be an increase in competition in duty free sales in Hainan. However, the overall duty free market is still witnessing encouraging growth which should be able to offset any pressure on CTG Duty Free in the next two years.

“In our view, the government’s focus on internal circulation will mean more policy supports for the duty free market development in Hainan, which CTG Duty Free still have over 90% market share. The company will strengthen its product mix and introduce more premium brand names into its portfolio to attract more patronage.

“Although there is positive progress on vaccination against COVID-19, most foreign countries still lag behind their planned vaccination schedule. Adding to that is the variant strains of the coronavirus, which will collectively make China’s outbound leisure travel recovery moving ahead slowly. These developments should remain positive towards CTG Duty Free’s businesses over the next two years. By 2022, the completion of Haikou International Duty Free City will add to its competitive strengths against the recent new entrants into the market.”