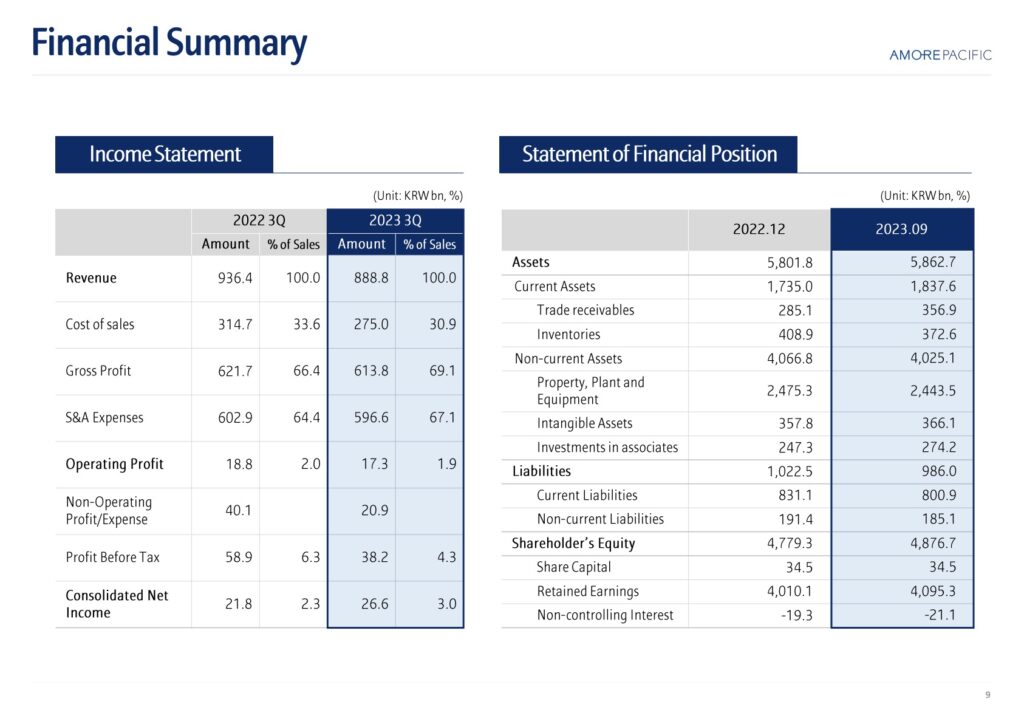

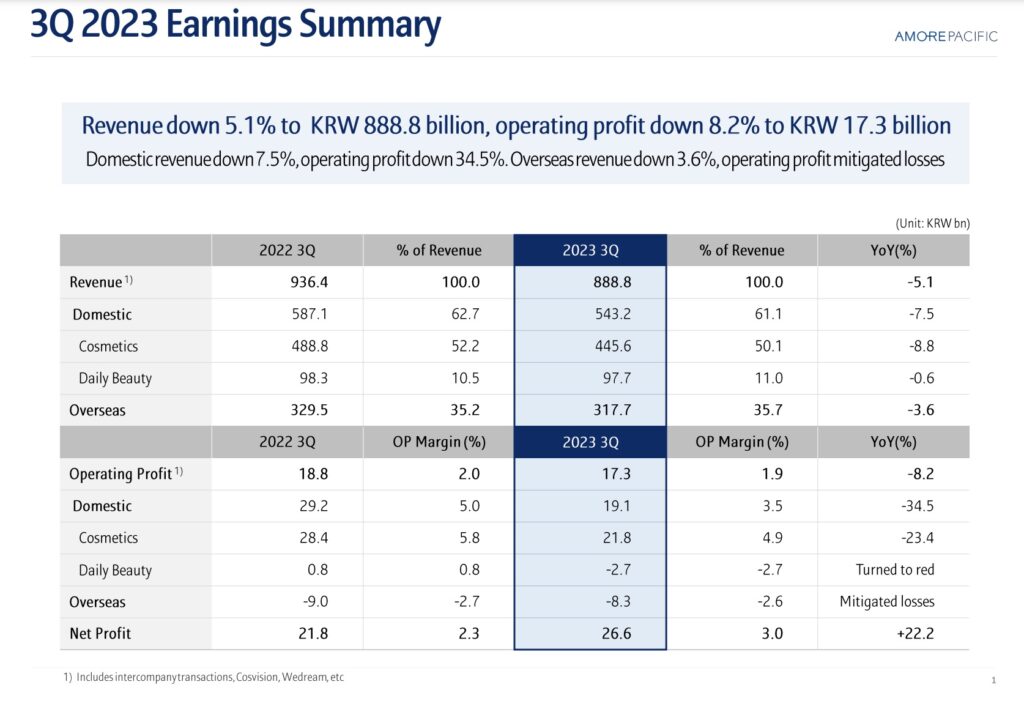

South Korean beauty company Amorepacific has recorded a -5.1% decrease in revenue to KRW888.8 billion (US$678 million) for its third quarter ended 30 September. Q3 operating profit fell -8.2% to KRW17.3 billion. (US$13.2 million).

Despite the overall decline in sales, net profits rose to KRW26.6 billion (US$20.3 million), up from KRW21.8 billion (US$16.6 million) in 2022.

