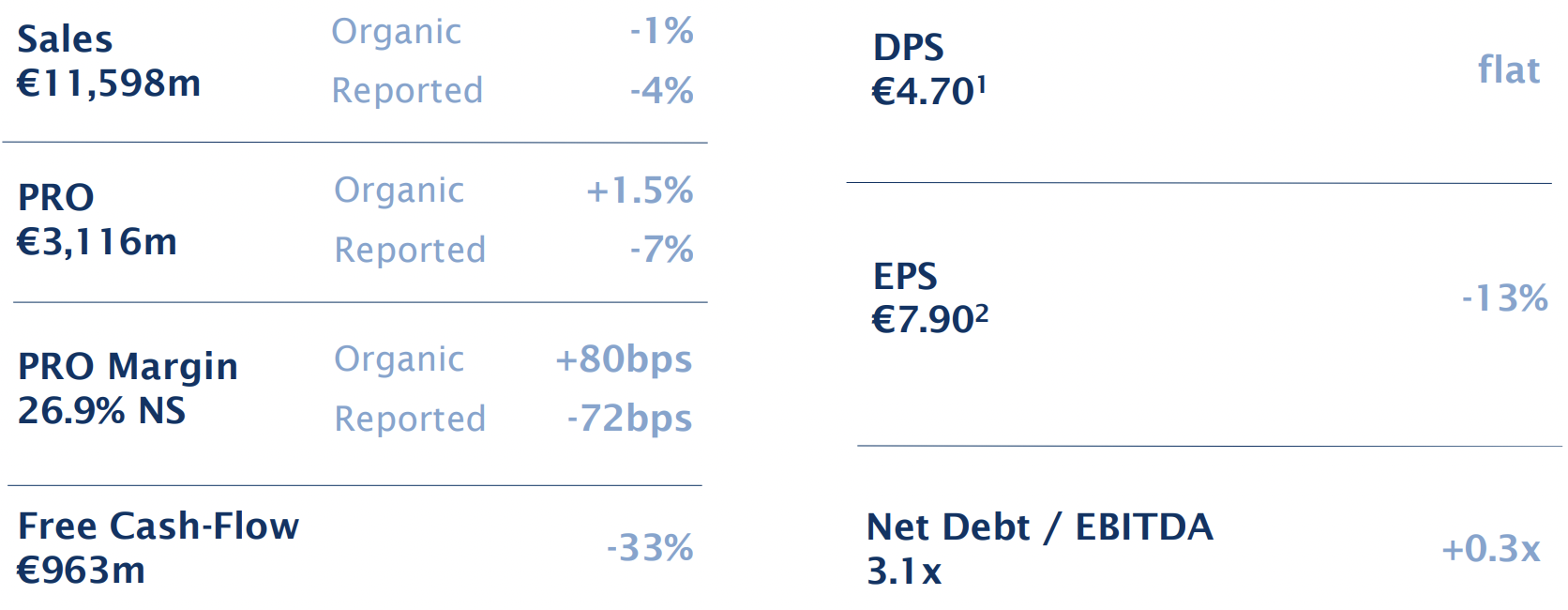

Pernod Ricard today reported €11,598 million in net sales for the year ended 30 June, down by -4% (-1% in organic terms) year-on-year.

Profit from recurring operations reached €3,116 million, a decline of -7% but up +1.5% in organic growth terms. Group share of net profit fell -35% to €1,476 million.

The company said a “strong performance in many mature and emerging markets largely offset a still-normalising US and challenging China”. It also highlighted sequential volume growth in the second half in most markets.

