Shiseido Company’s first-half travel retail sales plunged almost -23% year-on-year to ¥66.9 billion (US$454.2 million) amid changes in Chinese tourists’ spending behaviour and lower shipping volumes to key locations Hainan and South Korea.

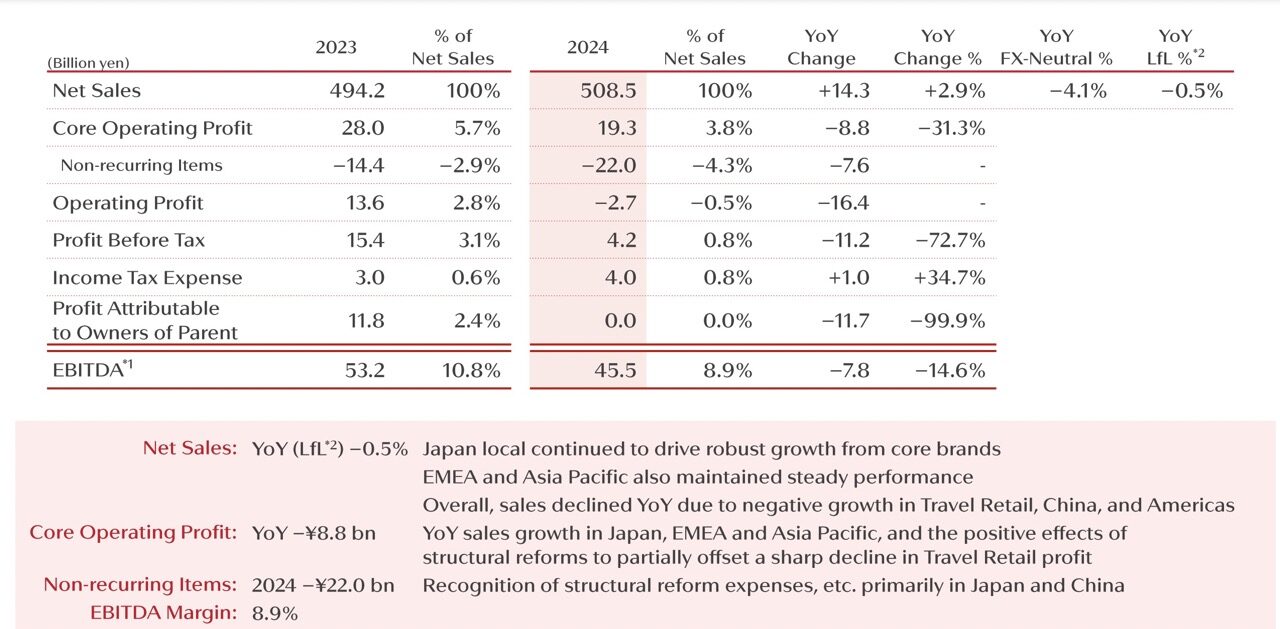

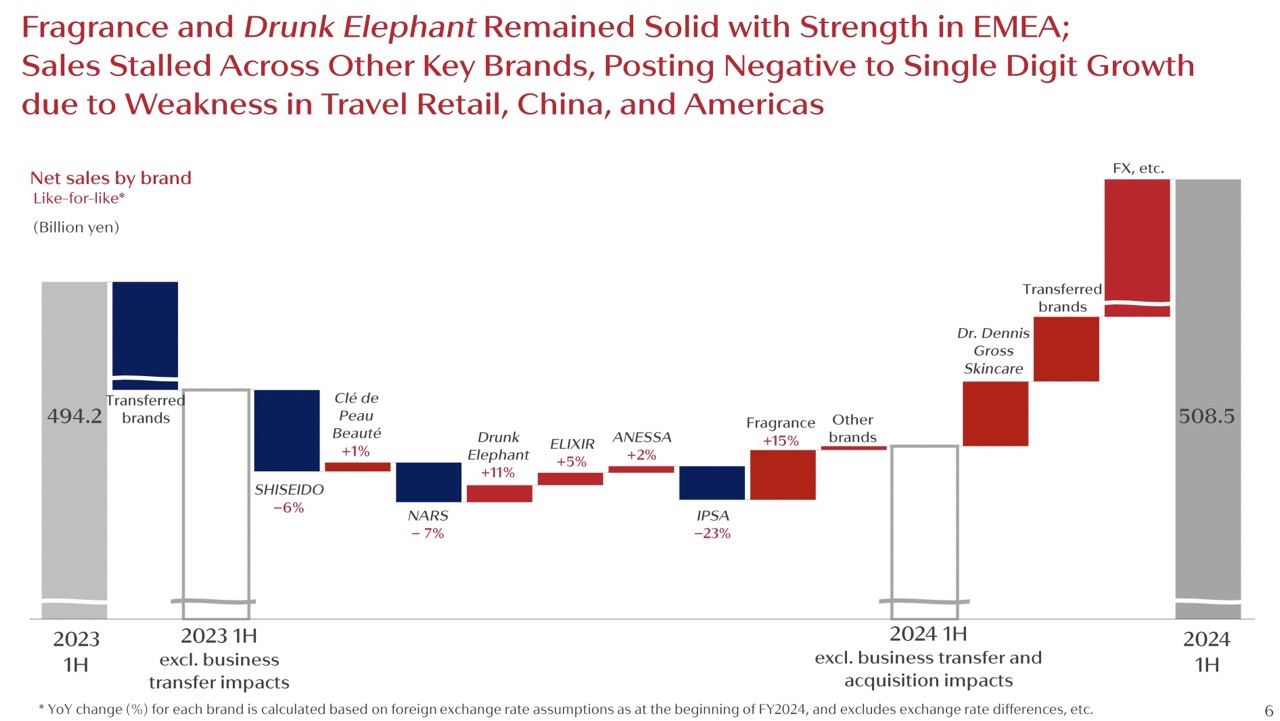

The Japanese beauty house’s struggles in the channel weighed heavily on group results, contributing to a -0.5% (like-for-like) decline in sales to ¥508.5 billion (US$3.5 billion) for the period ended 30 June.

Travel retail, the group’s third-biggest division with 13.1% of H1 net sales, turned in core operating profit of ¥7.7 billion (US$53 million).

Travel retail’s sharp decline was impacted by shifting Chinese consumer behaviour, coupled with lower shipping volumes in major travel retail hubs including Hainan. This segment, crucial for Shiseido, faces headwinds as regulatory crackdowns on the daigou trade (Hainan and South Korea) and economic uncertainties impact consumer spending patterns.

During the earnings call, Shiseido Chief Investor Engagement Officer Ayako Hirofuji commented: “Weakening Chinese consumer sentiment and changes in purchasing behaviour, which were seen as risks in the first quarter, became apparent, posting deeper-than-expected negative results.

