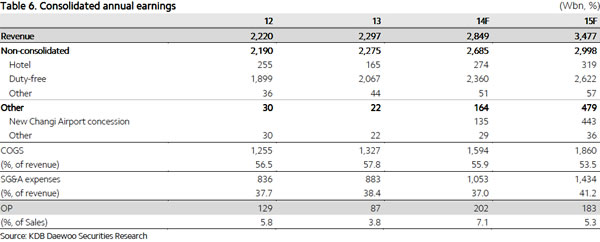

SOUTH KOREA/SINGAPORE. The Shilla Duty Free is set to grow its duty free revenues by +14% in 2014 as a result of new business at Singapore Changi Airport, according to forecasts by KDB Daewoo Securities.

The new beauty concession at Changi is anticipated to generate revenue of W135 billion (US$126.32 million) this year and W443 billion (US$414.51 million) in 2015, its first full year of operation.

The bank predicted that the benefits of international expansion, notably greater purchasing power and protection from currency fluctuation effects, would become the new drivers of Shilla’s duty free business, as opposed to the increasing Chinese tourist numbers to South Korea – although Chinese numbers are expected to contribute positively to sales this year.

As reported, Shilla Duty Free beat strong competition to secure the six-year concession for fragrances and cosmetics at Changi in January. The contract will run from October 2014. Shilla also operates two Bottega Veneta stores, a Prada boutique and – since last month – a luxury watches concession at Changi.

|

KDB Daewoo Securities noted: “Hotel Shilla has struggled with a higher COGS [cost of goods and services] ratio compared to global peers because its shops are predominantly located in Korea. Continued overseas expansion should lead to a more geographically diversified supply base, higher gross profit margins, and reduced exposure to US$/W rate fluctuations – all of which should help push up the average operating profit margin of the duty free shop business.”

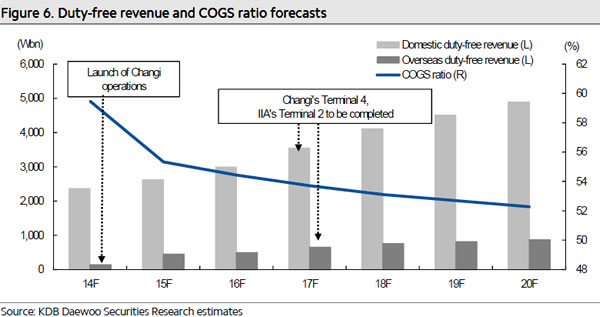

Shilla’s cost ratios in particular are expected to improve – from 59.4% in 2014 to 55.4% in 2015, and then to 53.2% in 2018 after Changi Terminal 4 and Seoul Incheon Airport Terminal 2 open – as a result of improved purchasing power.

“Large-scale operations in Singapore are likely to drive cost ratio improvement,” the analyst said. “Greater revenue and more stores should enable geographical diversification of sourcing sites, while giving the company more bargaining power when negotiating with product suppliers.”

|

More sales in Singapore Dollars will also insulate the retailer’s operating margin from currency affects. The analyst noted that Shilla’s duty free business has been very exposed to fluctuations in the US Dollar-Korean Won exchange rate, particularly to any difference between rates at time of inventory purchase and time of sale.

“Volatile exchange rates have frequently affected Shilla’s duty-free margins,” the company said. “Won appreciation will invariably weaken margins, irrespective of the actual performance of the duty-free business. In 2Q 2009, the business’s operating margin nosedived from 7.9% to 0.5% in just one quarter as the won appreciated +8.8% against the dollar.”

The Changi effect on currency exchange, together with an expected strengthening of the Won in the last quarter of 2014, lead the bank to anticipate an improvement in operating margin to 7.1% of revenue this year. The duty-free business unit is projected to deliver a +103.5% year-on-year increase in operating profit.

Duty free revenues are expected to reach W2,360 billion (US$2.21 billion) in 2014, up by +14%, and W2,622 billion (US$2.45 billion) in 2015.

NOTE: The Moodie Report is grateful to Regina Hahm from KDB Daewoo Securities for providing the company’s report on Hotel Shilla.

|

The Shilla Duty Free will take over the perfumes & cosmetics concession at Singapore Changi Airport in October |