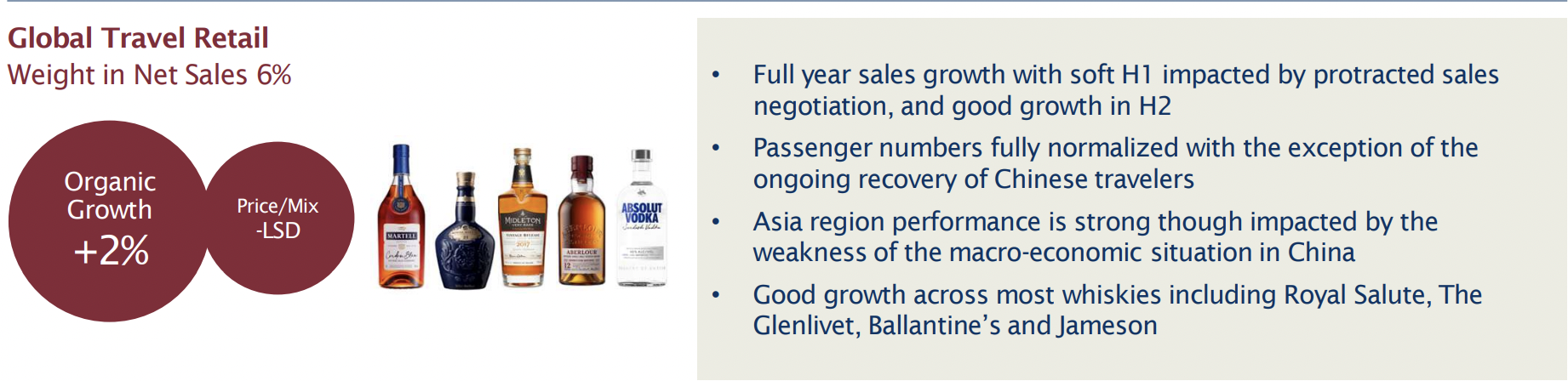

The Global Travel Retail division (+6% of total net sales) posted +2% sales growth, with a soft first half “impacted by protracted sales negotiation” followed by “good growth in H2”. The company commented that passenger numbers are now “fully normalised with the exception of the ongoing recovery of Chinese travellers”.

The Asia region performance in travel retail was strong but hit by the weakness of the macro-economic situation in China, said Pernod Ricard. It also highlighted “good growth across most whiskies including Royal Salute, The Glenlivet, Ballantine’s and Jameson” in travel retail.

