CHINA. In important breaking news, China Tourism Group Duty Free (CTGDF), parent company of the world’s number one travel retailer*, China Duty Free Group (CDFG) last night (26 December) announced its respective subsidiaries have entered into revised rental agreements with Shanghai Pudong International, Shanghai Hongqiao and Beijing Capital International airports.

Announcing the respective agreements on behalf of the CTGDF Board, Chairman Wang Xuan said they were both “conducive to the sustainable and healthy development of the company’s airport duty free business” and consolidate an already advantageous position in the sector.

See below for full details of both agreements. * = According to The Moodie Davitt Report’s annual sector benchmark rankings

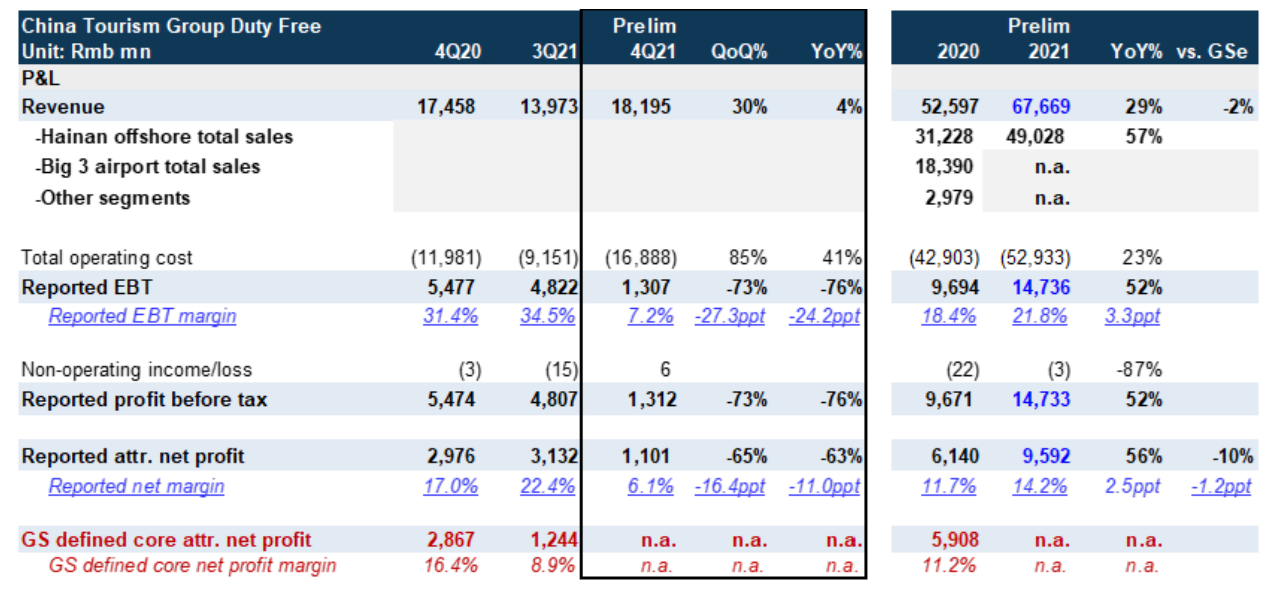

In a note, Goldman Sachs Global Investment Research echoed Wang’s view. Commenting on the Shanghai agreement in particular, the firm said, “We consider the revised contract as incrementally favorable to CTGDF and negative to Shanghai Airport when compared to existing agreements in that (1) the minimum guarantee amount has been lowered significantly.

“For instance, based on 3Q23 traffic, MAG could have added up close to RMB3 billion (US$419.9 million) calculated by multiplying the actual traffic by the per capita contribution of RMB135 (US$18.90). In the revised agreement, it would only be RMB0.7 billion (US$97.9 million).

“For instance, based on 3Q23 traffic, MAG could have added up close to RMB3 billion (US$419.9 million) calculated by multiplying the actual traffic by the per capita contribution of RMB135 (US$18.90). In the revised agreement, it would only be RMB0.7 billion (US$97.9 million).

“The revision might have been driven by the fact that it has taken longer than expected for per-passenger spending to fully recover to pre-COVID19 level of ~RMB365 (US$51.09) such that the airport DFS business is currently unprofitable for CTGDF after deducting the RMB135 per passenger payment to Shanghai Airport.