“Core operating profit was ¥ 19.3 billion (US$130 million), a decrease of ¥ 8.8 billion (US$60 million) year-on-year due to the significant impact of lower profit from travel retail. Although the decrease was partially offset by a positive impact of fixed cost reduction through structural reforms as well as year-on-year sales growth in Japan, EMEA and Asia Pacific.

“We will take additional company-wide measures to address the weakness in travel retail in China and continue to aim to achieve ¥55 billion (US$380 million) in core operating profit.”

Travel retail and China: A changing market landscape

In China, Shiseido’s sales declined by -7% on a like-for-like basis in the first half.

The slowdown in consumer spending, influenced by rising household savings and economic uncertainty, has affected sales, particularly of Japanese products.

Shiseido was also impacted (both in travel retail and domestically) by consumer pullback on Japanese products due to the controversial treated water release from the earthquake- and tsunami-damaged Fukushima Daiichi nuclear power plant. The release began in August 2023.

Hirofuji said changes in purchasing behaviour and weakening consumer sentiment had driven a slowdown in travel retail – traditionally a high-profit channel for Shiseido – and China. The sales decline had driven a significant profits decline, he noted.

“The current negative impact on profits in travel retail will be compensated by maximising the strong local sales in Japan and Europe, capturing demand from inbound tourists to Japan and company-wide efforts to improve profitability and so on.”