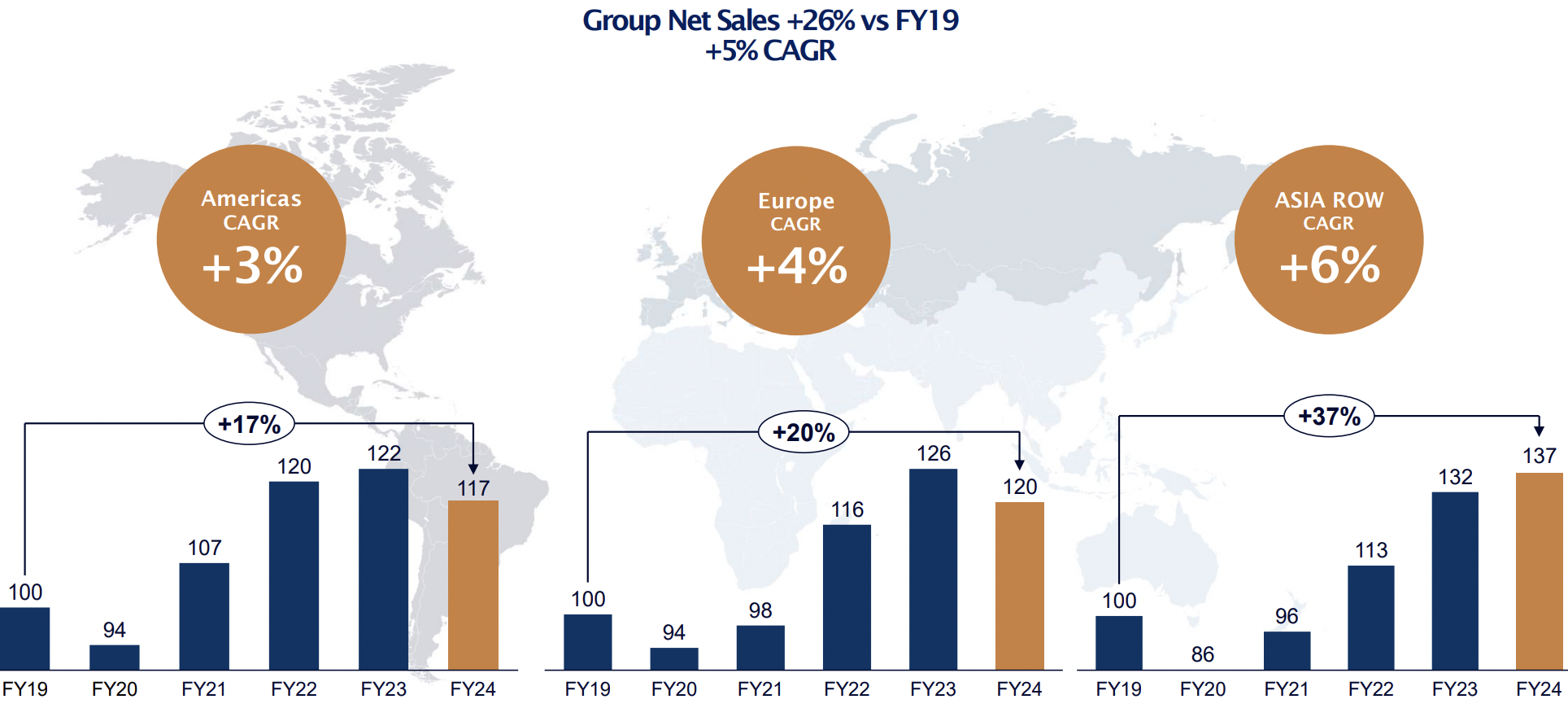

By region, sales in the Americas fell -5%, driven by a -9% fall in the US, though it noted that the market continues to “normalise”. Of trading in the US, Pernod Ricard said: “In a still elevated interest rate environment, further inventory adjustments are expected in FY25 leading to an anticipated decline in Q1.”

Asia-Rest of the World sales grew by +3%, with India (now the second largest market by net sales for the group) climbing +6% but China down by -10%.

Of China, Pernod Ricard commented that it anticipates “a strong decline in Q1, with subdued trade sentiment [and] a stronger consumer sentiment last year in Q1, with full year trend expected to be similar to FY24”.

Europe posted a decline of -5% in sales, with strong performances in Germany and Poland.

By key brand, Jameson continued its international expansion, Absolut showed “dynamic growth” in Asia-Rest of the World and Europe, though Scotch was negatively impacted by the US and China.

