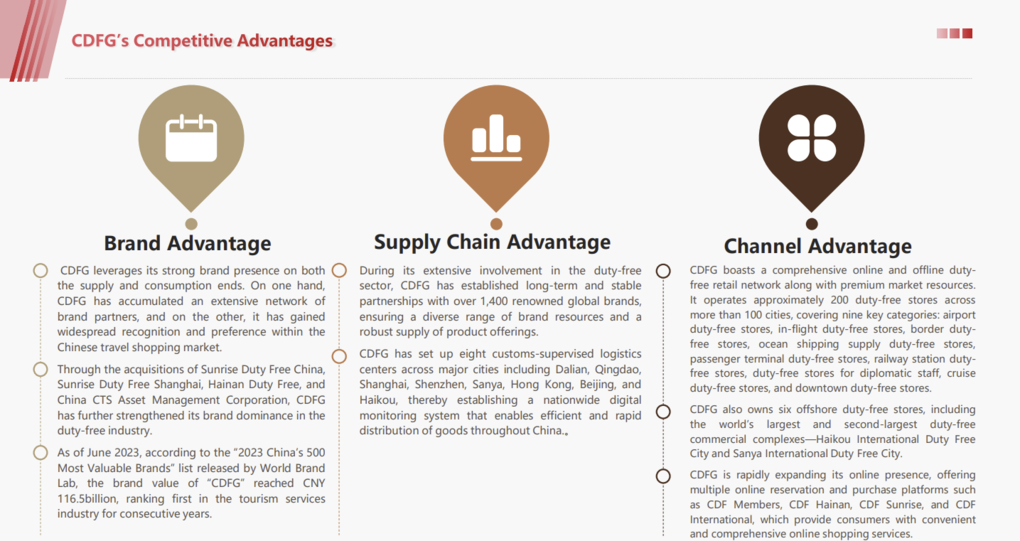

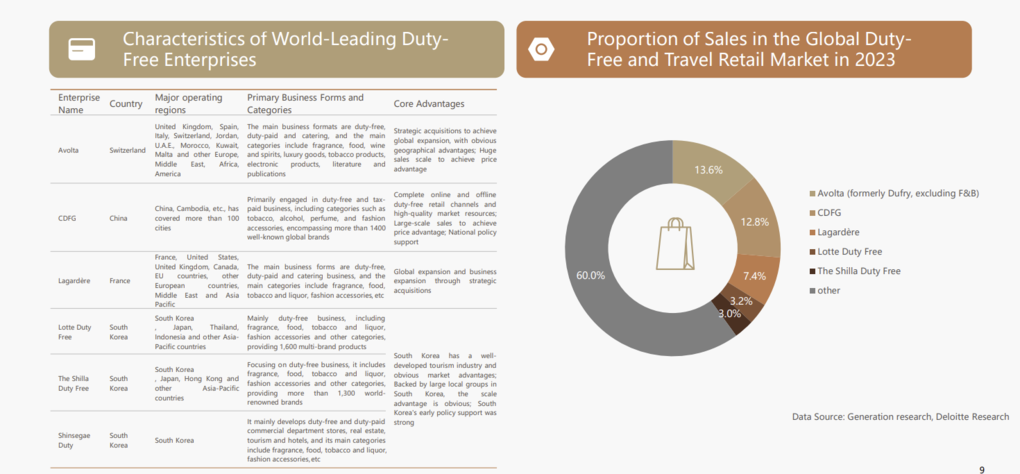

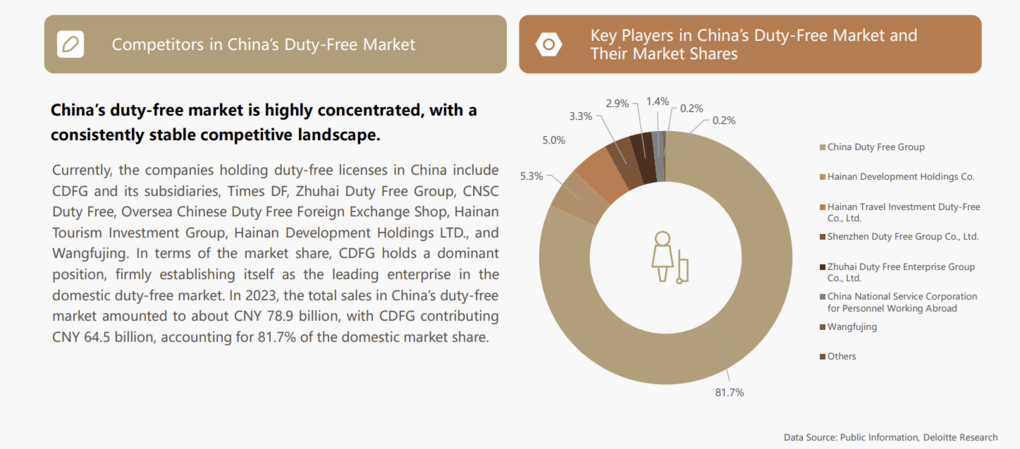

CHINA. China Duty Free Group (CDFG) and Deloitte China have jointly released the ‘2023 CDFG Membership Whitepaper’, an analysis of China’s travel retail landscape unprecedented in its detail.