China market remains vital despite headwindsShiseido views the China market as pivotal, despite current challenges. The company is optimistic about long-term growth, focusing on adapting to local consumer preferences and enhancing brand perception through strategic initiatives. Shiseido has adopted a cautious yet optimistic outlook for its China business and is dedicated to fostering a sustainable business model that emphasises quality and value. Shiseido Chief Commercial Officer and soon-to-beDirector, Representative Corporate Executive Officer, President and CEO Kentaro Fujiwara commented: “The China market continues to be an important market for the company in the mid to long term. However, given the recent market environment, we will be cautious of certain areas in our China and travel retail strategy going forward. Some key points to mention are the acceleration of market polarisation, increased focus on price and the price competition amongst retailers, including travel retail, are becoming very competitive. “Taking these factors into consideration, we will not only review the China and travel retail businesses, but also see the necessity to build a more resilient organisation and profit structure as well as optimised regional portfolio on a global basis,” Fujiwara added. “On the premise that the market environment will continue to be unstable, we will build a management strategy that will enable us to stably generate profit without being significantly impacted by the market environments change. We will continuously make efforts to turn China and travel retail businesses to structures that can generate stable profit.” Offering Shiseido’s second-half China outlook, Hirofuji added: “In the second half, travel retail is facing a difficult situation as the Chinese consumer sentiment weakens, like the China market. Also, the travel retail price appeal is declining due to the exchange rate fluctuation.” To address these issues, the company is investing in key areas and maximising sales in what it calls agile growth areas amid a weak macro-economic environment Shiseido will proactively develop hero products and enhance marketing investments for Shiseido and enhance its fragrance brands alongside Drunk Elephant, Clé de Peau Beauté and Nars. In China, Shiseido is enhancing the marketing link between China domestic and travel retail to create synergies between both divisions. It is also strengthening online platforms, enhancing online differentiation and reducing costs. The company is also optimising its organisational structure, streamlining its retail network and reducing the cost of goods sold.  Unauthorised market still growing despite daigou crackdown in Hainan and South KoreaHeavy discounting, price competition and the unauthorised resale of products has weighed heavily on Shiseido’s China and China travel retail business. China CEO Toshinobu Umetsu commented: “There is travel retail and airport duty-free, but there are also some other operators who are doing ecommerce and are providing cheaper prices. They are benchmarking beyond authorised price points in the channel. Brands want to control the price but are also offering price competition at their own discretion. “South Korea and Hainan have started to restrict unauthorised sellers, which has shrunk the market but the routes are still there. In Japan, product prices are impacted by foreign currency, so there are products now coming from Japan. So, while the overall unauthorised routes are shrinking, the size of the unauthorised market is still growing.” Shiseido’s approach, according to Umetsu, is to focus on prestige products and brands that don’t rely on heavy discounting. “We will focus on hero SKUs. If we can balance ourselves then in China and in travel retail, we can recover our game. We want to balance regular prices and promotion prices. That’s what we are aiming to do, and that’s what we’re doing right now.”

|

Regional Performances

In the first half of 2024, Shiseido experienced double-digit growth in Japan, which maintained strong momentum +13% growth in the first half.

In the EMEA region, net sales increased by +19.5% on a reported basis and +11.8% on a like-for-like basis. This growth was driven by the steady performance of flagship brand Shiseido and the success of fragrance brands such as narciso rodriguez, alongside the robust growth of skincare brand Drunk Elephant.

The Asia Pacific region also recorded solid growth, with net sales up by +12.3% year-on-year on a reported basis and +5.9% like-for-like. Brands such as Anessa, Drunk Elephant, and Shiseido continue dto perform strongly, contributing to overall regional growth.

In the Americas, net sales increased by +8.4% on a reported basis but declined by -5.4% like-for-like. This was due to lower shipping volumes caused by temporary declines in production, primarily affecting Nars and Drunk Elephant. However, Shiseido and narciso rodriguez showed YoY revenue growth, partially offsetting the decline.

Despite what it dubbed a temporary decline in sales, Shiseido maintained its annual sales plan, anticipating a turnaround in the latter half of the year.

Hirofuji said: “The first half saw double-digit growth in Japan and EMEA, but negative growth overall due to lower sales in travel retail, China and the Americas affected negatively.