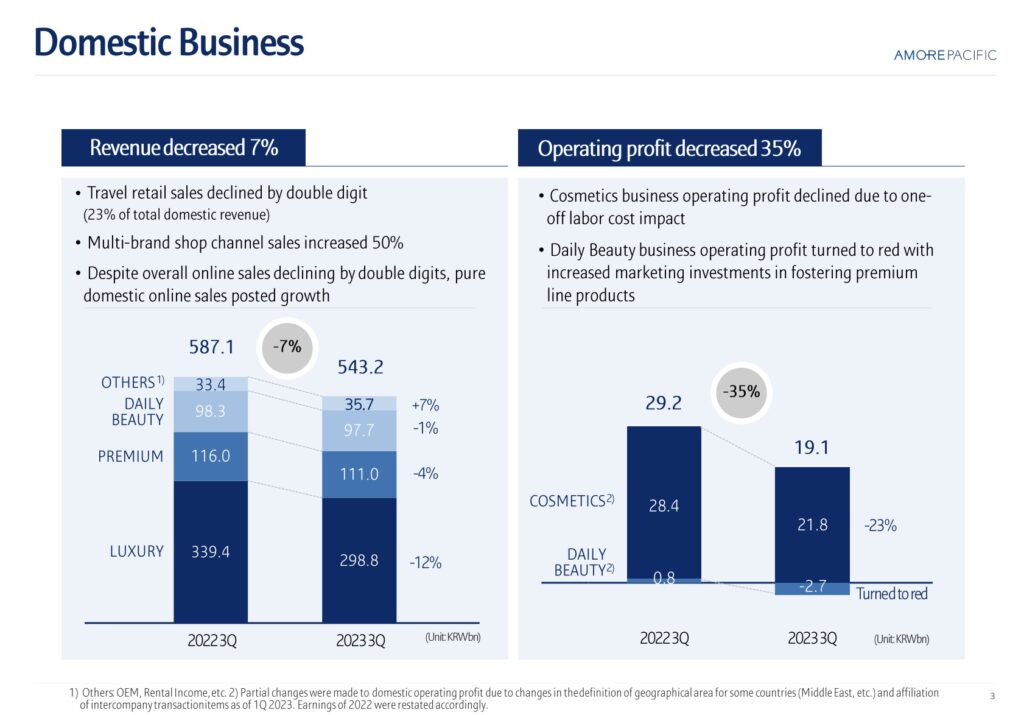

Travel retail, which represents 23% of the company’s total domestic revenues (see graphic below), was hit by a double-digit (according to Golman Sachs mid-teems) decline, contributing to a -7% decrease in the company’s domestic business.

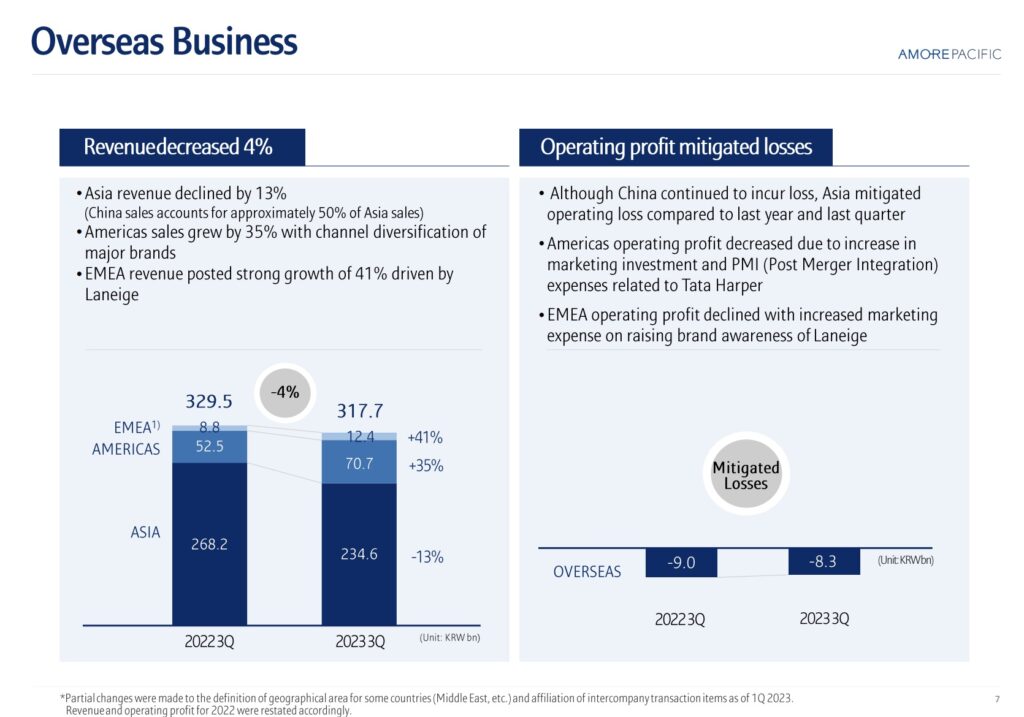

China sales account for approximately 50% of Amorepacific’s Asia business and the slower-than-expected recovery of prestige beauty in the region has caused a decrease of -13% in its Asia business.

As reported, the slowdown in global travel retail net sales has been driven changes in government and retailer policies related to the daigou sector in South Korea and Hainan.

Japan emerged as a bright shoot in Asia Pacific with sales accelerating by +30% in recent months driven by the robust performances of Laneige and Innisfree, new launches from Hera and Aestura and renewed relationships with major retailers.

The decline in Asia Pacific was softened by a stellar +35% increase in revenues in the Americas and a +41% increase in Europe. The strong performance in Americas and EMEA was driven by new launches and brand activations from Laneige, Sulwhasoo and Innisfree.

Amorepacific’s luxury business experienced a -12% decline. Luxury accounts for 55% of Amorepacific’s total domestic revenues driven by Sulwhasoo at 33% and Hera at 12%. Despite the decline in travel retail and new commerce channels, revenues from pure domestic ecommerce, department stores and Amorepacific-owned channels saw growth, the company said.

The premium business, which accounts for 20% of Amorepacific’s total domestic revenues, saw a -4% decline. According to the company, this fall was mitigated by the growth of the company’s domestic ecommerce and multibrand shops. ✈