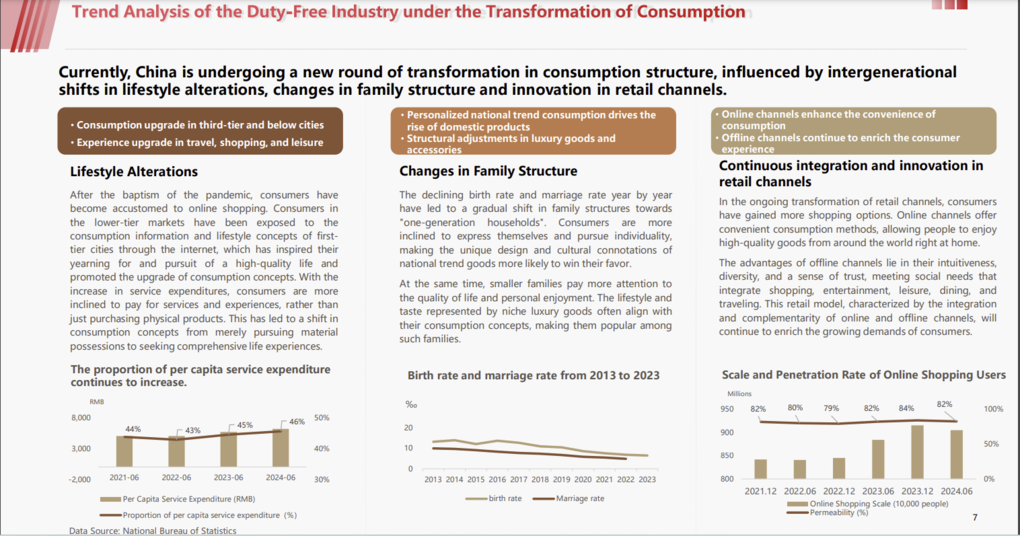

The 59-page Whitepaper assesses current duty-free policies; China’s and the world’s macro-economic environment; consumer trends; and analysis of the duty-free sector’s development pattern and trends.

