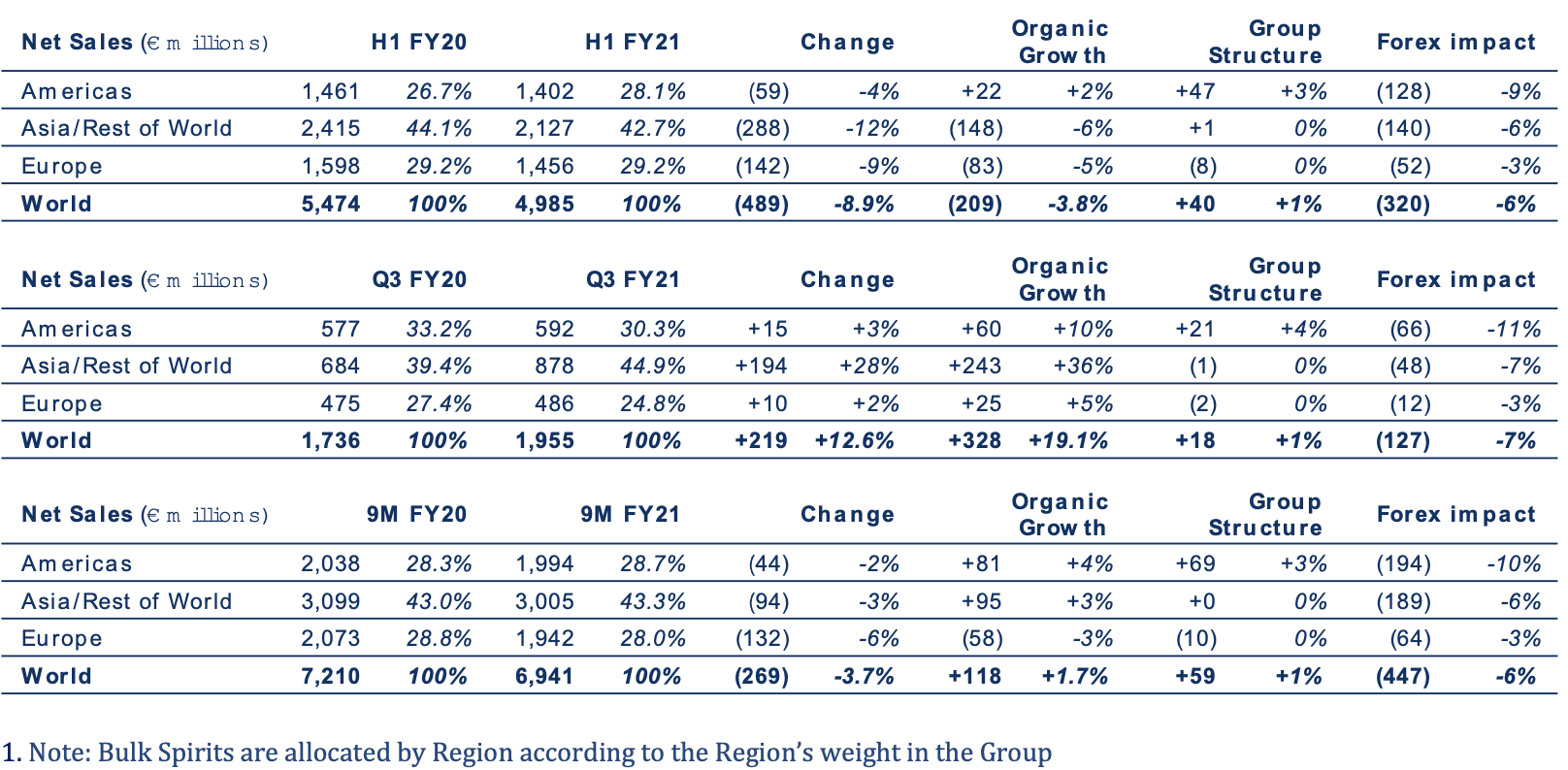

Pernod Ricard today revealed nine-month (to 31 March) sales of €6,941 million, down by -3.7% on a reported basis year-on-year (affected by currency exchange) but up +1.7% in organic terms. The performance was driven by a strong third quarter, with organic sales climbing by +19.1% year-on-year to €1,955 million.

Growth in the nine months was led by the “dynamism of must-win domestic markets”, with the US growing at +6%, China at +34% and India back to double-digit growth in Q3.

The company said that travel retail (-50% year-on-year) is “starting to lap an easier comparison base, but [is] still very subdued, with limited passenger traffic”. It highlighted a “softer rate of decline” in Q3, notably in Asia, as well as the “positive performance of off shore duty free in Hainan and Jeju”.

By category, Strategic International Brands grew sales by +1%, driven by Martell, Malibu, Jameson and The Glenlivet. Absolut and blended Scotch are still in decline, impacted by their exposure to travel retail.

Sales of Strategic Local Brands have stabilised, thanks to double-digit growth of Kahlua, Passport and Ramazzotti.

Specialty Brands climbed +22%, led by Lillet, Malfy and Aberlour in Western Europe, and tequila and American whiskey in the USA. Strategic Wines grew sales by +2%, particularly thanks to the off-trade in the UK and Canada.

Chairman and Chief Executive Officer Alexandre Ricard said: “Our Q3 was excellent, marking a return to organic sales growth. This confirms the strength of our business, with strong dynamism of our domestic must-win markets and good resilience throughout.

“In a still uncertain and volatile global context, with the current information available on the pandemic, we will continue to implement our strategy while actively managing resources, in particular strongly reinvesting where efficient. We expect our sales to accelerate in Q4 and accordingly are providing guidance of an organic growth in profit from recurring operations for full-year FY21 of around +10%.”