“(2) Although the company has not disclosed the exact revenue share % for each product category, we suspect it might have been lowered to below 30% taking into account for product mix by assuming higher share ratio for alcohol/tobacco and lower share ratio for general goods as in the prior contracts. This compares to our original 2024/25E revenue share estimate of 38%/37% in Shanghai and 44% in Beijing.

“By way of sensitivity, if we assume 25-30% revenue share ratio, our FY24-25E earnings estimates for CTGDF would be lifted by +4-9% while those for Shanghai Airport would be lowered by -12-22%, all else unchanged.”

Goldman Sachs added, “The announcement reinforces our preference for CTGDF (Buy) over Shanghai Airport (Sell) as we believe the former will continue to command stronger bargaining power by gradually expanding into more sales and distribution channels likely to be facilitated by further policy relaxation (e.g. downtown duty free stores).

“In addition, under the revised contract, CTGDF’s airport DFS businesses should be able to turn profitable, serving as a meaningful driver for its earnings growth in FY24-25E.”

Here are the key details:

BEIJING CAPITAL INTERNATIONAL AIRPORT

Background: In 2017, CTFDG subsidiaries won the bid to operate duty free departures and arrivals at Beijing Capital International Airport (Capital Airport) Terminals 2 and 3.

In October 2021, the parties reached an agreement on the operation fee for the third contract year of the original contract and signed a supplemental agreement.

Latest developments: This month (December 2023), CTGDF subsidiaries Sunrise Duty Free (China) Co., Ltd and China Duty Free Group Beijing Capital Airport Duty Free Co. Ltd – (collectively, ‘China Duty Free’) and Beijing Capital International Airport agreed to amend and optimise the relevant terms of the contract and entered into a supplementary agreement.

The new terms have been struck “to promote the sustainable, healthy and stable development of the company’s duty free business and further enhance the market competitiveness of the airport duty-free business,”CTGDF said.

Key contract changes:

- Boosting the competitiveness of the airport duty free business. The parties shall bring together their own advantages and create a duty free business cluster through upgrading and revamping to attract first-tier and second-tier international brands as well as affordable luxury brands. They will implement measures such as increasing the number of competitive brands or individual products and continuously improve customer shopping convenience and experience.

- Promoting duty free sales. Promotions will be intensified in the areas where Capital Airport permits, such as electronic screens and store entrances.

- Actively seeking support from brand suppliers. China Duty Free should utilise its channel advantages to actively strive for the support of more popular products and gather more core products to enhance the attractiveness of airport duty free shopping.

- Operation Fees. Each party agreed that the operation fees and the billing-related passenger throughput and operation area under the original contract agreement shall be combined. As a result the annual operation fees shall be calculated on the higher of the annual guaranteed operation fees and the annual actual sales commission.

The annual guaranteed operation fees shall be RMB558,284,196 (US$78.7 million), but if the actual annual passenger throughput is ≤ 9.6 million people (annual passenger throughput of Capital Airport’s international zone), the annual guaranteed operation fees = RMB558,284,196 × (annual actual passenger throughput ÷ 9.6 million people) × adjustment coefficient.

Key detail: In the formula, the adjustment coefficient shall not be higher than 1, to be negotiated by the parties according to the actual circumstances. ‘Passenger throughput’ refers to international passenger throughput and passenger throughput of the Hong Kong, Macau and Taiwan regions.

The sales commission is the sum of the category sales commission corresponding to the five categories of perfume and cosmetics, tobacco, alcohol, general merchandise and food. The category sales commission ratio ranges from 18% to 36%.

Other clauses:

- Capital Airport encourages China Duty Free to introduce competitive products.

Upon review and approval by Capital Airport, the sales commission will be calculated separately based on a certain proportion of the gross profit of each single product and added to the corresponding monthly category sales commission.

(2) The parties agree to establish an incentive mechanism whereby a more flexible adjustment mechanism would be applied to the calculation of operation fee for the portion of sales in excess of the monthly operation fee target for Capital Airport after the monthly operation fee target has been achieved.

(3) The Supplemental Capital Airport Agreement constitutes an integral part of the Original Capital Airport Agreement. This becomes effective from 1 January 2024 upon being signed by all parties.

SHANGHAI PUDONG INTERNATIONAL AND SHANGHAI HONGQIAO INTERNATIONAL AIRPORTS

Background: In 2018, Sunrise Duty Free (Shanghai) Co. Ltd. (Sunrise Shanghai), a subsidiary of CTGDF, was selected to operate the duty free shops at Shanghai Pudong International and Shanghai Hongqiao International airport and entered into an operation rights transfer contract.