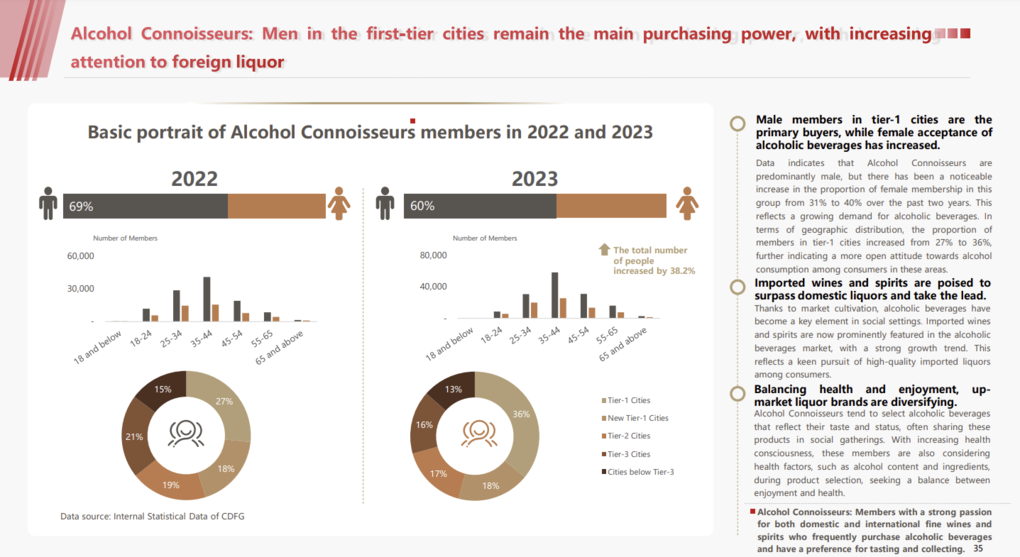

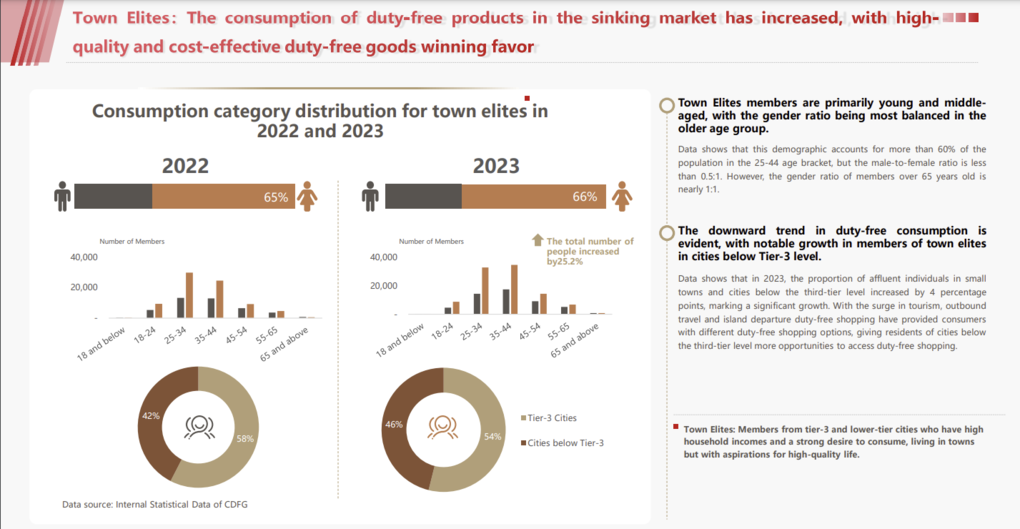

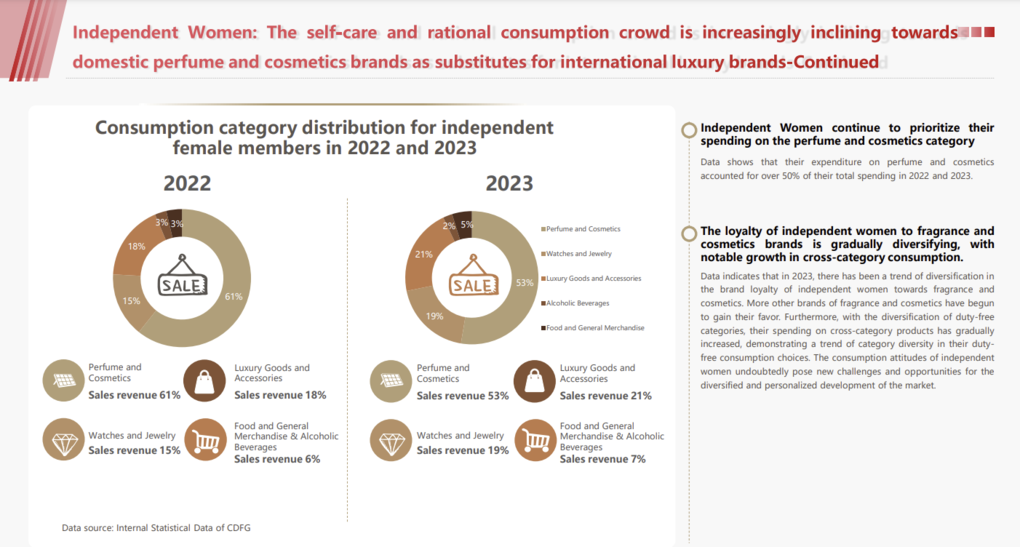

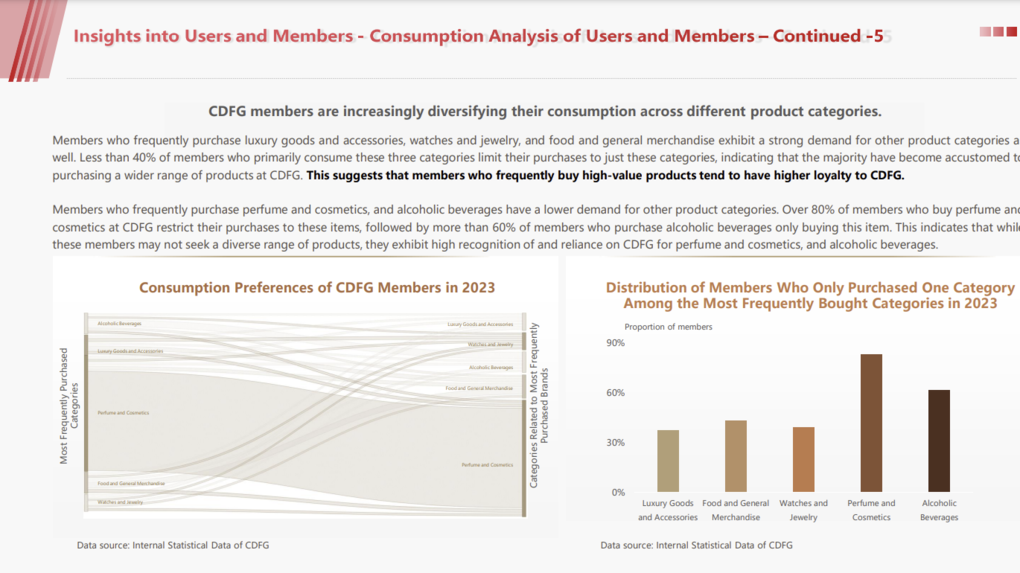