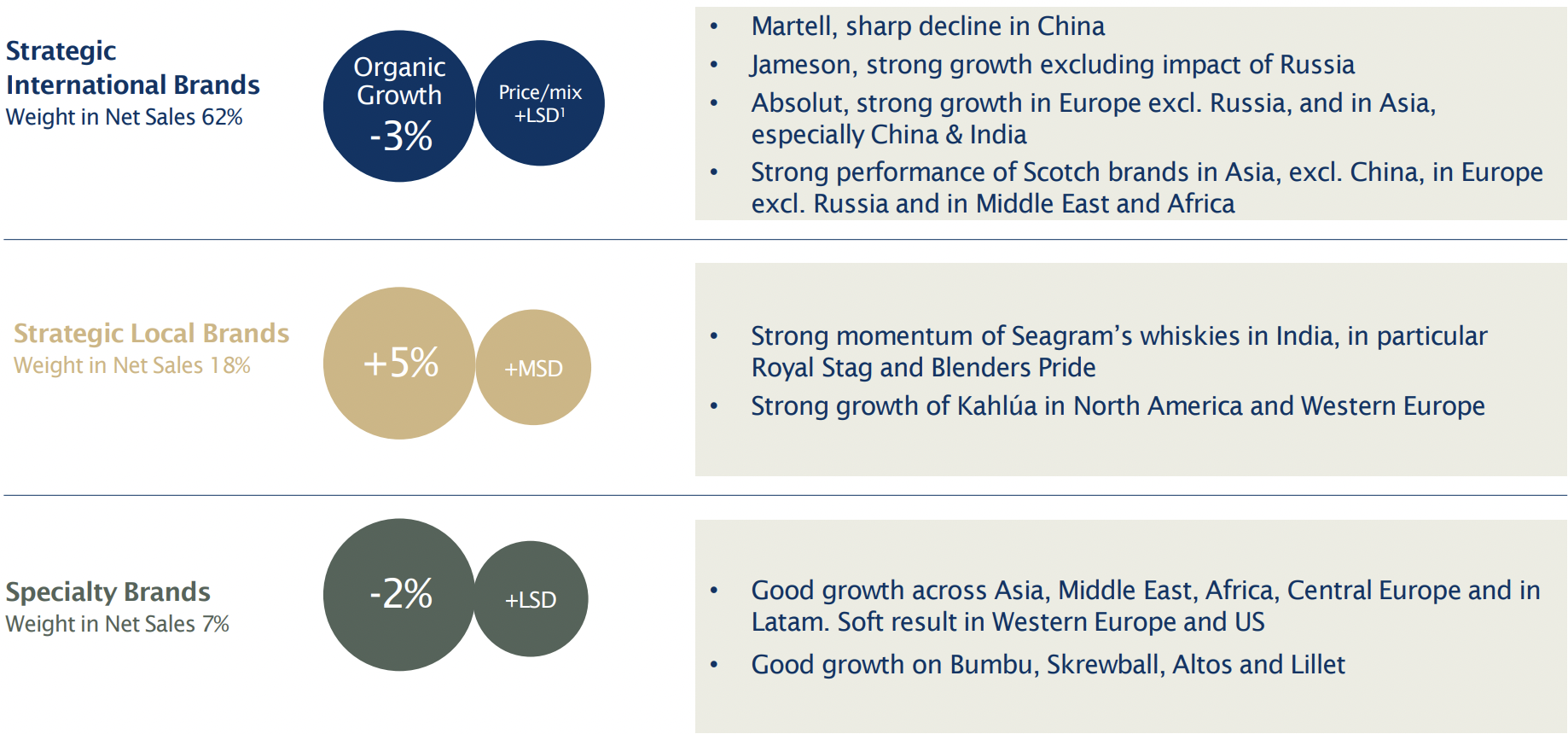

Strategic International Brands sales fell by -3% year-on-year, Strategic Local Brands showed +5% growth while the Speciality Brands division slipped -2%.

Chairman and CEO Alexandre Ricard said: “Pernod Ricard achieved robust results for the fiscal year ending June 2024 within an environment of economic and geopolitical uncertainty and spirits market normalisation after two years of exceptional post-pandemic growth.

“Our global scale, our agility and our portfolio of brands, the most extensive in the industry, combined with our capacity to understand and to invest behind our consumers’ desires and aspirations puts us in a very strong position to navigate these challenges.”

Speaking to investors today, Ricard said the group’s global reach helped to mitigate the impact of weaker results in the US and China.

He noted ‘market normalisation’ after the two-year period of ‘revenge convivialisation’ post-COVID, but also highlighted the ‘volatile environment’ in which the group is operating.

For China, weak consumer sentiment will continue, Ricard reiterated, but he added that “China’s long-term profile is a strong one”. He also noted stable sales of Martell Noblige and good performance of Absolut, Jameson, Olmeca and Beefeater in that market.

Ricard saluted the health of passenger traffic growth in buoying travel retail, with the softness in the China market the only negative.

On the brand offer, Ricard spoke about the group’s ‘active portfolio management’, with the disposal of local European spirits brands Clan Campbell and Becherovka, plus its Australian, New Zealand and Spanish wines, to focus on brands with greater international growth potential, notably in premium spirits and Champagne.

Of the outlook, he added: “I believe that big and diversified is beautiful, but only if big is agile.”

For the 2025 financial year Pernod Ricard said it expects:

- Full-year organic net sales back to growth with continued volume recovery and to sustain organic operating margin;

- A soft Q1 with further inventory adjustments in the US, a continued weak macro context in China and a good performance in the rest of the world. ✈