“In China and travel tetail, we had anticipated negative growth in the second quarter, even in the original plan due to the high hurdles of the previous year, but the negative growth was deeper than expected due to the changes in Chinese consumer sentiment in the market.

“In contrast, travel retail in Japan recovered its consumer traffic, marking a significant growth as well as the high growth rate in Americas and EMEA, particularly led by fragrance brands.”

Brand heroes

Drunk Elephant continued to perform strongly, particularly in the EMEA and Asia Pacific regions. The fragrance segment also showed robust growth, with notable contributions from brands led by narciso rodriguez.

Flagship brand Shiseido was down -6%, but Clé de Peau Beauté remained positive. Other core brands experienced lower sales or only single-digit sales growth due to weakness in travel retail, China and the Americas with Nars, down -7% due to thedeceleration of Asia Pacific travel retail.

Strategic approach and future vision

Shiseido’s strategic approach to recovery focuses on cost reduction and enhancing synergies between the China and travel retail businesses. The company is implementing structural reforms to optimise its organisational structure and drive gross profit maximisation.

Specific strategies include:

- Cost reduction and profit boosting: Shiseido aims to achieve cost efficiencies through global structural reforms. This includes optimising production and supply chain operations, reducing fixed costs, and leveraging economies of scale.

- China market strategy: In China, Shiseido is shifting from large-scale promotions to a more sustainable growth model focused on value-based brand and product communication. The company is tailoring its approach to meet specific consumer needs, with a focus on premium brands like Clé de Peau Beauté and Nars.

- Travel retail strategy: Shiseido is adapting to changes in the travel retail market by exploring new opportunities and adjusting its offerings to better align with evolving consumer behaviours.

Looking ahead, Shiseido Travel Retail highlighted five key beauty trends it will be focusing on as it drives the culture of beauty. Click here for our full story.

Vision and strategic direction for 2024 and beyond

Shiseido said it remains committed to its medium-term strategy SHIFT 2025 and Beyond, which aims to achieve a core operating profit of 9% by 2025. Key initiatives include:

- Global cost reduction: Implementing comprehensive cost-saving measures across all regions and operations.

- Japan structural reform: Driving profitable growth through the ‘Mirai Shift NIPPON 2025’ plan, which focuses on sustainable growth, building a profitable foundation and transforming human capital.

- Sustainable growth in China and travel retail: Rebuilding and strengthening business foundations in these critical markets to ensure long-term success.

- Advancing core growth brands: Prioritising high-growth and high-profit brands such as Shiseido, Clé de Peau Beauté, and Elixir to drive overall company growth.

Japan Focus

Philippe Lesné on Shiseido’s back to basics approach to recovery

Shiseido Travel Retail President Philippe Lesné discusses the Japanese beauty house’s ‘back to basics, back to growth’ approach to recovery. Lesne also introduces the company’s renewed mission to become a personal beauty and wellness powerhouse by 2030 as Shiseido Travel Retail embraces a new culture of beauty in this next phase of its expansion. Click here for our full interview. |

Shiseido is set to leverage the resurgence of inbound tourism to Japan as part of its strategy to drive growth in the second half of 2024. The first half of the year saw effective sales growth locally, with a notable increase in loyal users of core brands. Building on this positive trend, the company plans to continue strengthening investments in these core brands.

In response to the significant increase in inbound tourism, surpassing 2019 levels, Shiseido launched a tourist marketing team in July. This team is dedicated to capturing the demand from tourists visiting Japan.

Fujiwara said: “We established this dedicated inbound team at Shiseido Japan, and they will collaborate with travel retail Japan, China and the rest of Asia to create new growth opportunities in Japanese inbound market and to enhance communication from Japan to the world.”

Hirofuji added: “As for inbound sales, we have launched a tourist marketing team in July to capture the demand of tourists visiting Japan, which is now far above the size of inbound tourists back in 2019. Capturing travellers as another consumer segment, we aim to drive inbound sales by offering valuable experiences and enhancing brand and product recognition.”

In summary, while Shiseido faces significant challenges in the China and Travel Retail markets, its strong performances in Japan, EMEA and Asia Pacific, combined with strategic reforms and a clear vision for the future, position the company to navigate these hurdles and pursue sustainable growth. ✈