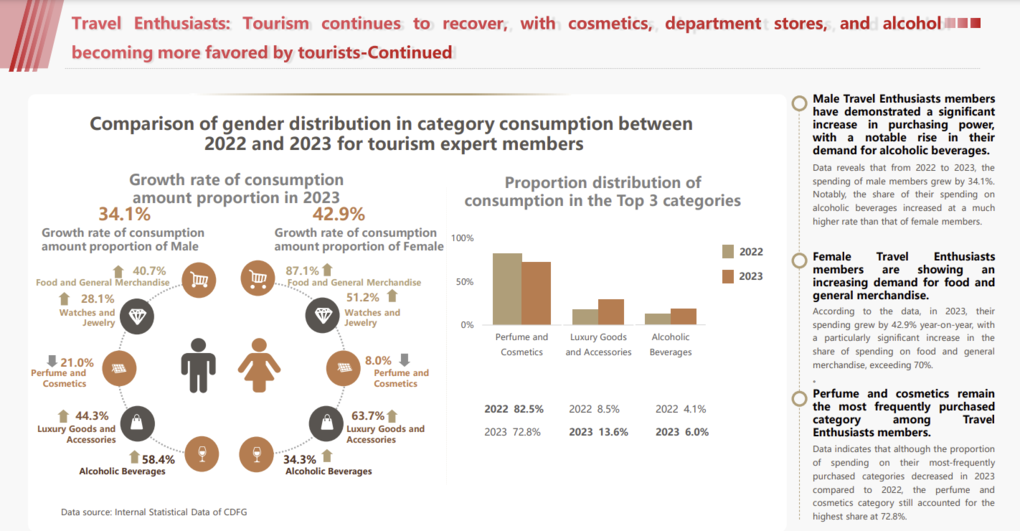

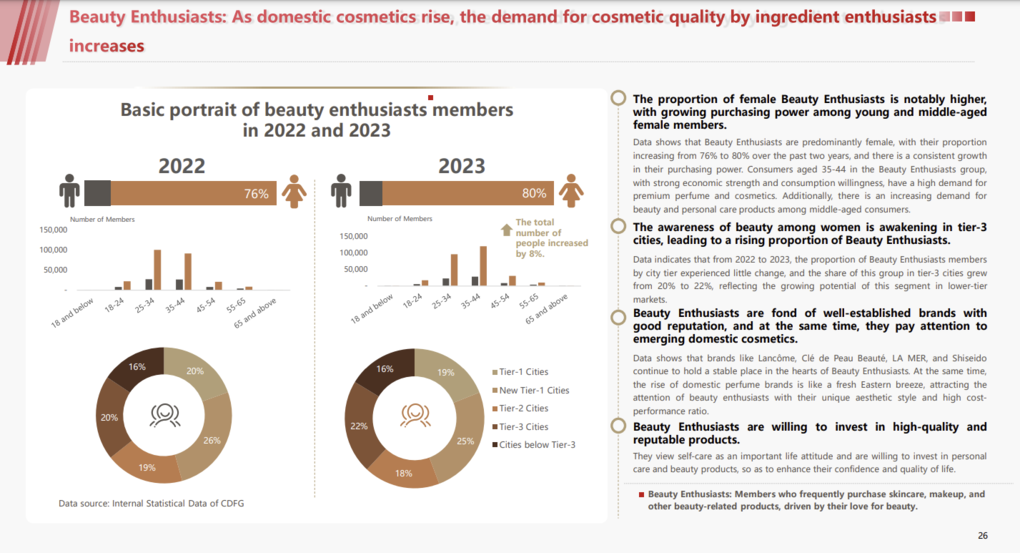

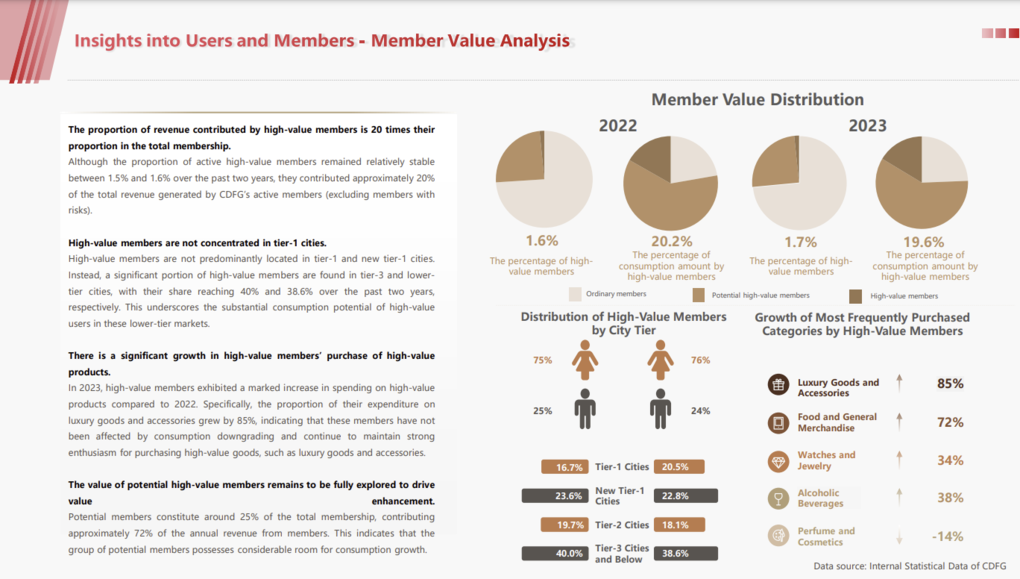

The report draws on CDFG membership consumption data during 2022 and 2023, offering insights into duty-free consumption trends and assessing the market’s development prospects.