In January 2021,the parties agreed to amend the original contract and entered into a supplemental agreement (collectively the ‘Original Shanghai Airport Agreement’).

Latest developments: In order to promote the sustainable, healthy and stable development of CTGDF’s duty free business and further enhance the market competitiveness of the airport duty free business, Sunrise Shanghai and Shanghai International Airport Co., Ltd. and Shanghai Hongqiao International Airport Co., Ltd. (collectively ‘Shanghai Airport’), this month (December 2023) unanimously agreed to amend the Original Shanghai Airport Agreement and entered into a relevant supplemental agreement (the ‘Supplemental Shanghai Airport Agreement’).

Key contract changes:

- Boosting the competitiveness of the airport duty free business. The parties shall bring together their own advantages and create a duty free business cluster through upgrading and revamping to attract first-tier and second-tier international brands as well as affordable luxury brands.

They will implement measures such as increasing the number of competitive brands or individual products and continuously improve customer shopping convenience and experience.

- Promoting the sales of duty free business. The promotion will be intensified in the locations where Shanghai Airport permits, such as electronic screens, carts, and store entrances.

- Actively seeking support from suppliers. Sunrise Shanghai should utilise its channel advantages to actively strive for the support of more popular products and gather more core products to enhance the attractiveness of airport duty free shopping.

- Actual monthly fees. The parties agree that starting from 1 December, 2023, the actual monthly fees shall be calculated based on the higher of the monthly guaranteed sales commission and the monthly actual sales commission, of which:

The ‘monthly guaranteed sales commission’ shall be calculated in accordance with the following agreements:

- If monthly actual passenger throughput > 80% of average monthly passenger throughput in the third quarter of 2023:

Pudong Airport: monthly guaranteed sales commission shall be RMB52,454,562 (US$7.34 million).

Hongqiao Airport: monthly guaranteed sales commission shall be RMB6,473,493 (US$906,100).

(2) if monthly actual passenger throughput ≤ 80% of average monthly passenger throughput in the third quarter of 2023:

Pudong Airport: monthly guaranteed sales commission = RMB52,454,562 × (monthly actual passenger throughput ÷ 80% of average monthly passenger throughput in the third quarter of 2023) × adjustment coefficient.

Hongqiao Airport: monthly guaranteed sales commission = RMB6,473,493 × (monthly actual passenger throughput ÷ 80% of average monthly passenger throughput in the third quarter of 2023) × adjustment coefficient.

(In the above formulas, adjustment coefficient shall not be higher than 1, which shall be negotiated by the parties based on the actual circumstances. ‘Passenger throughput’ refers to international passenger throughput and passenger throughput of the Hong Kong, Macau and Taiwan regions.)

The ‘monthly actual sales commission’ is the sum of the monthly sales commission per category corresponding to the five categories of perfume and cosmetics, tobacco, alcohol, general merchandise and food.

Monthly sales commission per category = monthly net sales of the category × category commission ratio, of which: monthly net sales of the category = monthly total sales of the category – monthly returns and refunds of the category.

The category commission ratio ranges from 18% to 36% based on the different categories and the per capita purchasing power of each category.

Other clauses:

(1) Shanghai Airport encourages Sunrise Shanghai to introduce competitive products. Upon review and approval by Shanghai Airport, the sales commission will be calculated separately based on a certain proportion of the gross profit of each single product and added to the corresponding monthly category sales commission.

(2) The parties agree to establish an incentive mechanism whereby a more flexible adjustment mechanism would be applied to the calculation of sales commission for the portion of sales in excess of the monthly sales commission target for the Shanghai Airport after the monthly sales commission target has been achieved.

(3) The Supplemental Shanghai Airport Agreement constitutes an integral part of the Original Shanghai Airport Agreement, which shall enter into force upon being signed by the parties.

In his full statement CTGDF Chairman of the Board Wang Xuan said, “The company expects that the signing of the Supplemental Capital Airport Agreement and the Supplemental Shanghai Airport Agreement is conducive to the sustainable and healthy development of the company’s airport duty free business and consolidates the company’s advantageous position in the duty free industry, and will not materially affect the Company’s results of operations in 2023.”

“However, as at the date of this announcement, the impact of the signing of the aforesaid supplemental agreements on the company’s results of operations for each of the years of the contractual period commencing from 2024 cannot be predicted, and shareholders of the company should be aware of the investment risks when dealing in the shares of the company.” ✈