Here in graphics form are some of the key takeaways

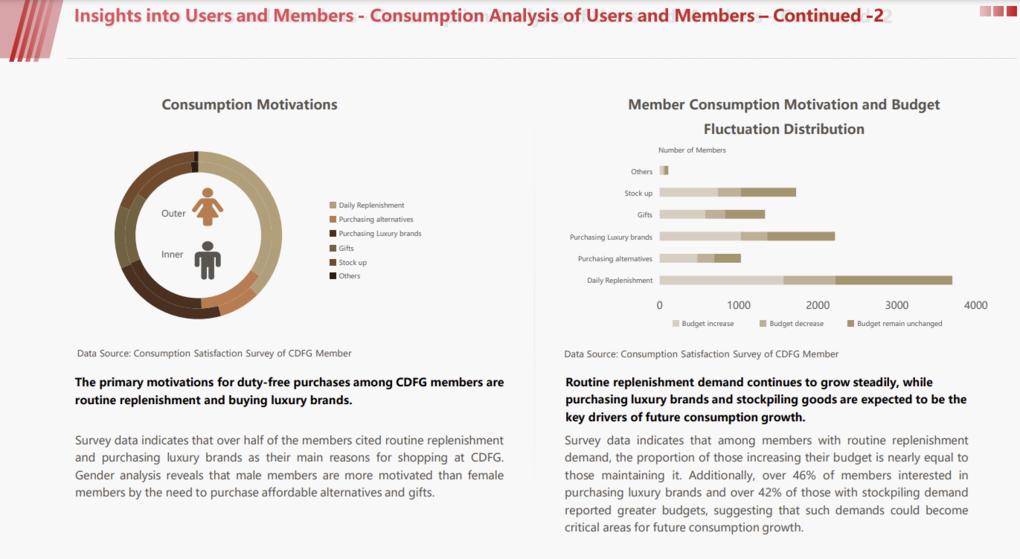

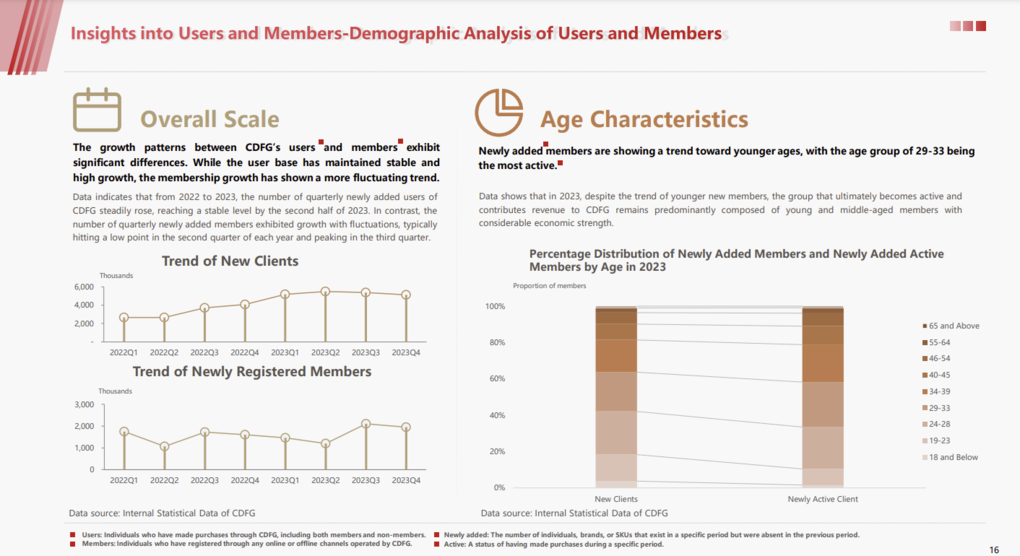

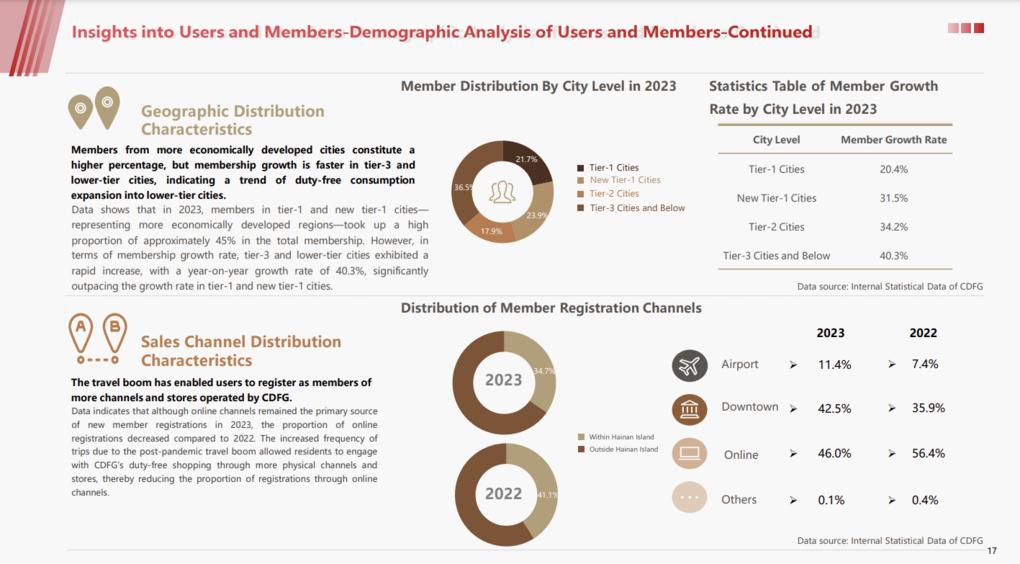

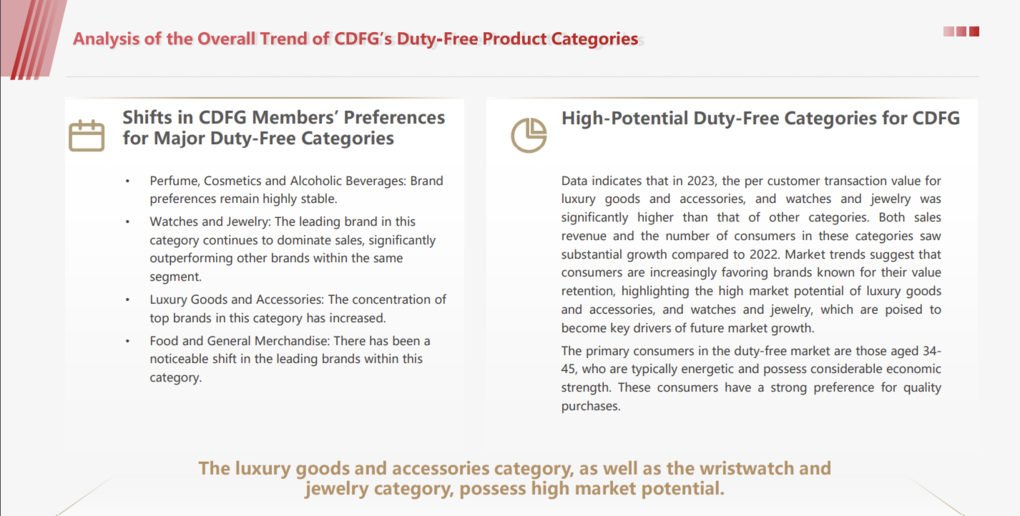

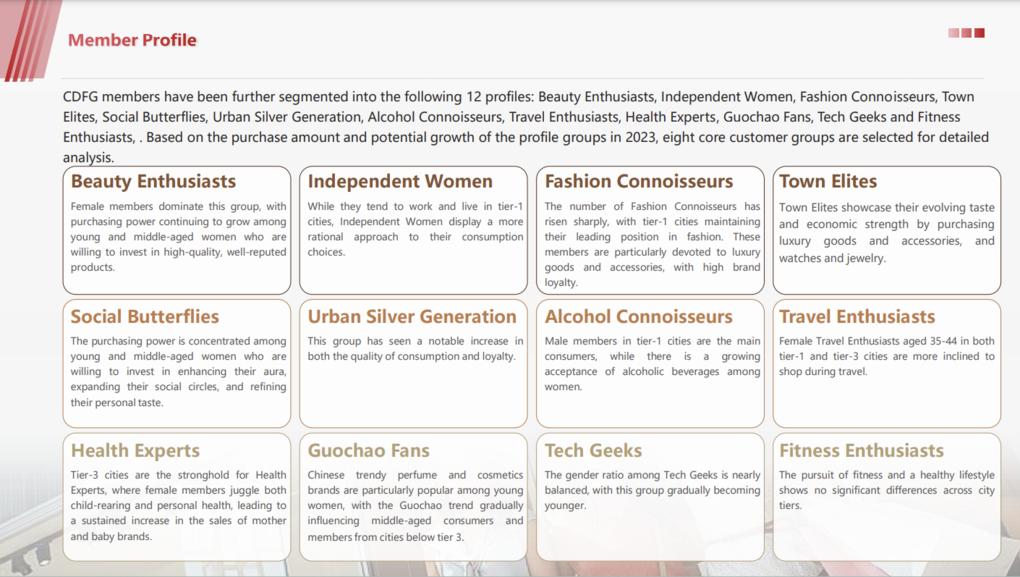

“New CDFG members show a younger trend and tend to consume a diverse range of duty-free products. There is a clear differentiation in consumption across different channels: online members tend to make entry-level purchases, while offline members are inclined towards high-quality, high-value consumption to satisfy their self-gratification needs,” the report observes.

Outlook

Describing 2024 as “the year of consumption promotion”, the study notes how the government is continuing to release incentive policies to boost spending.

“The duty-free market is closely related to the overall consumer environment,” it continues. “Practitioners in the duty-free market need to deeply understand different consumer profiles, actively embrace the consumption habits of the new generation of customers, and develop differentiated communication strategies.

“By embracing new media and new retail, fully realising the integration of online and offline channels, and through multiple touchpoints… they can accurately reach the target audience with personalised content and services, continuously improving the sense of experience and value for consumers, thereby increasing market share and enhancing travel retail performance.” ✈